I hit my $100,000 milestone before I turned 30, which felt like a feat considering I started with a take-home pay of $2,000 as a fresh university graduate.

Young working adults today will probably have an easier time hitting the $100k milestone before 30, considering how the median monthly gross salary for fresh graduates in full-time jobs has since risen to S$4,200 (i.e. 50% higher than my time).

Of course, the challenges that were present during my time remain – especially when it comes to being disciplined about one’s budget and learning to avoid lifestyle creep. And to be fair, while starting salaries have indeed risen, the price of food in the CBD has also gone up by at least 30% vs. what I remember paying for when I started my first job then.

But for folks who are willing to do meal prep and cut down on social entertainment (or find more cost-effective ways to hang out with your friends) like I did back then, you’d probably be able to hit the $100k milestone even ahead of the time that I did.

Here are 3 tips to help you hit that $100k milestone before 30:

1. Aim to save at least 50% of your take-home pay, if not more.

If you haven’t already watched Netflix’s reality show How to Get Rich (hosted by self-made entrepreneur Ramit Sethi, who travels around the US to help families sort out their finances), one of the key takeaways from the show is that even those earning the most money on the show had some of the worst financial planning sense. Over the 8-episode show, Sethi demonstrated that no matter how much money a family earns, bad habits and poor financial planning don’t disappear even on a higher income; instead, the problems only get magnified.

What I’ve noticed is that financially savvy folks tend to start with their savings, because they know that financial freedom ultimately boils down to how much you can keep vs. how much you make.

For example, I set a 50% savings target for myself when I first started work, and later managed to up that to 70% – 75% each month. Your exact number may vary depending on your paycheck and financial commitments at home, but see if you can challenge yourself to hit 50% at least, for a start.

2. Park your savings in a high yield savings account.

High yield savings accounts (abbreviation: HYSA) are bank accounts where you can park your savings and earn a higher interest than the nominal rate when you hit certain requirements each month.

You can use a HYSA for your short-term savings, and then for cash that you do not need in the immediate future, you can put them to work by investing it instead.

3. Start investing early.

You may have already heard this before, but time in the market matters more than timing the market. As a young investor, your greatest asset and edge over everyone else is your time.

When you start investing early, you’re allowing your investments to compound over time to grow into potentially significant returns.

And if you’re a beginner or inexperienced investor who doesn’t know where to begin, investing in something you’re already familiar with may be a good starting point. If you’ve spent the last few years living in Singapore, you’d probably already know of companies such as DBS Bank, CapitaLand and Singtel1 Instead of buying each of their stocks individually, you could go for an Exchange Traded Fund (ETF) tracking the Straits Times Index (STI), which includes all these companies and the rest of Singapore’s top 30 listed companies.

- * Reference to any particular securities or sectors is purely for illustrative purposes only and does not constitute a recommendation to buy, sell or hold any securities or to be relied upon as financial advice in any way. ↩︎

Employing a Dollar Cost Averaging (DCA) strategy – where you invest a fixed amount on a regular basis – via a Regular Savings Plan (RSP) is an easy way to get started.

Did you know? Some of our local banks even offer extra interest on your HYSA when you invest into a RSP through them.

The Nikko AM Singapore STI ETF is a popular one used by many investors to get exposure to the Singapore market in a single investment position, so that you don’t have to waste energy buying or tracking individual companies since the index automatically rebalances its constituents semi-annually. For instance, Seatrium was selected to replace Keppel DC REIT on the list last June.

If you prefer to combine with thematic investing, there are also other ETF options like the Nikko AM-StraitsTrading Asia ex Japan REIT ETF which offers exposure to real estate managers in Singapore, Hong Kong, India, South Korea, and more.

Or, perhaps you wish to ride on the growth trend of electric vehicles (EVs), especially since you can literally see (within your own neighbourhoods, no less) that Singapore is already beginning to embrace this trend as well. That’s why I’ve been watching the NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF, which offers exposure to China’s broader EV and future mobility ecosystem, covering not only EV manufacturers but also other players across the value chain.

4. Visualizing your path to $100k by 30.

With a plan in place, you can now start to project how your plan will play out in the coming years before you hit 30.

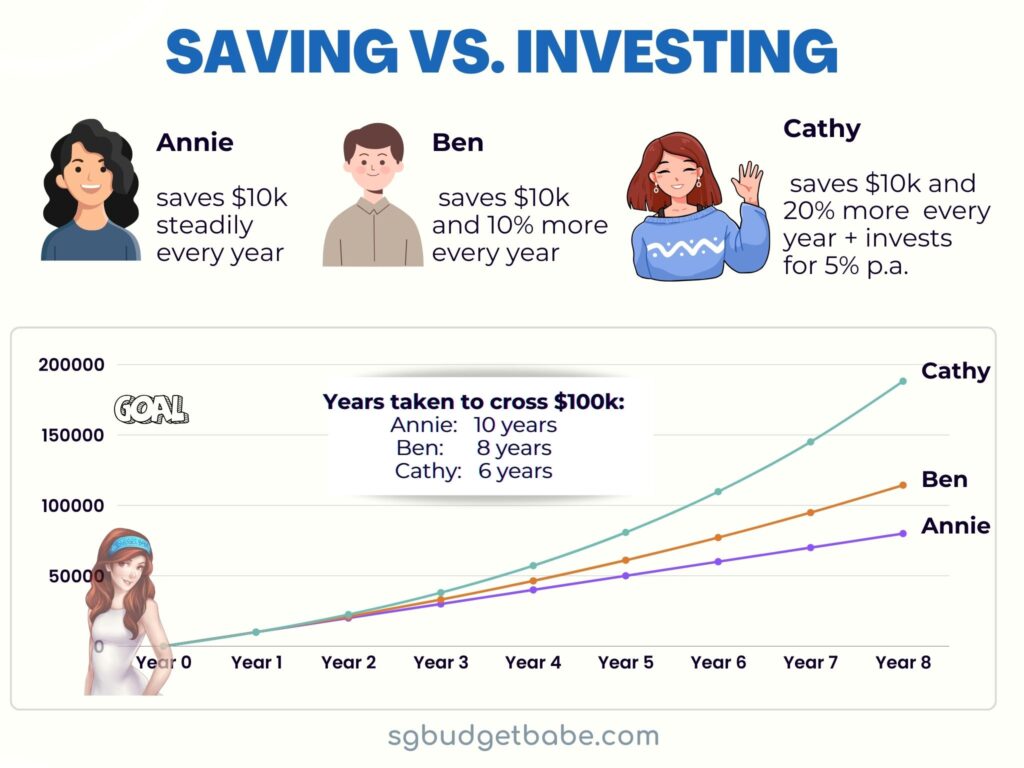

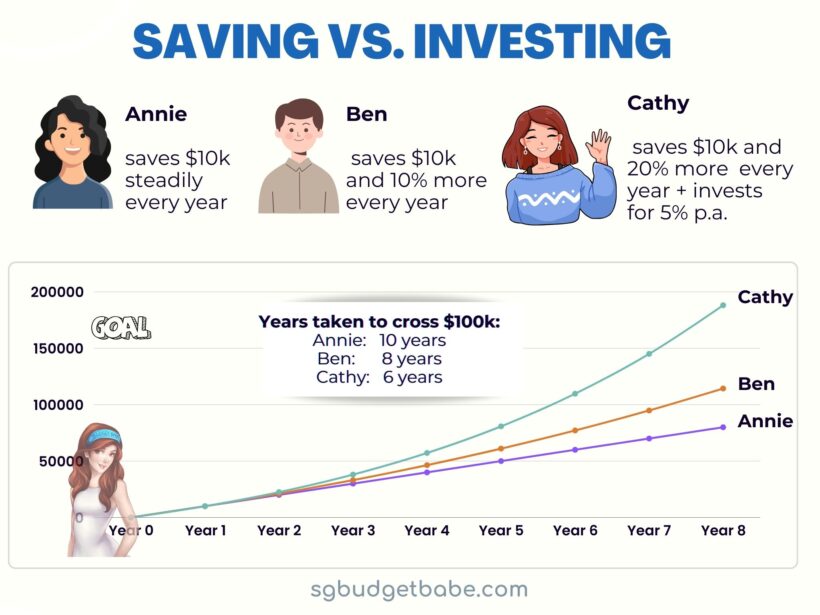

Imagine 3 fresh graduates who decide to start at age 24:

By relying on their savings alone, Annie and Ben do decently well, but still not enough to get to the $100k by 30 mark anytime soon.

On the other hand, Cathy – who employed both savings and investing strategies – was able to comfortably cruise towards her $100k milestone and hit it by 30.

Of course, what this chart doesn’t demonstrate is that Cathy also had to deal with more market volatility during this period. But market volatility is not a bug – it is a feature of the stock market. Once you understand and appreciate this, you are better equipped to take advantage of market volatility for your own gains instead of panicking when the average person is running for the hills.

The key message here? That if you try to only save your way towards a $100k (and your subsequent financial milestones), you’re going to have a hard time hitting them.

Instead, what I do is to save, earn more AND invest.

With these 3 in place, you’re now one step closer to hitting $100k by 30, or may even smash those goals by meeting it earlier than expected.

After all, it is with hindsight that I can tell you now – that’s exactly what happened to me, and you can track it all here on my blog.

Want to know how I hit $100k by 30, and how you can do the same?

Sponsored Message

Disclosure: This article is brought to you in collaboration with Nikko Asset Management. Nothing in this post is to be constituted as financial advice since I do not know the details of your personal circumstances. You are encouraged to read more about RSPs via MAS-licensed providers including DBS and NikkoAM to help you understand and decide how an RSP can fit into your investment objectives. Your investment returns may vary, depending on market conditions and your skill level. While DCA-ing into a RSP is a common strategy advocated by many, you need to know that there are no capital guarantees and as much as there’s potential for gains, there is also the possibility of losses. Important Information by Nikko Asset Management Asia Limited: This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”). Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund. The information herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. Reasonable care has been taken to ensure the accuracy of the information, but Nikko AM Asia does not give any warranty or representation, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore. The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units. The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time. Nikko Asset Management Asia Limited. Registration Number 198202562H.

2 comments

What specific investment options are recommended for young investors?

Hi Kateryna, age isn’t necessarily a reflection of one’s investing abilities and neither are investment instruments limited by age. Go back to the question of how confident you feel + where your own investing skills are at, and you’ll be able to discern which tools work best for u.

RSPs, as per this article, for instance, are great not just for young investors, beginner investors, but even older savvy investors use them as part of their portfolios. Of course, there are those who don’t use RSPs in theirs either for various reasons, so you gotta know yours and work from there 🙂 hope this helps!

Comments are closed.