I often get emails from readers telling me that they would like to invest in stocks after having read my blog, but are too afraid to start because they don’t know when is a good time to enter the markets, what stocks to pick, or are unsure if their capital is enough to get started with

My answer has always been that if you’re a beginner starting out on your investing journey, then Regular Shares Savings (RSS) Plans might just be a good place to start.

It is no secret that saving and investing consistently is one of the most effective ways to build long-term wealth. However, some people struggle with trying to find a suitable timing to invest, while others get caught up with their daily lives or a busy season at work and fail to keep up with their investments.

If that sounds like you, then automating your investments is the way to go.

This can easily be done via a Regular Savings Plan (RSP), which enables you to invest a set sum of money every month into your preferred investments. The amount is automatically deducted from your bank account and invested in your chosen asset – such as exchange-traded funds (ETFs), stocks, or unit trusts – and employs a dollar-cost averaging strategy, where you invest regularly regardless of market conditions.

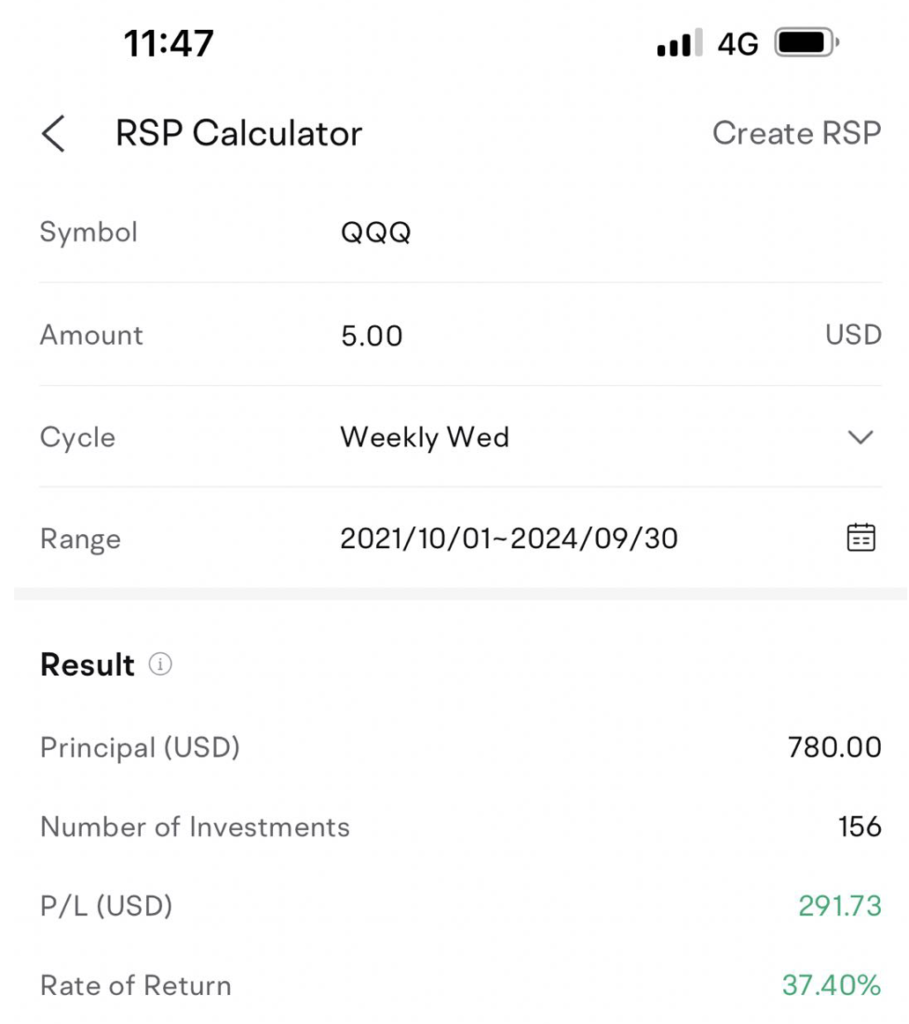

Here’s an example of how much you could have made if you had given up your weekly coffee to invest US$5 instead, every week for the last 3 years, into the QQQ. Your total returns? A 37.40% gain, and a healthier, less caffeinated body.

Benefits of a Regular Savings Plan (RSP)

If you are new to investing or do not have a large sum to invest upfront, and wish to invest steadily to grow your money over time, then a RSP may be the best investment tool for you.

- With low monthly contributions starting from as little as S$10, an RSP provides an accessible and easy way for you to start building your investment portfolio.

- By automating the investing process, it not only saves you time, but also reduces the need for you to have extensive market knowledge before you dip your toes into the world of investing.

What’s more, by automating your investments, you remove the emotional element of decision-making and force yourself to stay invested even when the market is volatile.

By investing at regular intervals, a RSP will also help you buy fewer shares when stock prices are high, vs. more shares when stock prices are lower. This will help to lower your average cost in the long run, and make it easier for you to stay invested for the long-term.

If this is your first time, here’s how you can set up and automate your investments for yourself.

A Step-by-Step Guide to Setting Up an RSP on Your Brokerage

Before you start, you should ask yourself these questions:

- How much money do I have to invest each month?

- What do I want to invest in?

- How often do I want to invest?

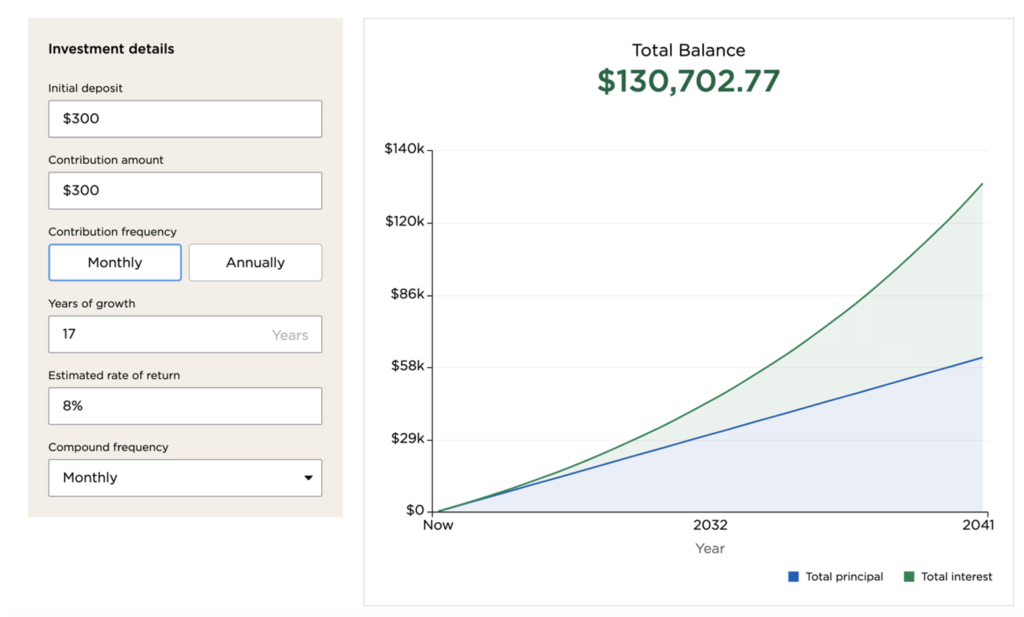

For instance, you could decide to invest $500 in an index fund that tracks the S&P 500 every month. Or, if you’re optimistic about the future of technology, you may want to invest $300 in QQQ every month, which tracks the 100 most innovative companies listed on the tech-heavy NASDAQ stock market. Maybe you feel that McDonald’s will always be a resilient stock to own, then you could set up a recurring investment of $50 every month towards it.

Step 1: Decide on your brokerage and how much to invest.

By now, most brokerages in Singapore have already started offering a Regular Savings Plan. Some of the traditional brokerages may call it by a different name i.e. Regular Shares Savings (RSS) plans, but they essentially refer to the same thing.

Each brokerage platform comes with different investment options, fees and the amount needed to set up an RSP. For instance, if you want to invest in a local ETF tracking the REITS index, the minimum you will need to invest ranges from $50 to $100 depending on your choice of broker.

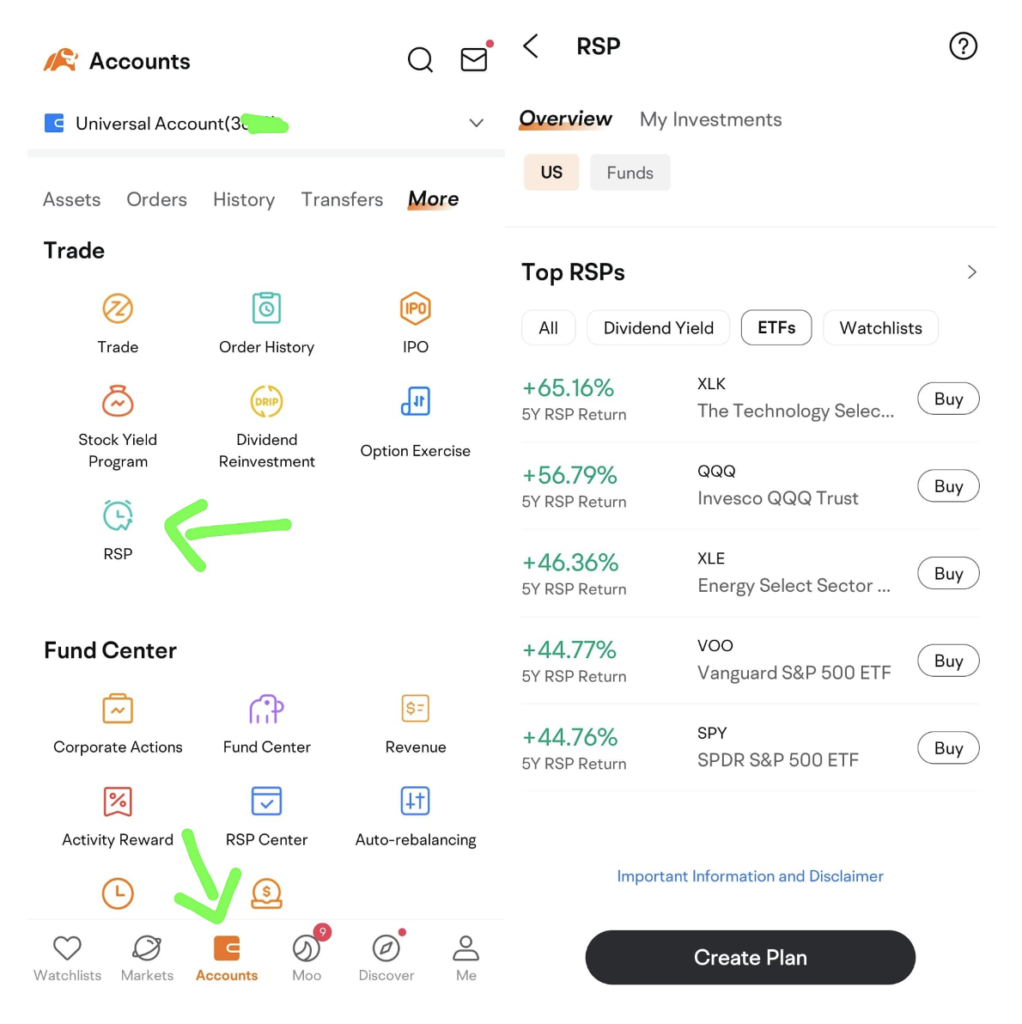

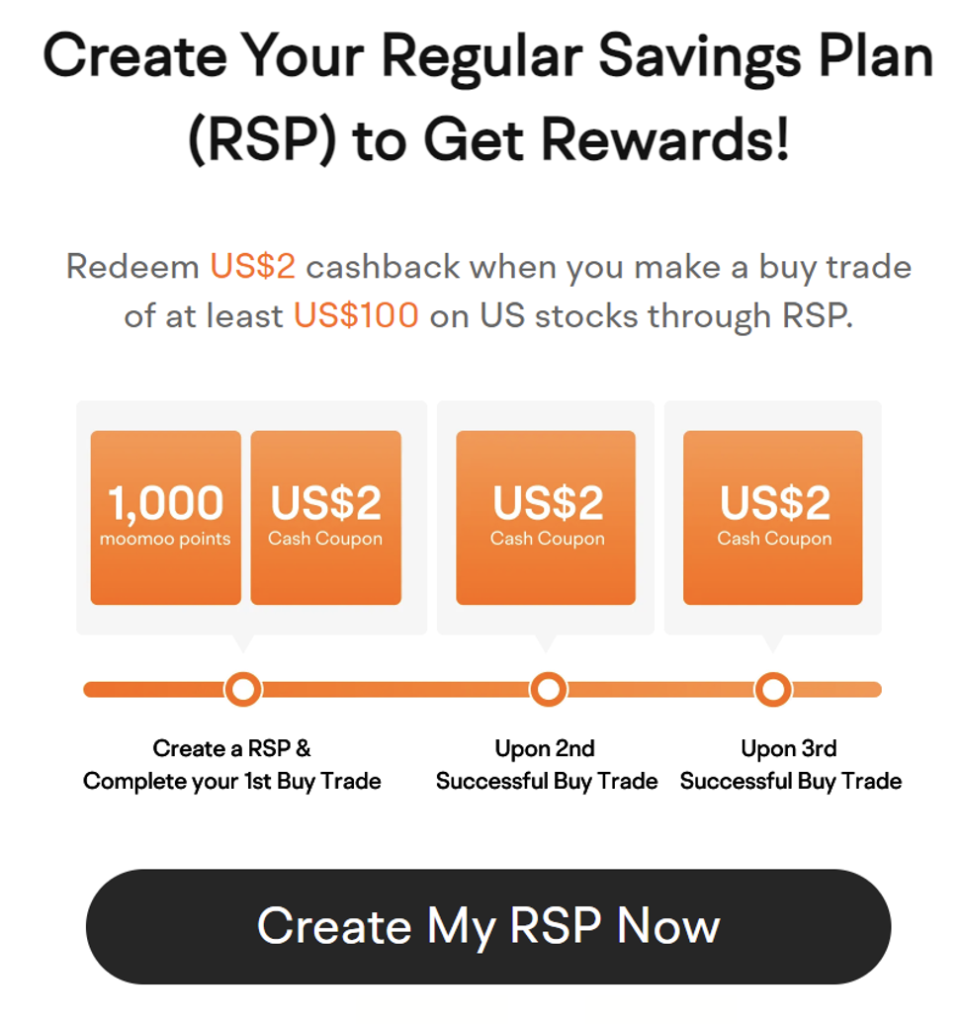

If you’re looking to invest from as little as S$10 a month, then check out moomoo’s RSP for US stocks, ETFs or funds here!

Step 2: Decide on what to invest in.

Once you’ve chosen a brokerage, it is time to select your investment options for the RSP. Most brokerages offer a variety of ETFs, unit trusts, or blue-chip stocks for you to choose from.

In Singapore, common options include:

- Straits Times Index (STI) ETF: A low-cost ETF that tracks the top 30 companies listed on the Singapore Exchange (SGX).

- REITs (Real Estate Investment Trusts): These give you exposure to the property market without having to buy real estate directly.

- Global ETFs: Some brokerages may offer access to global markets, allowing you to invest in US or international ETFs.

When selecting your investments, consider factors like your risk tolerance, investment horizon, and financial goals. If you’re just starting, diversified ETFs or low-risk unit trusts are an easy way to spread your risk.

For example, investing $300 per monthat an 8% annual return could grow to over $100,000 in about 17 years. The key is to stay committed and let your investments compound over time.

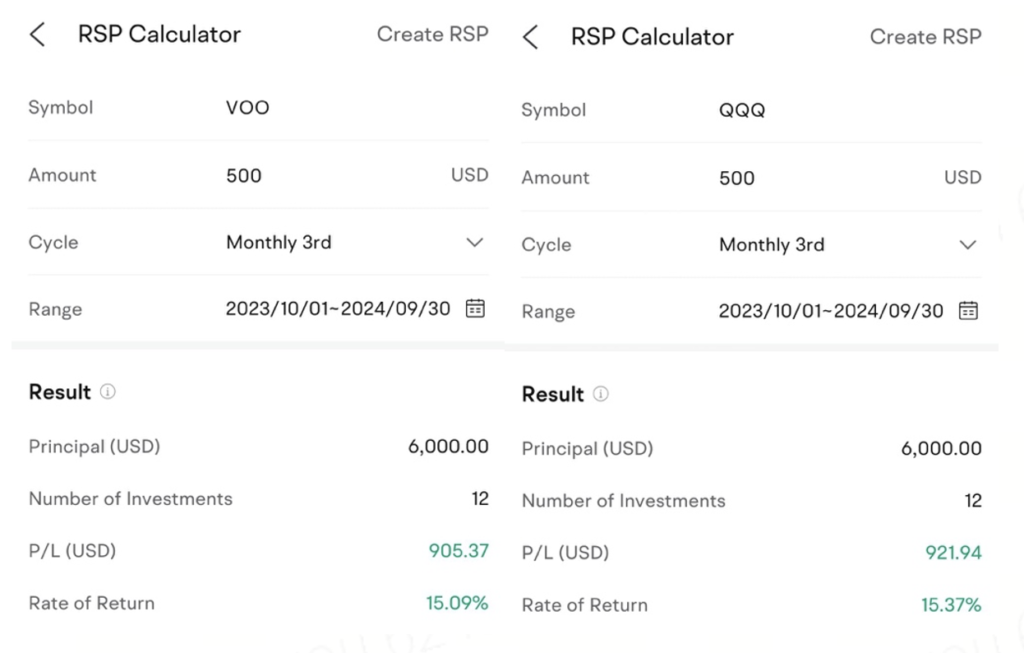

If you’re using the moomoo app, you can use their RSP Calculator to run a simple backtest to check what returns you would have gotten if you had set it up during a specified timeframe.

Unsure of whether to invest in an ETF tracking the S&P500 or the NASDAQ-100? Apparently, the returns for both funds over the past 1 year would not have differed by much!

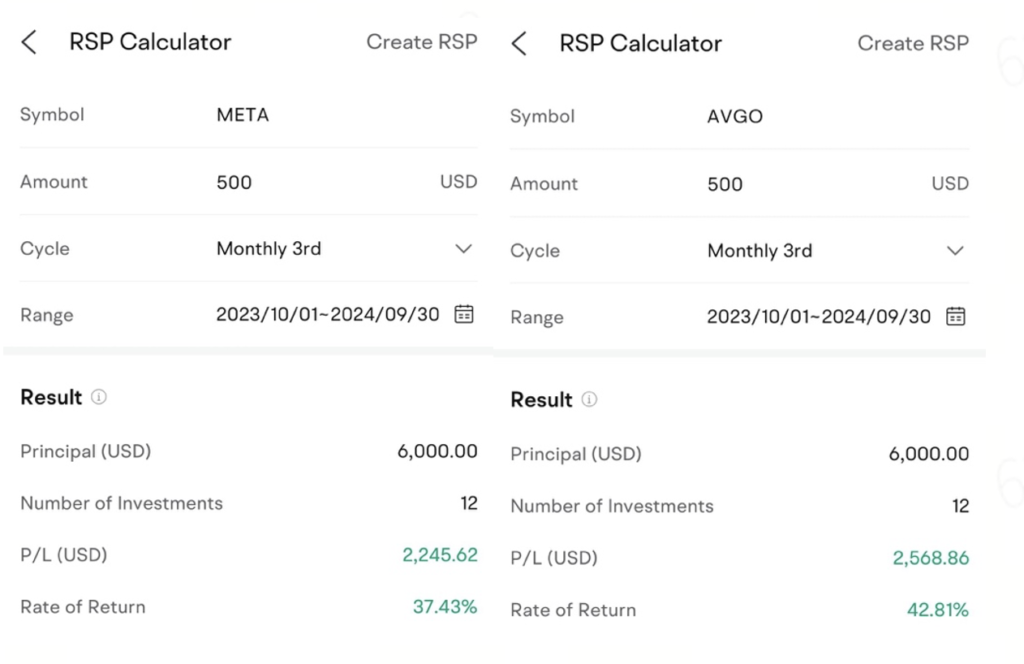

If you wish to set up a RSP for your favourite stocks, you can also do so. For instance, here’s what you could have gotten if you had invested in Meta vs. Broadcom at regularly monthly intervals for the past year:

Step 3: Set up automatic transfers.

The last step is to link your brokerage account to your bank account and set up automatic transfers. That way, you won’t have to remember to make monthly transfers manually, which will save you a lot of time and trouble.

Step 4: Review your RSP regularly.

Finally, don’t forget to review your RSP regularly, such as every 6 – 12 months. That’s because market conditions or your financial goals and life circumstances may change, so ensure that your RSP continues to align with your long-term objectives.

If your income grows, you can also choose to either adjust your monthly investment amount, or set up another RSP to invest into something else.

Once you’ve set up your RSP, your investments will automatically happen every month even if you get busy and forget to easy. That’s the beauty of automating it!

TLDR: Automate your investments today by setting up an RSP to take the emotions out of investing.

Moomoo allows you to automate and build your portfolio over time with daily, weekly, bi-weekly, or monthly recurring investments, starting from as low as S$10.

You can use moomoo to grow your wealth over time by dollar-cost averaging in the US market. Enjoy automated bank transfers and currency exchange to effortlessly invest a portion of your monthly salary for long-term returns!

Sponsored Message

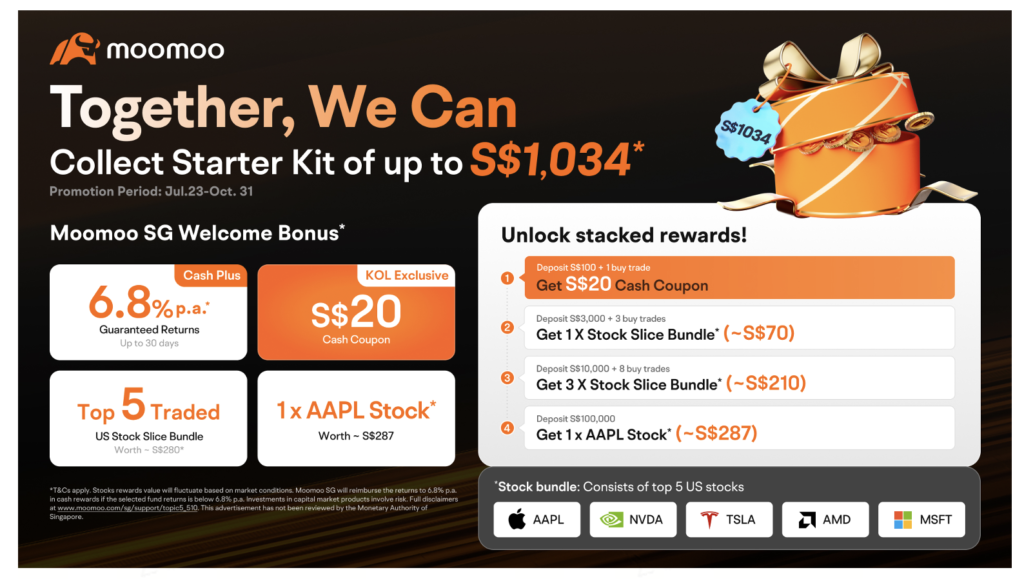

Get started with investing regularly in US stocks today with moomoo.

And if you are new to moomoo, you can check out their new users rewards here. Moomoo SG offers 0 commission trading for US stocks and 1 year 0 commission for SG stocks.

Click here to claim your welcome rewards here!

Disclosure: This article was written in partnership with moomoo. All opinions are that of my own.

*Campaign promotional T&Cs apply. All views expressed in this article are the independent opinions of the author.

Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.