How do we determine whether to invest in a stock?

Some investors build their own tools, but if you find that too daunting, you can always start from learning from the experts on the tools they use for their own investment metrics.

|

| Get the investment tools used by The Fifth Person to identify winning stocks here |

And if you’re based in Asia, then The Fifth Person should be a familiar name by now. Known for their investment track record and depth of articles, they’ve been covering stocks for many years and adding huge value to the investment community here.

I was a student of theirs several years ago as well, and benefited greatly from their lessons. What’s more, I’ve had lifelong access to their course materials ever since – which means I get updated each time they add new stuff, such as a recent video on how to chart out historical P/E without having to pay fees to any premium dataset provider.

I don’t advocate spoon-feeding, but if you’re seriously lost and have been looking for a guide that you can simply plug-and-play, then The Investment Quadrant is a good place to start.

The modules are quite comprehensive, covering areas such as:

- Introduction: Investor Psychology

- The Business Quadrant

– asset-light, high recurring revenues, economic moats, business risks, etc - The Management Quadrant

– includes insider trading and related party transactions - The Financial Quadrant

– COGS, SGA, CAPEX, profitability ratios, liquidity ratios, debt and more - The Valuation Quadrant

– P/E, P/CF, P/S, PEG and more - Entry and exit points

- Portfolio Management

and more. These concepts are largely taught through video lessons, which you play at your own speed and rewatch them if you need to.

But the most compelling part of their course materials has to be the investment tools that they offer:

|

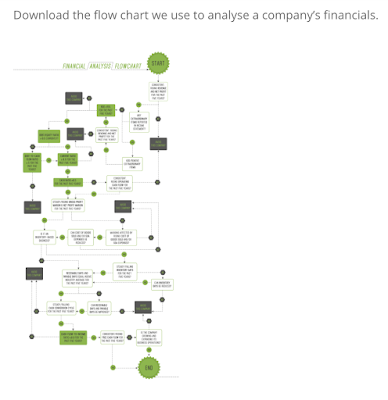

Their Financial Analysis Flowchart is one of the best I’ve seen so far. It outlines specific criteria and tells you what to avoid vs. what to continue with. If you get lost with the financial reports and simply want a flowchart that you can go through to tell you whether to keep or ditch the stock idea, then this would be a great tool to use.

The trainers at The Fifth Person have also built an Excel template for you to plug in the numbers and it’ll calculate the ratios for you. Easy peasy, no math genius required.

—

If you’re a loyal reader, you’ll know by now that Budget Babe doesn’t easily endorse investment courses.

But I’m a huge fan – and advocate – of The Fifth Person’s work. Their investment methodology, as well as the depth and quality of analysis, is admirable and has added a ton of value to the investment community ever since they first broke on the scene in 2014.

You see, that’s because I was a student myself, having attended the Investment Quadrant #paidwithmyownmoney several years ago when they first launched the course. And I easily made back several times the course fees on the first stock I invested using their framework thereafter.

So if you’re still on the fence contemplating on whether to register for the course, but yet you want to know the secret behind how Victor and Rusmin consistently spots winning, profitable stocks…then you’ll need to attend this course to learn from them how they do it.

After all, it isn’t every day that you encounter folks who managed to turn a portfolio of $400,000 in losses to over $2 million in profits within just 2 years.

So if you want a solid strategy and to piggyback on their investment framework, I would highly recommend for you to register for the course here before it closes on 19 July 2020.

And to top it off, because Rusmin and Victor has always been supportive of the work that Budget Babe does here as well – they’ve agreed to give a $100 discount off for SGBB readers.

So that works out to be SGD 497 to get your hands on their secrets.

Apply the strategies and tools that they’ll give you as part of the course in your own investment journey, and it shouldn’t be long before you (not only earn back your course fees) are on your way to becoming a profitable investor.

With love,

Budget Babe

3 comments

is the Investing course covering in us stocks metrics or sg metrics?

coz im based in Canada but im from Singapore so I mostly trade cad/usd stocks.

hello! the concepts and tools can be applied to US markets as well, as The Fifth Person also has a sizeable US investment portfolio 🙂

Comments are closed.