A review of FWD Critical Illness Plus insurance

When I was in my early 20s, I met an insurance agent who told me that critical illness insurance was a good-to-have, rather than a must-have.

“You see ah, if you get cancer, most people need to be hospitalised. Correct? Then in this case, can you claim the bill from your hospitalisation plan? Yes. So, you should be getting the best and highest hospitalisation coverage instead, rather than getting lesser coverage because you need to reserve budget for critical illness insurance as well. Somemore critical illness insurance is so expensive!”

While I’m paraphrasing her words because it has been over a decade since that conversation, her reasoning in fact influenced me for the next few years into thinking that critical illness insurance was unnecessary. So that was exactly what I did – I got the highest coverage for Integrated Shield Plan (IP) and none for critical illness (CI).

It wasn’t until later after a few things happened that I started to change my mind:

- I saw my friends get cancer, and they shared about their experience (including the costs incurred).

- My friend’s 3-year-old daughter got diagnosed with cancer, and I saw how she had difficulties working because she needed to bring her daughter for all the medical treatments on top of caring for her other children and a growing baby in her womb.

- A former dance acquaintance battled multiple critical illnesses in a short span of a few years and eventually succumbed.

These incidents showed me that critical illness insurance is a must-have. Not only for myself, but also my family as well.

And when you’re battling CI, it can be a long-term battle that stops you from working, resulting in a heavy toll on your finances and emotional health. By skipping CI insurance, it means you will need to spend your own savings to pay for medical treatments as well as daily necessities. The situation becomes even more dire if you have dependent(s) to care for, as their expenses will still need to be paid somehow.

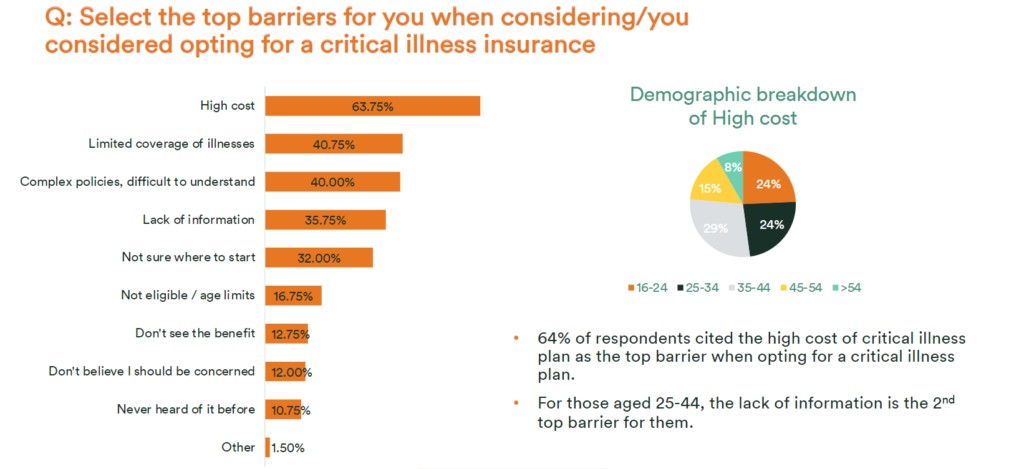

Unfortunately, many in Singapore continue to leave this gap unaddressed. The top reasons include the high cost and limited coverage, which suggests consumers aren’t always getting value for their buck even if they pay for CI protection.

To get covered for all of the 37 critical illnesses outlined in the framework by the Life Insurance Association of Singapore (LIA) often equates to paying a higher and more expensive premium – one that not everyone may have the budget for.

What if I simply want financial protection for the more common critical illnesses in Singapore?

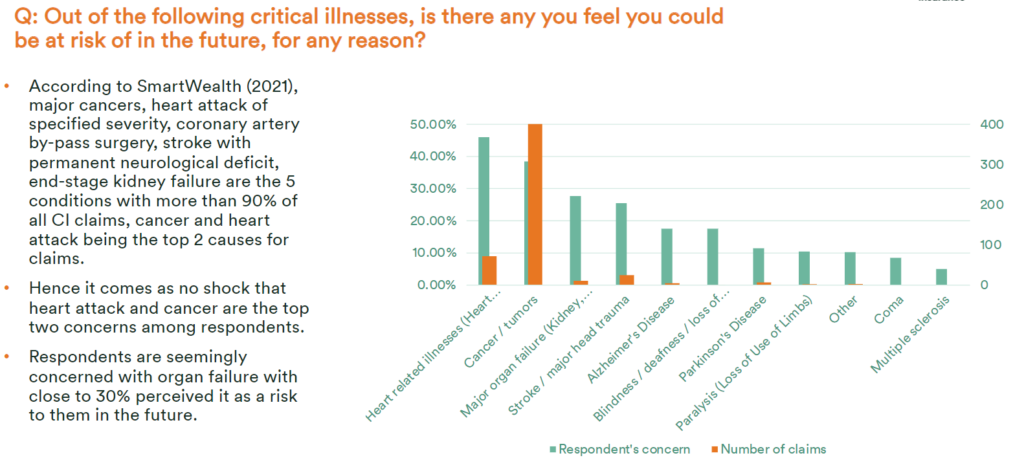

According to Gen Re’s “2012 Dread Disease Survey” published in 2015, 90% of critical illness claims in Singapore are due to cancer, stroke and heart attacks.

In this case, you could opt for a standalone plan like FWD’s Big 3 insurance instead, which gives you financial protection against these 3 most commonly claimed critical illnesses with a much lower price compared to a regular CI plan.

That will allow you to still get covered even if you’re on a leaner budget.

But what if I’ve made a claim and get diagnosed with another CI at a later age?

Unfortunately, the downside of many standalone CI plans in the market is that they only offer a single payout (i.e., once you’ve made a claim on your policy for a CI condition, the policy terminates, and you are no longer protected).

It then becomes extremely difficult (or almost impossible) to purchase another policy that will cover you, should you develop another CI later, years down the road. Almost no insurer will accept your case, and even if any does, you’ll likely be subject to premiums loading and/or several exclusions.

Given our longer life expectancy, more advanced diagnostics (allowing us to identify conditions earlier) and better medical treatment (more people recover rather than pass on from the condition), it is therefore not surprising that many insurers have since launched CI plans with multiple payouts in recent years.

But of course, in exchange for the longer and more comprehensive coverage, these CI plans with multiple payouts may come with a higher premium cost.

How do multi-pay CI plans work?

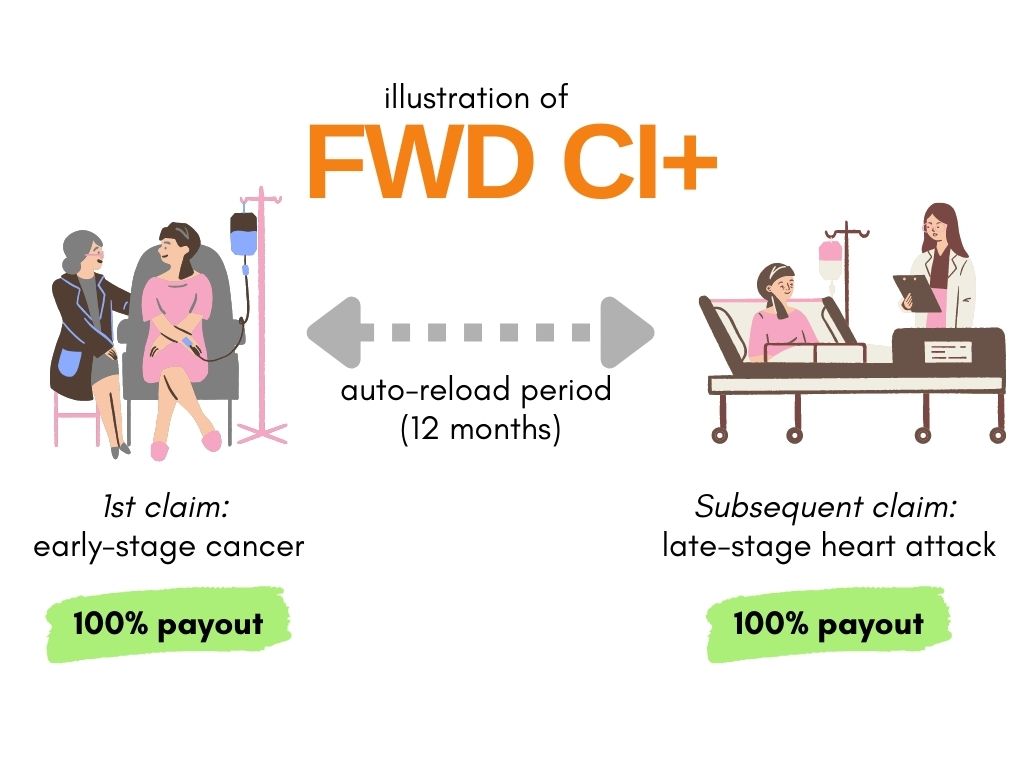

Most CI plans with multiple payouts in Singapore allows you to make multiple claims in the unfortunate event that you get diagnosed with a late-stage critical illness after an early-stage critical illness claim.

Depending on the insurer, these often include a waiting or reset period of anywhere from 12 months to 3 years in between claims.

Cost wise, there is a possibility that you may have to pay at least $1,500* each year, or higher.

*For a 30-year female non-smoker for $100k cover on a local insurer’s multi-pay CI plan.

One potential concern when you are considering a CI plan with multiple payouts could be the higher premium cost as compared to standalone plans. However, there are digital insurers that offer such plans and often priced at more affordable levels.

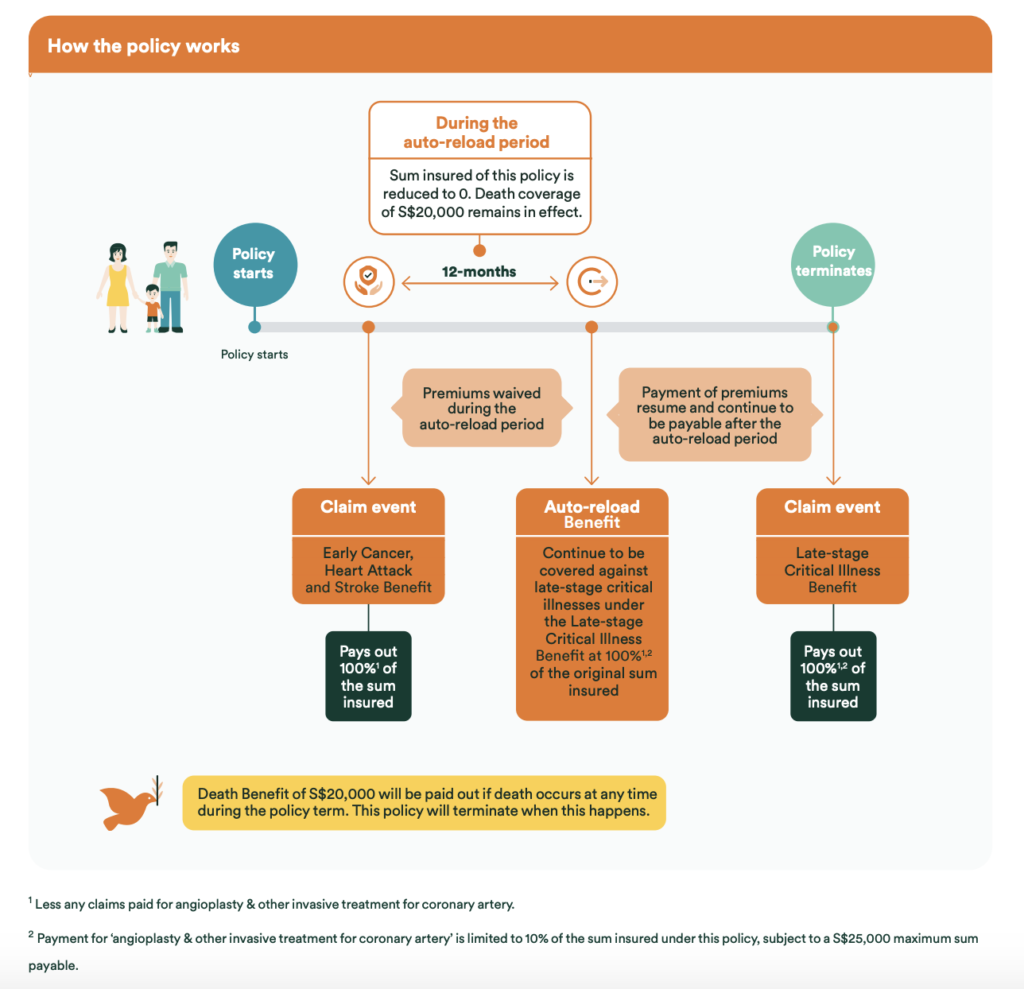

Hence, one solution could be to explore policies by buying insurance directly online, since they are often priced at more affordable levels. For those of you who want a policy that continues to protect you for late-stage critical illnesses even after you’ve claimed for early-stage cancer, heart attack or stroke, you can consider FWD’s latest Critical Illness Plus insurance. It can cover you for late-stage critical illnesses even after an early-stage cancer, heart attack or stroke claim. You have the flexibility to cover yourself up until age 85 and the policy will only terminate after a payout of 100% of the policy’s sum insured for a late-stage CI or when the Death Benefit has been paid.

What can I expect from FWD Critical Illness Plus insurance?

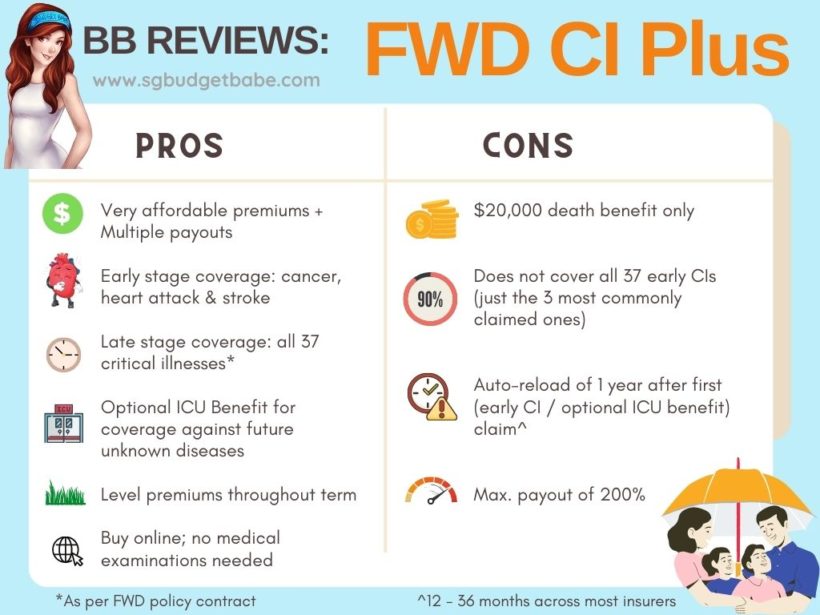

The main coverage that you get from the plan are:

- Early-stage coverage for cancer, heart attack and stroke

- Late-stage coverage for 37 critical conditions including Alzheimer, severe dementia and benign brain tumour

- Death benefit of S$20,000

Depending on your claim situation, you can get multiple payouts, up to 200% of your sum insured.

In terms of costs, they are relatively affordable – a 30-year-old female non-smoker will just have to pay S$69.90 per month to be covered until she’s 65 years old.

| For term cover till the age of 65 | Sum insured | ||

| Customer Profile | S$100k | S$200k | S$300k |

| Female, age 30, non-smoker | S$69.9/month | S$139.79/month | S$209.7/month |

| Male, age 35, non-smoker | S$76.13/month | S$152.25/month | S$228.37/month |

| Female, age 40, non-smoker | S$124.45/month | S$248.89/month | S$373.34/month |

| Male, age 45, non-smoker | S$148.39/month | S$296.78/month | S$445.17/month |

Premiums on FWD Critical Illness Plus insurance are also levelled throughout your policy term, making it easier for you to plan your budget in the coming years. A pro tip is to get your coverage earlier as insurers tend to charge you lower premium when you purchase the plan at a younger age.

There’s also an optional ICU Benefit that provides you with up to another 100% payout in the event that you are hospitalised in an intensive care unit for 5 continuous days on invasive life support, be it for an unforeseen accident or even an unknown disease in the future.

How much coverage do I need to get?

Referencing Seedly’s figures on cancer treatment costs here, the estimates are at S$8,000 to S$17,000 each month for cancer treatment. For late-stage cancer, treatment costs can easily add up to S$100k to $200k each year.

While higher coverage is always better, your decision should ultimately be based on how much you can afford to pay for.

With FWD Critical Illness Plus insurance, you have the flexibility to decrease your coverage for your sum insured at a later stage (e.g. when your children have grown up and are no longer financially dependent on you) in multiples of S$50k. However, do note that you won’t be able to increase your policy coverage after your purchase, so you may want to think about what is the highest vs. the lowest coverage that you need, and then work backwards from there.

TLDR of FWD Critical Illness Plus insurance

If you’ve been thinking of getting a CI plan with multiple payouts but have been putting it off because of the high costs, then you’ll like FWD Critical Illness Plus insurance as a first-of-its-kind protection plan that covers you for early-stage CI claims (cancer, heart attack and stroke) in Singapore and full financial protection for late-stage CIs.

While the early-stage coverage may not be as comprehensive (vs other plans that cover all 37 conditions) at first glance, heart attack, stroke and cancer make up 90% of all critical illness claims, and this plan allows you to strike a good balance between affordability and comprehensive coverage. If that’s what you care most about, then this could be the perfect plan for you.

Sponsored Message When it comes to your health, make sure you have 100% of what you need, when you need it. FWD Critical Illness Plus insurance gives you comprehensive critical illness coverage that you can buy online, with no medical check-up required. Get covered for early-stage cancer, heart attack and stroke while still being covered in the future for any of the 37 late-stage critical illnesses. Best of all, it is 100% lump sum payout, so you can choose to use the money however it best supports you. Terms and conditions apply. From now until 5th August 2022, get 30% off your first-year premium when you use promo code “SGBBCI30”. Get a quote here today.

Disclosure: This post is written in collaboration with FWD. All opinions are that of my own. As my life circumstances differ from yours, you should seek advice from a licensed representative for customised advice on your financial needs. The information including any comparison is meant purely for informational purposes and should not be relied upon as financial advice. This presentation contains only general information and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person. All insurance applications are subject to FWD's underwriting and acceptance. This does not constitute an offer to buy or sell an insurance product or service. Please refer to the exact terms and conditions, specific details and exclusions applicable in the policy documents that can be obtained from our authorised product distributor. You may wish to seek advice from a financial adviser representative for a financial analysis before purchasing a policy suitable to meet your needs. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg). This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 27 July 2022.