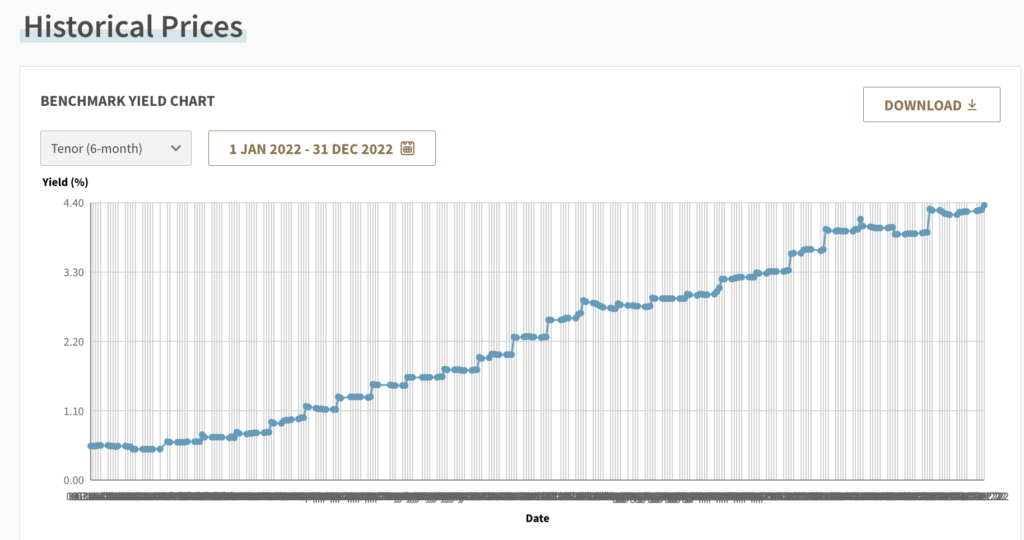

With fixed income instruments back in the spotlight again, the MAS treasury bills received a lot of attention as the yields climbed higher. Every tranche that was issued after July was between 2 – 3% yield, with the highest cut-off yield coming in at 4.4% p.a. in December.

Mind you, we haven’t seen such high yields in almost a decade, and some savvy Singaporeans have been quick to act. If you’ve been paying attention here on this blog and subscribed to some T-bills after I wrote this article, congratulations on your yield!

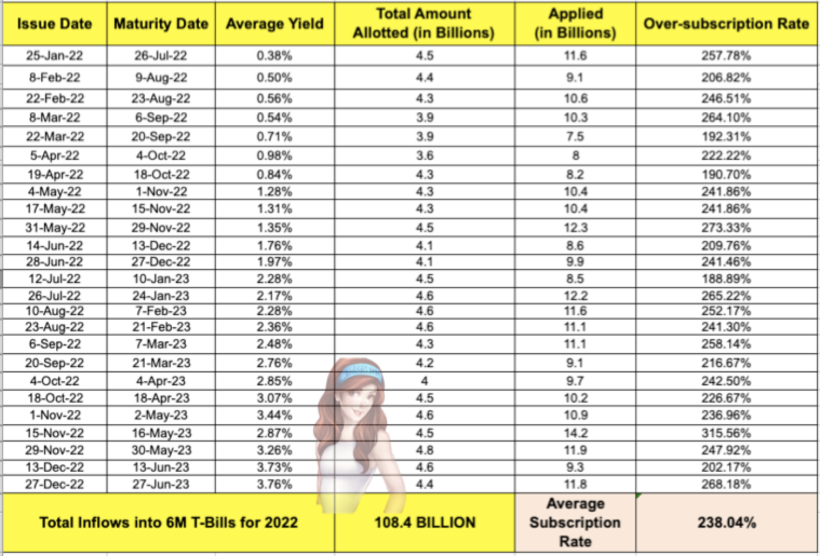

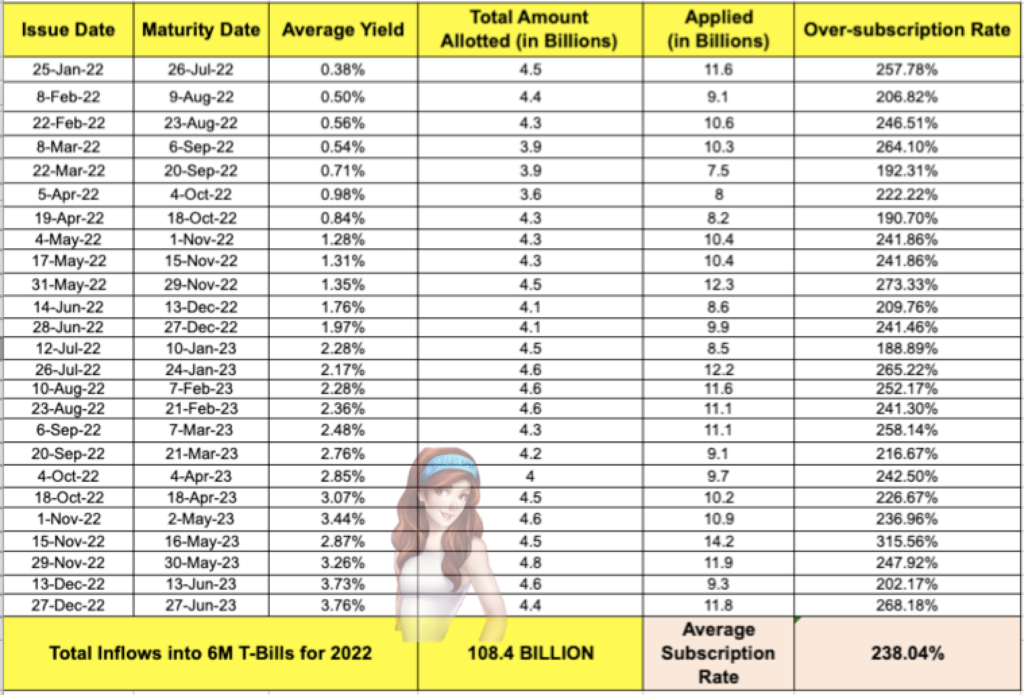

But how much did MAS receive in T-bills last year, and how does it compare with one year ago? Here’s your answer:

In 2022, Singapore invested SGD 108.4 billion into the 6-month T-Bills issued by MAS.

There were 25 tranches issued (same as in 2021), but the amount allotted was 9.4 billion more.

That’s 9,400,000,000 SGD more!

How did that happen?

Well, if you’ve been keeping track of the yield, it is not surprising to see why so many people have been rushing to subscribe.

And if you didn’t already know, you can also use your CPF-OA funds to subscribe, which kinda makes sense since the yield is higher than 2.5% p.a. right now. The trade-off? You’ll have to physically queue up at your local bank if you wish to invest your CPF funds.

How to calculate your T-bill yield

If you’re confused by all the terms shown on the MAS auction results page, here’s an easy formula:

Your Yield = (S$100 – $X) / $X x 100

$X refers to your purchase price, which can be calculated based on how much you spent on the T-bills (you need to minus off any returned capital and more). (S$100 – $X) is how much you got refunded, whereas the rest of your capital will come back upon maturity in 6 months.

The yield that you get at maturity is essentially the difference between the purchase price and the face value. Still lost? Ok, here’s an example:

- You put in $50,000 to purchase T-bills

- You got refunded $25,000 as your application was only partially successful.

- You also got back $498.75 as the final auction price was lower than your initial bid price.

- Hence, you got 250 T-bills at ($25,000 – $498.75) = $24,501.25

- Take that divided by 250 = $98.005 each (how much you paid vs. the original value of $100)

Thus, your scenario is now one whereby you’ve paid $98.005 for a 6-month T-bill with a face value of $100, so your yield is calculated as ($100 – $98.005) / 98.005 x 100 = 2.03% for 6 months.

That’s 4.06% p.a. (multiply by 2 because 6 months x 2 = 1 year).

Not too shabby, considering how you don’t have to ensure you’re depositing your salary by GIRO monthly / spend on your credit cards / clock 3 bills, right?