2020 was an interesting year as we saw the launch of cash management products, as an answer to consumer bemoaning the cuts to bank interest rates, which have plummeted even more ever since.

A History of High-Interest Rates

Once upon a time, high-yield bank savings accounts used to be a good answer for risk-averse folks who simply wanted inflation-beating returns without investing their monies. I recommended readers to park their income and savings into such an account as the first step of their financial journey, and even reviewed several bank accounts that gave you between 2%, 3% and even 4% on this blog. Unfortunately from mid-2020, many of these bank accounts have since reduced their rates accordingly as well.

Then came the Singapore Savings Bonds in 2015, which also offered rates as high as 1.98% (1st year) to 2.2% (10th year) p.a. interest rate in its February 2019 tranche. However, even this started falling significantly from May 2020 onwards, with the latest issuance giving a mere 0.27% (1st year) to 1.64% (10th year) p.a.

Even fixed deposits have been sub-par at under 1% with a lock-up period of 12 – 18 months.

Thanks to global interest rates being cut, we’re unlikely to see local interest rates by our banks go up anytime soon either.

This is likely why many have been flocking to short-term insurance plans for 1% – 2+% p.a. as another option in recent years, albeit with a lock-up period of anywhere between 1 – 3 years.

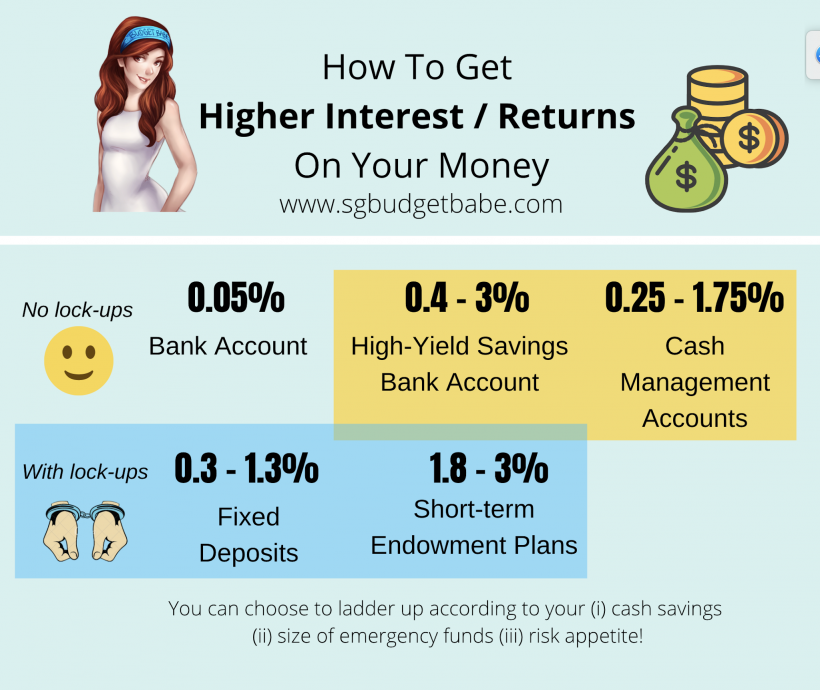

Knowing where to park your money is important so you don’t let your cash be eroded over time by inflation.

Times have changed, so we’ve to adjust our strategies accordingly as well.

What are Cash Management Products?

Enter cash management products, a fairly new hybrid introduced in 2020 that gained traction as an alternative for folks seeking higher returns on their money with fairly low risk. Offered by several investment providers and robo-advisors ,the rate of returns range from 0.25% to 1.4% p.a. with no lock-up periods sounded enticing enough.

How do these work?

In general, your money gets invested into the underlying cash fund(s), money market funds (MMF) or even short-duration bond funds. These include instruments like fixed deposits, government treasury bills or even institutional bonds.

Note that since these are investment products and NOT a bank savings account, your deposits are NOT guaranteed by SDIC. If you want that level of protection, you’ll be best sticking with the local bank accounts (with lower and lower rates).

Who are Cash Management Products good for?

I checked the interest rate from a high-yield bank savings account I’ve had for over 6 years, and the results were disappointing.

I expected to earn more this year, but with the announced interest rates cuts, obviously reality turned out very differently.

Which is why it didn’t make sense to keep our emergency funds with the banks anymore, and I’ve started moving cash out since a few months ago.

If that sounds like you as well, and you’re looking for a rate higher than what the banks / SSB / fixed deposits can give you without having any lock-ups on your funds, Syfe Cash+ might be a good option for you.

Review: Why You Should Consider Syfe Cash+

(6 April 2021 Update: In light of interest rates and yields on short-term bonds expected to remain low in the months ahead, Syfe’s projected yield has been revised to 1.5%)

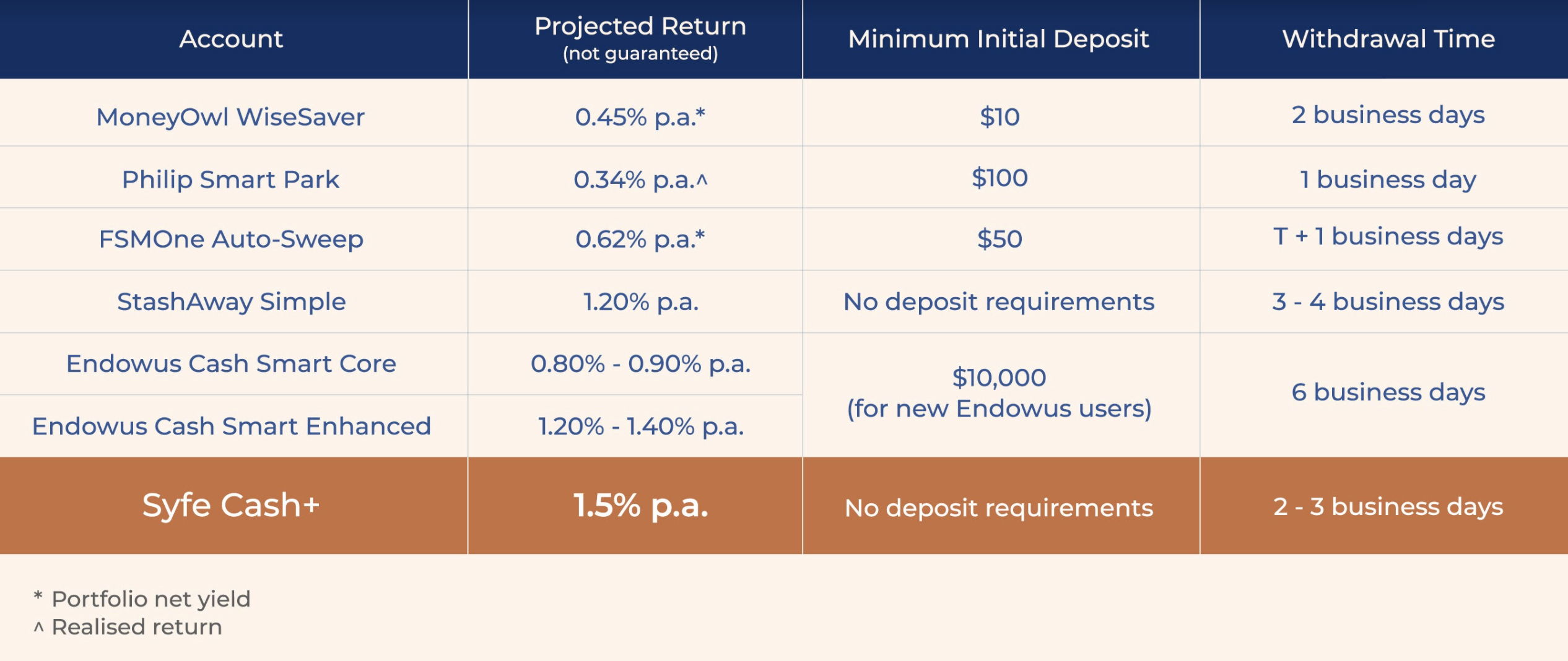

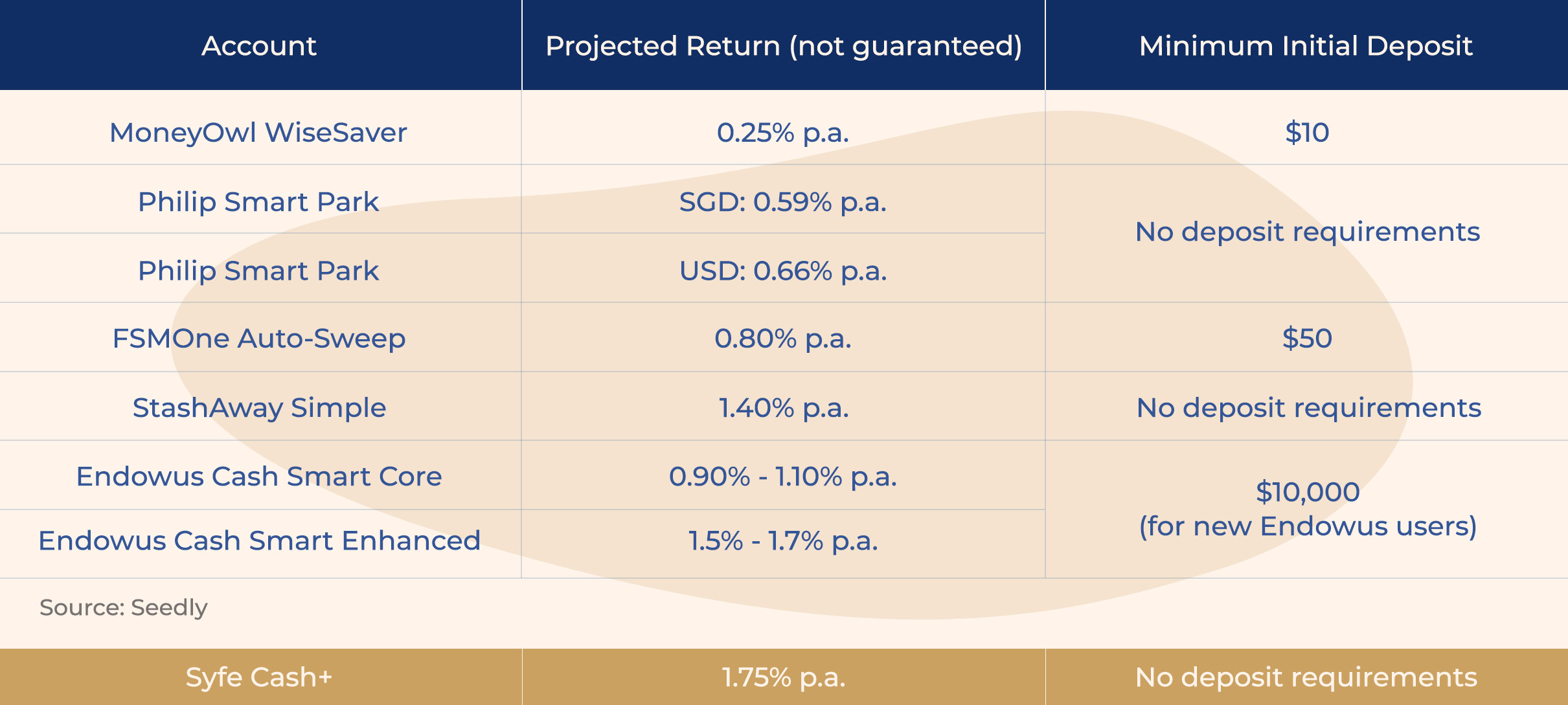

Among all the cash management accounts available now, Syfe Cash+ has (i) the highest projected yield at 1.75% 1.5% and (ii) no minimum deposit requirements.

I won’t go into detail of the other cash management options available in Singapore right now (maybe in another post), but they generally range between 0.25% to 1.4% p.a. with varying deposit requirements.

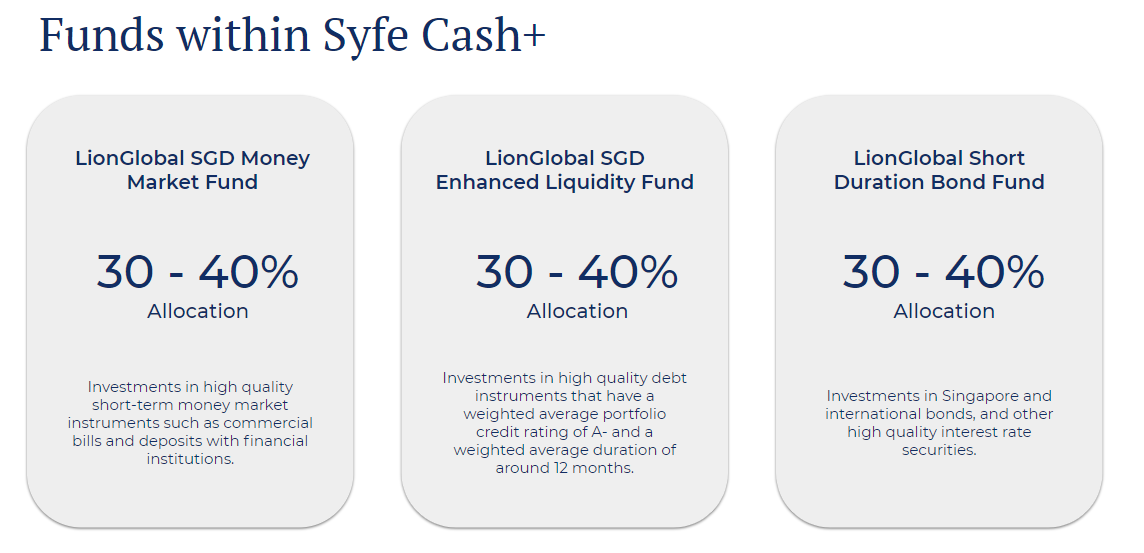

For those of you who want to know where your money is parked in to get such returns, here’s how they’re allocated:

You can read more about the 3 funds here (and a further deep-dive here including fund-level fees, overall weighted duration, maximum drawdowns, etc).

Benefits of Syfe Cash+

The key benefits of Syfe Cash+ is that it has:

- Daily accrual of returns

- No lock-up period

- Unlimited, free withdrawals – withdraw your money anytime you want, with no extra charges

- No management fees (from Syfe’s end)

- 100% rebates on fund-level fees

Any conditions for Syfe Cash+? What about costs?

With no minimum deposit amount nor minimum balance to maintain, you can also make unlimited transfers and withdrawals – free of charge.

In the event that you’ll like to transfer your Cash+ funds to Syfe’s investment portfolios later on to boost your returns, you can also easily do so anytime within the platform.

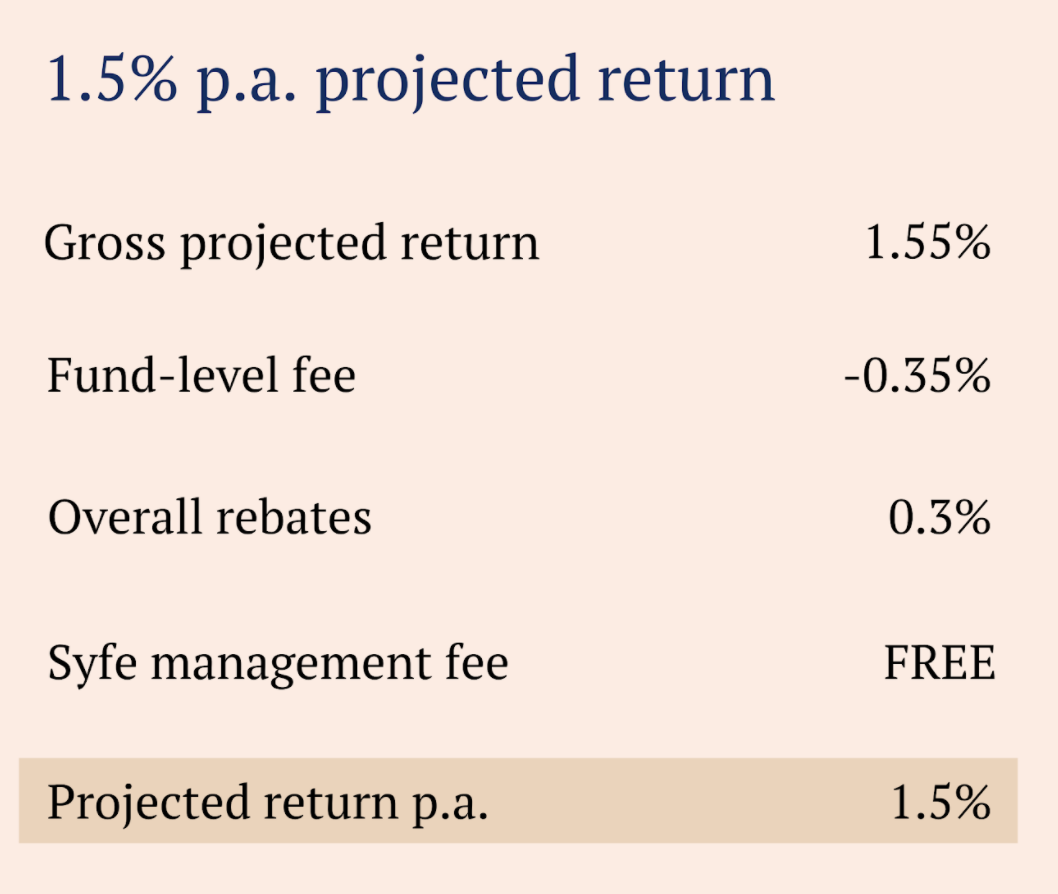

What’s more, Syfe does not charge any management fees on the Cash+ portfolio. For the purpose of this post, I reached out to them to ask how they deliver the projected returns of 1.75% 1.5% p.a., and this was what they shared with me:

|

| Source: Syfe |

In essence, your deposits are invested into the institutional share class of the underlying Cash+ funds, which have lower fund fees and expense ratios. (This is also why Cash+ is more cost-efficient than purchasing the underlying funds directly on your own!)

The overall fund-level fee charged by LionGlobal is 0.35%, but when third-parties distribute these funds, there are usually rebates involved. In this case, Syfe has decided to credit any rebates they receive from LionGlobal back to consumers.

Given that Syfe also doesn’t charge any platform usage fees to consumers, all in all, what these mean is that costs are minimized for the consumer, and hence we get to earn more on every dollar deposited with Syfe Cash+.

So in general, this is a good alternative rather than leaving your cash…in cash.

How has Syfe Cash+ performed thus far?

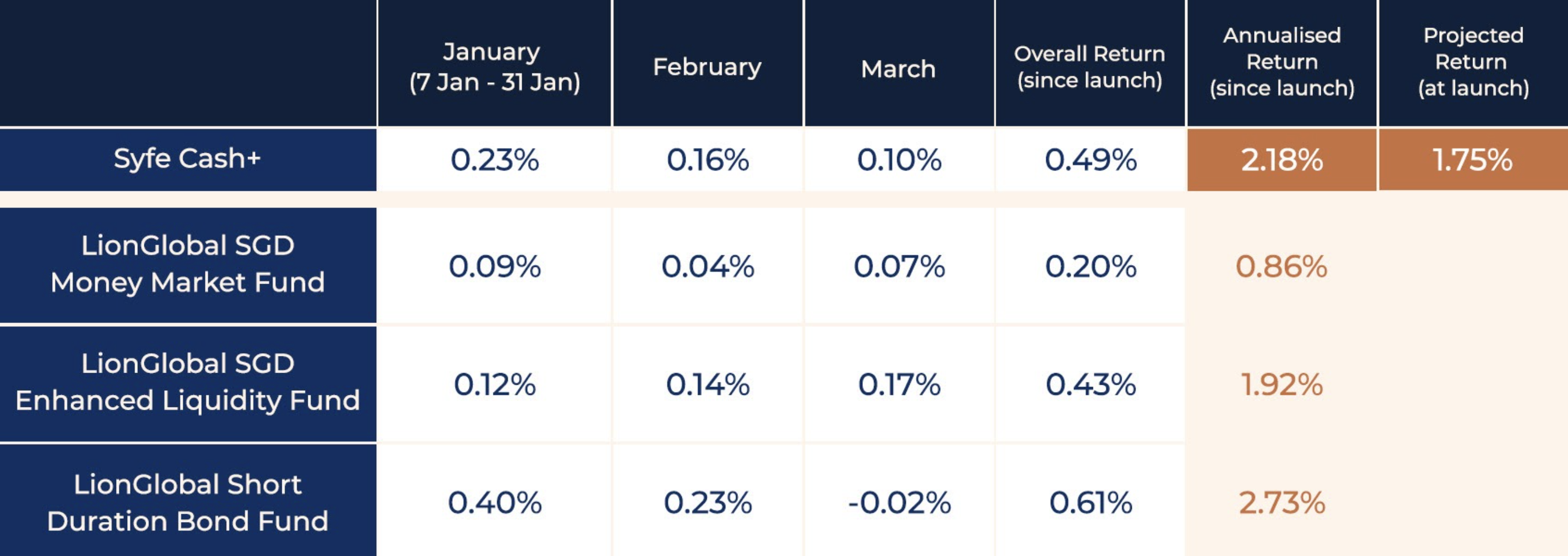

(6 April 2021 update)

It has been 3 months since Syfe launched this product, so let’s recap their performance to see if they’ve indeed been meeting projected yields:

The Risks

If you compare this to any of your existing high-yield bank savings account(s), the obvious difference is that your deposits in Syfe Cash+ won’t be protected by SDIC – since they’re both completely different categories of products, so such a comparison isn’t a fair one anyway.

But when you compare it to any other instrument out there that offers you low risk, no minimum deposits and no lock-up period, then this is where Syfe Cash+ stands out.

And when you compare it specifically in the category of cash management products, there’s no better option than Syfe Cash+ right now.

For those of you who may already be Syfe users and are wondering how this compares to their other offerings, note that since the returns for Cash+ are made from short-term debt instruments, the risk level is relatively lower (vs if you opt for their Global ARI, REIT+ or Equity100 offering).

In my view, this makes Syfe Cash+ a good place to park your emergency cash funds, since it gives you the assurance of being able to withdraw your funds without any penalty, as and when you need them.

I’m not sure about you, but as I mentioned in a recent blog post, I’ve set aside 24 months of emergency funds (living expenses) given our circumstances. Once upon a time, it made sense to keep almost the entire sum in our high-yield bank savings account, but not anymore.

I won’t be mentioning how big the fund is here because we want to avoid having more people come to us to borrow money, especially family members.

But the truth is, given the size of the fund, we need multiple places to park it in so that its value doesn’t get eroded by the inflation rate.

And that’s why Syfe Cash+ piqued my interest as well.

There is no limit to how much you can deposit in Cash+ since the projected rate of 1.75% p.a. applies on all deposits. If you’ll like to find out more, head over here for more details and how to open an account.

Sponsored Message from Syfe:

Learn more about how you can put your cash to work in 2021. Watch our webinar here.