A few months ago, I was interviewed by Channel News Asia (CNA) for advice on how to reduce one’s income tax bill, which I penned into a blog post here as well. With tax season here, many of you have asked if there’s a specific one for working parents like myself, so this article is for you – may this help you to reduce your income taxes!

There are 18 ways you can use to reduce your income taxes, aptly summed up in the visual (by IRAS) above. For those of you who are confused about why certain schemes are named as “relief” vs “rebates”, here’s the definition provided by IRAS:

- Reliefs – reduce the chargeable income that you’ll get charged taxes on i.e. before the bill.

- Rebates = used to offset your tax liability after the bill has been ascertained, so if it wasn’t used fully in this year, it will be carried over to your following tax bills until it is used up.

Before we dive into details, here’s a quick overview of the different reliefs/rebates that working parents can use to reduce your income tax:

- Parenthood Tax Rebate (one-off)

- Qualifying Child Relief – $4,000 per child

- Parent Relief – for non-working parents whom you’re supporting

- Spouse Relief – for a non-working spouse whom you’re supporting

- Grandparent Caregiver Relief – for working mothers who engage their parents/in-laws to look after their child while they go back to work

- Foreign Domestic Worker Levy Relief – for working mothers who hire a domestic helper to look after the household while they go back to work

- CPF Cash Top-Up Relief – for voluntary top-ups made to your / your loved ones’ CPF

- Course Fee Relief – for relevant upgrading courses taken in the year

- Supplementary Retirement Scheme – for those who voluntarily top-up your SRS account

- Donate to charity – get 250% tax deduction when you donate to IPCs

There are some that can only be claimed by working mothers vs. working fathers, so here’s another easy summary table:

Parenthood Tax Rebate (PTR)

This is only one-off, in the year that your child is born. If you did not use up the entitlement, it will carry forward and you can use it to offset your subsequent years tax bills until the rebate has been fully used up.

So if your child is older than 1 year old, then you can forget about this rebate…until you have another child, that is.

Qualifying Child Relief (QCR)

This is automatically given by IRAS in a 50-50 equal split per parent once the child is born, where you can also claim QCR of $4,000 per child or $7,500 HCR per child as long as your child is not earning an income.

This can be split between you and your spouse, if need be.

Tip: As confirmed by IRAS, it would be a financially smarter decision to give the QCR to the higher income spouse.

Parent Relief

At least 55 years old and earns no more than $4,000 in a year. If you’re staying with your parent, you can claim up to $9,000 – but this is shared between siblings. The same dependent cannot be used to concurrently claim for Spouse Relief either.

Spouse Relief

If one spouse is staying home and not working, you can claim a maximum of S$2,000 for Spouse Relief. However, take note that this relief cannot be claimed in conjunction with the Parent Relief. Here’s an example:

e.g. Dad wants to claim for Spouse Relief because his wife is not working, but at the same time the siblings want to claim the Parent Relief on the mother as well, then both reliefs cannot be claimed at the same time on the same dependent. In this case, the family will need to discuss who gets to claim what!

Financially, the smarter way would be to claim the higher relief i.e. the children claiming for Parent Relief on their non-working mother would get $9,000 vs. the dad claiming $2,000 via Spouse Relief.

Grandparent Caregiver Relief

Only claimable by married women, and designed for situations where the mother asks the grandparents to help take care of their young kids so that they can go back to work.

And even if your child has more than 1 caregiver (e.g. both your mom and dad are retired and helping to look after your kids), you can still only claim for a maximum of $3,000 on one related caregiver under GCR.

In the past, you couldn’t claim this if the grandparent was still doing some salaried work (e.g. part-time roles) and earning an income. But starting from YA2024, this will be changed to cover grandparents whose annual income not exceeding $4,000 you can still claim.

Foreign Domestic Worker Levy Relief

This is also only claimable by working mothers, for situations where they hire a domestic worker to help look after the household while they work. Doesn’t matter if you don’t have a child.

You can claim up to 2 times the amount of levy that you paid in the previous year on 1 domestic worker.

If you’re rich enough to afford and employ more than 1 domestic helper, please read here for how much relief you can claim.

CPF Cash Top-Up Relief

When you make voluntary cash contributions to your CPF account or that of your loved ones, you can claim for tax reliefs on these. The maximum CPF Cash Top-up Relief per Year of Assessment has also recently been raised to $16,000 (maximum $8,000 for self, and maximum $8,000 for family members) as of last year.

This means you can claim for the maximum by doing the following moves:

- Make a voluntary cash top up to your Special/Retirement/MediSave Account

- Top up your loved ones Special/Retirement/MediSave Account

Note: Loved ones refer to parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings. However, you can only get tax reliefs for top-ups to your spouse or siblings’ if they have an annual income less than $4,000 in the year prior (salary, bank interest, dividends and/or pension) or they are handicapped.

The tax relief is only up to the Full Retirement Sum (FRS), so it is a good idea to check whether you and/or your loved ones are approaching the FRS in your CPF account(s) before you make the contribution.

Check out more information and eligibility criteria here.

Course Fee Relief

In line with lifelong learning, as long as you have attended a course or conference that can lead to a higher qualification relevant to your employment or vocation, then you can also claim up to a maximum of $5,500 in course fees reliefs each year.

Note: You cannot claim for courses that are for leisure purposes or general skills (e.g. baking / social media / basic website building). Neither can you claim for courses that were paid via SkillsFuture credits or your employer. I know, because I tried and had to call in to clarify!

However, IRAS has said that this will lapse for YA2026 onwards 🙁

(Source: IRAS Deputy Director, Individual Income Tax Division, Sau Hing Chin)

Supplementary Retirement Scheme (SRS)

Another easy hack is to open an SRS account with any of the 3 local banks and contribute cash into the account, which will allow you to enjoy up to $15,300 of tax reliefs ($35,700 for foreigners).

The only downside of this is that deposits in your SRS account earn only 0.05% p.a. interest, so you might want to consider investing it instead. Read this for some ideas on what you can invest your SRS monies in!

If you want a simpler, fuss-free method of investing your SRS funds that doesn’t need so much monitoring, check out ETFs instead – here are some of the most popular ones that fellow SRS investors are going for.

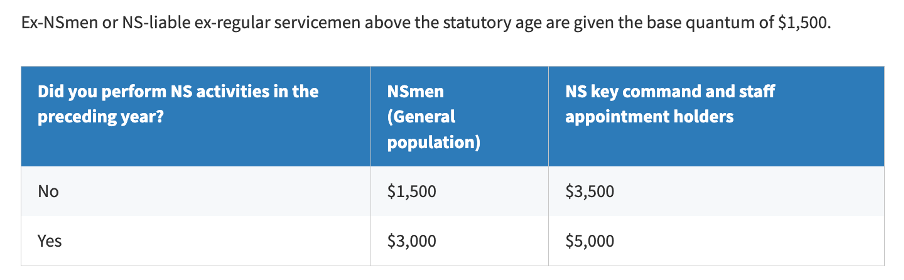

NSman Relief (self, wife and parent)

All eligible operationally ready National Servicemen (NSmen) are entitled to NSman tax relief, including their wife and parents in recognition of the support given.

If your husband is an NSman, you can also claim $750 under the NSman Wife Relief. Think of it as the nation thanking you for supporting your husband in his service to the country.

And if you are a parent whose son is an NSman, each parent can claim $750 regardless of the number of children who are NSmen. Yes, so that means even though I have two boys, I won’t be able to claim 2 x the reliefs on each of them in the future.

Well, what if you are a mother where both your husband and son are NSmen? In that case, you can only get EITHER the Wife OR Parent relief of $750 (and not $750 x 2). Not fair? Yeah, I think so too 🙁

Donate to charity

When you donate to any charity that is an approved Institution of a Public Character (IPC), you can enjoy a 250% tax deduction based on your donation amount.

This is usually automatically calculated and applied on your tax bill – provided that your donation went to a registered IPC.

As an example, if you donated $1k to an approved charity, $2.5k will be deducted from your total income to be assessed. And if that brings you down to the lower income tax bracket tier, it’ll definitely bring you even more joy than the gratification you felt from doing a good deed. Talk about killing two birds with one stone!

Reliefs with the most financial impact

The most significant tax relief that I get is definitely the WMCR, followed by my moves in topping up cash to my CPF, my dad’s CPF and also to my own SRS account.

The other reliefs barely move the needle, but help to inch closer to the maximum income reliefs cap of $80,000. And whenever I find myself on the edge of one income tax bracket, I’ll resort to Method #4 (donate to charity) to try and see if I can bring myself down one tier.

If you’re in a household where the husband is the higher-income spouse, then it may be worth giving the entire QCR and Parent Relief to them so that your total household income taxes payable will become much lower.

What other income tax hacks do you use?

Share if you found this article helpful!

With love,

Budget Babe

4 comments

“If you’re in a household where the husband is the higher-income spouse, then it may be worth giving the entire QCR, GCR and Parent Relief to them so that your total household income taxes payable will become much lower.”

Hi, didn’t you mention that GCR is only available to working mothers and not working fathers? The paragraph above seems to suggest that GCR can be given to the higher-income husband…

Is miles covered for Paywave (mobile Payment) for UOB lady cards?

Yes if your Paywave is on the selected category for that quarter.

thanks for pointing out my typo – I’ve fixed it! you’re spot on, GCR is only for working mothers.

Comments are closed.