If you’ve been investing regularly into the S&P 500 ETF from here in Singapore, there’s a good chance you’ve been doing it all wrong.

You’ve probably heard the usual spiel online: invest a fixed amount in the S&P 500 every month ➡️ dollar-cost average ➡️ compound at 8 – 10% until you becomes a millionaire (or a multi-millionaire).

What is the S&P 500?

The S&P 500 is one of the most popular stock indices in the world, representing the 500 largest publicly traded companies in the United States.

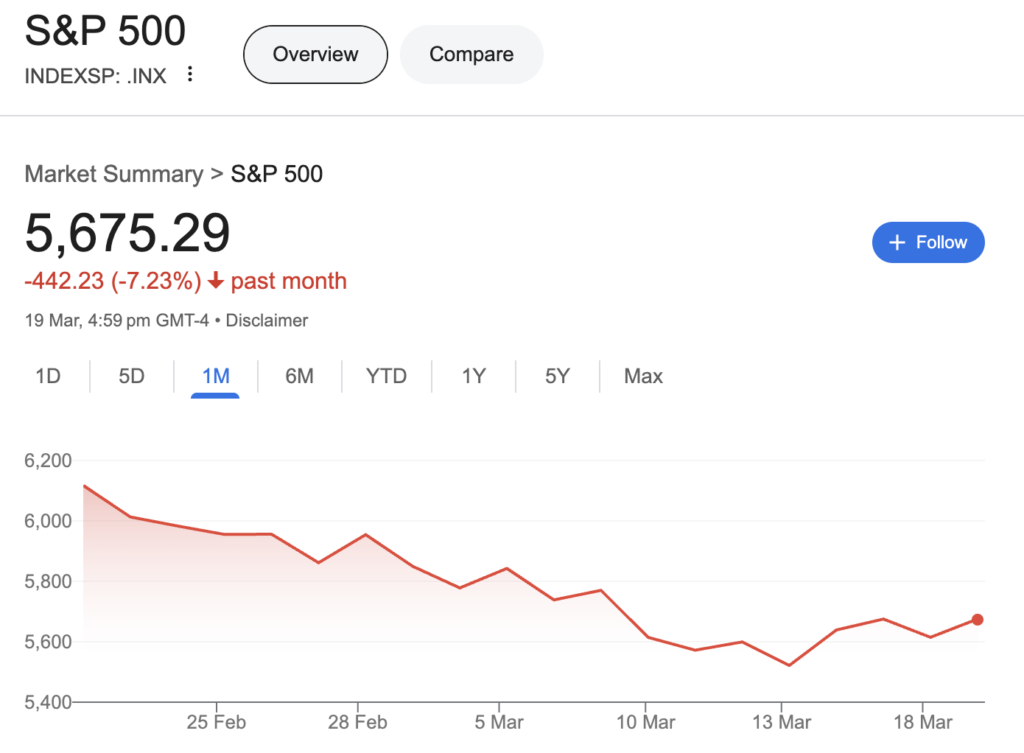

Over Chinese New Year, I heard several mummies talk about this when their peers were asking what to do with their angbao monies. Many of them were echoing this “advice” based on what they had read online, and these same folks are panicking now that the S&P500 is starting to dip.

On the other end, there are the investors who have been buying up the S&P 500 precisely because it is down, or because they automated their investments and continue to stay the course despite the ups and downs.

If you’ve been trying to learn about investing from online finance “gurus” (especially those based overseas), you would likely have bought into either of the following by now:

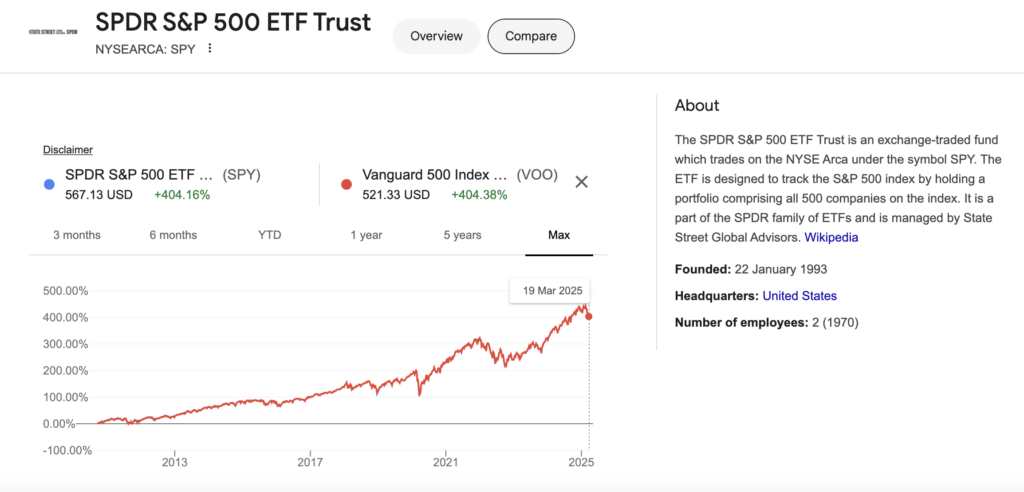

- The SPDR S&P 500 ETF Trust (SPY)

- The Vanguard S&P 500 ETF (VOO)

But if you’re not based in the United States, you really shouldn’t be blindly following such advice. That’s because for Singaporean investors, there’s a much better way.

How can Singapore investors invest in S&P 500?

The most common mistake I see my newbie friends make is that they set up a recurring investment through their robo-advisor, or proceed to DIY invest in the S&P 500 via SPY or VOO.

Buying SPY or VOO from the US stock market

This typically happens if you’re consuming content from US creators or writers, where Vanguard funds are often touted as the best low-cost solution for individual retail investors. Unfortunately, this advice is not tailored to foreign investors outside of the US – including us Singaporeans – because it doesn’t take into the account the many other costs we have to pay in order to access the US markets (which the locals don’t).

The world's most renowned book on the topic of index investing - The Little Book of Common Sense Investing by John C. Bogle - is written by none other than the founder of Vanguard himself.

I've recommended this book since 2017 in my reading list here, and highly recommend reading it if you haven't already done so!

So when I tell my friends about the downsides of investing in these funds as a Singaporean investor, they’re usually taken by surprise:

- You’re paying for custodian fees as a foreign investor.

- You’re subject to dividend withholding taxes (and that’s why you receive less than your friends in the US, even though you’re both investing in the same counter).

- You’re subject to estate taxes – which means the dollars you see in your investment account is not what your loved ones will get if you are no longer around.

If you don’t mind investing by yourself on a brokerage, then a better alternative to SPY or VOO will be the CSPX (iShares Core S&P 500 UCITS ET). Unfortunately, most discount brokerages such as moomoo do not offer access to this since it is listed on the London Stock Exchange, whereas the local ones like DBS Vickers or POEMS charge a recurring custodian fee for it.

Nonetheless, switching away from SPY / VOO to CSPX alone will already help you halve your dividend withholding taxes from 30% to 15% and eliminate estate taxes. You’ll still have to pay for custodian fees though, although there’s another way to skip that (more on it below).

DCA into S&P 500 through a robo-advisor

For those who prefer not to DIY entirely, another commonly used method here in Singapore is by setting up a recurring monthly investment on your preferred robo-advisor.

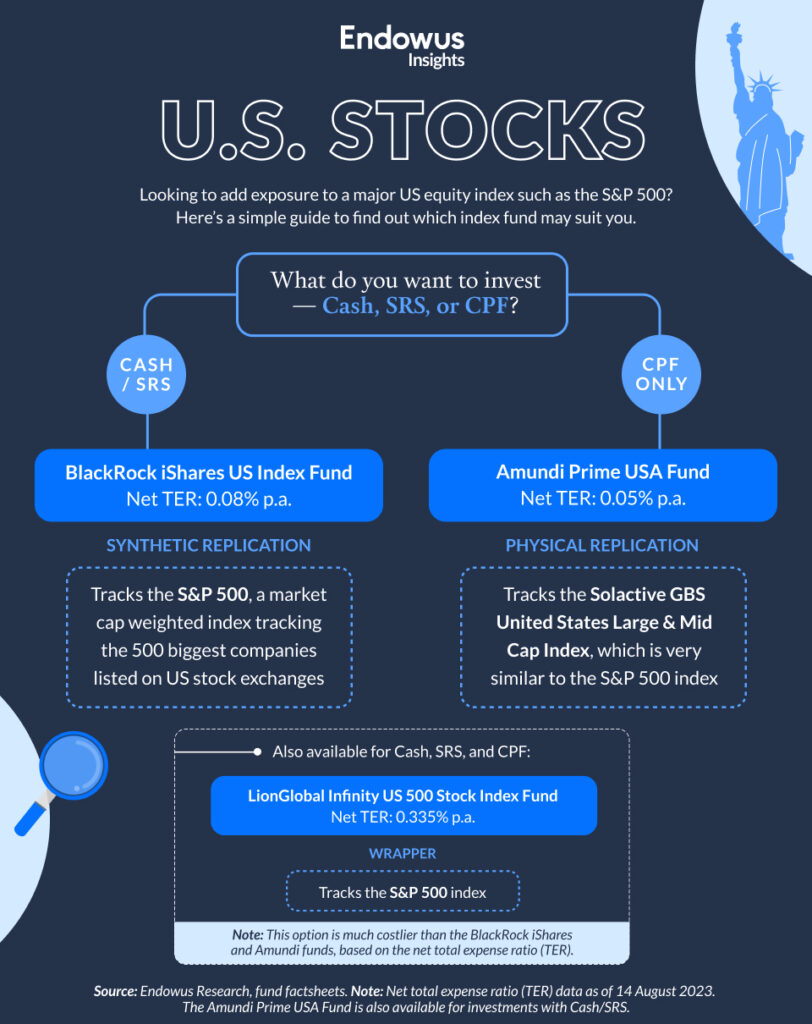

Most people use EndowUs for this purpose, given the firm’s aggressive marketing campaigns across social media and on public transport. What’s more, it is one of the few options available for anyone wanting to use their CPF or SRS funds to invest in the S&P 500 instead of cash.

Of course, there are fees as well. When you invest in any of these single funds, you will pay an all-in fee from (starting from 0.3% per annum) to Endowus, as well as the TER or fund-level fee to the fund manager.

My friends who choose to invest their SRS funds in the S&P 500 through EndowUs have been paying 0.30% p.a. (to EndowUs) + 0.08% p.a. to BlackRock.

That’s a total of 0.38% p.a. in fees.

While paying 0.38% p.a. is a small fee if it at least helps you to stay the course and keep up the discipline of investing regularly, this will add up in the long run as your portfolio grows – especially since you’ll have to pay the 0.30% platform fees to EndowUs every year regardless of whether you buy/sell anything. Are those costs something you want to reduce even more?

Most Singaporean investors don’t know this, but there’s in fact a better way.

What is SGX:S27?

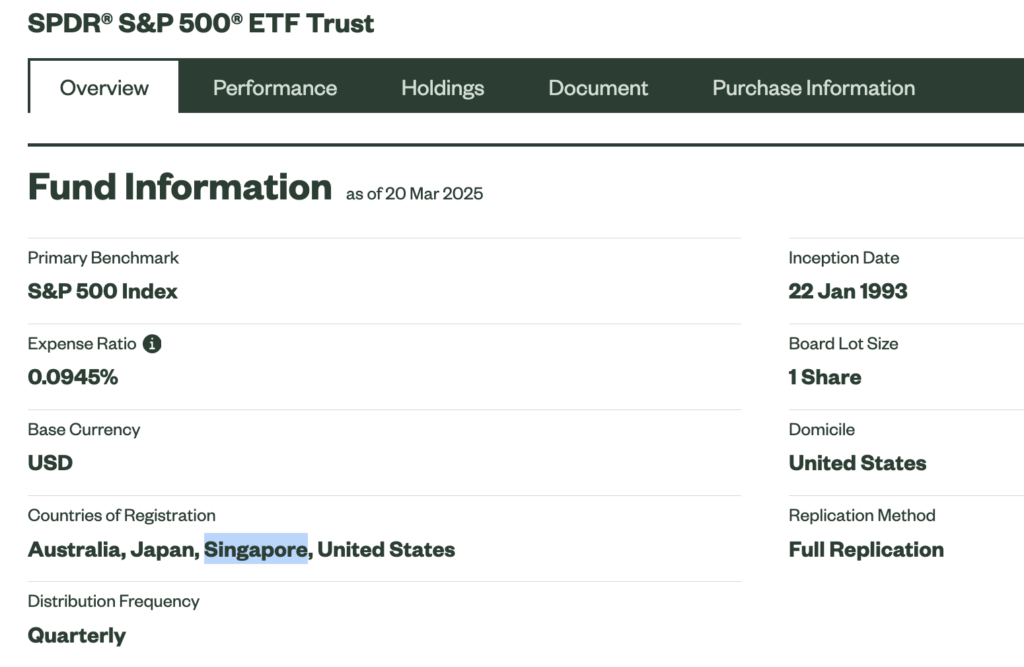

Not everyone realises that SPY is also listed in the Singapore Exchange (SGX), via a secondary listing that occured in 2001. After all, there hasn’t been much marketing or advertising campaigns around this, so imagine my surprise when I learned about this recently over dinner with the SGX folks themselves!

For Singaporean investors, the SPDR S&P 500 ETF (SGX: S27) offers an easier way to gain exposure to the U.S. stock market with the following benefits:

- No need to pay custodian handling fees.

- You get to own it in your own CDP account.

- You can invest using your Supplementary Retirement Scheme (SRS) funds for long-term growth.

Here’s a quick comparison of popular S&P 500 funds among Singapore investors:

| S27 | SPY | VOO | Amundi Prime USA |

|---|

| Exchange | SGX (Singapore) | NYSE (USA) | NYSE (USA) | Euronext (Europe) |

| Index tracked | S&P 500 | S&P 500 | S&P 500 | Solactive GBS United States Large & Mid Cap Index |

| Expense Ratio (p.a.) | 0.09% | 0.09% | 0.03% (cheapest) | 0.05% |

| Incepted in | 2001 | 1993 | 2010 | 2020 |

| Dividend Withholding Tax | No additional tax (already deducted at fund level) | 30% | 30% | 15% (Ireland-domiciled) |

| Dividend Treatment | Distributing | Distributing | Accumulating | Accumulating |

| Trading Hours | SGX market hours (9 AM – 5 PM SGT) | US market hours (9:30 PM – 4 AM SGT) | US market hours (9:30 PM – 4 AM SGT) | Euronext market hours (3 PM – 12 AM SGT) |

| Can use SRS funds to buy? | Yes | No | No | No |

| Can use CPF funds to buy? | No | No | No | No |

But isn’t the 0.09% (p.a.) expense ratio the highest?!

Remember, when you compare your choice of S&P 500 funds, you need to factor in all fees applicable to you instead of looking at just the fund-level fees.

After all, that’s precisely why VOO isn’t the best option for non-US citizens like us. While Vanguard indeed charges the lowest expense ratio at 0.03%, people forget to factor in custodian handling fees, platform fees and more. Buying VOO on DBS Vickers, for instance, this will cost you custodian fees of SGD 2 per quarter, which works out to be $8 per year.

In contrast, investing via SGX:S27 comes with zero platform or custody charges, since local brokerages do not charge custodian charges for SGX-listed securities! Your exact fees payable will depend on your choice of brokerage (e.g. fees are lower on moomoo vs. DBS Vickers), where transaction fees can vary widely. What’s more, there are no annual platform charges to worry about either, as compared to buying the Blackrock or Amundi option on EndowUs.

And if you’re buying through a CDP-linked brokerage like POEMS or DBS Vickers, then you get to own S27 in your own CDP account as well. This is a benefit that you won’t be able to find anywhere else.

SGX:S27 is the only S&P 500 ETF that you can own in your CDP account under your own name. All other S&P 500 funds available to Singapore investors today are held under custody.

Additionally, if you’ve been thinking of investing in the S&P 500 for the long-term using your SRS funds, you typically couldn’t because only SGX-listed ETFs are eligible for SRS investing.

But now, you can.

Today, SGX:S27 is the only S&P 500 ETF available for direct investments using SRS monies.

In case you ever need your money urgently, S27 has a standard T+2 cycle (about 2 business days) for the funds to reach you as soon as you decide to sell, whereas investing in the Amundi Prime USA fund via EndowUs or POEMS will usually take longer to clear at 5-7 business days instead.

Conclusion

The SGX folks told me that S27 has consistently ranked among the most traded ETFs for SRS investors in Singapore, especially given that it is the only option available. Unfortunately, most of the investors who trade S27 are typically the older folks (who are more tuned into SGX offerings) and that there’s a huge gap in awareness about S27 among the younger generation.

When you invest in S27, you’re keeping your money here too instead of having it flow abroad to the US or London markets. If that matters to you, then you may want to relook your choice of investments. Watch the video below to learn about your downsides when you invest in the S&P 500 as a non-US investor:

I like owning counters in my CDP wherever possible, and have spare SRS funds to deploy, so I’ll definitely be putting my own money into SGX:S27 now that I know of its existence.

So if you’ve been buying SPY on the US market or you’ve been investing through your robo-advisory platform, you may want to consider whether switching directly to SGX:S27 makes more sense for you.

With love,

Budget Babe

Disclaimer: This is an educational piece and NOT a buy/sell recommendation. I am not a licensed advisor and will never accept my readers' money to invest for them.

Disclosure: None. This is not a sponsored article, but if you'll like to get in touch about adding in relevant sponsored links on this piece, feel free to reach out to me!

8 comments

how about FX risk? since SP500 is USD

i have been using CPF OA funds to buy Endowus Amundi Prime USA fund. So there should not be a prob.

The country of domicile is important.

S27 is listed on the SGX, but domiciled in the US. Therefore the dividend withholding of 30% and US estate tax of upto 40% beyond a threshold apply to this ETF.

To bypass that, choose an ETF domiciled in Ireland, such as CSPX.

Thanks for this useful comparison of laying down all fees across the different modes!

@MunSeng, thanks for calling that out! You’re right – I made a typo and have corrected the table to reflect that Amundi Prime USA Fund can be bought using CPF monies via EndowUs.

Thank you!

@Arvind, that’s right. If the objective is to get LOWEST fees and taxes, then CSPX remains a better option. I’ve also explained this in the accompanying YouTube video 🙂

If I were buying using cash from my bank, I would definitely go with CSPX.

S27 is for those who want to buy in their SRS or own it in their CDP. I have limited funds in my SRS and don’t want to manage it too much, so this option is attractive to me.

@S27: FX risk applies. Petition SGX to talk to State Street and offer a SGD one? Haha.

@S27: I reckon a SGD version of S27 would be far less intuitive though since S&P 500 is always tracked in USD. Even if there’s a SGD version, personally I’d probably still go for USD.

Comments are closed.