Every quarter, traders and investors await with anticipation for companies to release their earnings report. But is the report important and how much of it should you pay attention to, especially if you’re pressed for time? In this article, I’ll share with you how you can easily review the report(s) within minutes and while on the move.

It is crazy how fast technology has evolved – from having to trade at my desktop barely a few years ago, to being able to do it now on my phone app within seconds. Similarly, this has also made it easier to review information on the go, especially with brokerage apps that consolidate everything within one place.

Why are earnings reports important?

A company’s earnings serves as a barometer of the business performance.

Publicly-traded companies are required by law to disclose their earnings and financial statements to the public. Most do it every quarter (for US stocks, this is known as the Form 10-Q), while the entire year’s worth is consolidated within the annual report (or Form 10-K).

Whether you are a long-term investor or a trader banking on short-term price movements, the earnings report plays different roles:

- For investors, it provides insights into the company’s financial health, including revenue, profits, expenses, and future growth prospects.

- For traders, it may reveal opportunities for profiting from short-term price movements vis-à-vis analyst expectations.

By analyzing the earnings reports, we investors can get a clearer idea of the company’s financial health and check whether this aligns with the narrative. This includes looking at how much money it is making, how it is performing vs. management’s guidance, where it is spending its money, and how much it is reinvesting back in its business.

If you find that earnings have been (persistently) weak, it could also be a warning sign that there might be deeper fundamental issues that you’ve missed.

Using these insights, you can then make an informed decision on whether you want to buy, sell, or hold onto your investment position(s).

How do earnings affect the stock price?

Typically, when a company announces better-than-expected earnings, its stock price often rises, due to more investors becoming more optimistic about the company’s future prospects. The opposite is true – when a company reports lower-than-expected earnings, its stock price may drop, as investors become more concerned about the company’s financial health and whether the issues that emerged in the recent quarter could end up to be a more persistent problem impacting the longer-term business prospects.

If you’re a skilled trader who pays attention to earnings reports, you can also use it to capitalize on market movements by buying or selling stocks at the right time to maximize your returns.

For investors, this could be a potential opportunity e.g. if you know that the weak earnings this quarter is due to a temporary reason that is likely to go away soon, you may choose to accumulate more shares at lower prices.

Where to find earnings reports?

You can typically find the reports on the company website under the Investor Relations section. Today, you can also simply make use of apps like moomoo to review it while you’re on the move.

Information overload? Here’s what to look out for

Digesting a company’s earnings report can be quite a bit of work, especially if you have multiple investment positions that you’re trying to keep on top of.

If you only have a few minutes, here are a few things you can zoom into:

1. Revenue / Profitability

Revenue is the top-line number that tells you how much money the company is generating from its products or services. Ideally, you’d want to see consistent revenue growth over time, especially in contrast to how its other peers are doing.

Gross margins tell you how much the company has made after deducting expenses. Rising revenue is meaningless if the company profit bottomline is in fact weakening.

Earnings per share (EPS) tells you whether the profit is translating well for shareholders, as it reflects the profit earned per outstanding share of a company’s stock.

2. Liquidity assessment

The worst thing that could happen is for a company to go bankrupt. And especially in this era of higher interest rates, investors should pay close attention to the company’s liquidity to ensure that they are capable of paying off its short-term debt obligations.

3. Is management delivering on its stated goals?

Good management is one that does what it says, and sets realistic, achievable goals. As an investor, you can assess management quality by looking at the earnings report to see if they have indeed been able to grow earnings / reduce costs / improve operating efficiency…or any other goals that they had previously mentioned.

Case Study: Tesla

Using Tesla as an example, you can see how I do a quick analysis on a company’s earnings.

I tend to do a lot of these on the go (including while travelling on the train or car), because my time in front of the computer is limited due to the fact that I have kids who will keep asking me to stop working and go play with them. Thanks to the moomoo app, I’m now able to sit with my kids and get some analysis work done at the same time!

Step 1: Click on Tesla’s latest earnings on my moomoo app

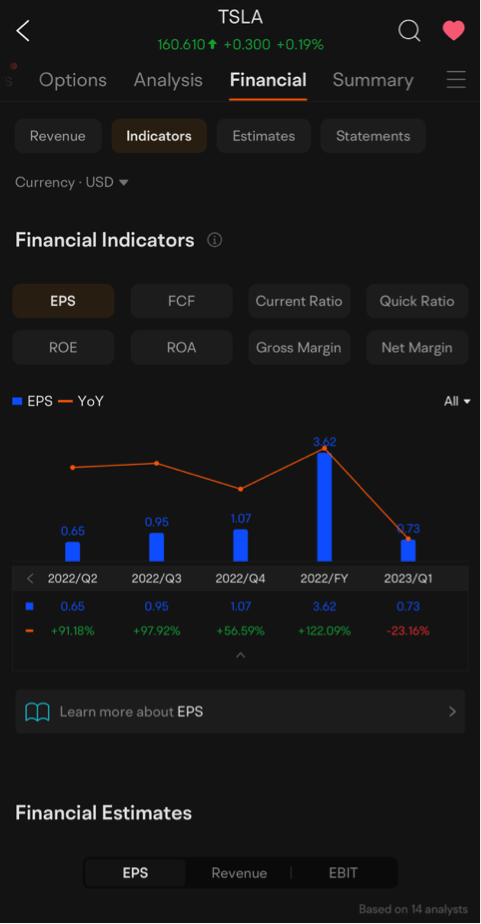

I’m able to see that while revenue is 25% higher, unfortunately this has translated into a lower profit and Earnings Per Share has shed 21% of its value!

I can also click in to see Tesla’s historical EPS and check whether this is a one-off event, or indicative of a larger trend.

I click in for more details and free cash flow is also down by 80%, which looks terrible.

What exactly happened?

Step 2: Uncover reasons

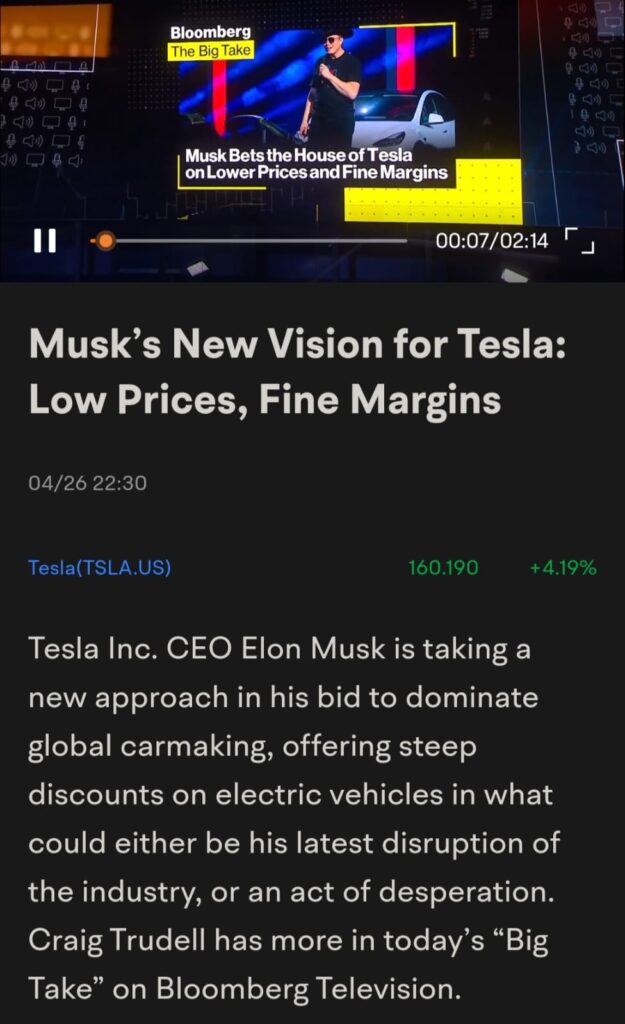

Next, I try to understand WHY this happened, or what could have caused it. Based on recent Tesla news, I recall that Tesla announced a cut in its vehicle prices within the same quarter which might explain the poor results.

I click in for details and find something helpful:

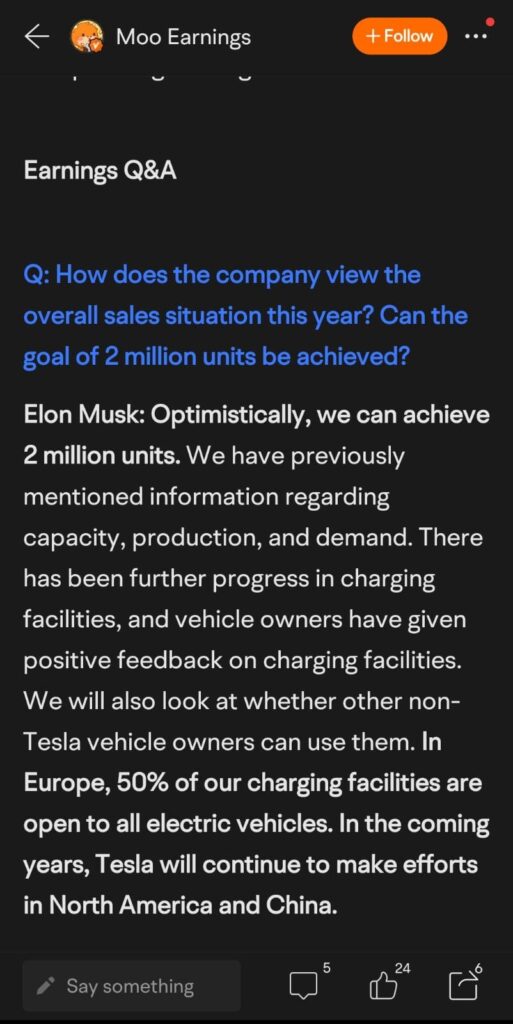

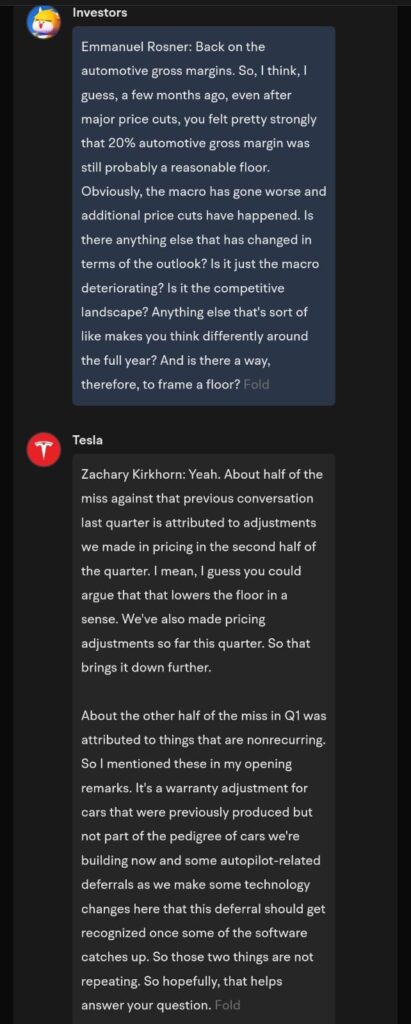

Over in the Investor Q&A, there’s another useful question that provides more insight that the reasons indeed include Tesla’s recent pricing adjustments.

You can always choose to watch the conference call for more details, but since it is too long at over an hour and my reading speed is much faster, I head online to look for the transcript instead.

I find it on Yahoo Finance, and this part catches my eye:

We’re continuing to simultaneously make significant purchases of NVIDIA GPUs and also putting a lot of effort into Dojo, which we believe has the potential for an order of magnitude improvement in the cost of training. And it also — Dojo also has the potential to become a sellable service that we would offer to other companies in the same way that Amazon Web Services offers web services, even though it started out as a bookstore. So I really think that, yes, the Dojo potential is very significant. In conclusion, we’re taking a view that we want to keep making and selling as many cars as we can.

Despite this being an uncertain macro environment, this is a good time to increase our lead further, and we’ll continue to invest in growth as fast as possible.” – Elon Musk (20 April 2023)

Interesting. If that happens, Tesla’s valuations might change (potentially increase) as more value is unlocked out of this service.

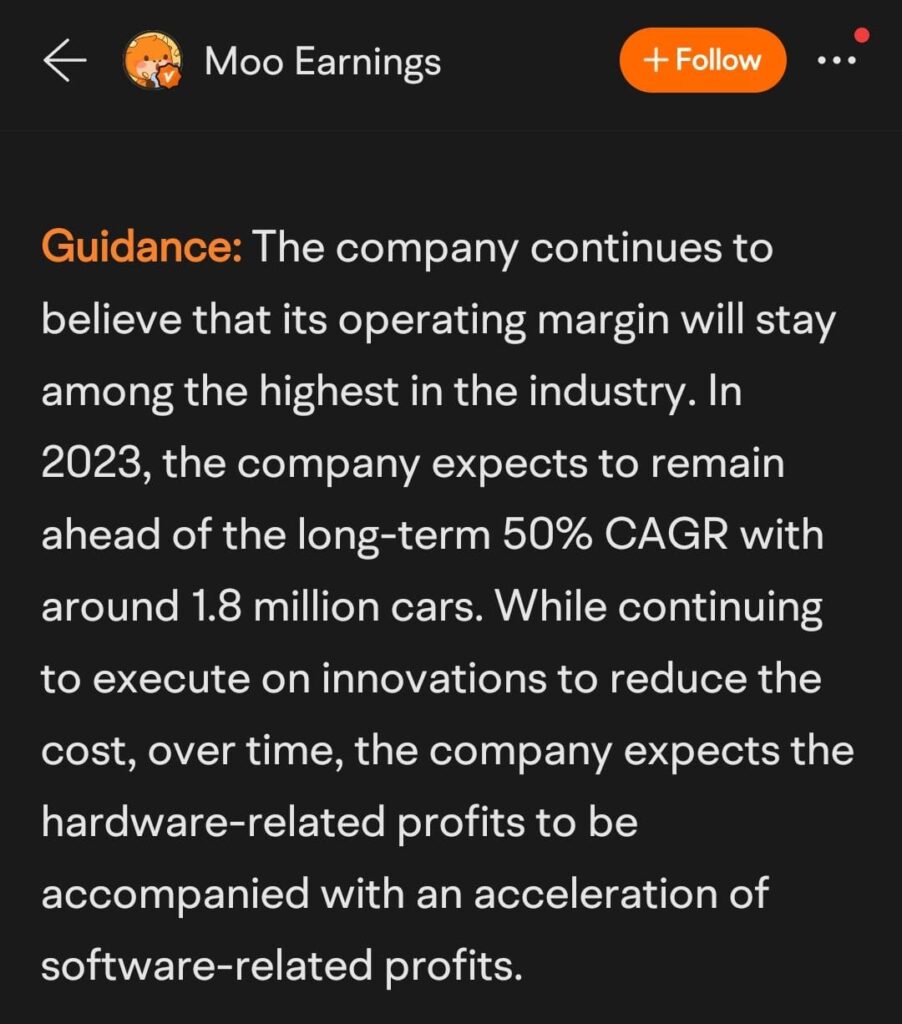

Step 3: Check on guidance and future moves

There’s a quick summary provided by moomoo:

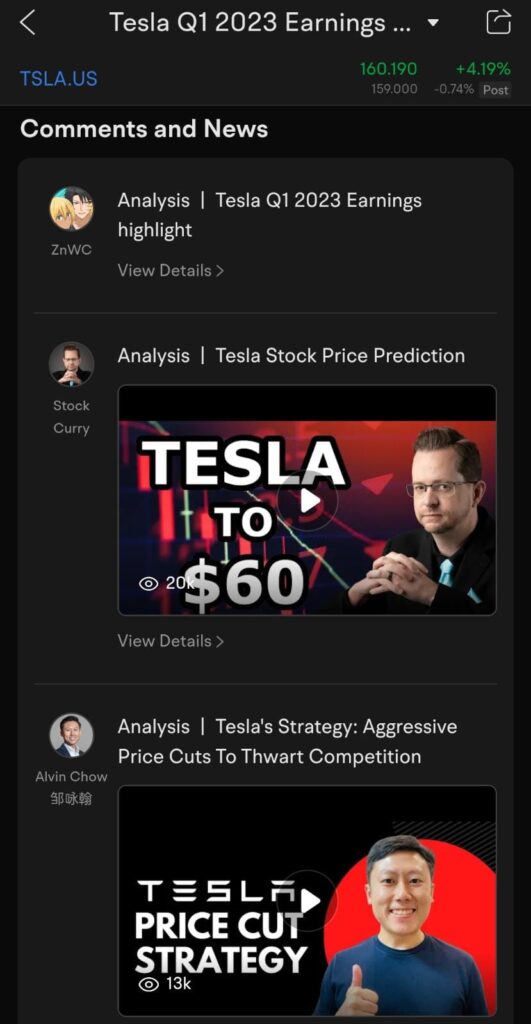

Step 4: Check on market sentiment

The moomoo app is useful because you can read/watch what others have to say as well, or even scroll through the comment section to get a pulse on investor sentiment.

The comments look overly optimistic to me (lots of “I have faith in Elon Musk” and “to the moon!”) so I just ignore them.

Step 5: Decide on what action to take

I’m not a Tesla shareholder (but am open to accumulating when valuations are right), but based on the latest earnings, it still doesn’t give me faith to buy Tesla’s stocks at this point.

Although I tend not to take the comments on moomoo as the absolute truth on investor sentiment, it does make me feel that people are still overly optimistic about Tesla at this point, suggesting potentially overstretched valuations that might change in the near term, especially if Tesla’s profits continue to drop. There might be better opportunities in the near future, so I choose to sit this one out again once more.

Conclusion

I hope the above helps you to see the power you can unlock on the moomoo app, especially now that they’ve built up this incredible Earnings feature!

With new-age mobile apps like moomoo constantly building and improving their tools for users, gone are the days of us having to sit at our desktop to analyze and digest through endless pages of earnings reports.

I appreciate their latest enhancement on Earnings, as it has made it sooo much easier for me to conduct my analysis. You too, can use the tool to help you do this while travelling around, waiting in between your appointments, or even while you sit and play with your kids!

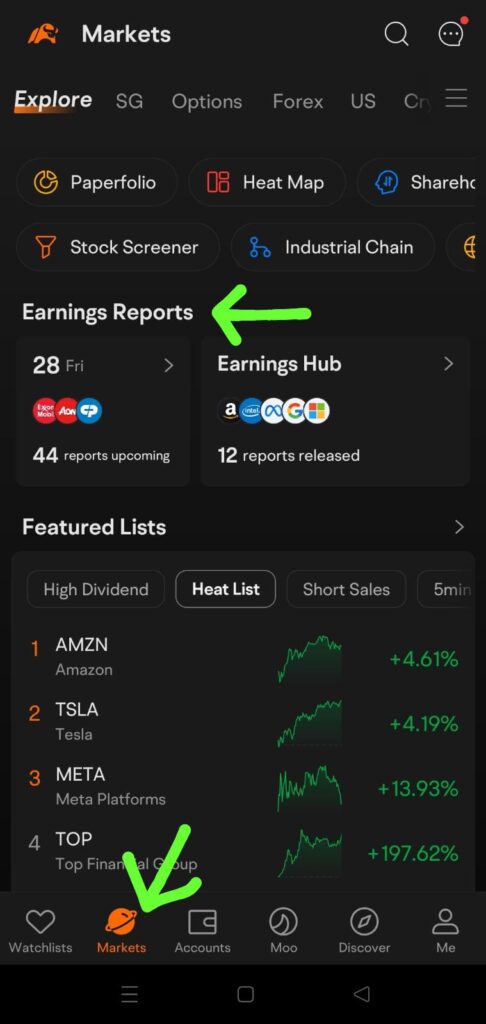

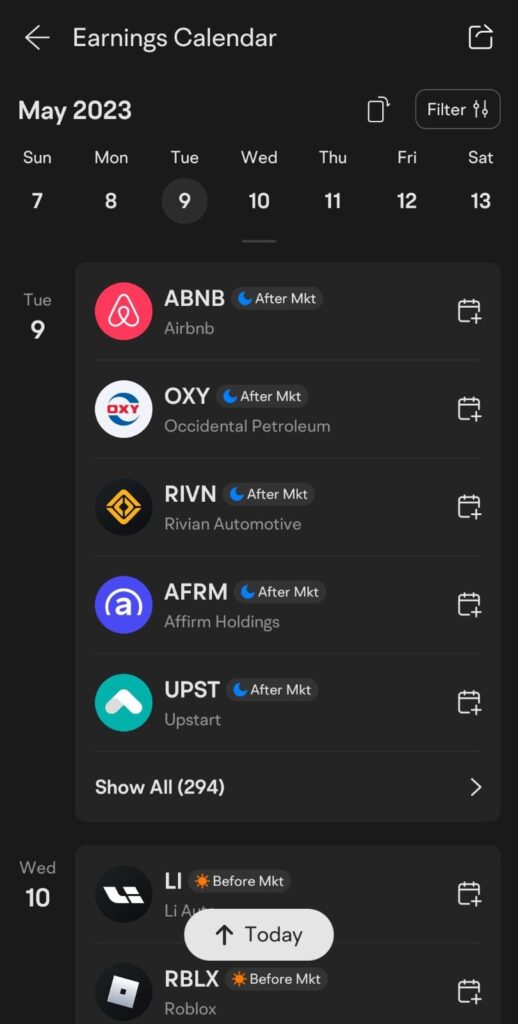

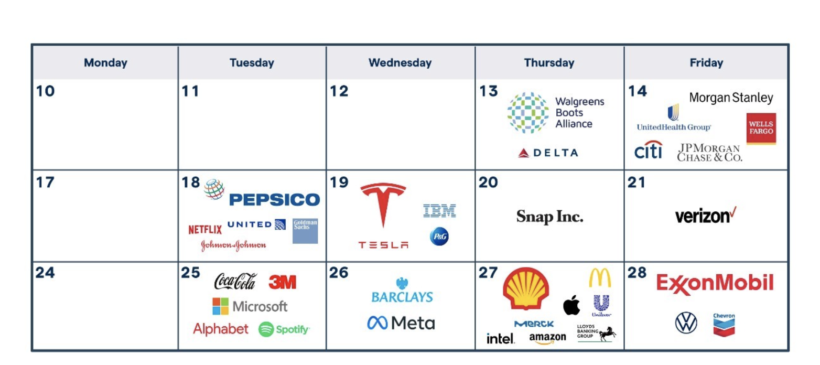

To access it, click on Markets and you’ll find the Earnings Report tab in the middle, where you can:

- view a calendar of upcoming earnings announcement and add the ones that you’re keen on to your own Calendar (Google, Outlook, etc)

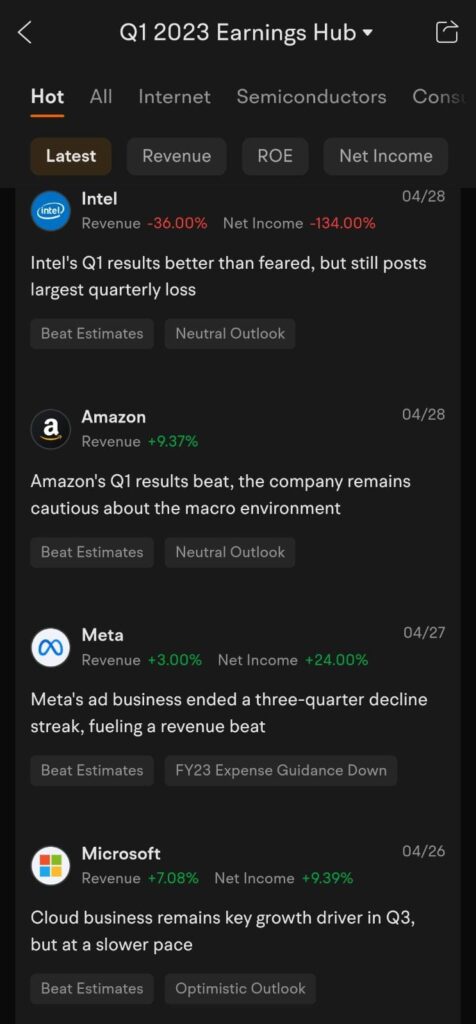

- tap on Earnings Hub to view the latest quarter of earnings across the various companies, together with a summary

I understand it can be difficult to keep up with every quarter worth of earnings (it is a problem that I struggle with as well), especially when you have multiple positions in your investment portfolio. One way is to prioritize and focus on those that are either more affected by current market conditions, or those that are bigger positions in your portfolio.

Say goodbye to hours spent trawling online websites during earnings season, and use your moomoo app instead.

P.S. Even existing moomoo users get perks! If you’ve already signed up with moomoo, don’t miss out on their current rewards when you fund your account or add more to your current position(s).

Sponsored Message by moomoo

Start growing your wealth today with moomoo.

If you haven’t already signed up with moomoo, use my affiliate link to sign up here:

Disclaimer: All views expressed in this article are my own independent opinion and the illustration of Tesla is neither a buy/sell recommendation. Nothing in this article is to be construed as financial advice as I do not know your personal circumstances or investing goals. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. All information provided is accurate as of 8 May 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

1 comment

This is helpful!

Comments are closed.