Hitting $1 million for retirement

A lot of my friends laugh at me when I tell them that I'm saving up for retirement. To many people my age, they prefer to spend on travelling, facials or manicures, and other luxuries.

Some save up for their wedding or house. Most think I'm crazy to be thinking about retirement at this age.

"Huh, you're so young leh! Simi retirement?!?"

😓 #dayrefinance #bbinvestments

There are folks in my social circle who are encouraging of my goals. But they're mostly friends who are insurance agents, or who have just joined the industry. Shortly after showing support, many of them have tried to get me out for a "catchup"…only for me to realise that all that support was merely so they could lead up to selling me an investment linked policy or endowment plan.

#realfriends huh? No thank you!

I believe in starting early because I can then make use of the powerful magic of COMPOUND INTEREST.

The longer I wait, the more I need to save.

My 20s are the best years of my life to save. At this age, I have very little financial liabilities. My mom is still working, my dad still has his CPF retirement payouts, my sister has her own job… I don't have a housing loan or kids to worry about feeding yet.

I can easily save up to 75% of my monthly salary if I don't dine at restaurants or go partying too often.

Some of these money goes towards my emergency funds and saving jars – #dayrebrides #dayrehomes and other impending milestones.

Some gets parked in investments #dayreinvest The rest gets channeled into my CPF. I'm letting them sit and grow between 4% to 8% in returns. That should net me $1 million easily before I hit 50.

The keyword is TIME.

Basically the more you let your money compound over time, the easier it is for your money to grow.

Talking to older folks has made me realised very early on the importance of saving and starting young.

Too many people wait until they're in their 40s before they start thinking about saving for retirement. But by then, you'll need to save a lot more just to reach a comfortable sum.

You may have a higher pay by then, but how much can you realistically save at that age? We'll have a house to pay off, retired parents to support, kids to feed, etc.

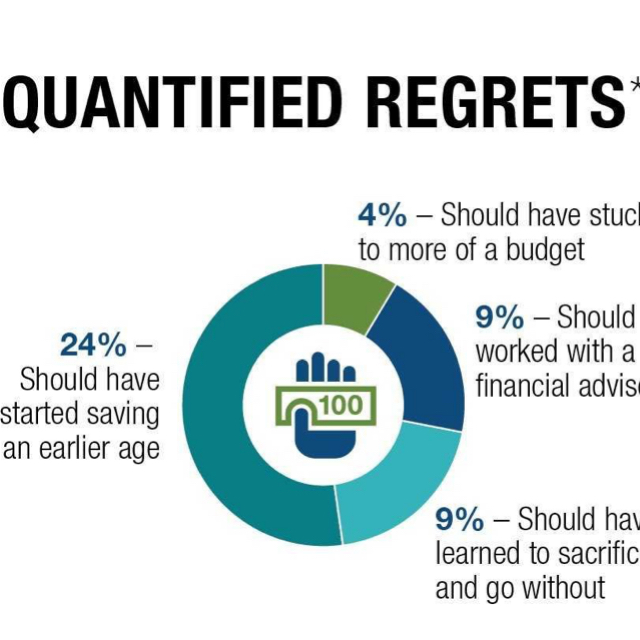

Business Insider interviewed 100 year olds previously and asked them what were their biggest regrets in life.

I don't want to end up having those regrets. There are so many passions that I want to pursue – giving free General Paper tuition to needy students, teaching kids and young adults about personal finance and investments, publishing another book, starring in a short film, etc.

I've personally PAID out of my own pocket to attend investing courses. They're not cheap.

One that I attended last month tried to sell me into their program for close to $5000.

They said that the $5000 would gain me access to tried-and-proven investing secrets that would guarantee me returns of 25% every year.

$5000!!!!!! 😱😱😱 I would need to work for more than a month just to get that amount!

And 25% is insane. I don't believe it one bit. Even Warren Buffett doesn't have that kind of results consistently.

I don't see why we need to pay so much to learn how to invest. Frankly speaking, I learnt everything I know from reading books and financial bloggers' analysis.

That's also why I started writing more about my investments on my blog. And I try to reply every reader who emails me for help or advice. But there's so many more people whom I'm not able to reach and help.

Anyway, back to my dreams. All these pursuits are difficult to chase after when I have to worry about having enough money for my regular expenses.

I want to become financially free so that I can then go after my dreams without any worries or regret.

Life is too short for regrets.

I don't care if people judge me for it. I've seen too many people regret the choices they made (or failed to make) when they were in their 20s, and I don't want to become like them.

#dayresavings

Starting a new hashtag #dayreinvest ! I realised no one has been talking about this topic but if you do, let's start a new community!

Investing is better when you have a network to check your ideas with and get differing opinions to weigh. I've been doing this with my male friends but their approach to investing is very different from a female! Surely I can't be the only female investing… Would love to meet the rest of you! 😊