Should you buy ETFs or invest in stocks?

For those who aren't familiar with the term, ETFs stand for exchange traded funds. They're basically a basket of companies that you can buy on the stock market.

Wanna buy 10 REITs but only have enough money for 1? You can have your cake and eat it too, by buying into a REIT ETF. In Singapore, this was introduced for the first time last year in the form of SGX APAC REIT ETF managed by Philips.

Here's a look at what you can get by buying into this ETF:

A mix of 10 REITs across three different countries. At its present price of 93 cents, you'll only need $93 to buy 1 lot (excluding brokerage fees).

If you were to invest in each of them yourself, $100 is totally impossible. You'll need a lot more money than that.

ETFs are also greatly touted by many legendary investors including Warren Buffett himself. He has publicly said that after his death, he wants his funds to be put into ETFs.

What makes ETFs so attractive?

1. They're cheaper to buy than the totality of its stock components.

2. You get to diversify across the whole sector as well in a single purchase, thus spreading out your risks.

3. They have low management fees, costs which would otherwise eat into your returns.

4. They're simple to understand and a no-brainer for folks who are either too lazy, busy with no time to analyse, or who can't really comprehend individual stocks.

5. They're convenient.

6. There's a large variety of different ETFs. You can buy gold ETFs, bio-pharma ETFs, S&P 500 ETFs, etc.

7. They're relatively safe and track the stock market returns to a close margin. For instance, in Singapore, you can buy the STI ETF which is a basket of Singapore's top 30 biggest companies like DBS, Capitaland, Singtel, etc.

8. The stocks within the ETFs are rebalanced accordingly. You might have heard of Noble, which has been on a downturn for quite some time. Last year, it was finally removed from the STI Index.

9. You can practise DCA on it without too much worries.

DCA, or dollar cost averaging, is a method where you basically average out your purchases.

Say for instance, the price of mangos, which we know is a seasonal fruit. There are times when mangoes can cost $3.50 each, sometimes $2, or so on and so forth. Their prices fluctuate based on demand and supply.

If you commit yourself to spending only $10 on mangoes every week, you'll get more mangoes when they're on sale, and less when they're being marked up in the supermarket.

Let's pretend you bought this:

Week 1: $10 for 3 mangoes ($3.33 each)

Week 2: $10 for 4 mangoes (fire sale! $2.50 only!)

Week 3: $10 for 5 mangoes (lelong lelong! $2 each!)

Week 4: $10 for 2 mangoes (a fire destroyed all the mango plants and there's a serious shortage now so you've to pay $5 each if you still want your mangoes)

Let's also pretend that these mangoes somehow can all last forever (hey, it is all imaginary right so anything goes).

What's your total average price for all your mangoes now?

You spent $40 and managed to buy 14 mangoes. That works out to be $2.85 per mango.

Did you realise what just happened?

By using DCA (where you commit a fixed amount to buy each month), your disciplined approach gets you more mangoes when they're cheap and less when they're more expensive. On the whole, you would have paid less per mango.

It isn't the cheapest, but definitely not $5 per mango.

DCA is also a no-brainer method, so it is easy to execute without you having to spend time analysing individual stocks, digesting their financial statements, yadah yadah. (For a worked example, refer to my Dayre post last weekend on Asian Pay Television Trust stock).

If you asked me what is one advice I have for any beginner investor on how to get started, I would point to the DCA method via ETFs. I've been saying this both on my blog and Dayre for the longesttttt time (omg BB why you so naggy).

"Eh BB, should I buy direct or through the banks then?" (question from @xisng)

Buying through the OCBC blue chip plan or the POSB InvestSaver plan is great. I've been recommending the latter in particular, because it pretty much forces you to be disciplined as it deducts the money from your account each month to invest.

But if you know yourself well and feel that you're a very disciplined person who can resist the temptation of your wants vs putting your money into investments, then you can go direct. There will be some cost savings you enjoy when you don't go through the bank (I didn't bother calculating).

"Then BB, how come you buy stocks directly instead of buying ETFs?"

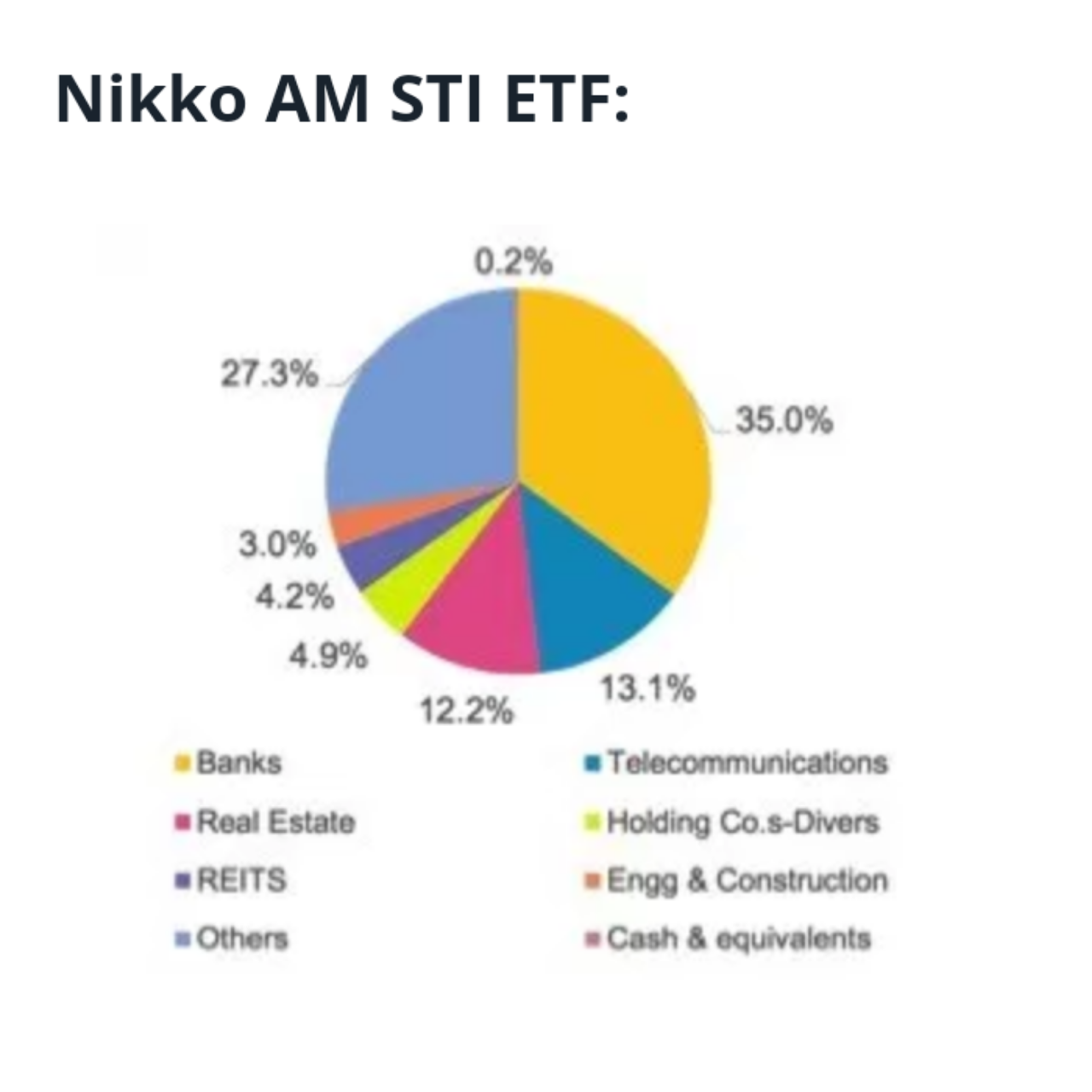

Nikko AM

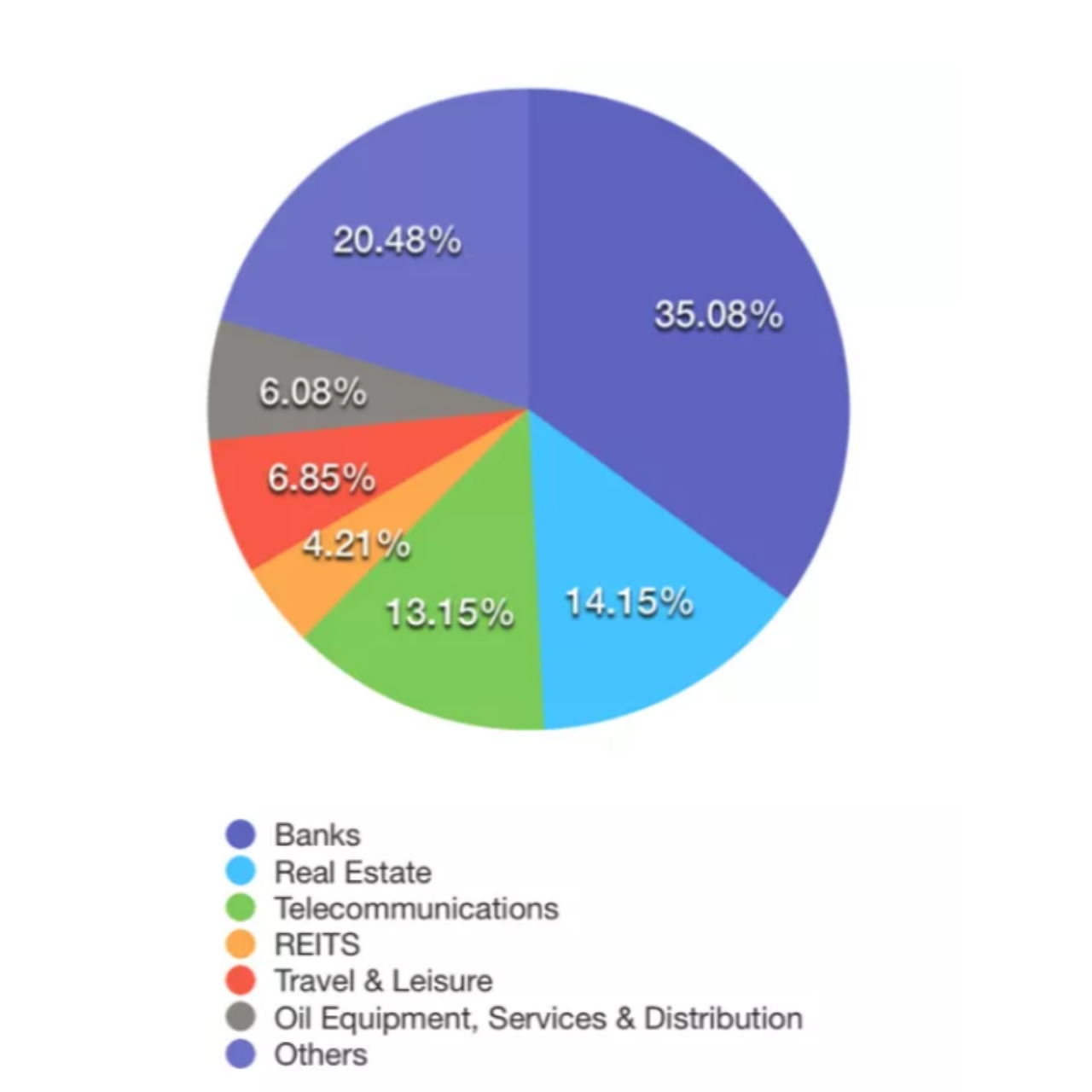

SPDR.

The differences between the two are marginal. Don't ask me which one to buy k – make your own decision! It's like asking me "Eh BB do you think I should buy Starbucks or Coffee Bean?" 😑

I personally don't like UOB, SPH, Thai Beverage and Global Logistic. Take SPH for example, I think they've been too complacent and slow to adapt to the changing media landscape. In the past, advertisers could only spend their marketing dollars mostly with SPH or outdoor events. Today, advertisers are also flocking to websites like Mothership and individual influencers. No wondet SPH profits dropped so much recently (go read).

I also like analysing stocks and businesses. Call me weird, or maybe it is just an occupational hazard.

(I teach General Paper to JC students, which involves a lot of critical thinking, analysis and evaluation.)

So for me, I prefer researching into individual stocks and buying the ones that I like, instead of a broad index like the STI ETF.

Which method is better?

When you invest in a broad index ETF, your returns will mirror the stock market returns. If the stock market crashes that year, your portfolio will take a hit as well.

When you invest in individual stocks, the risks are higher, but so are the rewards. You may end up picking a poor stock, but the likelihood of this can be reduced if you do your due diligence properly, or thoroughly. Returns can be magnified (my most profitable was a 25% gain on a single stock in 3 months).

So if you know how to pick the better quality stocks, you can focus your money on the winners. Keppel for instance returned 24% in the last year but the STI index has only returned 10% both from the January 2016 downs.

Which method is better? Depends on you. I don't know what your personality is, or your ability to research or spend time and effort studying your stock, so I wouldnt know which is better for you.

I wanna hear from you guys! Which method do YOU prefer and why?