And so, another year has passed.

We're now into a brand new cycle again, but really, what has changed? Or what will we change this year? On this road of self-improvement, are we willing to delay gratification and get challenged for a better us, or are we simply content to stay status quo?

I worked 7 days a week for the most of 2016, and it certainly took a toll on my health. Balancing my day job, my weekend tutoring, and my weekday night dance practices was no mean feat. I got tired easily.

Every year, I try to make it better than the last.

In 2014, after saving $20k on a meagre $2.5k of monthly salary, I wanted to make 2015 the year I cleaned up my insurance policies and contribute more to investing. In 2016, after missing the Black Monday boat due to insufficient cash, I swore to work even harder to beef up my savings before the wedding and house came along.

And I'm glad I did. With the wedding and honeymoon next year, it'll eat into a significant portion of my savings, and then the house will probably come soon after.

So saving money continues to be my top priority, as my 20s are my best time to save before other heavier responsibilities come my way. By then, my savings will probably take a backseat.

Some people don't believe in making new year resolutions, but I do. More importantly, I believe this is the best time to set financial resolutions.

Now that I've reached more than $100,000 in net assets (inclusive of CPF) wayyy before my target of 30, I'm slightly more assured that I'll be well prepared from here. Short term pain, long term gains. I'm hoping that this will bring me closer to achieving financial freedom earlier so I can finally spend more time on chasing my childhood dreams as a published author and a maker of words.

For those of you who emailed me, here's a readers challenge that I sent out last year. It basically details baby steps to get your financial health in order and are extremely achievable.

If you're feeling lost or new to #adulting , feel free to make use of these for your own!

Clearing these milestones by 2016 certainly helped me to get to where I am today.

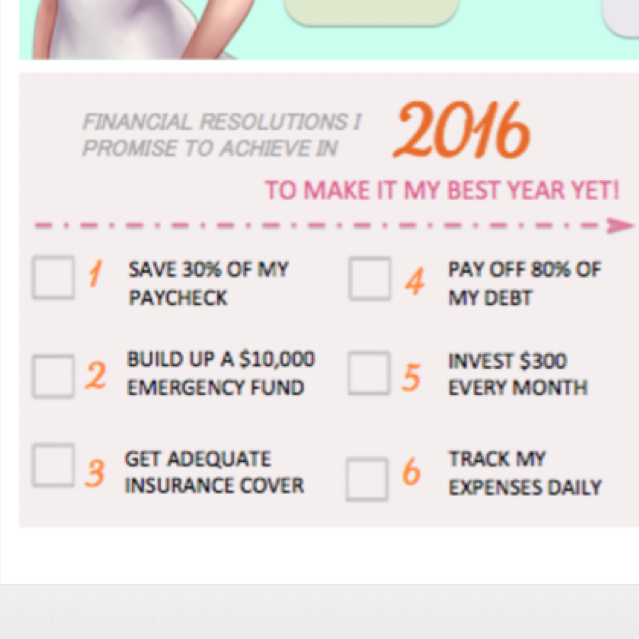

For those of you who already have your #dayrefinance in order, here's a more strategic approach you can consider for the new year.

Those of you who attended my talk last Friday, I'm sure you will find this set of goals meaningful. Also, remember why I advised you to clear off your debt first?😎

What are your financial resolutions for 2017?

Beyond financial goals, I also hope that 2017 will be a year of reconnecting, and future growth in my career.

Now that I'll soon be getting my own assistant, I look forward to mentoring someone and achieving even more growth together for our office.

The older I get, the more I realised how it isn't about the number of friends that you have, but rather, it is the quality that matters. Have already arranged some meetups for 2017 with friends whom I cherish and hold dear.

The best takeaway from 2016 has probably been all the encouraging reader emails who shared with me their own stories of how they were able to save $10,000 to $20,000 after adopting the tips that I shared on my blog.

It gives my life meaning, and there's no greater fulfilment to a writer than hearing that your words have changed or transformed someone's life for the better.

May 2017 also give me more chances to influence people to take charge of their finances and make smarter decisions.

I also hope that 2017 will open the doors to a new world of like-minded female investors, especially here on Dayre. Yes, I know #dayrebeauty #dayrefatties and #dayremakeup are far more exciting, but wouldn't #dayreinvest have a longer term rewarding impact on your life? Or maybe that's just me geeking out again.

What kind of resolutions are you guys setting for the new year?

Or what kind of topics / articles can I write on, to help you achieve your goals?

Please let me know! I'm learning alongside you guys too 😊

———–EP?!?———-

Woke up to my Dayre notifications and I was confused for a second – usually it says a new follower every few hours but this time it was coming in seconds?!? Wow thanks for all the follows guys! I'll keep writing stuff that you'll find useful hopefully 😊

Anyway just to clear things up – I'm not a repeat EP! Saw a bit of confusion (my friends get confused too) but I've been writing under this moniker SG Budget Babe since 2014! I know the names are similar but ✌🏻️different people k! Haha.

I'm heading out to teach tuition now (General Paper) so I'll blog a short intro about myself when I'm back tonight! 😎 or you guys can leave me comments below – I'm reading every single one of them!

Short intro here! Honestly my About Me page is quite extensive so I'm not quite sure what I should be writing. Q&A?

I live multiple lives – my office job, a GP private tutor, a writer and a dancer. I've been writing on www.sgbudgetbabe.com since 2014 – about savings, cutting on expenses, debts, loans, insurance, investments,etc – and I'll really like to connect with like-minded female investors because this circle is almost non-existent!

Let's start 2017 right together! Some of you have written in to suggest topics for this week – I'll definitely get these pieces up! Great suggestions btw.

Let me know what else you'll like to see from me?