Traditional concepts and ratios like Price-to-Earnings, Free Cash Flow and Net Profit don’t quite apply to cryptocurrencies, especially a large number of crypto projects still are in development and aren’t ready for mass adoption in the real world yet.

So what’s a crypto investor supposed to do?

We need to first understand that the crypto markets are still in their infancy. Unlike stocks (which have been around for a much longer time), there is still no universally accepted metric on how to value a crypto coin right now.

- If you had used the traditional Price-to-Earning metric to value Amazon, you would have been alarmed at its negative P/E given Amazon’s $5.78 million losses in 1996

- Amazon returned no dividends to investors, nor did it do share buybacks

What would you have done? Probably stayed far away from this investment, because traditional valuation metrics were screaming red flags.

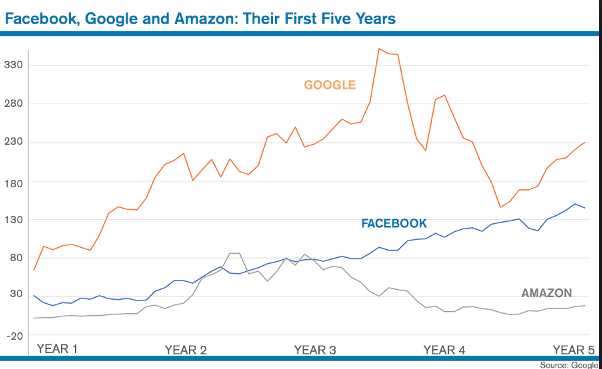

You could have waited until then to invest, but wouldn’t your returns have been infinitely more rewarding and explosive if you had bought Facebook right after listing, when valuations were still murky and uncertain?

Today, we know how to use cost-per-click (CPC) and click-through-rate (CPC) in our projections of future earnings when valuing Internet companies, but did we know that before when the Internet was still in its infancy?

Even now, such valuations are more of an art than a science. Therefore similarly, we cannot expect to apply traditional knowledge and valuation models to crypto. They just don’t work. My friend Aaron from Mr Stingy, also raised a very good point that the model you use will probably fall flat as well if the rest of the world isn’t using it too.

But for those who insist on a numerical way to quantify exactly how much a coin is worth, there are still ways to be found. Let me illustrate with 2 examples.

Disclaimer: The below portion is purely for educational purposes, and is not a recommendation to buy any of the cryptocurrencies mentioned.

Kucoin Shares (KCS)

There are coins which can serve as a source of passive income (i.e. dividend-like investments). An example is KCS, which share a portion of its revenue from transaction fees earned through trades conducted on their exchange with its investors. There will also be buying demand for KCS as it offers discounts of up to 30% on trading fees. Hence, as Kucoin grows in popularity as an exchange, the value of KCS tokens will also go up. You could try to quantify how much it is worth by running daily trade transaction numbers, fees collected from trading, KCS buybacks, and more.

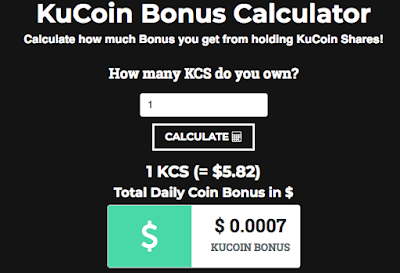

Someone even created a website for you to estimate how much your KCS tokens are worth.

|

| Source: https://kucoinshares.com/ |

As more people use Kucoin, more trading fees will be collected, therefore the size of the payouts will increase over time. And because your dividends are paid in the form of alt coins, there is also a possibility that you’ll be earning as their prices go up as well.

Assuming Kucoin grows to become the top 10 exchanges and handles slightly under $1 billion of daily trade volume, we could estimate:

$0.0007 per day x 365 days x 10 (growth in trading volume) x 4 (conservative estimate of growth of coins) = $10.22

If you hold 1000 KCS, that should give you $10,220 in passive income every year. Not too bad considering how 1000 KCS costs less than USD 6000 to purchase right now. Unfortunately, the Kucoin Shares scheme has been discontinued since last month.

OmiseGo (OMG)

Another example is OmiseGo. I previously shared a financial valuation model on my Facebook page where it examines various scenario, including the price of OMG tokens if it charges X% of transaction fees assuming that it is successful in taking over Y% of the e-commerce or remittance market. The spreadsheet was created by Nodar Janashia and shared online.

Even so, that doesn’t mean this standard of valuing OMG tokens will be accepted by everyone. If your assumptions are way off, then your price estimations will also be problematic.

|

| Source: Nodar Janashia |

1 comment

Awesome website with awesome articles keeps up the good work.Online Coursework Help

Comments are closed.