With all the uncertainty in the markets over COVID-19, there are fears that we may start sinking into an economic recession. When this happens, there will always be people who are inevitably worried and wish to minimize their risks. But if the rates offered by fixed deposits aren’t your cup of tea, and you’re not keen to increase your equity exposure at this point, then perhaps short-term endowment plans might be an option.

In the current environment of extremely low interest rates, short-term endowment plans have been making a comeback, especially for those who are unwilling to take any risks in the equity markets right now. If that sounds like you, then you might want to know that one of the latest products in the market to take note of would be Capital Plus by NTUC Income. Read on to find out!

Details that you need to know before deciding whether this product would be right for you:

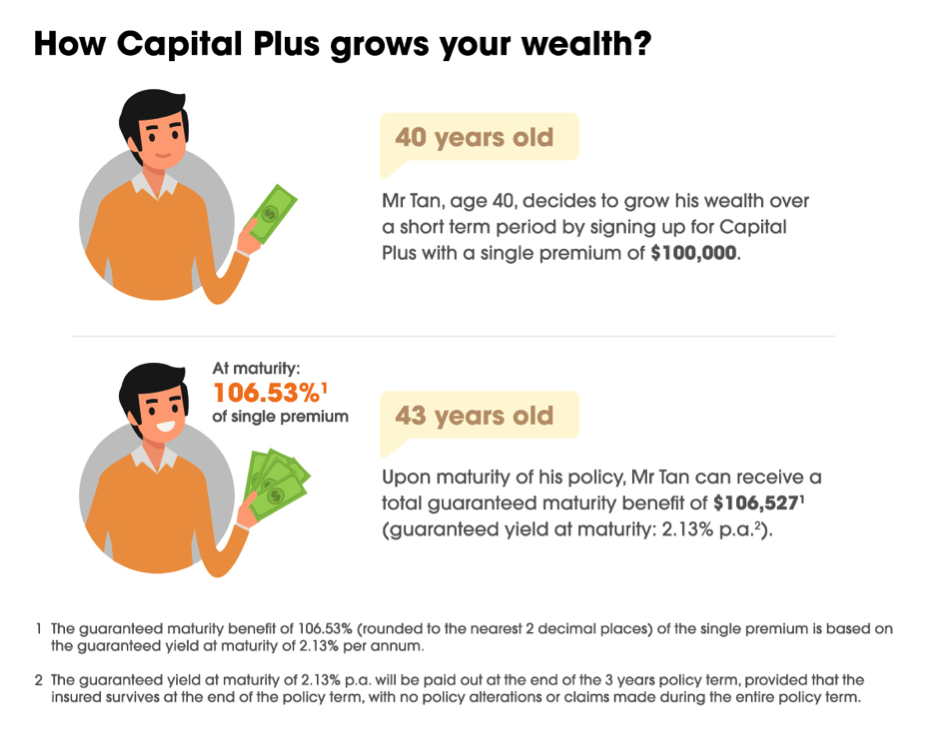

- a 3-year single premium endowment plan

- provides a guaranteed yield at maturity of 2.13%^ p.a.

- insurance coverage for death & total and permanent disability (TPD before age 70), during the policy term

If you have a lump sum of cash on hand and no idea where to put it, this could be a good option for the short term. Do note that as with all endowment plans, you should only put in funds that you do not need in the near term to avoid early termination penalties.

Aside from having capital guaranteed at the end of the policy term, you are also entitled to the compounded interest at a rate of 2.13^% p.a., while enjoying insurance protection throughout the duration of your policy at the same time for an extra peace of mind.

Of course, do make sure that you’ve already maximised your bank savings account limits first to claim your bonus interest with no lock-up and liquid flexibility. For anything more which you do not need in the short term (and yet you do not wish for this sum to lose out to inflation), then NTUC Income’s Capital Plus might just be your best bet right now.

With its short maturity period of 3 years, this should appeal to those who are saving up for the down-payment of your upcoming BTO, wedding or even your child’s preschool fees, especially if you’re not able to stomach the volatility in the stock market right now.

The PROS of Capital Plus

The most important point is that your capital is guaranteed, as long as you hold onto the plan for the next 3 years with no policy alterations or claims made.

No medical underwriting is required, and you can get started from as little as $5,000 for online applications.

The downside? As with every endowment policy, if you were to terminate the policy before your 3 years is up, you may receive lesser than the premium you’ve paid.

Where can I get it?

The good news is that you can now purchase it online via their Online Life insurance platform. Capital Plus is only available for a limited period based on a first-come-first-served basis, so do act fast if you want to get your hands on this, especially with the minimum premium starting from as low as just S$5,000 for online applications.

You can click here to find out more about Capital Plus now.

^ The guaranteed yield at maturity of 2.13% p.a. will be paid out at the end of the 3 years policy term, provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

Disclosure: This post is in collaboration with NTUC Income. All opinions are that of my own. The information is meant purely for informational purposes and should not be relied upon as financial advice. As my life circumstances differ from yours, you should seek advice from a licensed representative for customized advice on your financial needs.

Protected up to specified limits by SDIC.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 27 March 2020.

1 comment

This comment has been removed by a blog administrator.

Comments are closed.