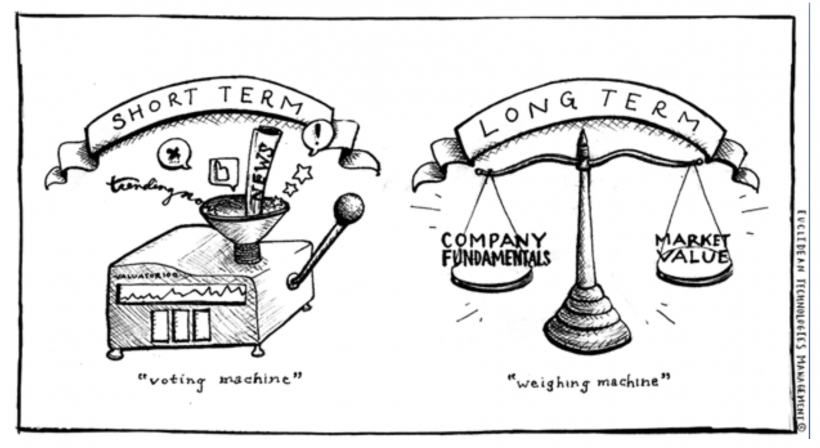

“In the short term, the market is like a voting machine. But in the long term, it is like a weighing machine.”

Looking at the state of the stock market today and how distanced stock prices have become from their underlying company fundamentals, I’m very much reminded of this age-old quote by legendary investor Benjamin Graham (also teacher of Warren Buffett).

I invest in exceptional businesses and pay reasonable valuations for them. When reasonable valuations are elusive, I will continue building cash instead while waiting for opportunities to enter – SG Budget Babe

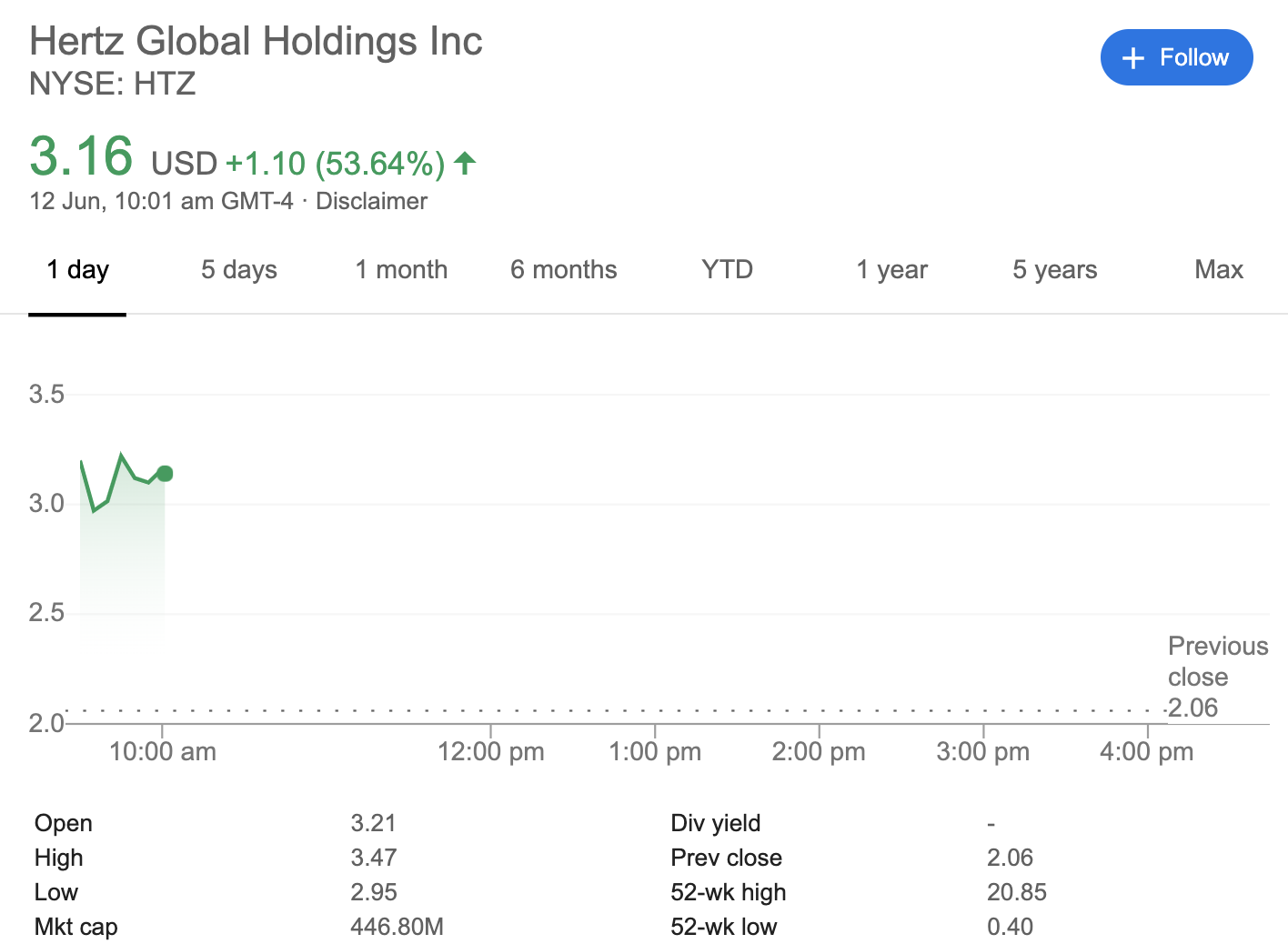

- Hertz rose over 800% since filing for bankruptcy protection on May 22

- J.C. Penney climbed over 400% since filing for bankruptcy on May 15

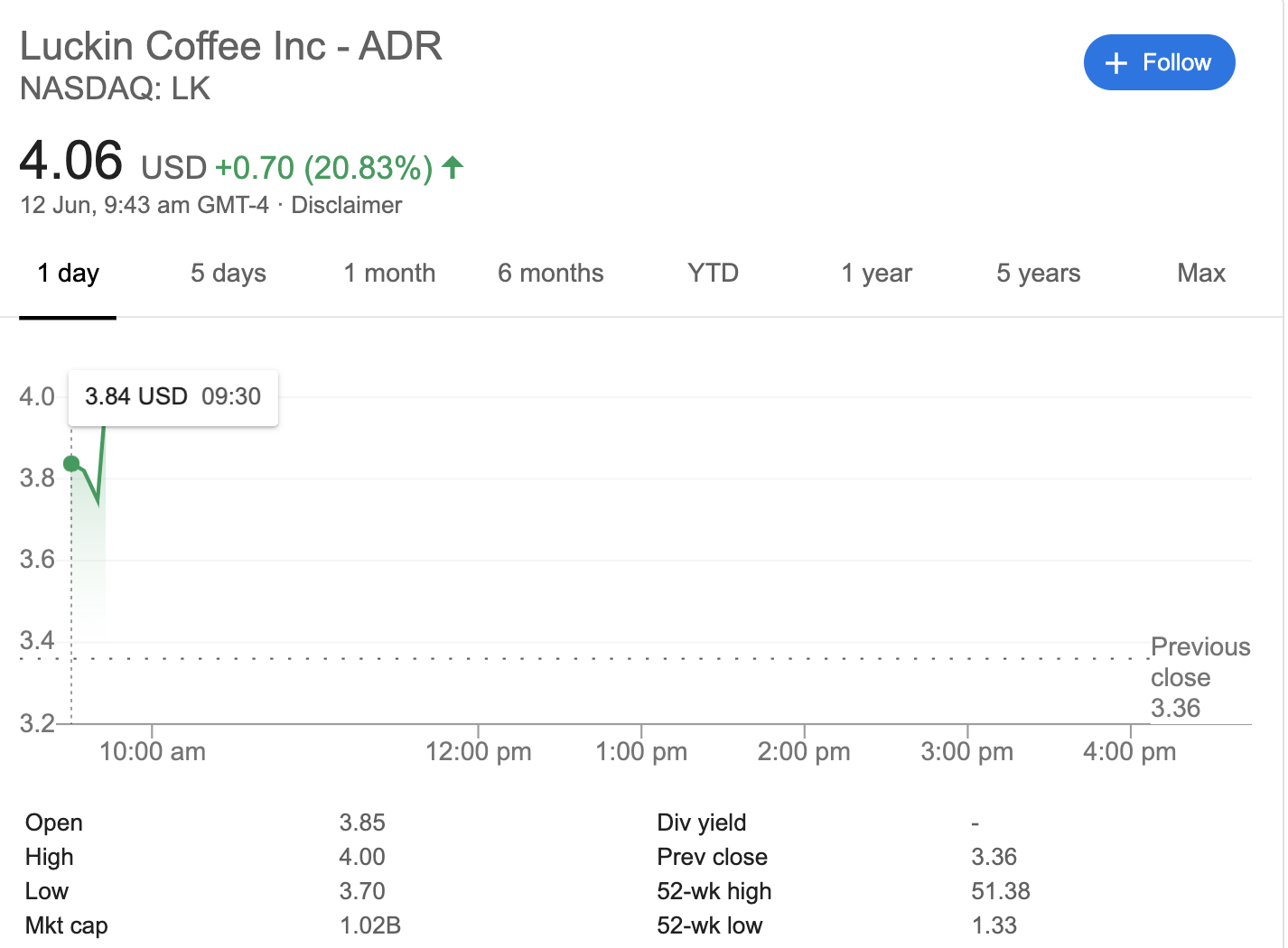

- Luckin Coffee rallied close to 300% despite its imminent expulsion from NASDAQ for fraud

|

| How can a company admit to fraud and still have a market cap of $1 billion? |

Under normal circumstances, you wouldn’t expect investors to pile their money into bankrupt or fraudulent companies.

But then again, I’m reminded that we’re living in unprecedented times.

Unlimited quantitative easing.

The Fed buying junk bonds.

Bankrupt and fraudulent companies making stock investors rich.

People saying that value investing is dead.

Warren Buffett is no longer relevant.

This time it is different.

At every point in history, there were almost always people saying this time it is going to be different.

Our economic troubles aren’t behind us yet, and I’d rather not run out of cash so soon.

The speculators and Robinhood investors might be the ones making the money right now, but that doesn’t mean you should immediately throw away all your fundamentals out of the window.

2 comments

I wonder who said that value investing is dead?

plenty of investing "gurus" proclaiming that on Youtube, you can Google it lol

Comments are closed.