When it comes to investing on SGX, I’m not a fan of companies who delist only to re-list again later. Which is why I avoid their IPO, and tell you guys I have “no comment” if you were one of those who asked me about whether the IPO is worth subscribing to.

Let me use the most recent IPO of Econ Healthcare as an example.

The company was privatized in 2012, citing “low trading liquidity” as a reason, but are now back with a brand new IPO attempt again, this time with 50 million offering shares at 28 cents each earlier this month.

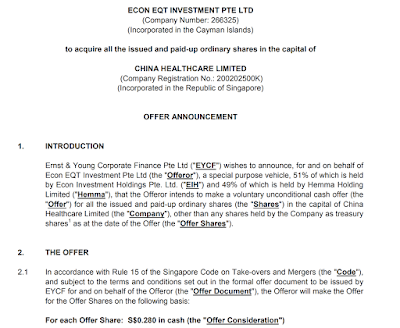

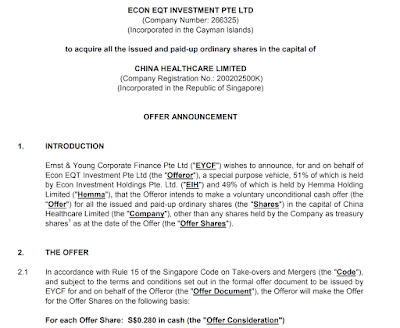

They went through 2 steps to take the company wholly private. The first one was by delisting it on SGX in 2012:

|

| Credits to my friend Wien who helped me dig this up, you can check out his blog here! |

The second one was in 2016, when the remaining 49% stake was bought back by the founder for an undisclosed amount. I wonder how much, and why cannot disclose? Who got the better deal here?

And now they’re back again.

Watch what the media chose to report when it came to the results of their latest IPO:

|

| Source credits: Business Times |

Sounds like an attractive headline?

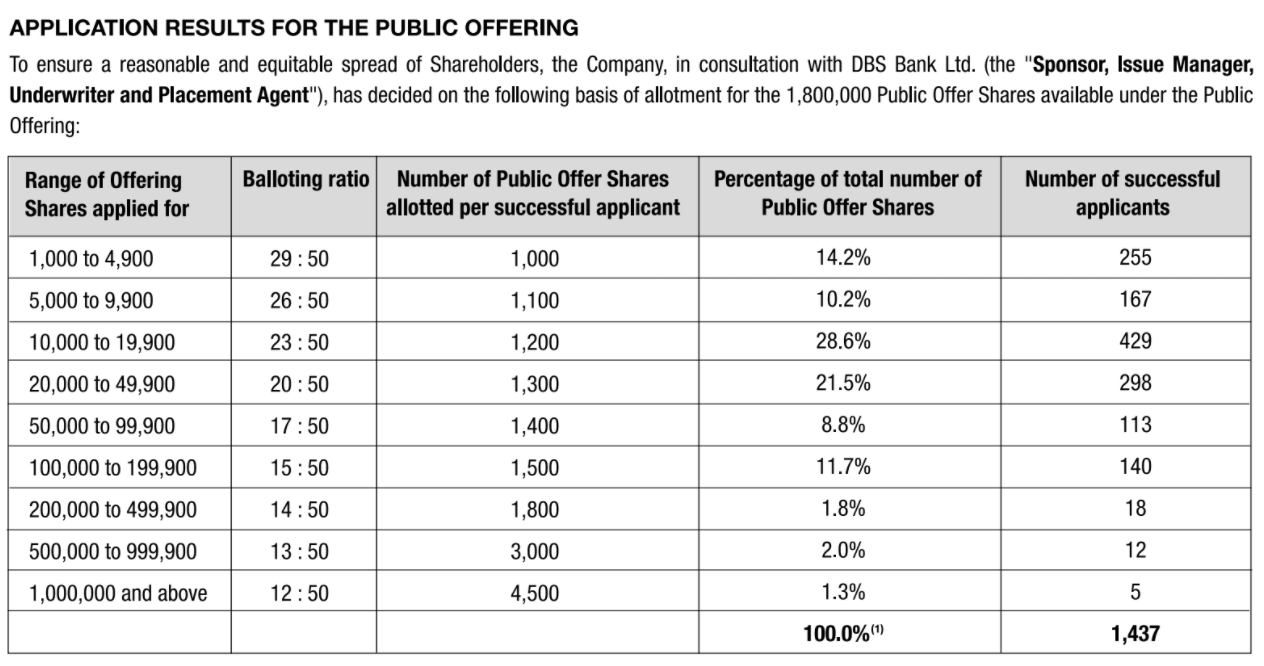

Wait till you see this:

Let’s digest that a little. Each retail investor got allocated $280 – $1,260 worth of shares, depending on how much they applied for.

I get that they’re trying to be “fair”, but if I’m an investor who applied for the IPO and only got so little, it barely does anything in my portfolio. Luckily, there’s always the option to buy back more on the open market if you’re really bullish about the company, and since the current share price isn’t significantly higher than its IPO offering price…there’s still a chance.

After all, it says it is THE largest private nursing home operator + ageing population growth trend. It should do well…right?

So you apply for $14,000 worth (50,000 shares), but end up only getting 1,400 shares i.e. $392.

Even if it rises significantly on the first few days of trading, how much profit can you make when your base is only a few hundred dollars?

I’d feel royally screwed over, if that was me.

Regular readers should know by now that when an IPO interests me enough, I tend to do a deep-dive analysis on this blog and publish it. But you didn’t hear anything from me on this one, did you?

——

Let me just end off with this…

|

| Source Credits: The Straits Times |

Don’t just read the media headlines, guys. You’ll be making snap judgments when you do, and we all know how that usually spans out in investing…

When I initiate a position, it has to also be better than any of my existing portfolio holdings, and Econ Healthcare doesn’t fit my bill. So in the meantime, I won’t be investing.

But I’m definitely watching to see if there will also be “low trading liquidity” this time round, and am curious what the company will do next if so.

If you need some popcorn, you can buy some at your nearest Fairprice and join me.

With love,

Budget Babe

3 comments

Hi Dawn, you mentioned here that Econ Healthcare doesn't fit your bill for investing. Could you share more on why? Given that healthcare is a defensive play, I would think that it would have a place in a well-rounded portfolio. Thanks in advance!

1. Subscribing to it during the IPO placement made little sense, given that the number of shares allocated to the public was so little. It would have only made sense if you could go the private placement route and get your hands on more.

2. Nursing homes have both public and private options. Econ's nursing homes rates aren't exactly cheap, and they aren't operating at full capacity anyway, with occupancy levels being at 88% so there's still empty beds.

3. Their foray into China sounds enticing, but will only have 44 beds. That's hardly a sizeable number.

4. With all that talk about ageing population, demand for nursing home places, etc…I'm surprised that their revenue, operating cashflow and profits have been declining in the past few years. You can go take a look at their financial statements for yourself. EPS has also similarly fallen – this fails one of my basic criteria for good companies. I get that they're investing money into their upcoming nursing homes but still…

5. Revenue and profitability has been on a steady decline since FY2018. I suspect 6M2021 may likely be "artificially boosted" by government grants such as the job support scheme, staff accommodation, and foreign work levy rebates. But don't take my word on this, let's see.

6. The founder holds 80% of shares. I like high insider ownership, but having so much control by just one person is also a red flag for me because whatever he says then goes. This can play out both ways.

At the end of the day, while healthcare is a defensive play, there are so many other ways to get on the trend as well. There's medical diagnostics, therapeutic solutions (e.g. QT Vascular), health screening (e.g. AsiaMedics), hospitals (e.g. Parkway Life REIT), suppliers (e.g. Medtecs, Haw Par)…the list goes on. Given all the various options out there that I can explore, I don't see what makes Econ Healthcare more attractive than the rest.

Disclaimer: none of the above stocks are recommendations. DYODD.

I missed out on reason #7: low liquidity.

The company delisted in the past due to low trading liquidity. Could that happen again now?

I'm not a fan of stocks which are hard to liquidate – accumulating and disposing of them as and when I want/need to will be difficult. Why make my life so difficult when there are other more liquid plays in healthcare?

Comments are closed.