The global insurance industry struggles with a major conflict of interest when it comes to earning commissions based on what one recommends to their client. While there are advisors who have learned how to navigate these conflicts (even if it’s at the expense of their own earnings), there will inevitably be many more who are unable to manage – or are subconsciously influenced by – the monetary conflict.

In Singapore, the Monetary Authority of Singapore (MAS) has guidelines in place to govern the fiduciary duty of the insurance industry. It is worth noting that these are guidelines and not laws. You can also check out how the choice of language leaves a lot of room for debate as it says “should place” rather than “must place”.

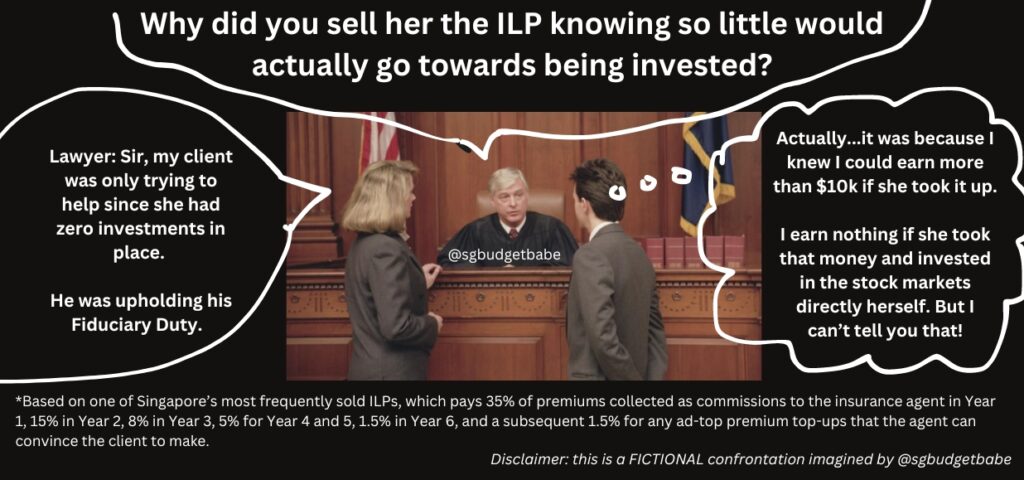

Therein lies the next dilemma, how does anyone know whose interest was placed first…other than the agent himself who gave out the “advice”?

Many years ago, I wrote about some of the questions I generally ask the insurance agents I meet in order to help me decide whether (i) I can trust their recommended policies and (ii) if I’ll be better served buying my insurance policy through them or another agent.

But because of how that article went viral, I’ve since heard about agents who use this to train their new recruits on what to say in response. While some will genuinely mean what they tell you, there’ll always be others who might simply be smoking you in order to make sure you don’t decide to “fire” them…just because you follow Budget Babe and they didn’t match up to her standards.

Which is why I’m going one step further today – let’s look at the numbers, so we can all discern for ourselves and know whether the agent(s) we work with are worth keeping…or not.

That way, consumers and the industry will all be better off.

How insurance agents get paid

In Singapore, insurance agents get paid commissions and various incentives. Here’s a quick overview of some common ones:

Now, there’s nothing wrong with being paid for a service that you’re rendering. But how your financial advisor mitigates that conflict of interest is the biggest question you should always be asking.

This doesn’t apply just for insurance agents, but also to your bank RMs and hedge funds. Or basically, anyone who gets paid for making you a recommendation.

The insurance industry has significant conflicts of interest.

In an ideal world, we should all be able to safely trust that every single insurance agent we meet prioritizes the client interests above everything else…including that of their own income and commissions.

But in reality, we live in a capitalistic world where everyone needs money in order to survive.

So let’s get this out of the way first – conflicts of interest DO exist with financial advisors because they are paid via commissions, and hence it isn’t surprising that some are likely to direct you to products that will pay them higher fees.

After all, your insurance agent is a human just like you and me, who’s also trying to earn enough to put food on the table and give their family a good life.

Did you know? Since this post went out, a few agents have expressed their dissatisfaction with my piece and pointed out that financial institutions & financial advisors are in fact required to disclose their commissions at the point of sale for investment products and distribution costs for life insurance policies.

But let's get real, how many of you are reallllly able to get this info from your agent? By now, most insurance agents have learnt how to skirt the question, or answer you in a way that is part of their "Objections Handling 101" training. Hence, this article will reveal to you what really happens on the backend.

So if any agent denies this conflict of interest…that’s your first red flag to watch out for.

Instead, trust the one who explains to you how they mitigate the undeniable conflict…and then use your own antenna to judge (whether they’re just smoking you or telling the truth).

This is what I do with my own insurance agent(s), which is why I don’t have a problem even when I learn that they’re being compensated well for the plans that I decide (of my own accord) to purchase with them!

But what I cannot tolerate is when someone delivers a poor service to me and yet is being paid well for it. It gets even worse if it’s at my expense…which is unfortunately how the insurance industry payment structure works, since the commissions come out of the premiums paid by the consumer.

Ok, so how do insurance agents earn?

Here are 5 ways:

1. Direct Commissions

The majority of insurance agents get paid commissions based on the products sold to you.

This is true regardless of whether they’re a tied agent, working in an independent agency…or are in a bank to distribute insurance plans.

In other words, what you buy from them will directly influence how much they earn. Which is why insurance agents are thus salespeople as well. The more sales they clock, the more they make.

If you were put in such a situation too, can you confidently say that you will NOT let money influence you, even at a subconscious level?

Wilfred Ling, who works for an IFA, also shared this letter from an agent on his blog a few years ago:

“I feel this is largely the fault of the commission structure. I feel very unethical about this, but at the same time, I do need money to make ends meet. Unfortunately, with the commission structure I am being encouraged to simply sell the highest commission products possible. While a term plan might be more appropriate in some cases, I cannot sell it as I will not receive sufficient commission to cover the cost of prospecting for the client and meeting the client, and worse a term plan is not considered a “life case” so I will be screamed at by my boss (I have seen some bosses throw heavy objects at their agents and I feel concerned for my safety). I was not even given product training on anything except the highest commission products.”

While you cannot change that, what we can change is by becoming more educated consumers so that we’re less likely to fall for any salesperson’s tricks.

Every industry has its bad sheep. What we want is to find the best salespeople who make money not because they’re a snake oil salesman, but because they offer so much value or reliable advice (proven over time) that their clients consistently choose them over others.

Your job is to be able to discern between the good agents vs. the lousy ones who tell you that “it’s good for you” when in fact they’re just lining their pockets with fatter commissions.

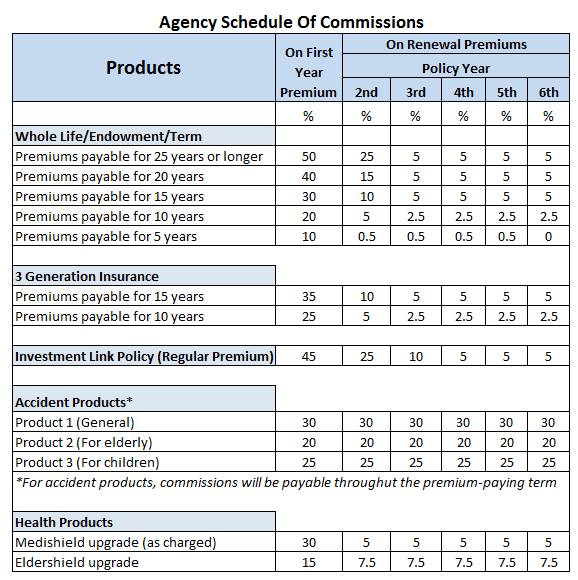

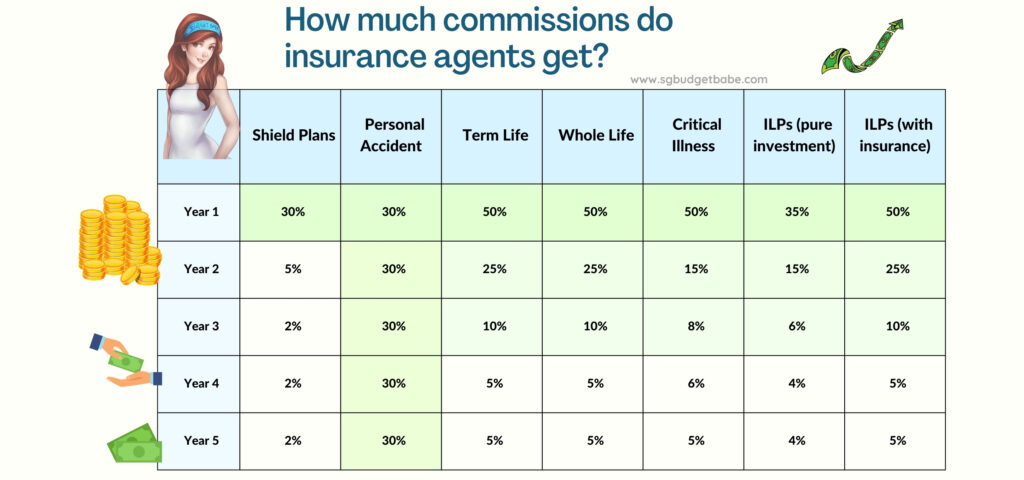

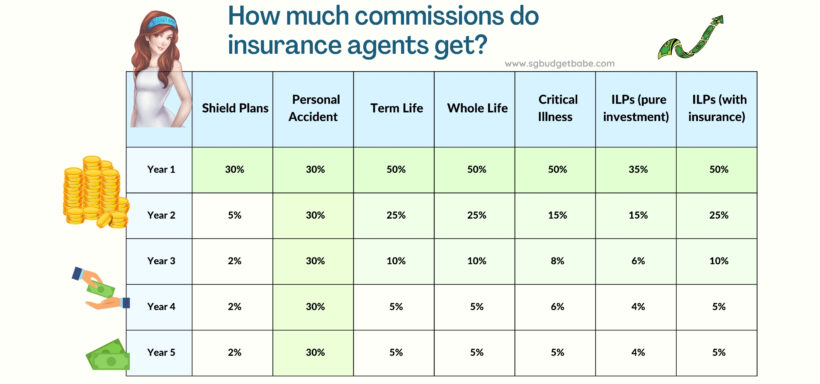

The bulk of agent commissions are paid in the first 1st year and tier off over a period of 6 years.

That’s right – this means that the agent earns the most in Year 1 for closing the sale, but continues to receive 5 more years of renewal commissions for as long as the client does not terminate the policy.

Sell once and get paid for 6 years…not a bad deal, isn’t it?

Back in 2012, this table below was exposed on a blog (which has since gotten locked).

I’ve spoken to a few agents in recent weeks and this is my version today after collecting data from several agencies and insurers.

You may use the above figures as a guide, but note that these are not 100% accurate when it comes to how much your insurance agent makes, since there are several factors influencing the actual commission rates:

- The agency – different agencies have different commission tiers. In selling a whole life plan, the 6 years of earnings differ for a Prudential agent vs. a Great Eastern vs. an NTUC Income agent.

- The payment duration – the longer the client pays premiums for, the higher the commission tiers. A 5-year limited-pay whole life plan will earn less commissions (40%, 20% and 8% for first 3 years) for the agent vs. a 25-year payment term.

- The actual premium – commissions are a percentage of the premium amount collected, so someone who’s young and healthy paying a lower premium vs. an older person with pre-existing conditions and loading will earn differently for the agent.

- The policy type – some plans pay less depending on which target audience you sell it to (e.g. a lower commission percentage if a PA plan is sold to children vs. adults). For instance, selling a disability plan to those under 45 gets you 40% commissions, but drops to just 17% – 19% if the customer is older than 55.

- The distributor – from time to time, there may be bonus incentives given to push a certain plan.

There’s also a misconception that agents who sell you personal accident plans over whole life plans are “better” or “more ethical” agents. In fact, most PA plans give 30% perpetual commissions for the entire lifetime of the policy, which means your agent could still be earning from you in Year 10 or 20!

If you think about it, PA plans can be a great strategy for new agents because:

- Agent sells 5 PA plans per month with average annual premium of $300

- After 1 year, 30% x $300 x 5 customers x 12 months = $5,400 commissions yearly

- After 5 years at the same pace, that’s a $27,000 passive annual income!

Takeaway: Commissions DO inevitably play a part in influencing agent behaviour in front of their customers. Be conscious of this conflict of interest so you can judge your agent’s recommendations for yourself.

2. Bonus commissions for renewals

Some agencies also offer a bonus for renewals on top of your commissions. As long as the agents keep their clients happy and ensure that they do not terminate or switch their policies, the company pays the agent an extra cut.

In AIA, this is known as a “career benefit”, while Great Eastern calls it a “persistency bonus”. The term used may differ between agencies and countries, but the idea is generally the same.

Using AIA as an example, here’s how an agent can get two rounds of commissions paid out:

- If you hit $10,000 worth of renewals, you can get 80% i.e. additional $666 monthly passive income

- Your bonus rate can grow from 80% to 90% and even 110%, the longer you stay with the company

Given that most senior agents clock at least $40,000 of renewals in a year, at a 100% career benefit level, that translates into $3,333 in passive income each month! And that’s even before you calculate their active commissions from cases that are still running. So if you’ve ever encountered an older AIA or GE agent who appears super chill about sales, you now know why 😉

Takeaway: A good agent will be more incentivized to sell you a plan that is beneficial for you over the long-run and one that you’ll stick to, so that they can earn their renewal bonuses as well.

3. Other bonuses

There are also other bonuses that each agency may give its agents to incentivize them further. For instance, here’s the bonuses an agent can expect to get if they sell investment plans to their customers:

| Collective Investment Scheme – Yearly Revenue Collected | Bonus due to agent |

| $0 – $15k | None |

| $15k – $40k | 10% |

| $40k – $70k | 15% |

| More than $70k collected | 20% |

And to reward agents who are producing well, there are other commissions given out as well. For instance, agents at some agencies can expect another bonus commission based on their personal sales of life, accident and health products for the year:

| Year 1 Commissions Earned on protection plans sold | Additional Bonus |

| $0 – $10k | None |

| $10k – $14k | $2,000 + 34% on excess of $10k |

| $14k – $22k | $3,360 + 38% on excess of $14k |

| $22k – $38k | $6,400 + 42% on excess of $22k |

| $38k – $62k | $13,120 + 50% on excess of $38k |

| More than $62k | $25,120 + 60% on excess of $62k |

Takeaway: Your agent does not only earn the upfront 30% – 50% direct commission that you think. There are more bonuses behind the scenes that you’re unaware of.

4. Incentive trips

Another monetary factor that can influence agent behaviour would be “soft incentives”, such as a temporary or time-sensitive bonus that is given if you hit a certain target.

If you’ve ever seen your insurance agent friends go on “company trips” abroad, this is what I’m referring to. And let’s get real, these trips can be a huge cost savings for the agent and their partner, which is why it isn’t surprising that many agents work hard to push more sales and hit the targets required to qualify for it.

| Incentive Award | KPIs required |

| Mid-haul trips (e.g. Japan, Korea) | $15,000 commissions in a quarter |

| Long-haul trips (e.g. Venice, Iceland) | $182,000 premiums in a year (or $56,000 commissions) |

These trips also make for great recruitment activities 😉 who wouldn’t want to join a company that sends you on overseas trips several times a year for free?

You could easily be saving $3,000 – $12,000 on such trips since the insurer pays for your flights and hotels. Would YOU say no to such an incentive?

What’s more, for some of these incentive campaigns, should the agent push a certain product range or type, the qualifying sales volume required will drop e.g. by 30%. This means that if you’re eyeing a free trip to Europe, you could be strategic about what you sell so that you only need to clock a lower $125k of premiums instead.

There will usually be a limit to how many tickets an agent can earn under such “soft incentives” e.g. 2 tickets. Hence, once they hit the maximum tickets, some agents will then switch their sales focus to another insurer’s incentive campaign to earn more overseas trips for themselves.

Depending on when you meet the agent, the recommended plans they push to you may then vary…and you’ll never know it’s because of the trip incentives behind it.

Takeaway: Unless you have full details on what soft incentives are being offered at every moment, it is difficult for a consumer to know whether their agent is recommending them the product because it is truly good for them or because they’re trying to hit a company incentive.

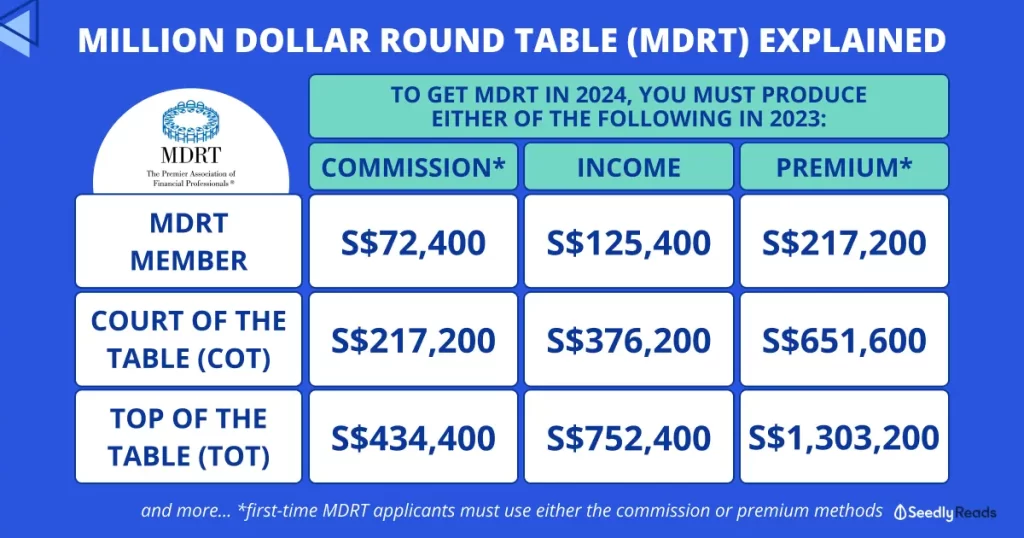

5. MDRT vs. COT vs. TOT

Another incentive given to agents would be the industry recognition awards i.e. MDRT, COT or TOT.

Some agencies also give cash incentives if you hit these awards, so that’s an additional source of income there.

Takeaway: Contrary to what you think, your MDRT insurance agent did NOT earn $1 million in commissions (or premiums collected) last year.

The difference between tied vs. IFAs vs bank agents

There’s also a general misconception that agents working in non-tied advisory firms are better than tied agents.

While it is true that tied agents can only sell insurance plans from their own company, the reality is that the advice you get from FAs can be influenced by the bonuses given to them by the underlying insurer – which you have no knowledge of.

How many of you remember from few years ago when many FAs were aggressively pushing AXA Pulsar?

Unknown to most consumers, a FA recently shared with me that the commissions offered on that ILP back then was bumped up to 60% (vs. the usual 35 – 50%). Perhaps that might explain the behavioral change?

In case you’re unfamiliar with the difference between the different types of agents, here’s a quick overview:

| Tied agents | FAs | Bank distributors | |

| Examples | AIA, GE, HSBC (formerly AXA), Prudential, Income, Singlife | Financial Alliance, Finexis, PromiseLand | Standard Chartered (sells Prudential plans) DBS (sells Manulife) |

| Compensation | Commissions OR base pay + a cut from commissions | Commissions vary by the underlying insurer (e.g. AIA) which first gets a cut, taken from the commissions. Remaining will be given to agent. Special bonuses may be offered by the insurer from time to time. | Base salary e.g. $3k – $4k. Commissions paid based on total revenue (premiums) collected. Sales targets are on a quarterly basis. |

Agents from FAs can often give you a printed sheet of the same policy across different insurers to do a premium vs. benefit comparison for you, but what is less transparent are the commission percentages or bonuses that they get if they push certain products.

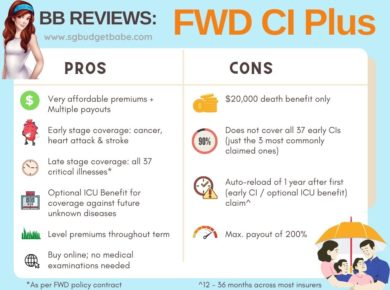

For instance, say you told your agent that you needed X amount of coverage but only have a tight budget of $Y. Your agent could then present to you a comparison sheet where you could be seeing a lower premium from China Taiping ($1,200) vs. FWD ($1,500) being presented to you, but what you may not know is that the commissions on China Taiping is higher at 50% vs. FWD’s 20%. You may then feel good that your agent is emphasising your budget and recommending you the cheaper plan, but would you still feel the same way if you knew it’s because he earned double by pushing you in that direction? After all, incentives can potentially influence which features of a salesperson decides to downplay or push more emphasis on.

The same goes for bank distributors, which are salaried workers known as “Insurance Specialists” or “Bancassurance Sales” by most titles. These people aren’t really agents, as you can see from the bank disclaimer below:

These bank “specialists” are paid commissions based on the volumes they move. There are no incentive structures for them to focus on retention and renewals, which helps explain my experience is that so many of them like to recommend me to buy single-premium endowment plans from them, even when I tell them I only use insurance for protection! 🙄

As a consumer, I would never buy any insurance product from a bank specialist – but that’s because I want to have an agent servicing me for the policy lifetime if I were to commit to any plan.

What about you?

Conclusion: find out how YOUR agent mitigates conflicts of interest

This has been a difficult topic to investigate and write, and I had to tread carefully lest I get sued (let’s see!) while also protecting my sources who opened up transparently about the commission rates in the industry in order to make this piece possible.

But I feel this is an important topic to address in the name of transparency. What’s more, the information online is either skewed or downright wrong (such as forum posts that claim insurance agents earn 180% of commissions sold from ILPs – that’s not accurate and I found no evidence supporting that). Otherwise, they’re often presented from one-sided POVs, with each defending why their (or their own agency model) is best. With the rise of insurance agents taking to social media to do their marketing, we’re starting to see more and more one-sided POVs being presented and that’s where things can get dangerous.

Check out the TikTok saga here between a tied agent insisting why commissioned agents are better for the clients vs. fee-paying advisors? Btw, check out the comments section – it gets even more heated there.

My view is that I don’t just believe in simplistic, overgeneralized statements such as

- “insurance agents are bad”

- “agents who sell whole life plans / ILPs are unethical”

- “tied agents are better” or “IFAs are better”

Instead, I care more about the agent’s ethics and am interested interested in WHY the agent recommended those plans to their client, especially if they presented alternatives for their clients to consider in the first place. Here are some examples:

- Buy Term Invest the Rest vs. Whole Life Insurance – if the agent already told the client that BTIR is better for them, but the client decided to buy a whole life anyway because they want the assurance of being covered until age 99, then how is that the fault of the agent?

- DIY Investing vs. via an Investment-Linked Plan – if the agent already told the client that he has the option to invest through DIY, robo-advisors or even buying funds directly through banks or brokerages…but the client still decided to invest in an ILP anyway to enforce discipline and have the agent manage it for his convenience, then how is it fair when others label the agent as a “black sheep” for selling the ILP?

Believing “general truths” propagated online about “tied agents are evil” or “whole life plans are bad” can be dangerous. The truth is, there will always be different trade-offs and some agents or plans will be better for some customers, while worse for others.

Personally, I work with a small handful of both tied and IFA agents to get their different inputs before I make the best insurance decision for my own family. Some of our plans are through IFAs, while others are with tied agents. But at the end of the day, I’m the one making these decisions – so whether or not my agent was making me a recommendation swayed by his incentive trip doesn’t affect me.

At the end of the day, YOU are the only one who can make the best financial decisions for yourself and your family. If you’re relying 100% on your insurance agent’s advice, then that can be a very dangerous thing. You should learn how to take their words as opinions and alternative viewpoints instead, while weighing against your own in order to arrive at your final decision.

I hope this article has shown you how the conflicts of interest exist in the insurance industry…and will likely persist.

But that isn’t necessarily a bad thing, because now that you’re aware, with more knowledge comes greater power (to the consumer).

Since the vast majority of consumers do not wake up thinking they need to buy insurance, the reality is that insurance is seldom bought; it often has to be sold instead, which is why all these sales-based incentives in this industry exists. We don’t have to deny it, but we need to be smarter about how these conflicts of interests are being managed.

And that’s why I believe that the only solution is for consumers to become more knowledgeable and savvy with their finances so that they can smell out bullsh*t disguised in the name of “advice” when they see it.

It’s harder to tell if your friend is a new agent in the industry, but the longer they do good ethical work in selling the right protection plans, the more word-of-mouth and referrals they’ll get. Eventually, over time, it becomes easier to see who’s the real deal vs. the wolves hiding in sheep clothing.

Now that we, as consumers, understand these conflicts of interests, we can be more discerning about what our agents tell us and only work with those who can strike a good balance between their own earnings vs. their client’s interest.

I hope this article has opened your eyes to the industry, and more importantly, helps you to find the best agent who can serve YOUR needs.

With love,

Budget Babe

2 comments

Hi SG Babe

Thank you for this eye opening article on insurance which lay person like me feel I ought to know beforehand and be equipped especially there are so many plans and coverage and I always wonder if the agent really acting in my best interests. Just a note on your calculation example: After 1 year, 30% x $300 x 5 customers x 12 months = $5,440 commissions yearly (should be $5,400)

Hi Dawn.

Thank you for the great piece. Insurance has always been a headache area. I have a decision to make regarding my very old policies but no agent can give me proper advise for it. They just want to sell me products instead after talking to a few of them.

Can you put me on your subscriber list?

Comments are closed.