Would you give up 1/3 of your future wealth just to invest in unit trusts, or a mutual fund?

I’m sure most of you would agree that having a third of your portfolio value eroded in this way would quite clearly make this a bad investment tool to even begin with. Can you imagine anyone who would pay so much for such a type of investment?

The funny thing is, there are plenty of people who do.

Despite the growing availability of financial literacy tools today, many people still choose to put their money into unit trusts or a mutual fund, which charges investors in return for professionally managing their money. For the newbies, this is often done at the recommendation of their financial advisor or bank relationship manager.

Case in point: After my post on saving $20,000 seemed to become the new financial milestone for a Singaporean to hit, the Straits Times ran a series that talked about how to invest if you have $20k or more. The top choice of investment vehicle as advised by the “experts” interviewed? Unit trusts.

Read what the financial bloggers here choose to invest their first $20k in instead. Hint: None of us recommended unit trusts.

I recently also signed up for a new trading account, and the banker who was handling my account mentioned that there were some great investment tools with “high returns” available today in this bear market.

“Such as?” I asked out of curiosity.

“Unit trusts”, came the answer.

Most believe (or are misled to believe) that they’re better off leaving their money in the hands of professionals to manage. While there is indeed value in paying for superb investment performance, the truth is that most unit trusts do NOT consistently outperform the market over the years. You’ll be better off putting your money into a low-cost index fund instead. Try the STI ETF (SGX: ES3) instead, which you can buy for $2.86 per counter right now.

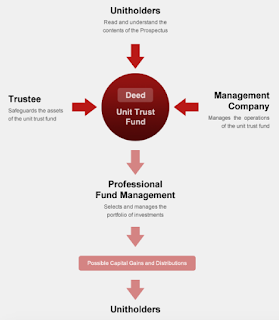

While many experts (from banks, insurance companies, financial advisors, etc) are quick to tout the advantages of unit trusts and mutual funds, few will tell you that the biggest downside of unit trusts are in their costs, as you’re essentially paying a professional fund manager to manage your money for you. Most funds average between 2 – 4% in Singapore, but there are apparently some that can charge as high as 10% of your total investment. Regardless of how well (or badly) your portfolio performs, you still have to pay these recurring fees.

|

| How unit trusts work. Image credits: HSBC |

While the costs may look small, but what if I told you that the cost of paying an extra 1% each year in fees is the equivalent of you giving up 33% of your potential wealth over the next 40 years?

I’m lazy to draw up a pretty table to illustrate, but you can open up Excel and input the figures for yourself to see if you’re curious.

Waaaaait, how is this even possible?

While the 1% fee looks minuscule, it is actually 1% of your entire portfolio value, and NOT your gains in that year (a common misconception many folks have).

Furthermore, the effect of these fees compound over time to become a much bigger sum. We already know about how compound interest over time can be a powerful weapon to help us grow our money. However, the reverse holds true as well – costs compounded over time will escalate into a bigger hole in your net wealth.

Don’t look down on that 1% – that 1% fee you pay can end up costing you a few hundred thousand dollars over your investing life. By then, it’ll be the fund managers laughing to the bank, while you can only cry over your investment mistake.

Let’s talk about units trusts or mutual funds in Singapore, where the fees are usually between 2% – 4%. For a conservative measure, let’s take the lower end of the range for our calculations instead.

Let’s assume the Singapore stock market has averaged about 7% annualized gains till date, and that you’re invested in a rare unit trust which bought into different stocks and outperformed the market at 10%. The fund manager would then report a 8% gain in the statement you receive (10% minus the 2% in fees you pay to them).

Are you realllly paying only 2% in expenses then? Obviously not! While you’re indeed paying 2 percentage points, your actual expenses in fact work out to be 20% of your gains (take 2 percent divided by 10 percent).

Now factor in inflation, and the numbers get even scarier. Assume that the inflation rate for the year weighed in at 2%, which means your real return for the year works out to be only 7% (10% gain minus 3% inflation). In this case, your 2 percentage point expense ratio in the unit trust will take almost 30% of your real gain for the year (2% divided by 7%).

Try thinking about your fees that way, and I’m sure you’ll soon be able to see why these 2% are anything but little.

|

| Image Credits: BigFatPurse |

If you’re already invested in a unit trust / mutual fund, try calculating the real costs you paid last year in fees and decide if you wish to continue the investment.

Here’s how you can figure how much your fund is costing you:

1) Take the reported gain from the fund, as reflected in your yearly statement

2) Add the expense ratio to get the gain before costs were deducted for management fees

3) Subtract last year’s inflation rate to get your real gain

4) Divide the expense ratio by answer in step 3

Still think it is a good idea to pay someone that much just for managing your money?

I don’t know about you, but I would rather keep the money and learn how to invest instead.

With love,

Budget Babe

4 comments

Thank you BB for shedding some light on those shady dealings of the Unit Trust Industry.

What if unit trusts had to charge fees like all other businesses in the form of a monthly bill sent directly to customers?

I could guarantee one thing: Investors would wake up from their slumber.

Imagine if every month, while paying our housing loan, our utility bill, and our cell phone bill, We had to write a check to our fund manager for, say $200, and perhaps another check to a custodian bank for, maybe $25?

We would instantly become keenly aware of fees. We’d probably become obsessed with them.

Would we continue to put up with a high-fee investment manager who chronically underperforms his benchmark?

Until investors actually have to write a check themselves, they are going to be unaware of the fees they’re paying. That promises more bad investing decisions, and a wealth transfer from workers to bankers based solely on a lack of understanding.

That's a fabulous idea – such a pity that it is unlikely for us to reach that stage unless regulatory changes on reporting are implemented in such a direction.

I'm obsessed with my mobile phone prices because I get the bill every month, but my mum hardly cares (or even knows) how much of fees she's really paying on her unit trusts because all they get is a generic results statement.

You should go petition this! 😛

Any other supporters of that petition?

The two of us is a good start, but hardly enough to stand a chance against the almighty financial lobby fighting hard to protect their rice bowls. 😉

It's true!Learning how to manage and grow your money is the only way for getting rich.

regards,

market neutral

Comments are closed.