Putting your money in Singapore Savings Bonds beats fixed deposits (FDs) hands down

I'm not a fan of fixed deposits. #bbinvestments

My grouses are mainly that they involve too much work in moving my money around, and the kind of returns they provide are generally quite pathetic to justify all that effort needed.

I can be lazy when it comes to growing my money and the idea of constantly searching for the best fixed deposit rate doesn't quite appeal to me.

So when MAS introduced the Singapore Savings Bonds (SSB) recently, I literally went hallelujah! #dayresavings

Yay! SSB over fixed deposits anytime, with higher returns, little penalties and much lesser work!

How do Singapore Savings Bonds work?

SSBs are bonds issued by the Singapore government (read previous post on bonds). They're one of the safest ways you can grow your money.

You need to be 18 or older to purchase SSBs, which have a maturity period of 10 years. You can easily buy them through ATMs of our local banks – DBS, POSB, OCBC, or UOB.

SSBs pay a higher interest rate than fixed deposits.

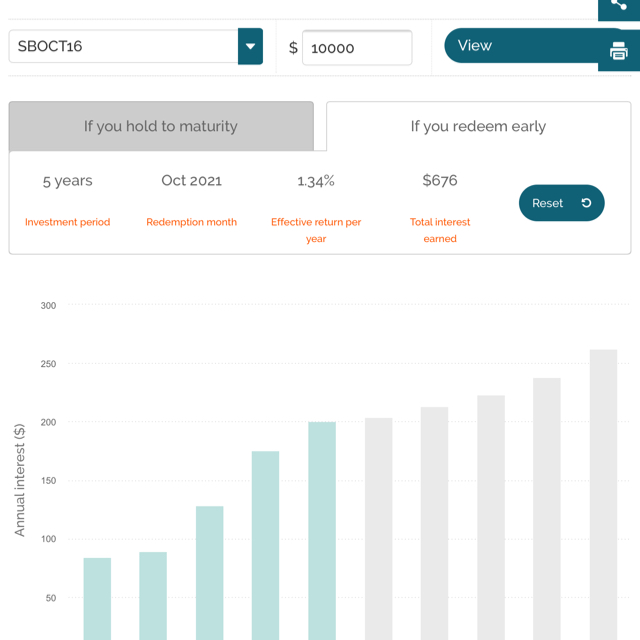

The interest rate varies depending on when you buy and redeem it, but you can easily calculate it on their website!

If you have $10k saved up but you're too scared to invest, putting it in these SSBs are a great way to grow your money. #dayreinvest

If you don't touch it for 10 years (max), you'll get over $1800 in total interest. That nets you a 18% return if you hold to maturity!

Lower minimum sum to buy SSBs than fixed deposits.

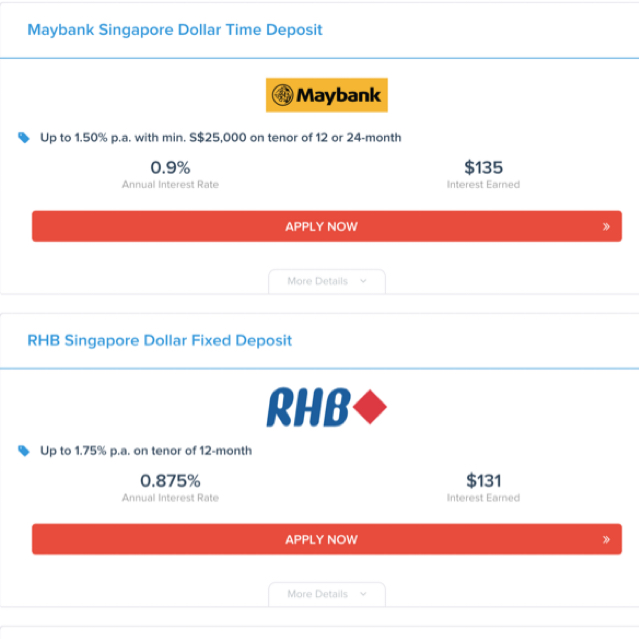

When I was shopping around for good deals on fixed deposits, the better ones required me to commit a minimum of $5k to $10k for a fixed period (usually 3 or 5 years). #dayrefinance

SSBs, on the other hand, only requires as little as $500 for you to start. That seriously makes it perfect for fresh graduates and folks who are new to the workforce!

Flexible withdrawals if you need the money unexpectedly.

But being a typical "kiasi" Singaporean, I always wonder about what if I need my money urgently. I can't touch my money in FDs. That's also why I don't favour endowment plans either. #dayremoney

SSBs are different. I can withdraw my money anytime (early redemption) without a penalty.

The only downside is that I kiss my future (higher) interest rate goodbye. But who cares if I need the money urgently, right?

Can't touch my money for 18 months just to earn $100+. I can easily get that amount from cashback and rebates instead.

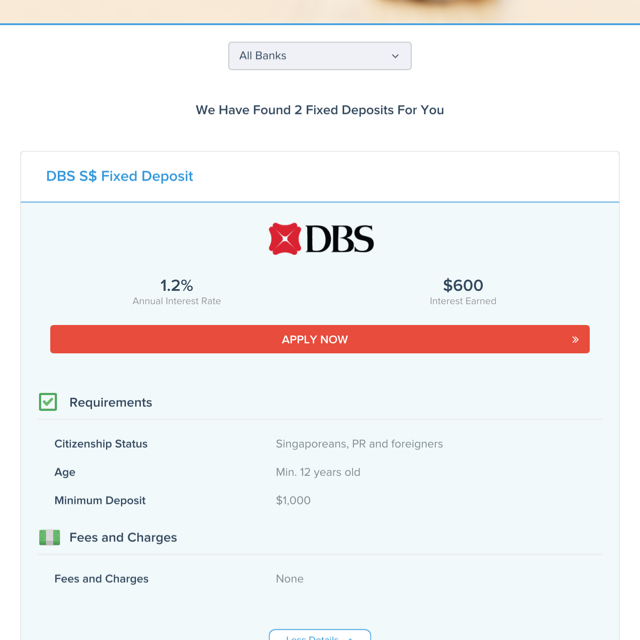

A longer term FD gives me slightly better interest, but for $600 I won't be allowed to touch my money for these 5 years.

SSB gives me slightly more interest and I'm also entitled to withdraw my money anytime I want.

SSBs are perfect for a lazy approach to growing your money.

With FDs, I have to compare between different banks to find out what are the most attractive rates offered in the market at different periods.

With the SSBs, I don't have to bother about comparisons. Its benefits are higher and more flexible. Best of all, I don't need to do much homework! Just buy, receive free money every year and go to sleep.

Are there any risks in putting my money with SSB?

Every financial tool has its own risks la. But SSBs are backed by the Singapore government, so what are you worried about? The whole world knows that our government is super frugal and has tons of money saved up in the national treasury. If the day ever comes where the govt can't even pay these minor SSBs interest coupons, then I think Singapore is screwed. Highly unlikely to happen if you asked me.

So there you go! I get a lot of questions on where I would recommend fresh grads or students to invest in, and here's a basic one that I highly recommend.

I even have friends in Malaysia and the U.S. who wants to buy our SSBs! But unfortunately it is a privilege for just our local citizens.

Feeling proud to be a Singaporean. Especially after reading about that survey where Singapore is ranked as the #2 greatest place in the world! (Eh Donald Trump, that's not America ok).