Is it safe to invest in bonds?

Here's a quiz: which one of the following investments have the lowest risk?

a) forex

b) stocks

c) bonds

If you answered bonds, I urge you to think again. #dayreinvest #bbinvestments

Are bonds really as safe as we think they are?

What are bonds?

Simply put, bonds are fixed income securities. Borrowers issue bonds to raise money from investors who are willing to lend them money for a fixed time period, promising to pay interest while you wait for the borrower to accumulate money to pay you back.

In the investment world, bonds are generally regarded as the safest types of bonds. There are government treasury bonds (most of which are literally risk-free), corporate bonds, and junk bonds.

Junk bonds are usually bonds that offer a high-yielding coupon rate (interest payments). But as the saying goes, one man's junk could be another man's treasure.

High yielding bonds usually come with a higher risk, which is why they have to offer a more attractive interest rate in order to get people to part with their money.

Basic rule of money: high risk, high returns. Low risk, low returns.

I consider the Singapore Savings Bonds as an example of a high quality and low risk investment. #dayresavings The only risk of default would probably be if our government collapses. Unless World War 3 or a zombie apocalypse happens, I doubt this will ever materialise. If it does, we'll all be screwed anyway. Who cares about money when your life is at stake?

What about corporate bonds? Are they safe?

It depends. There is a thin line when it comes to whether corporate bonds are safe or risky investments. Too many investors get screwed by corporate bonds, thinking that bonds = safe.

Not all bonds are made the same! 😧

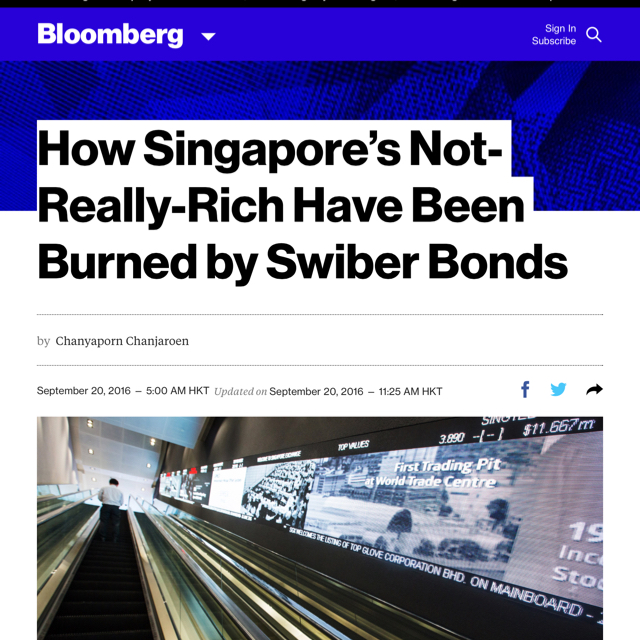

If you haven't heard about the recent Swiber case yet, you probably should take note. Investors in Singapore who invested in Swiber's corporate bonds got screwed BIG TIME. Each investor lost $200k or more.

One of them included a mother of 3.

These investors are everyday folks like you and I. #dayrefinance Among them include the mother who has been saving up for years so that she can send her kids to university. The father who needs to take care of his own ageing parents, wife and kids. The old uncle who slogged at his business and lived a frugal life all this while.

All of those life savings, wiped out from their bank accounts. They're not gonna get it back.

What happened? Well, not too long ago a local company Swiber tried to raise funds for its business by offering bonds. They promised to pay attractive interest rates in return for the loan, and that they would pay off the capital within a few years.

Just this week, Swiber announced that they have no money and will have to default on their loans. Their business took a hit from the state of today's oil and gas economy. Swiber is now facing liquidation and may soon wind down.

When a listed company gets liquidated, retail investors usually don't get their money back because you sit at the bottom of the chain. The debtors, shareholders and employees go first. If there's anything left after distributing it to them, then the retail investors get a slice of it.

Unfortunately when a company goes bankrupt they seldom have much money left. So you can kiss your money goodbye.

There were a few bonds offered lately. Hyflux bonds, Aspial bonds, etc.

Before you buy into any corporate bond, ask yourself these essential questions first.

1. Do I feel comfortable lending this company my money?

If the company is shady or doesn't seem to be earning much then maybe you should stay far, far away.

2. Why is the company coming to us for funds?

Is it because they got rejected by the banks? Why target the average investor, who has less money?

Can I be sure that the company will pay me back my money?

Good or bad bond?

Your ability to assess the company's financial position and determine whether they can pay you back is crucial.

If you have doubts that they can repay their loan obligations, then just don't invest! That's precisely why I avoided Aspial and Hyflux bonds when they launched it on the open market.

Of course, you and I could be wrong. Maybe Hyflux is too big to fall. Maybe their sponsor will come in to pay off their debt obligations if they run into financial problems. Maybe a knight in shining armour will appear. And if they successfully turn around the business, you'll be rewarded for having stuck with them during this time.

So ask yourself if the interest rate is good enough for you to take that amount of risk.

If it is, then go for it! If you're uncertain, then find another investment opportunity. There are plenty of other options.

$200k lost per investor, who could be your aunt, your teacher, or even your friend.

Did you know that these folks were sold Swiber bonds by their bankers? They probably trusted the "experts" or thought they were in safe hands as it was backed by DBS. But remember that bankers have KPIs to meet – how much you get from your investment isn't how their performance is being measured by.

Be smart about your investments, or risk losing your money. #dayreinvest