Today will be my last day as EP, and I just wanted to say thank you to all of you who have shown me encouragement in one way or other – this week has really spurred me to keep on writing and sharing my knowledge on personal finance and investing with you guys!

My ultimate dream is to become a published author someday, and I hope that through my words, the world of finance becomes a little easier for you guys to understand 😊 that's a dream come true for any writer!

This week, I've invited you guys to join me on a journey to transform your finances. We've looked at:

📅 Day 1: Financial Resolutions (to make and keep)

💸 Day 2: There's no need to spend just to impress others

👯 Day 3: What is Financial Freedom and how you can get there

🙅🏻 Day 4: Financial Fasting #dayrefinancialfast

👗 Day 5: Decluttering your wardrobe and being aware of how much you've been spending on clothes

📚 Day 6: Basics of personal finance for students and beginners

Day 7: ???

I don't have an emailing list set up cos I'm hesitant about spam, but if you'll like to receive updates on my blog, you can follow me on Facebook for updates.

My blog is my personal journal on my financial journey, and also where I jot down all my learnings and knowledge – whether I picked them up from books, newspapers, analyst reports, or my mentor.

I try to write at least once a week to keep myself accountable, and in-depth investment analysis of stocks are always uploaded here so I can look back on my investment thesis in the future.

www.sgbudgetbabe.com

Each time I update the blog, I'll put it out on Facebook too. That way, you'll be able to know when there's something new to read.

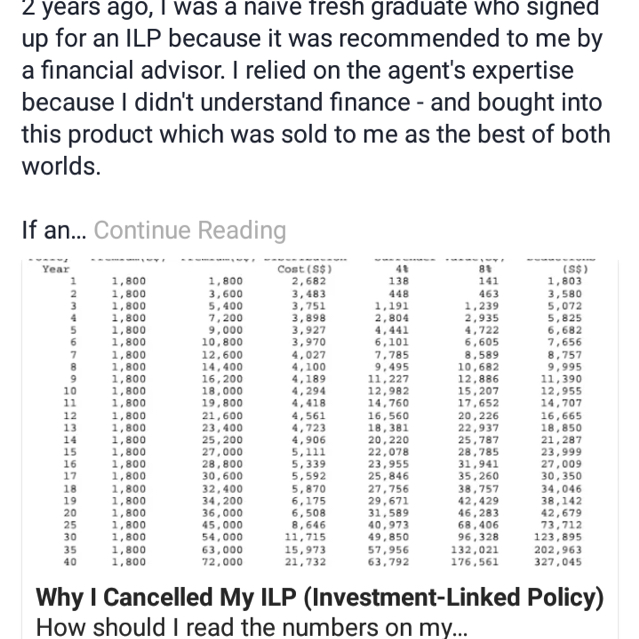

Industry experts and other finance writers always describe my style of writing as very "brutally honest" 😅 because there were so many people being mis-sold ILPs by their agents, I eventually disclosed the numbers on my (cancelled) policy in the name of transparency. Under ordinary circumstances, you'll have to buy the insurance before you even get to see these sort of numbers and T&Cs.

But contrary to what many people think, I don't just save and save – I like to have a good time too! My kryptonite is overseas travel, and I like looking out for good deals whenever I head abroad. This was what I have planned for 2017, and thought it'll be useful to share with whoever wants to travel too (but can't afford the luxury of more expensive locations!)

A lot of people are reliant on their insurance agents (they call themselves "financial advisors" or "wealth planners" now) to manage and grow their money for them. My mom was the same.

It was only a few years ago when I realised she has been overpaying for her insurance – her monthly premiums are about the same (based on age level k) as my current plan, but she's only insured for a sum of $25000 instead of the $200000 I have.

And she was completely clueless 😓

If you really think your financial advisor is gonna help you become rich, I'll say you're either super-super-duper-extremely-realllllllly lucky 😕 or just plain naive.

Rewind the clock back by 20 or 30 years. Folks during that time really believed in their insurance agents, and many bought into endowment / investment-linked plans / unit trusts with their advisors. They diligently put aside enough money and paid monthly premiums, believing that the money would grow into a huge pot of gold.

After all, that's what their agents (and the insurance companies) "promised" them. Believing that these "experts" knew more about finance and investing than them, many from the older generation bought into it.

Fast forward back to today, where they've paid 20+ years of premiums. It is now past the supposed "break even" point, and they excitedly ask to cash out their policies, only to realise the gold wasn't technically what they thought they would be getting.

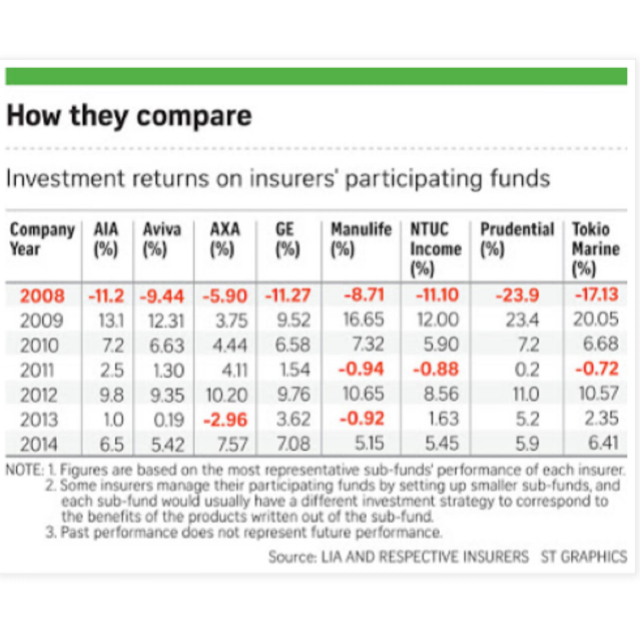

This isn't fiction; it is real life. See how the fund managers (who are supposed to be the experts) didn't fare as well as others expected them to?

This hit the headlines last year as many Singaporeans filed complaints about their insurers, claiming that they did not deliver on what they promised.

Oh?

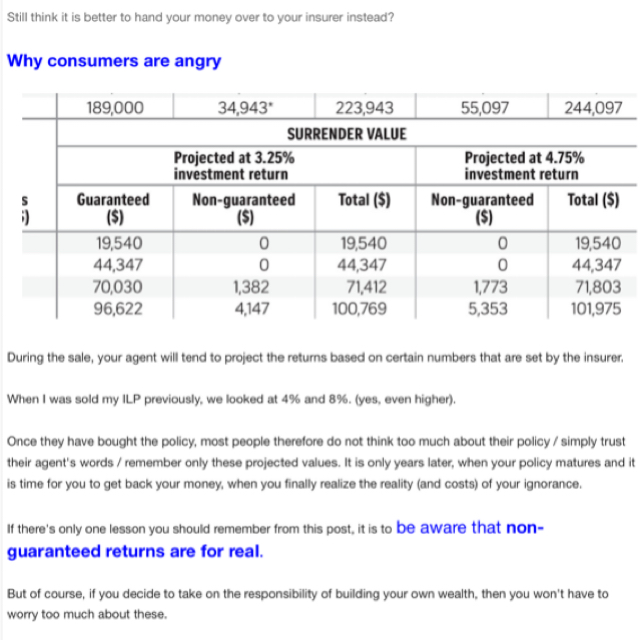

It took them years to realise that the difference between projected maturity values and the actual payouts by insurance companies can be quite significant. Not too long ago, a Singaporean woman in her late 50s lodged her complaint against her insurance after she was taken by surprise when her policy matured and gave her a lower maturity payout than the projected maturity values she had been expecting.

The illustrated terminal bonus had also not been paid to her upon the policy's maturity. However, she didn't win the case. Instead, her insurer merely reiterated that "the projected maturity values were not guaranteed, something that was stated in the contract" 😓😕😒

According to LIA's compilation of life funds' returns requested by The Sunday Times, insurers Manulife, Prudential, AIA and Tokio Marine have achieved average returns of just slightly above 4 per cent per annum over a seven-year period ending 2014.

Most insurers will combine both stocks and bonds in your funds when you invest with them. We then looked at an imaginary scenario of a portfolio comprising 60% blue-chip stocks and 40% government bonds. (You could call it "diversifying", almost similar to what your insurer tells you they do.)

The results here are exceptional :

You would have achieved a return of 4.02%, HIGHER than ANY of the other insurance companies in this same period.

This is a portfolio that you can EASILY replicate, which can likely OUTPERFORM the various insurance funds, as we have seen above. The question is, are you willing to spend those few minutes doing it?

Imagine if you paid all that money for YEARS, genuinely believing that you would be getting back $XXX amount of money, only to be given a fraction of it.

But by then, it'll be too late. Who do you blame? Your agent? Your insurer? Yourself for being so naive?

Regardless of who you blame, the reality is that what has been done is done. Nothing you do will help you to turn back the clock and get back all that lost time.

If others are taking steps to get ahead in their finances / life, why are you allowing yourself to fall behind?

I paid thousands of dollars on my own Investment-Linked Plan (ILP) to learn the painful lesson of "distribution cost" and how it erodes our returns. Basically, the reason why your fund performance sucks is because a lot of the money is used to pay the insurer to "manage" your funds!

And to maximise their money earned, many insurers practise "churning". I won't go into this today because I don't wanna get sued k?

My heart (and wallet) ached when I decided to cancel my ILP. But there wasn't any point crying over split milk – I had only myself to blame for naively trusting everything my agent told me. He was a trusted long-time friend too.

I wished someone had told me this before I even bought the ILP years ago, but no such information was available. Even when I blogged about it, no one else had publicly spilled the beans about the industry and disclosed their policy details in this manner.

Who would want to admit that they lost money, right?

But it is a fact that I had been foolish once, and I hope that by sharing about my mistake, you guys can learn from my errors and avoid having to learn such an expensive lesson by yourself.

So take charge of your finances, because if you don't, then no one else will. (Unless you marry a financially-savvy spouse la hahaha!)

How exactly can I invest? What do I invest in?

I'll continue to write more about finance and what I know! Once in a while, I may also simplify my investment thesis here on Dayre if there's a stock simple enough to explain without too much numbers or technical terms. (For the more complex ones, you'll have to search the stock name on my blog.)

I also read and reply every single one of your emails, so if you want to stay in touch or ask me something in private, feel free to drop me a note anytime!

Email address can be found at the bottom of my blog.

I promised some of you that I'll write a little more about each different asset class, and also touch more on insurance + how to manage your finances as a student, so I'll get them out over the next weeks k!

In the meantime, if you're looking to learn more, don't forget to sign up for my 24 Jan talk on personal finance for beginners. We'll be covering about savings, expenses, basics of insurance and investments for those without huge $$$$.

Link is on my post yesterday! 😊

Of course, other than bonds, there are many other financial instruments that you can choose from to grow your money.

Some other examples include:

💰 government or corporate bonds

💣 junk bonds (😱 please, no)

🏠 property and real estate

💰 gold, silver or Bitcoin

💶 forex (but highly volatile)

📈 stocks : blue chips, REITS, etc

📰 stock market indexes

🎫 peer-to-peer lending

⌛️ unit trusts

And more!

Of course, you can also invest in YOURSELF. By increasing your own "market value", you'll be able to command a higher income over time, and possibly become the best money-generating asset for yourself.

Important disclaimer: this is not a post advising you to avoid or terminate your ILP altogether, but a tale of how I made a mistake on my own ILP.

Remember that different financial instruments are designed for different purposes, and in order to know whether one is right for you, you'll have to make that judgment with a consultation by a qualified financial advisor. I can only share what I know, but I can't always advise you either, and neither should you rely solely on my advice!

Remember that ultimately the one who has to be responsible for managing your own finances has to still be you 😊

(I originally planned to talk about basic insurances that I feel are necessary, term vs. life, hospitalisation, critical illness coverage, etc…but according to a critic in the comments below I'm not qualified to do so 😕😕 ??? )

Do you guys want me to write more about insurance this week?