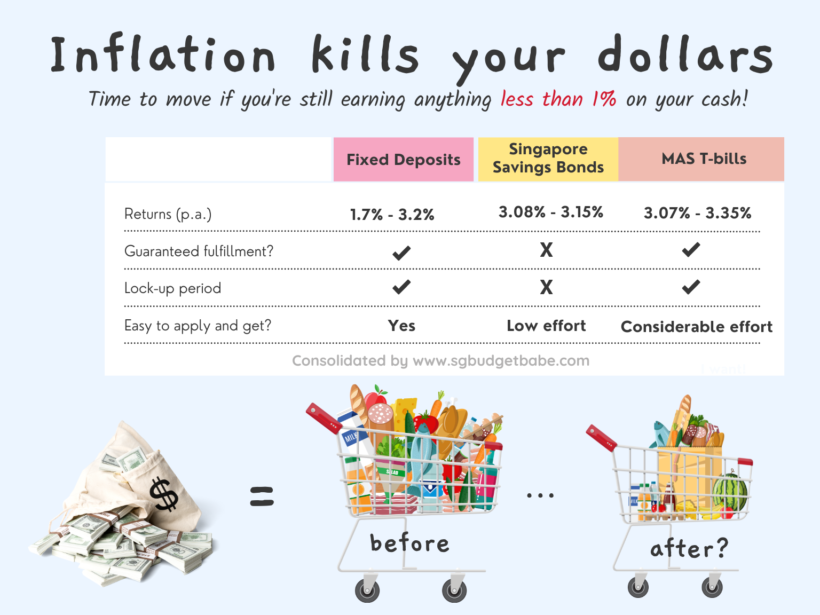

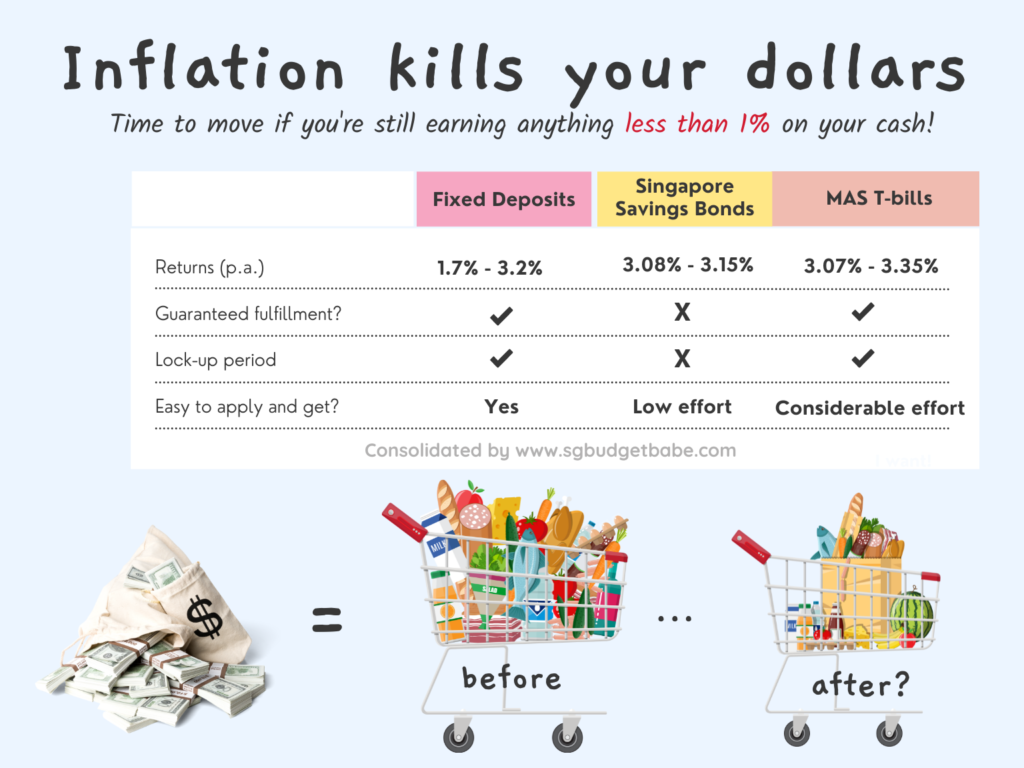

If you’re still earning anything less than 1% on your cash, it is time to wake up and do something…before rising inflation erodes the value of your dollars any further. Here are some tools you can consider using, including low-risk and capital-guaranteed ones.

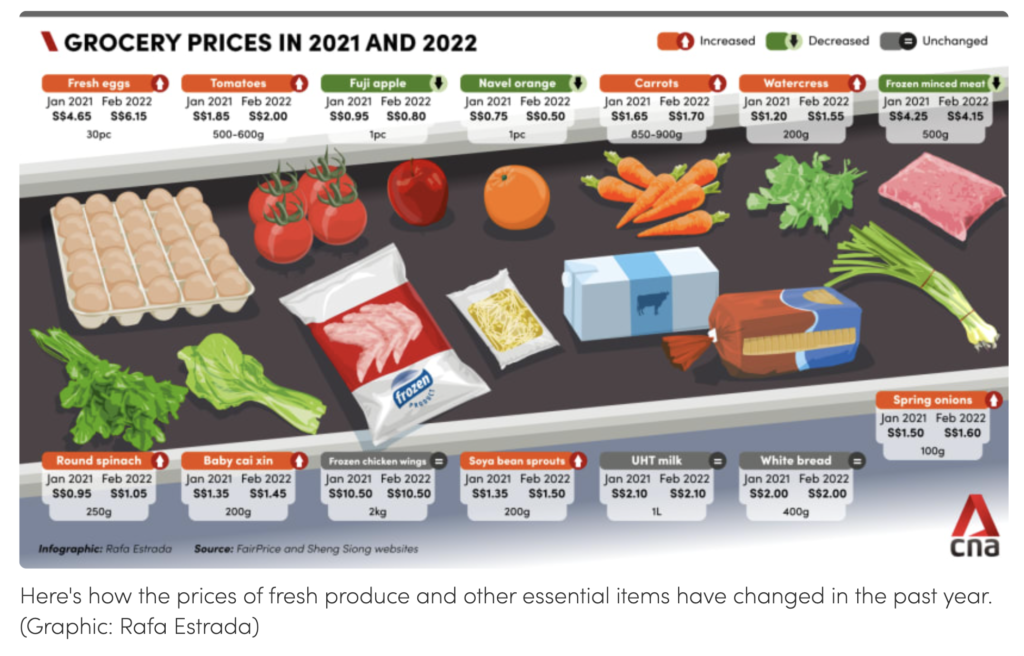

Inflation is scary. At first many people thought it would merely be temporary, given the supply chain constraints brought on by the pandemic and later on, the Ukraine-Russia war. But fast forward to today, and it is clear that inflation isn’t going away anytime soon. The big question now is, what will happen to our cash, and how much of it will be eroded by inflation? How much can we still buy in the future if prices keep soaring?

For most savers, the risk-adverse and the conservative folks, investing the money you have may seem like a tough task. You worry more about losing money, but yet it has gotten to the point where it is no longer enough to stash your savings away either. What’s a saver to do if you don’t want to invest?

It troubles me to hear that there are still plenty of people who have yet to switch to one of the various high-yield savings accounts offered by our local banks, and are still keeping their money in an account that pays only 0.05% p.a. Being lazy is one thing, and while that was acceptable in the last decade, your laziness and reluctance to switch will cost you heavily in the coming years should inflation levels remain elevated.

But I can understand – the effort needed to maintain a high-yield savings account isn’t something that every person will be willing to work for, and for some folks, there are still months where you’re unable to qualify and hit the bonus interest, making it a colossal waste of your efforts.

If you think your time is better spent doing something else than to jump through the hoops imposed by the various banks, then in this case, I beseech you to at least consider short-term saving instruments that will pay you higher than what your default bank account is giving you.

And there are plenty of options, too:

Fixed deposits

If you like the idea of just heading to a bank and signing up for a fixed deposit, then these are the various options you can get right now:

- The shortest lock-in period would be 1 year, yielding 2.85% by Bank of China

- The highest rate would be 3.2% for a lock-up period of 2 years, offered by RHB

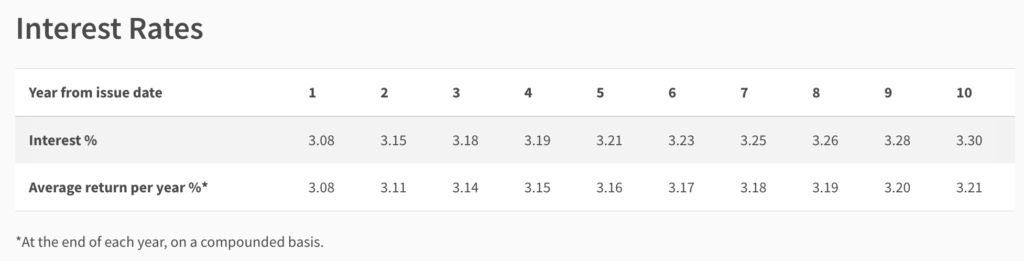

Singapore Savings Bonds

If fixed deposits aren’t your cup of tea, then what about the Singapore Savings Bonds? It’ll take a little more effort to apply for them, but nothing a 10-minute research exercise (here) will fix. Just set your calendar reminders for the next application date, get your cash ready, and apply at the ATM or even through your iBanking login, then hope that you’ll get maximum allocation.

The beauty of the Singapore Savings Bonds is that they provide more liquidity than fixed deposits, as you can stop and withdraw your funds within the following month. If you keep your cash there for the next 2 years, you get an average return of 3.11% p.a. which isn’t too shabby at all.

MAS T-bills

Looking for even higher yields? Well, if you’re willing to put in more effort and hard work, then the MAS T-bills might be right up your alley.

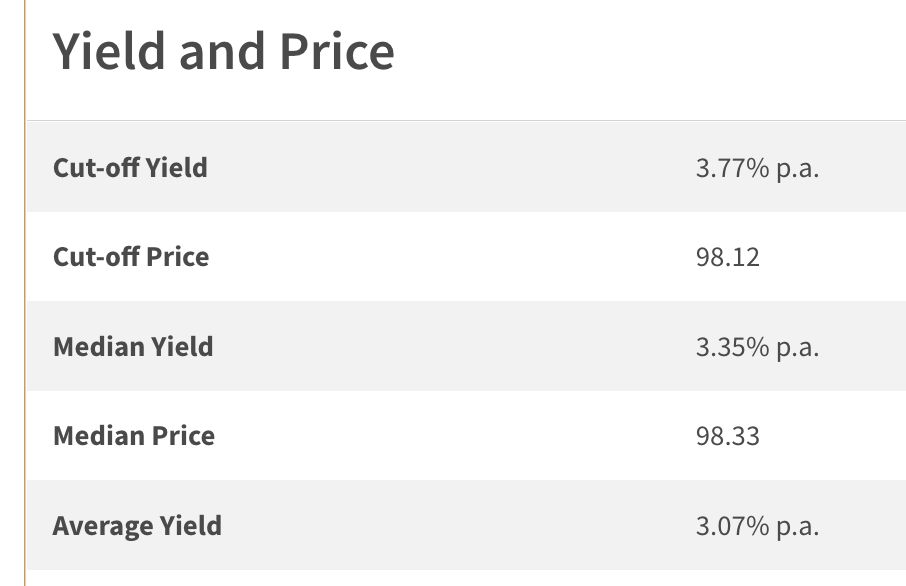

T-bills are slightly more complex to navigate, but if you play your cards right, you can potentially still get the median yield of 3.35% for the next 6 months, or even up to the highest cut-off yield of 3.77% if you’re really lucky.

The downside? Most of the more attractive T-bills are only for 6 months, so you will need to repeat the process at least twice a year, and continuously look out for the application date to make sure you make it in time before it closes. Oh, and if you haven’t heard, the auction process is a little more tricky to navigate, so just be careful while you’re executing your auction bid.

But if the complexity puts you off, there’s one last easy option that I can suggest: short-term fixed endowment plans.

Short-term endowment plans

We’re no stranger to this tool by now, and I’ve reviewed several decent offerings here on this blog as well. And right now, I’ve caught wind of the fact that Great Eastern has just released their latest GREAT SP Series 9.

Disclosure: Great Eastern has kindly invited me to do a review and explanation of their latest offering, and the following section is sponsored by them.

Key Details:

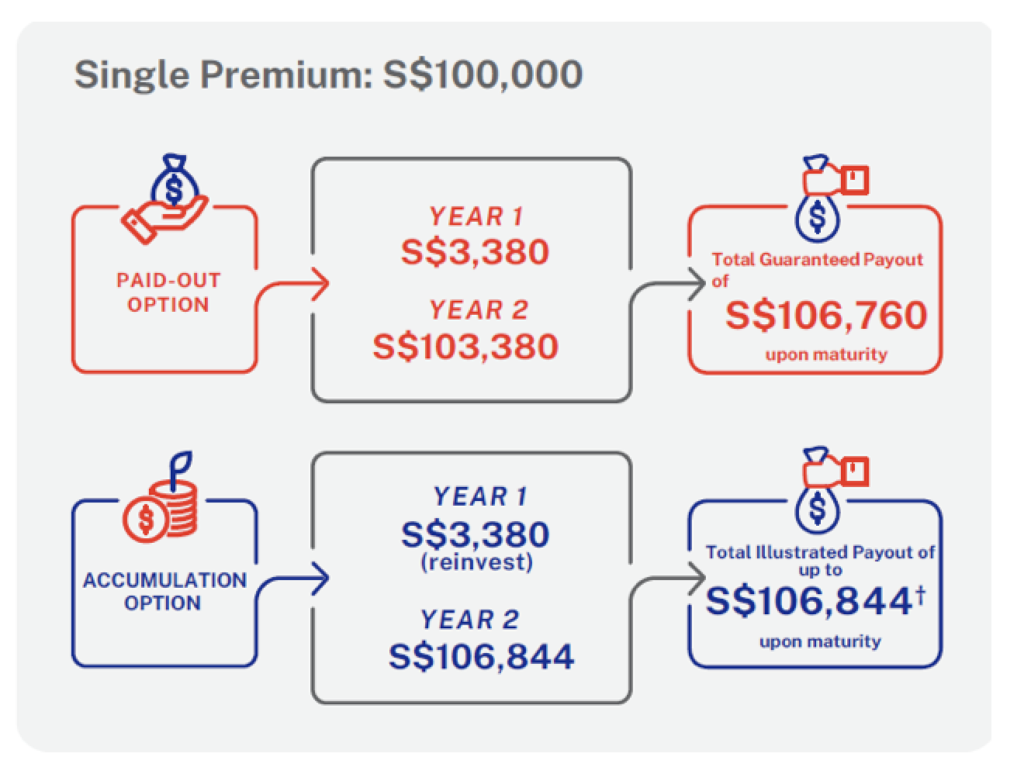

- A 2-year single premium endowment plan, with a minimum of $10,000 to apply

- Guaranteed returns of 3.38% p.a*. upon maturity

- Guaranteed payouts at the end of each of the two policy years

- Capital guaranteed, upon maturity

- Also provides insurance coverage against death and total permanent disability

This could be an attractive option if you don’t mind the 2-year policy term.

If you ask me, one way to manage this would be to put in money you likely won’t need for the next 2 years, and choose the accumulation option (which reinvests your payout) so that you’ll get higher returns at the end of the duration.

*Guaranteed survival benefit equivalent to 3.38% of the single premium will be payable annually on survival of the life assured at the end of each of the two policy years.

† This figure is subject to rounding and is based on the prevailing accumulation interest rate of 2.50% per annum on cash payout. In other words, if you choose the accumulation option, your first year payout will be reinvested at an interest rate of 2.50% per annum (not 3.38%). Based on accumulation interest rate of 1.00% per annum on cash payout, the total illustrated payout at maturity is S$106,793. These rates are not guaranteed and can be changed from time to time.

The amount of effort needed? Minimal.

Application is pretty straightforward and you can do it online within a couple of minutes. There’s also no need to monitor changing auction/issuance dates, track its progress, or worry about having to draw out your money in 6 months – 1 year time and find the next best instrument all over again to rotate it to.

As we’re in a rising interest rates environment, you might be thinking if it is worth getting this…what if interest rates rise further tomorrow?

The thing is, none of us can predict the future, but we can certainly take steps to grow our wealth.

What if interest rates rise further tomorrow?

Well, if you’re of the view that interest rates will be higher from next year onwards, then allocate your money accordingly between the various options I’ve shared so far. You might then want to put more into liquid options like SSBs, and less of your money into instruments like fixed deposits or Great Eastern’s GREAT SP Series 9.

But if you’re of the view that interest rates may not rise significantly higher from here, then what about doing the opposite? i.e. put more into higher yielding options – like Great Eastern’s GREAT SP Series 9 – which can guarantee you a certain level of return, and the rest of your money in more liquid options like SSBs or T-bills so you have easy access to withdraw at anytime.

Conclusion

Too many people are still earning less than 1% (or worse, just 0.05% p.a.) on their money today, which is going to be a big problem soon if they do not wake up and change their financial habits. With the prices of food, electricity, water, mortgage interest rates and other lifestyle essentials rising…can your salary rise fast enough to keep up, and will your savings be able to continue providing you the level of safety that it used to be able to?

At the end of the day, even for savers and the risk-adverse who aren’t keen on investing your money, I wanted to highlight that there are still plenty of options out there to help you deal with inflation and prevent the value of your money from being eroded too much.

It is just a matter of what you prefer. And if you’re not too sure, then I certainly think the latest Great Eastern’s GREAT SP Series 9 is worth considering – especially with guaranteed returns of 3.38% p.a. upon maturity.

And now, the ball is in your court. Go forth and choose the methods that best work for you.

Psst, such tranches are popular and tend to sell out quickly, so please act fast if you’re hoping to secure a portion of this tranche for yourself.

Check out more details on GREAT SP Series 9 here.

Disclosure: This post is brought to you in collaboration with Great Eastern, who fact-checked the provided product information about GREAT SP Series 9. All opinions in this post are mine.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you. Protected up to specified limits by SDIC. Information is correct as 26 October 2022. This advertisement has not been reviewed by the Monetary Authority of Singapore.