I often get asked on how I analyse stocks, especially as a busy mom who juggles my career, content creation, e-commerce business and my kids.

The answer? I analyse while I’m on the go – on my mobile phone, during my regular commute (or sometimes while I’m lying in bed patting my kids to sleep).

This is only possible now because I rely a lot on apps like moomoo, which I’ve been using since their launch in Singapore in 2021.

Let me walk you through with some quick examples:

Visualised Financials

With just a quick glance, you can now get a sense of the company’s financials from its cash flows, balance sheets, and more on the moomoo app.

How to access: Stock -> Company

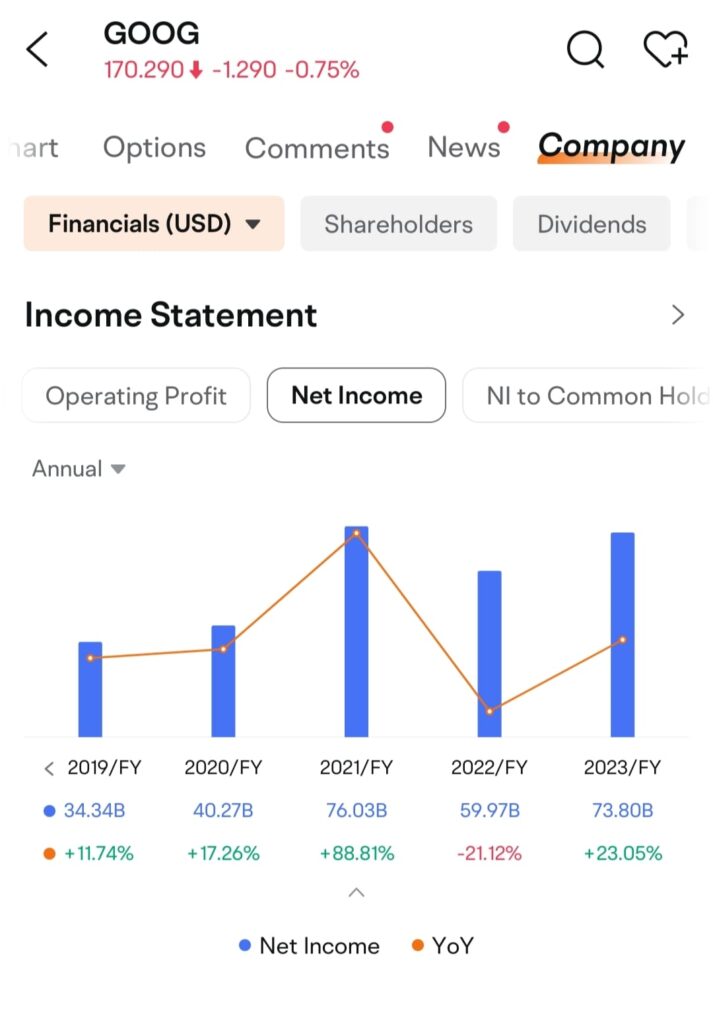

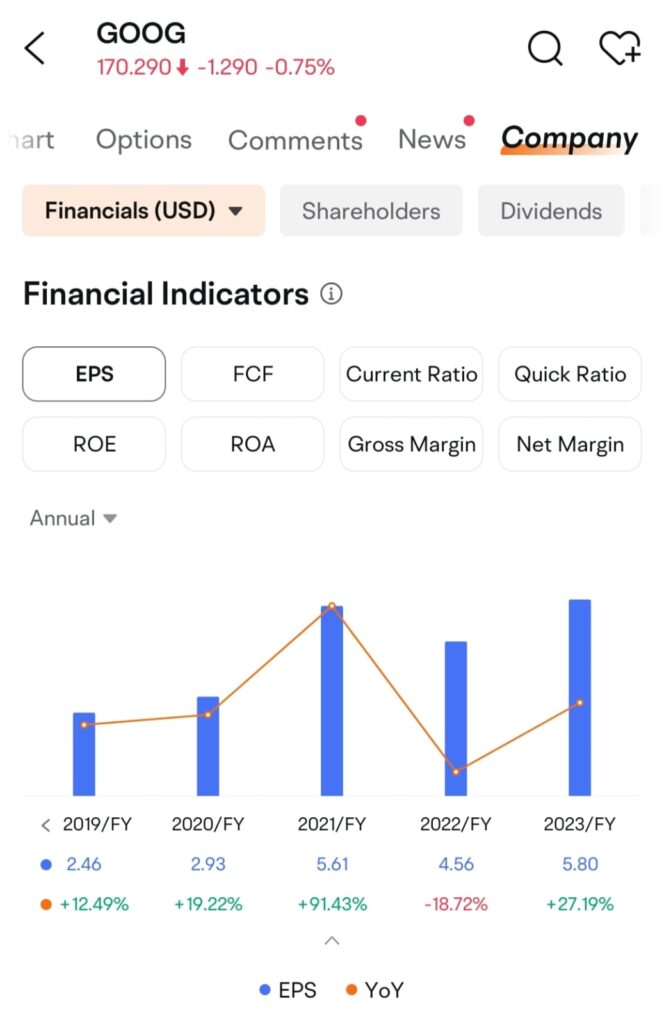

First criteria I look at: is the company profitable? Has it been growing its profits? Is the company growing its EPS and shareholder returns?

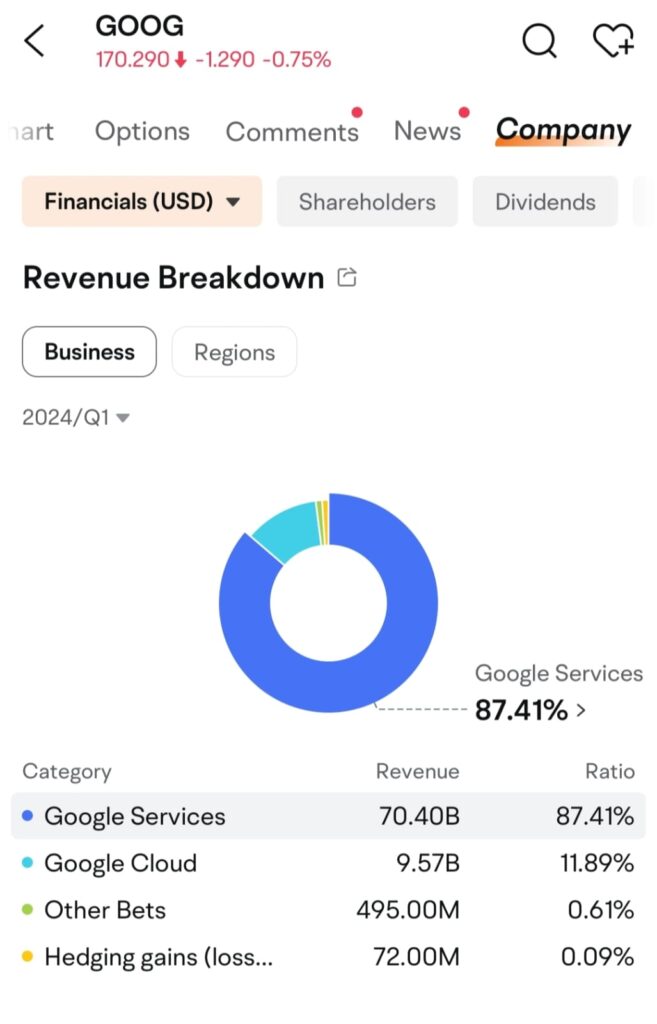

I’ll also examine other aspects such as their debt exposure levels, profit margins and more on the app. Once I’m convinced that there might be a case for investing here, then I pull up their revenue breakdown so I can figure out how this company makes its money and whether that’s sustainable.

P.S. I usually select “Annual” rather than “Quarterly” so I can get insights on a longer historical duration.

Only then do I go to my desktop to do more in-depth research, which happens usually on Sundays when our parents can help look after our kids so I can focus on deep work.

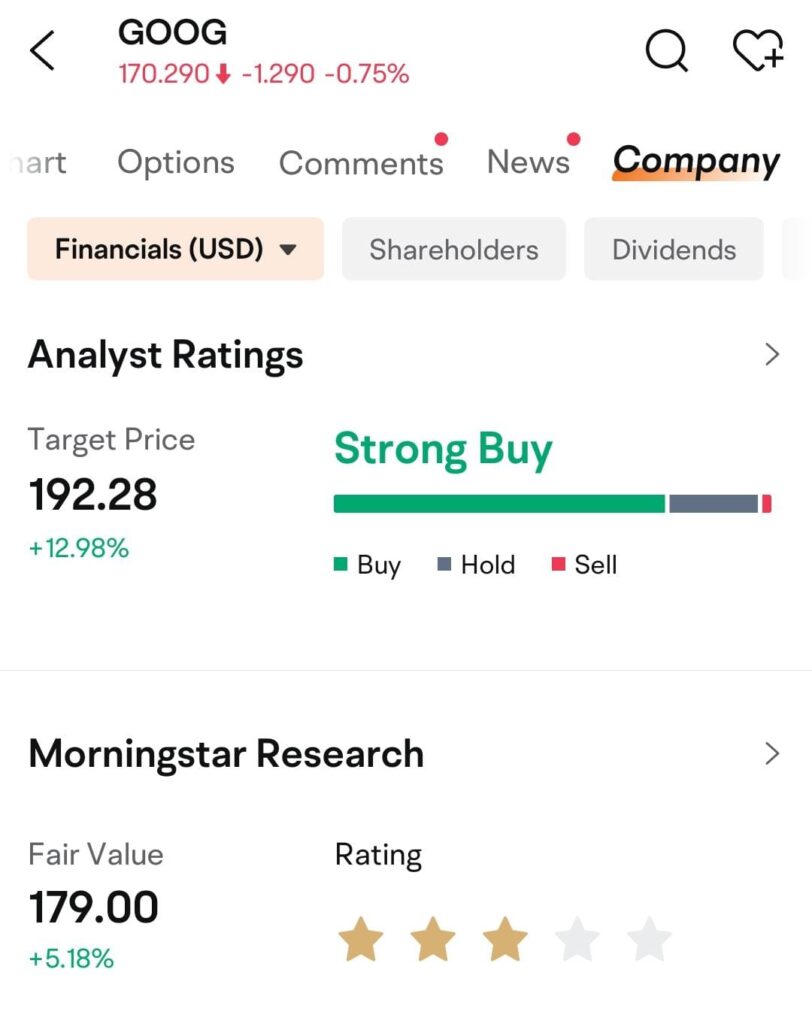

Analyst Ratings

If you care about what the professional analysts are saying, here’s where you can see what they’re ranking the stock as. This can also help give you a pulse on the market sentiment over on Wall Street:

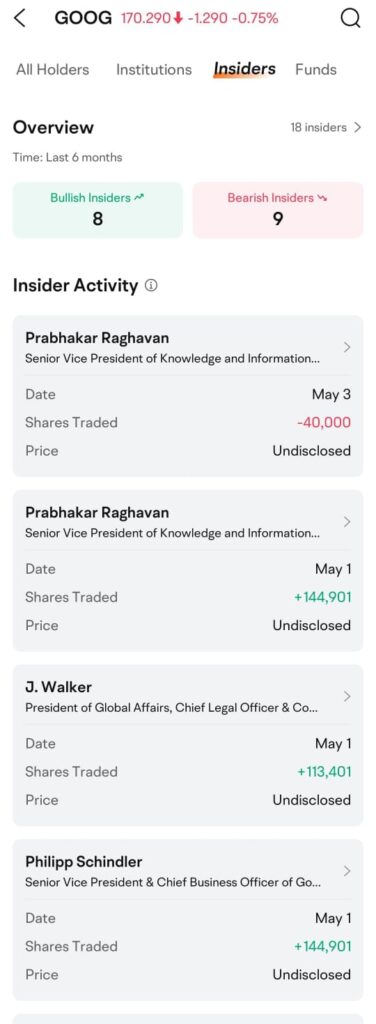

Insider Activity

I like to for changes in the holdings and trading data of company insiders, so I used to spend quite a bit of time monitoring the SEC filings (or SGX announcements for Singapore stocks) to get these insights.

Thanks to moomoo, I can now literally see this within seconds!

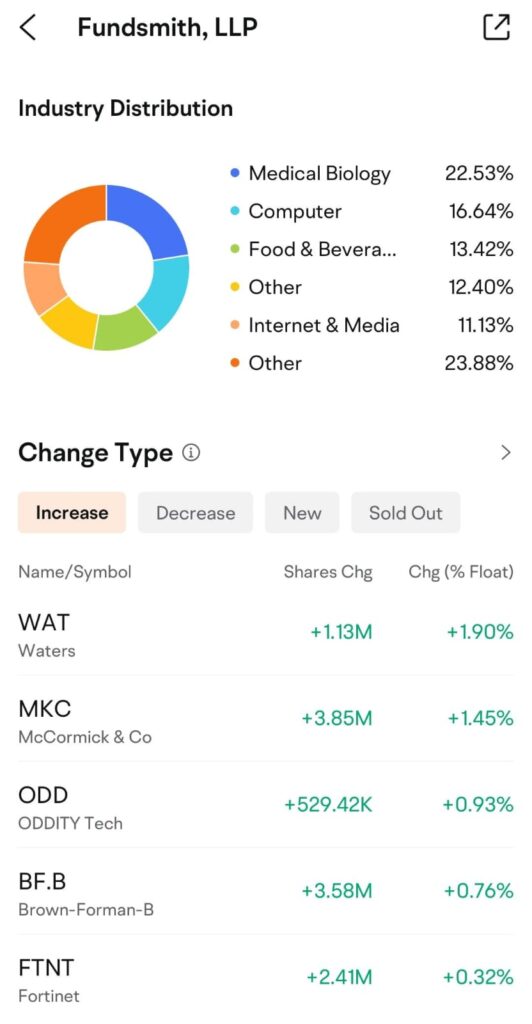

Institutional Tracker

You can now track the big money and get ideas from watching how the large institutions trade, as well as monitor their quarterly holdings to see what they are adding (or trimming down).

How to access: Markets -> US -> Institutional Tracker

For instance, Terry Smith is a legendary investor whom I track. Now, from within the moomoo app, I can kaypoh and see that his fund has recently been buying more shares of Waters (NYSE:WAT), a global provider of analytical laboratory instrument and software solutions for scientists across the world.

Hmm, could that be a stock idea in the making?

Message from moomoo

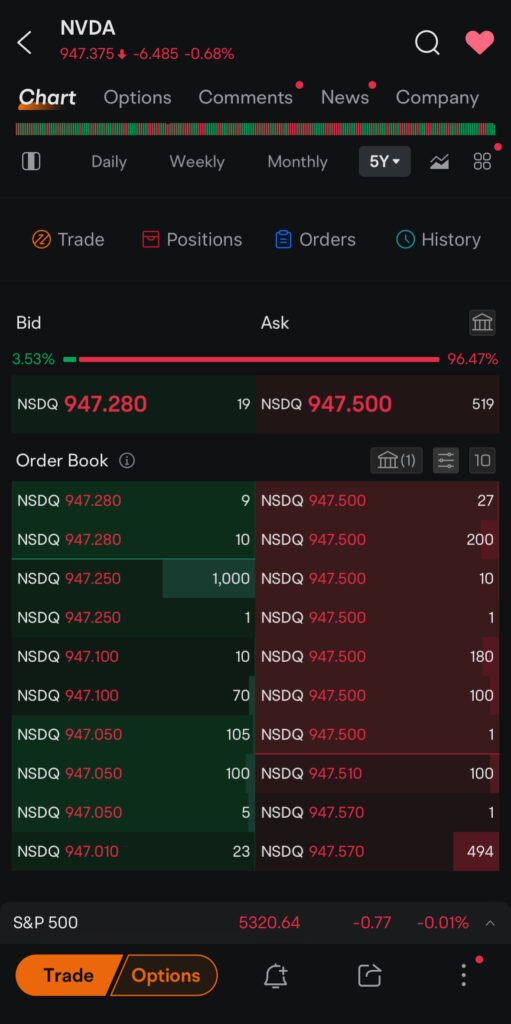

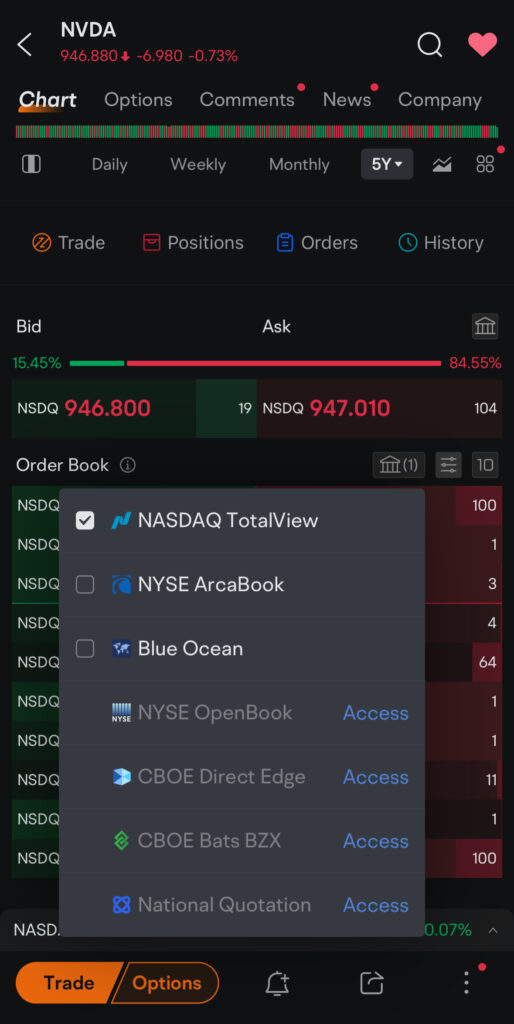

Psst, did you know that you can now also get access to NASDAQ TotalView (Level 2 market data) on moomoo…for free?!?

This makes moomoo one of Singapore’s few investing apps that offer such access (it is a payable service on many brokerages both locally and around the world).

I recently had the privilege of being sent to the NASDAQ headquarters in New York, where I got to learn directly from the NASDAQ data folks themselves.

NASDAQ TotalView is an advanced data feed subscription service that provides unparalleled insight into the NASDAQ stock market’s order book, unlike standard Level 2 market data feeds that offer limited visibility. It reveals every quote and order at every price level for NASDAQ-listed stocks, showing not only the best bid and ask prices, but also the full depth of orders behind those prices – including hidden orders and the size of each order at different price levels.

You can use this tool to:

- Help you make better decisions about price movements

- Plan your trades accordingly

- Spot support and resistance price levels

- Identify potential pullbacks or rebounds in stock prices

You can also watch a deep dive here on Youtube:

So if you’re trying to make money from small share price changes, or gauge where the market sentiment is moving towards, this tool can be valuable in helping you make your trading decisions, especially for high-frequency or intra-day traders.

Click here to claim your NASDAQ TotalView privileges for free!

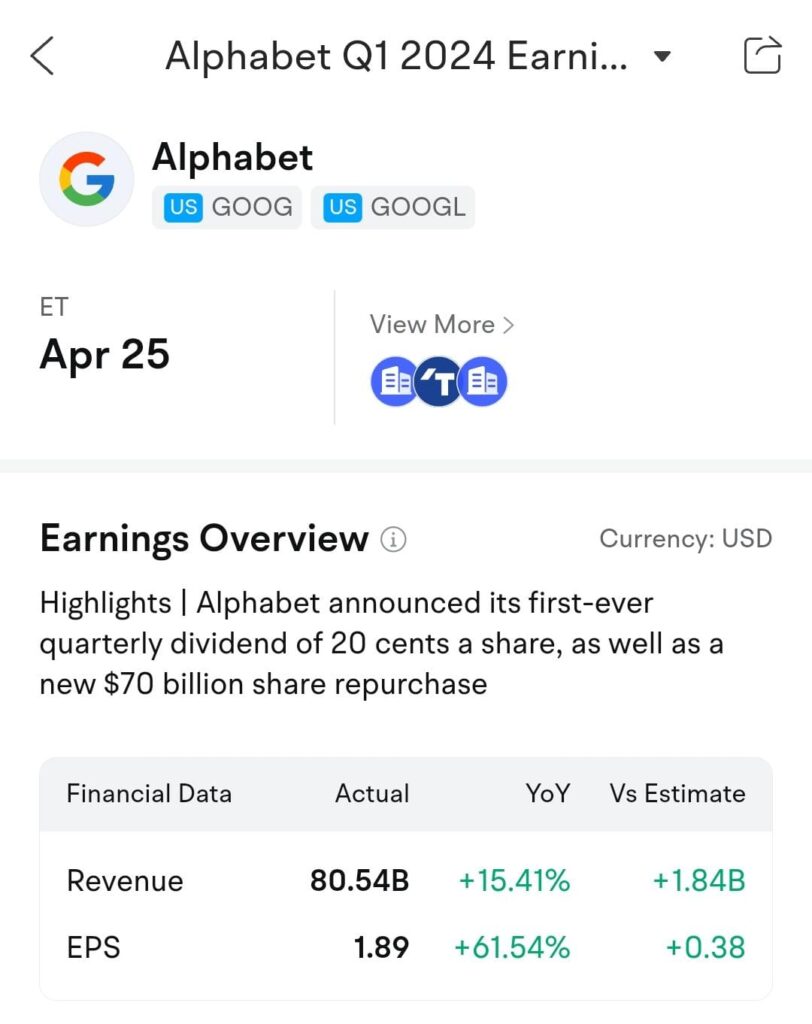

Earnings Calendar

I used to have to sieve through pages of earnings reports, but that has become more challenging to keep up with today ever since becoming a mom (who’s forever pressed for time).

How to access: Stock -> Company -> Earnings Hub

For instance, Alphabet held their earnings call right before I was due to fly to New York for my NASDAQ training (!!), so there was absolutely no way for me to spend my trip digesting pages and pages of the earnings call transcripts and data.

Luckily, my moomoo app solves that pain point for me because it helps me gain insights from earnings briefs and result highlights reported, all within minutes.

This meant I could settle for catching up on my moomoo app…while I was at the airport waiting to board!

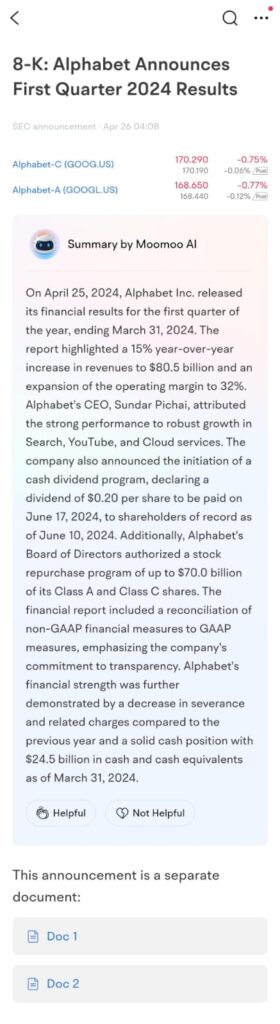

Moomoo AI even gives me a summary of what went down during the quarterly earnings call, which helps me to get updated within just 2 minutes of reading:

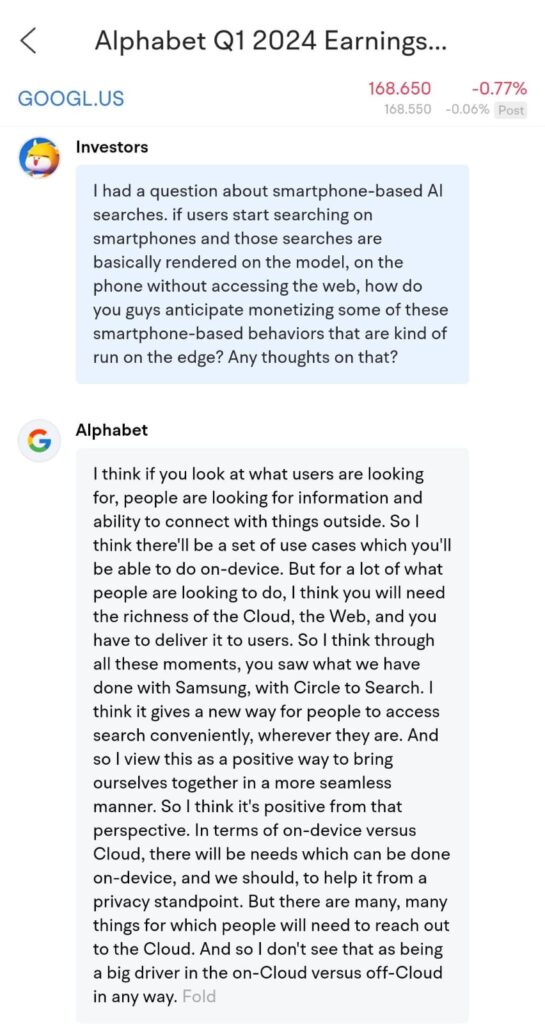

Perhaps the biggest value from every earnings call often lies in the questions asked to management, but sieving through the ones posed by multiple analysts’ can often be a pain as I don’t really care about short term numbers or outlook.

For Alphabet, what I cared the most was how management viewed the change in search behaviour (from desktop to smartphone-based AI searches), so I appreciated how my app gave me this within just 3 minutes of scrolling (vs. 20 minutes of earning the full earnings transcript!):

Invest better with the moomoo app

Having been with moomoo ever since they launched in Singapore, I’ve personally witnessed the dizzying number of changes and improvements they’ve made to the app over the years.

Moomoo’s mission to democratise access to investing knowledge, tools and data for every retail investor has been commendable and clear to all who have been watching them on this journey.

I personally appreciate how moomoo has made it so much easier for me to analyse stocks on the go, which has seriously been a huge time-saver. If not for moomoo’s tools, I’d definitely have difficulties keeping up the level of manual data and research that I used to do in the early 2010s back then.

If you aren’t already on moomoo, I recommend that you sign up for the moomoo app to help you save time on your stocks analysis.

Budget Babe

Use it to help you screen and identify great stock ideas (or eliminate lousier ones)…before you block out time to conduct deeper research on your desktop to cement your decision.

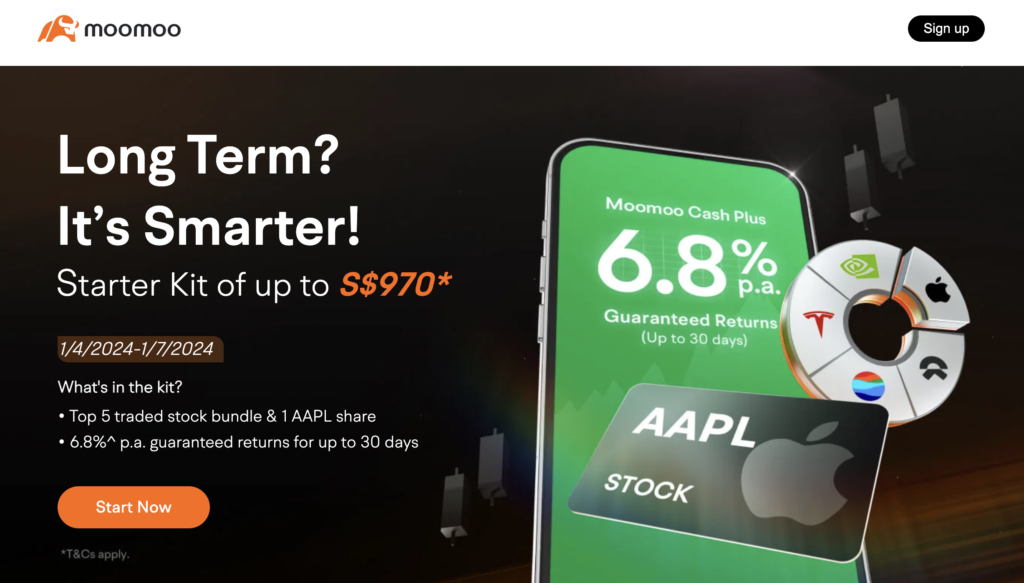

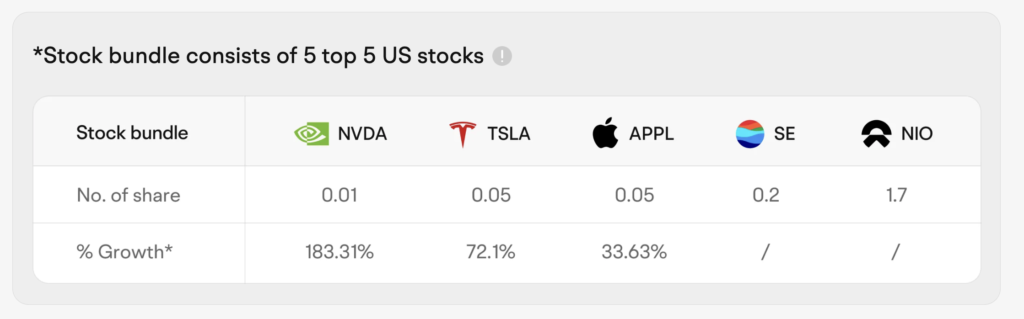

Download the moomoo app today and get a free stock bundle to help you kickstart your investing journey today!

Disclosure: This article is brought to you in conjunction with moomoo Singapore, who had no say or influence over how I personally use their app to invest and conduct my due diligence on companies that I invest in. The only thing they did have a say over was in having their US folks and product lead demonstrate to me more of their tools while I was in New York!