BB's Investment Guide for Beginners ☺️

Did you guys see the news this morning?

20 people said they lost S$1 million in investments – among them included a bank employee Jeffrey Tan, who considers himself as savvy in making financial investments.

But yet he went on to lose his entire capital, and 10x more of that after persuading his family and friends to join him.

Actually if you asked me, the red flags were pretty darn clear – anyone or anything promising you 2% to 10% risk-free returns a MONTH is a dead giveaway.

But I just realised with articles like the one today that while these red flags may be obvious to us, apparently not a lot of people know how to spot these signs. It really is quite sad 😕😓 and I hope writing more on issues like this can help the next person not to lose their hard earned money!

Feeling encouraged by all of you who poured in your support and eagerness to learn more in my previous post! So I'm starting on this to share as much as I know with all of you guys. There's too much to write and complete in one day so I'll be splitting this up in a series of posts! #dayreinvest #beginnerinvest

You can track the entire series with #bbinvestments or leave me a comment with questions or ideas for the next post! 🙆🏻

Index Investing – the Straits Times Index

Starting off this series with the simplest one – the STI ETF!

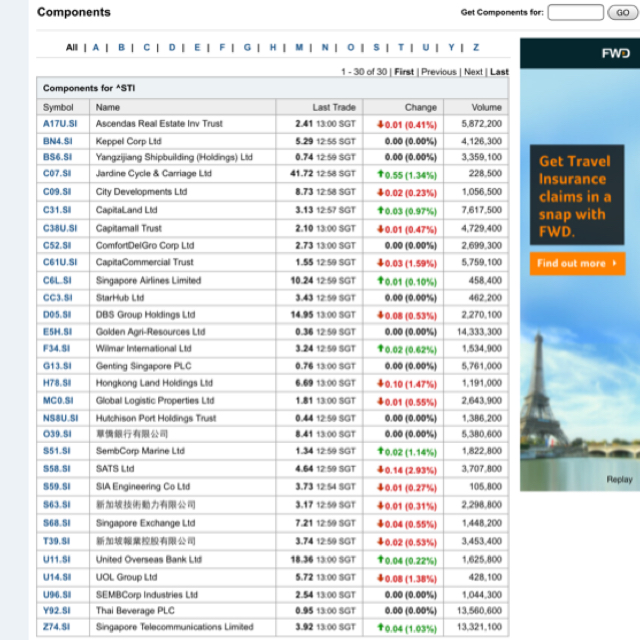

If you're new to investing and don't know how to go about picking stocks, you can easily invest in Singapore's biggest 30 companies with just one counter.

That's right! And the magic code names are ES3 or G3B.

You get a slice of Singapore's biggest companies in a single purchase – DBS, SingTel, Keppel, etc.

Why choose when you can get all of these in one shot? Perfect for beginners who want to get started but don't quite know how.

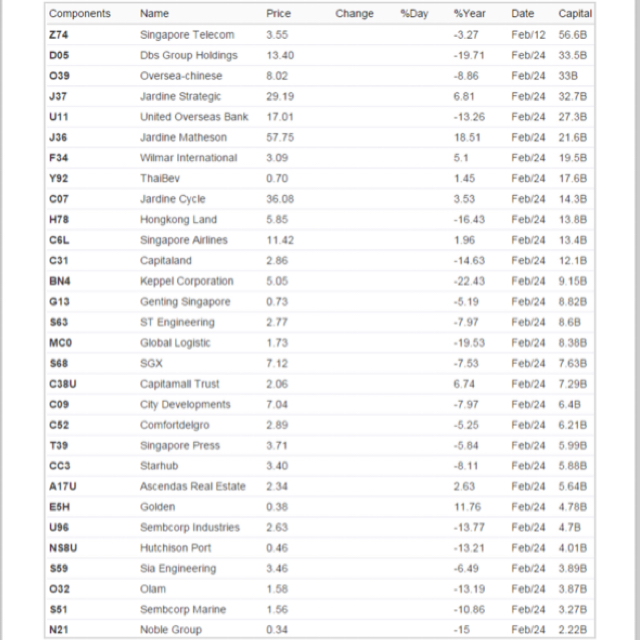

Look at Noble on the list. You might be thinking, wait, weren't they in a lot of trouble over the past few years?

Well good news, they've now been excluded from the list, which is updated to keep track of companies and their ups and downs.

The updated list for what's in the STI Index. This keeps changing – as companies lose money or become bigger, they get replaced or added to this list. Thus you'll always be getting a slice of Singapore's top 30 companies.

One easy way to do this with discipline is to automate your monthly investments to purchase the index on your behalf. That way, if you're busy with work or just life in general, you don't have to worry your pretty little head about having to make time to invest either.

This strategy helps you balance out your risks with market conditions, and is basically the lazy man's method to investing…

Dollar Cost Averaging (DCA)

The DCA strategy is basically committing a fixed amount each month (or quarter if you're not earning that much) to buying stocks that you're keen on.

Applying this to index investing, you can start with as little as $100 a month. When the market is expensive, $100 buys you lesser stocks. When it is cheaper, you get to buy more. Thus, you'll be buying more when stock prices are lower and less when it is higher.

As asked by @fatallyflawless a while ago, one easy way to do this is to sign up with POSB InvestSaver to automate this for you.

In fact, if you already have a POSB account now, here's one more reason for you to get started: you can now get CASHBACK for investing!!! 😱😱

(I've never heard of this before until POSB's latest campaign. Find me another bank who rewards you cashback for investing!!)

Imagine if you put $300 each month into POSB InvestSaver and get $9 cashback each time. Not bad right!

Typical Budget Babe, everything also must milk until max HAHA my mindset is that I must earn more from credit card companies / banks than they do from me!!! #dayresavings

You can check out my blog for a recent review I did on this POSB cashback campaign. Really not bad at all 🙆🏻

www.sgbudgetbabe.com !

That's the end of Chapter 1 for #bbinvestments ! Hmm what should I write for Chapter 2? Any ideas on what you guys would like to see? 😊