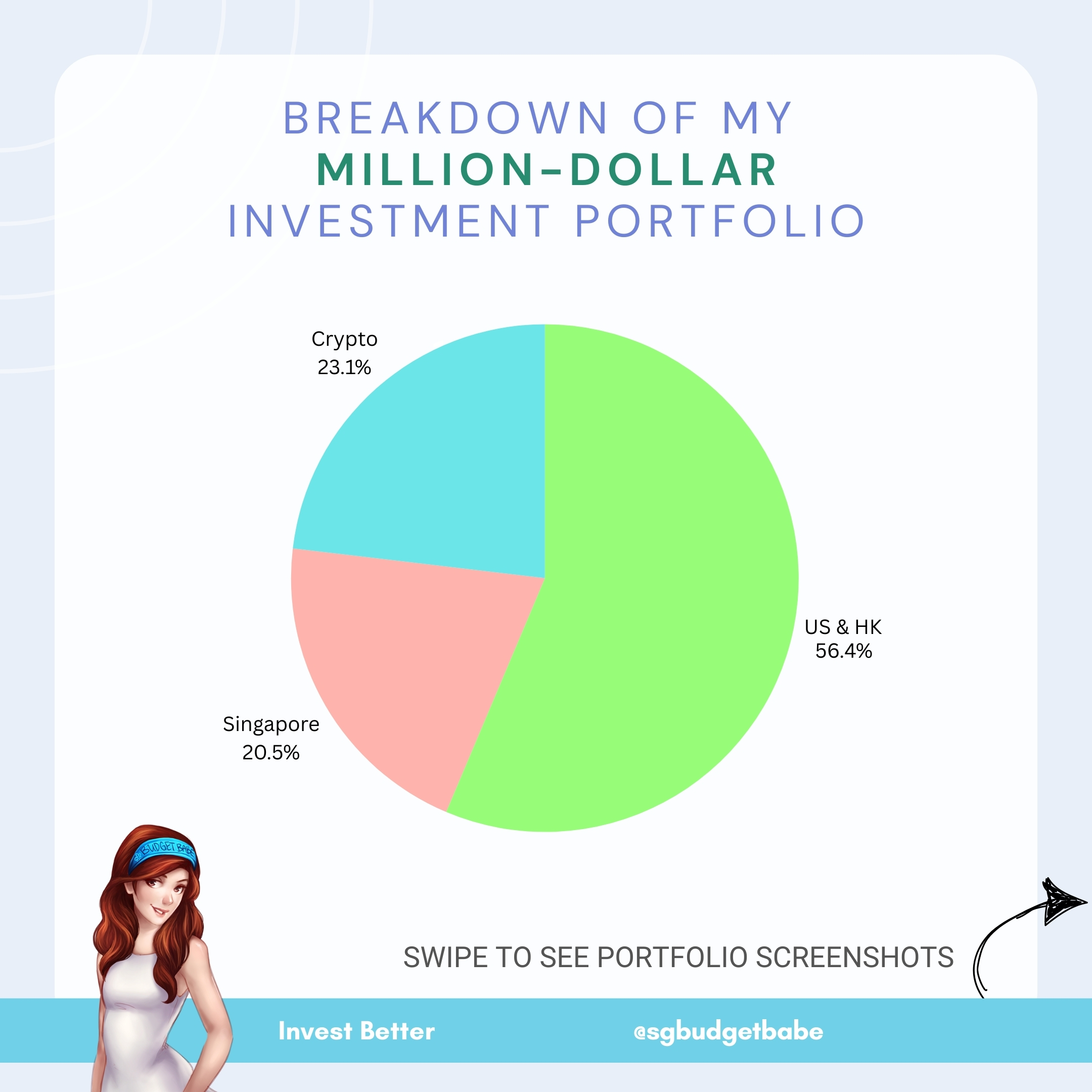

Ever since I revealed publicly about hitting the much-coveted millionaire milestone I had set for myself back in 2014, many of you have reached out to ask about the breakdown of my investment portfolio.

If you’re new to my blog, here’s a quick breakdown of where I started and how I got here.

In 2014, I was still an employee who only knew how to budget and save.

I wrote my first article here to share with my friends about how I managed to save $20,000 as a fresh grad who had started working full-time, which then unexpectedly went viral. That was in an era when most fresh grads were earning $2k – $4k on average, and I was being paid the lower end of $2,500.

Back then, many people left comments on that article, including folks who advised me to start investing now that I had a decent capital to work with. However, I knew nothing about investing then, so I started learning – through a mix of reading books, attending courses…and learning from Mr Market himself.

I will always remember my first stock purchase. It was SingPost, which was heavily shilled to me by my broker back then (whom I’ve since “fired”) as he insisted that he was a “licensed professional” and “knew better” than me. I bought SingPost at about $2 and lost close to 80% of my investment on it. The financial losses I incurred on that “safe, blue-chip” stock taught me a painful lesson: the professionals do NOT necessarily know better than us.

If you're Gen Z, that was in an era before the invention of digital brokerages i.e. each retail investor had a human broker assigned to their account, who earned some fees for each transaction that we made.

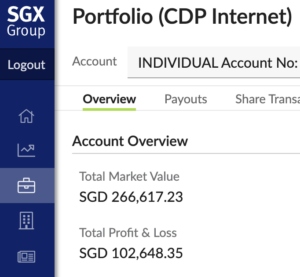

I was determined to learn, and invested mainly in the Singapore stock market during that time as I continued adding periodically at strategic timings over the years e.g. during the 2016 oil crisis, the COVID pandemic crash and the 2021 – 2022 crash. The companies I own have continued to increase their dividends over the years, so I’ve enjoyed both capital gains and a growth in passive income (my dividend income collected each year has crossed 5-digits, which also means my yield-on-cost is now at double-digits). I like to reinvest these dividends for even more growth.

In 2016, I diversified into US and Hong Kong stocks.

As I learned more about investing, I realised that the listed stocks we have here in Singapore are but a drop in the vast ocean. If I wanted international growth and exposure, there were far bigger firms in the US and Hong Kong that were making an impact across global markets.

My venture into the US markets have paid off well. Most of the companies I invested in were scooped up at a significant discount over the years, including Meta, Shopify and Masimo, just to name a few. I will not be sharing the undervalued gems I found this year as that’s a secret reserved only for my closer friends and readers 😛

While the Chinese markets remain down and battered, the US markets have delivered astounding returns over the years and soared to new all-time highs this year.

As a result, my portfolio has benefited from several multi-baggers. All these have propelled my portfolio to new all-time highs as well, as you can see in the chart below.

In 2017, I added crypto into my portfolio.

I remember being excited when I learnt about how crypto and blockchain technology works, and I could see how in the near foreseeable future, it would definitely play a bigger role in our finances. However, investing in crypto during that period where everyone was calling crypto a scam wasn’t easy (and I, too, had to deal with a lot of hate comments and criticisms from skeptics and even several financial bloggers who disagreed with me venturing into crypto assets). Nonetheless, I tuned out the noise and bought the bulk of my cryptocurrencies then because I truly believed in the future of this new asset class.

However, as it was pretty high risk and volatile, I capped my exposure to just 20% of my entire portfolio. I don’t play MEME coins or NFTs, and I don’t trade crypto futures or derivatives either.

Of course, this year turned out to be a watershed year for crypto, with the SEC approving crypto ETFs and governments finally giving Bitcoin their stamp of approval (mostly thanks to Donald Trump). As Bitcoin surged past the $100,000 mark, my portfolio has also gone up. Of course, along the way, I made several losses (anyone remembers USDT?) from crypto projects that unexpectedly failed, but overall, crypto has still given me a 4-5X gain on my capital which is just mind-boggling.

I've a few friends who started out in crypto during the same time as me, but made a bigger move in liquidating all their other assets (equities, bonds) to put it all into crypto. They became multi-millionaires ("whales") much earlier than me - during the last crypto bull cycle in 2020 - and have since cashed out on some of the money to buy property.

Do I regret it? Of course I wonder what my life could have been like if I had taken the risk back then, but I also know that even if given the chance to turn back time (and without hindsight bias), I would have still made the same decision because I had to think about my family and kids. Sometimes, it pays to start investing early when you don't have any commitments to take care of yet.

In 2024, my investment portfolio crossed 1 million dollars.

Last year, thanks to the bullish performance of the stock and crypto markets, as well as the effects of long-term compounded growth, my investment portfolio has surged past the $1 million dollar mark this year.

Honestly, I didn’t see this coming, and this realisation only hit me this month when I was doing my yearly review of my finances to reflect on how (well or badly) I’ve done this year. The goal I had set for myself in my 20s was to hit $1M by the time I turned 45, but back in 2022, this didn’t look possible (my portfolio was down by -35% in that year alone) so I thought I’d have to push the timeline further back. Who would have known that the markets would come roaring back the way it did in these recent 2 years?

Some of the stocks I own? Meta, Shopify, Disney, Tencent, Alibaba (yes I’m in the green for this since I averaged down at a time when most investors were fleeing), Zoom, DBS, Jardine C&C, etc. I hold some ETFs, but they’re a small portion of my portfolio compared to individual stocks. As you can see from my selection, my investment approach has always been to find wonderful companies and buy them when they’re undervalued – this is very much influenced by Charlie Munger and Warren Buffett, whose writings and annual AGM sharings greatly inspired me in my younger years. Even in crypto, I apply the same investing philosophy – although the risks are definitely higher there since more crypto projects fail than companies going bankrupt or delisting.

Personally, I don’t trade, I don’t use margin, and I don’t employ leverage. I’ve taken courses to learn how to do them, but have concluded that such high-risk trades don’t suit me because I simply cannot sleep well at night for as long as the position is open. I’ve also dabbled in options and futures in the past, but have come to realise over the years that these approaches are really ill-suited to me given my personality and schedule. Instead, I very much prefer to study the fundamentals of companies and doing market research vs. looking at charts for patterns, and I avoid stocks like Tesla not because I don’t believe in their future, but because my heart cannot withstand the volatility (aka Elon Musk).

The $1M does not include my 2 properties (1 in Singapore, 1 overseas) or CPF assets as these are less liquid investments.

If you’ve stuck around for the last 10 years and watched my investment growth story happen, I hope this inspires you that it is possible to become a millionaire when you consistently save and invest your way to financial freedom. I also want to thank you for supporting the work that I do on this blog, because while I don’t take up a lot of sponsored gigs unlike other full-time KOLs (to the point where I’m notorious among the agencies for being “picky” and turning down a lot of gigs, including opportunities by XM, etc – well, that’s a label I’m happy to accept), this side hustle called writing (or content creation?) has nonetheless given me a decent income that has helped me to save and invest even more.

I’ve enjoyed writing on this blog for the last 10 years, and I look forward to being able to do it for a good 10, 20, or even 30 more years. Perhaps then it’ll become a retirement travel blog rather than educating people on managing their finances better, haha.

If you’re new here and have no appetite to go through the 700+ articles that I’ve written and charted in the last 10 years here, you will be able to read more about my story and approach next year when my book is out in bookstores later this year. Please do support that; I’m excited to finally realise my childhood dream of becoming a published author 🙂

2024, you’ve been absolutely amazing – here’s to greater things to come in 2025.

With love,

Budget Babe