There’s no need to bemoan the loss of the GrabPay card, since it was hardly that fantastic to begin with. But for those of you who think you’ll miss the numberless card feature, you’ll be glad to know that while Grab was indeed the first to launch that feature here, 2 other card issuers have followed since – so here’s those 2 alternative options you can consider instead.

When I first read the news yesterday about Grab’s decision to discontinue their GrabPay card (from June), my first thought was that it might have been an April Fool’s prank played by the brand.

Except that it wasn’t.

Shortly after, I received several DMs on my Instagram from readers asking if I knew of any other cards that could offer “similar benefits”. That initially left me bewildered, because in my head I was thinking, “WHAT benefits did the GrabPay card have in the first place?”

You’ve seen me feature various cards here on the blog, and I’ve talked extensively about how I’m a regular Grab user here, here and here.

But let’s get real, that doesn’t mean every Grab offering is good. And the GrabPay card is top of that so-horrible-why-does-it-even-exist list.

The history of GrabPay card

The GrabPay Card, essentially a prepaid MasterCard, was launched in late 2019 and back then, had at least some justifiable use cases for it:

- Paying for various transactions with your GrabPay card gave you Grab points according to your Grab membership tier e.g. your public transport rides, insurance, AXS transactions, online shopping, dining, etc.

For Platinum Grab users (including yours truly), that was the equivalent of a decent 1.2% cashback…albeit in the form of Grab points. - The best benefit was how users could “double-dip” and earn DOUBLE rewards i.e. top up your GrabPay card using your credit card to get (i) cash rebates or miles from your credit card issuer and (ii) earn Grab points at the same time. Most credit cards exclude e-wallet top-ups from earning rewards so this was a loophole…until it got nerfed.

- And then in 2020, Grab decided to do the unthinkable and devalue (!!!) their points. Your points were now worth less and it cost more to exchange Grab points for your desired rewards.

- In 2022, Grab nerfed the rewards system further which made it essentially a maximum of 0.3% cashback for certain (read: not all) F&B transactions only (e.g. McDonalds). Each Grab reward point became worth $0.002.

That was the final nail in the coffin for the GrabPay card. The changes not only rendered the GrabPay card useless, but also made the the entire Grab point systems too much effort for too little reward. And let’s be honest, while the GrabPay Card’s reward scheme was decent at best, but when you weigh it against some of the heavyweight credit card offerings out there, it’s like bringing a knife to a gunfight. What’s more, navigating Grab’s rewards system was about as straightforward as a hedge maze – you’re better off without it in your life anyway.

Since then, it has pretty much been a useless card to keep; you’d be better off with a specialised card that rewards you for spending on Grab, such as DBS Woman’s World, Citi Rewards or HSBC Revolution for miles (4 mpd) or 10+% cashback with UOB One Card.

Security as a card benefit

However, there was one minor card benefit left: Grab’s numberless card feature.

Remember, back in 2019 when Grab first launched the card, it touted it as Asia’s first numberless physical card for enhanced security. That meant that even if you lose your card, you didn’t have to worry about someone stealing and using your credit card numbers for their online purchases since all of your card details securely stored within the Grab app, and you could lock the card instantly through the app in case of an emergency (read: scams).

After several voice messages with this reader, I finally understood why she was still using the card – it was mainly for her online transactions on suspicious-looking websites. She was also looking into a numberless credit card for her elderly mother to bring out in replacement of her POSB Debit card, so she asked me for help.

While I personally choose not to keep a card in my arsenal unless it has security AND other benefits (which is why GrabPay did not meet my requirements), I have to acknowledge that there are some groups of consumers who don’t mind owning a card solely for security purposes.

Except that…you really don’t have to settle. Let me tell you why.

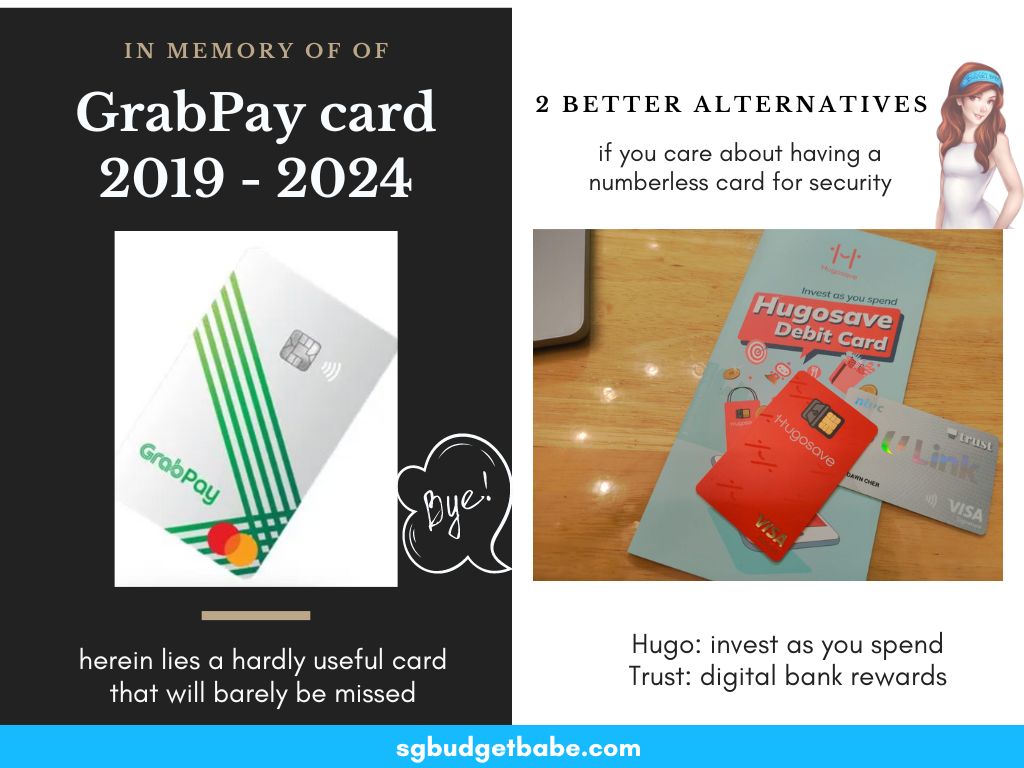

Better alternatives to the GrabPay card: Trust card and Hugo card

Seriously, if you haven’t ditched your GrabPay card already by now, isn’t it good that this discontinuation now forces you to break up with a card that hardly serves you?

There’s no need to mourn the impending closure either because really, there are better cards out there that can offer BOTH security and rewards. The GrabPay Card might have been a decent contender in its heyday, but the fintech evolution in Singapore has already levelled up since. So in that sense, the end of the GrabPay Card isn’t just a closure; it’s a chance for you to level up your financial game.

Using numberless cards as the main priority feature, here’s 2 cards that I recommend you guys check out to replace GrabPay card instead – Trust and Hugo.

Trust (bank) card

Trust Bank Singapore is a digital bank backed by Standard Chartered and FairPrice Group, and their Trust credit card is also a numberless physical card.

- Your Trust Visa Signature Card is a numberless credit card, which means that only you can access your card details on the Trust app. Just like the GrabPay card. In the (rare) event that your card details are compromised, you can immediately disable it on the app. You can also set the credit limit (I chose a low $1,000 for mine) and adjust it anytime, so you do not have to worry about scammers siphoning off more money than you can afford to lose or pay back.

- Money in your Trust account is safeguarded by Standard Chartered Bank with a $100k SDIC protection.

- You get to earn upsized LinkPoints and enjoy merchant promos (I’m a regular at Wang and Burger King with my Trust card perks).

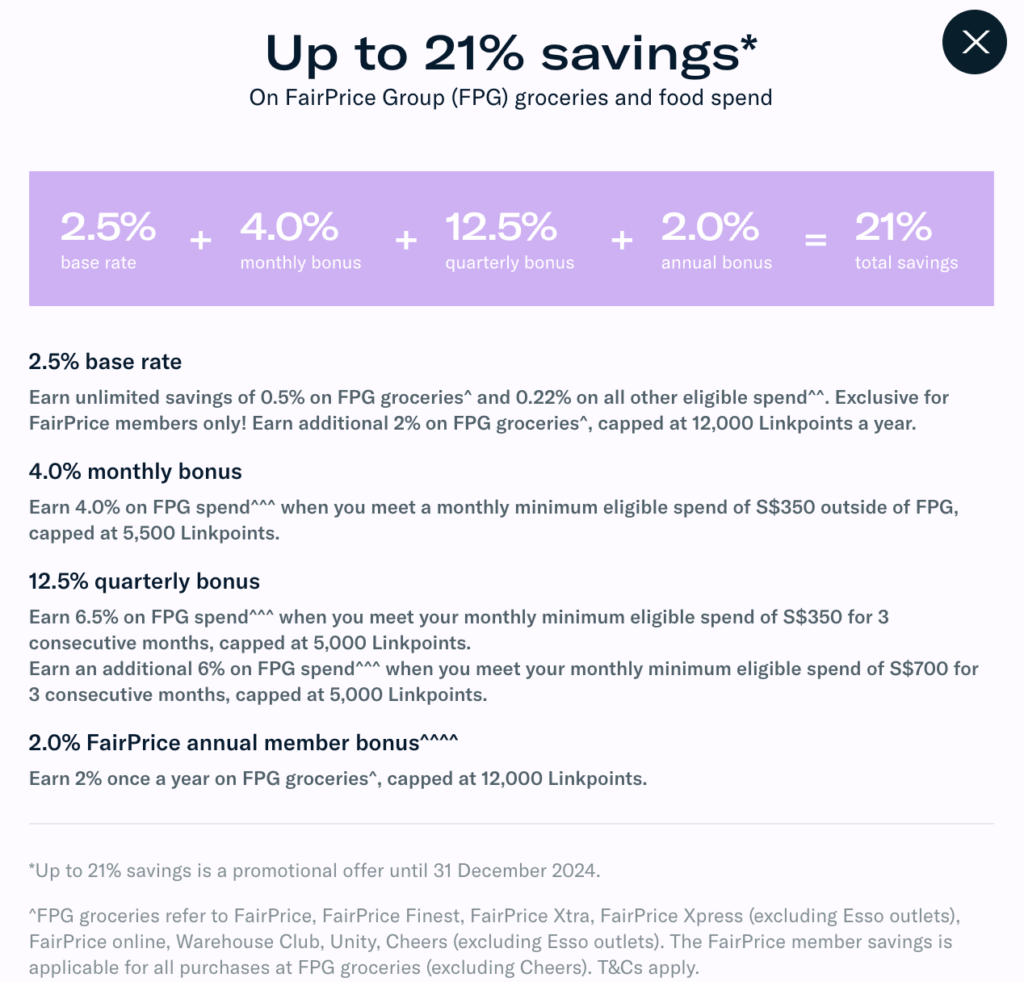

Unlike Grab who nerfed their rewards, Trust has actually increased it (from a previously 15% to up to 21%* savings today on FairPrice Group groceries and food spend). There are also other benefits including preferential loan rates and the option to buy cheap insurance ($0.50 per month) for family accident plans underwritten by NTUC Income.

Read my detailed review of Trust bank and its card here to decide if this is right for you. While the $170 can no longer be earned since they removed the bonus $25 welcome voucher back in 2022, you can still get a $10 welcome Fairprice e-voucher immediately upon signup and other perks.

Don’t forget to use my referral code before you sign up to get $10 FairPrice vouchers! Use 0BWH3B31 (that’s a zero in front).

Hugo Card

If you like the idea of being able to “invest as you spend”, then Hugo might be right up your alley:

- Your Hugo Platinum Visa Debit Card is a numberless debit card, which means that only you can access your card details on the Hugo app. Just like the GrabPay card. In the (rare) event that your card details are compromised, you can immediately disable it on the app and feel safe that the maximum the scammers can siphon off is limited to the cash you’ve kept in your Hugo debit account.

- It works like any Visa contactless card would, and money in your Hugo account is safeguarded by DBS Bank i.e. even if Hugo were to cease operations one day, your money will still be there in DBS.

- It “rounds up” your savings (anything in cents) and invests that spare change into your Gold vault. I’m in profits now thanks to this because of how much gold prices have risen since I started using Hugo!

- This card can also be ideal for those of you thinking of giving your kids or elderly parents a Hugo Account + card, since you can load their spending allowance each month (without worrying about them busting the budget!) and track where they’re spending at. Avoid a scenario of your kids spending thousands of dollars on online games, merchandise or even mystery boxes!

You can read my detailed review about the Hugo card and its entire app offering here to decide if it’s right for you.

TDLR Conclusion: Goodbye GrabPay card, say hello to Trust or Hugo!

As you can see, there really is no need to mourn the loss of the GrabPay card – I would say instead that the card should have been closed earlier (back in 2022, probably) once it ceased to become useful to most people.

And if you think you’ll miss the numberless card security feature, then take this as your chance to check out Trust card or Hugo card instead. I have both and use them for different reasons (Trust card for my FPG shopping, and Hugo for smaller purchases / invest into gold), but you may prefer to get just 1 instead if you’d rather keep your wallet slim.

In short, here’s a quick summary of how the 3 cards stack up:

| Card | GrabPay | Trust Bank | Hugo |

| Type | Mastercard credit | Visa credit | Visa debit |

| Money kept in | Grab | Trust (a digital bank by NTUC & Standard Chartered) | DBS Bank |

| Rewards | GrabPoints | Linkpoints + 1.5% interest on deposits | Auto-invest in gold and precious metals |

Which will you prefer?

With love,

Budget Babe

Apply for Trust card here and key in 0BWH3B31 to get a S$10 FairPrice e-voucher.

Apply for Hugo card here and start earning up to S$80 Goldback.