Here’s my secret sauce to being a savvy consumer even in an era of inflation and rising cost of living.

If you feel it has gotten harder to stay within your budget due to inflation and rising prices, you’re not the only one. And with GST heading to 9% in a few months from now, what can a Singaporean consumer who’s trying to save money do to cope?

Here’s the reality – while we consumers have no control over costs or how prices are set, we do have control over what we can do to rein in our expenses instead.

And the good news is, you can still stretch your dollars when you learn how to be a savvy shopper and inculcate smarter shopping habits on a daily basis.

Here’s my secret:

Budget Babe’s approach

As a budget babe, I generally use a 4-pronged mental framework before making any purchases:

Check –> Calculate Utility –> Compare –> Buy

You see, I’ve learnt over time that being a savvy shopper isn’t just about buying the cheapest item. Cheap isn’t always best, especially if the quality is bad, since I end up spending even more money later on to replace it over and over again.

Stop wasting money on flimsy $5 plastic organisational dish racks that keeps breaking because it cannot hold the weight of your plates, and buy a better quality rack instead even if it costs you slightly more.

Instead, let’s be a savvy shopper who knows to buy only what we need, while getting it at lower prices whenever possible.

This can mean making use of time-limited discounts, credit card promotions or even bundled offers, so that we pay less for the same item than what it would have cost us on other occasions. I personally like to buy during a brand’s birthday sale, as that’s often when they run the biggest discounts.

Let me walk you through how I use these 4 steps and show you how powerful they can be in helping you stretch your dollars further.

Step 1: Check

Too many people make the mistake of buying something that they already have. That’s why, before I buy anything, I always do a check first just to make sure that I don’t already have the item lying around at home.

Tempted by a sale for your favourite instant coffee? Check first to make sure you don’t already have extra packets at home, otherwise, you might very well end up in a situation where you can’t finish all the coffee before its expiry date.

It might also be worth doing an annual spring-cleaning of your storeroom, just to make sure you know what’s inside…especially those hidden right at the back of your shelves. I’ve found expired drinks and canned foods that we’ve forgotten about, and not only does that hurt my wallet, it doesn’t make me feel great either about wasting food.

Step 2: Calculate Utility

Let’s be honest, in today’s modern society and world of online shopping, it can be tough to stay sane and disciplined with our spending in the face of temptations and sale, sale, FINAL SALE!

We are already being bombarded by ads everywhere and anywhere. But savvy consumers know better than to give in to temptation (although we may still have our moments of weakness) and be smarter than to keep falling for marketing gimmicks and traps.

One great hack to use is to think in terms of utility cost rather than looking at the price tag alone. I have previously written about the concept of utility cost here, but in summary, how this works is that you simply calculate by dividing the price of an item against the number of times you’d use it.

For example, a $70 top that is worn every 2 weeks is a much better purchase than a $30 dress that sits in my wardrobe collecting dust, simply because I can’t find the right occasion to wear it out often enough. I’ve been guilty of such white-elephant purchases on several occasions!

Go for stuff that gives you more mileage on your dollar, as these are high in utility and practicality. The price tag alone tells you nothing about what the item is really worth in your life.

Step 3: Compare, compare, compare

Savvy shoppers never pay more when we can easily get the same item for less. The same canned drink, for instance, can cost over twice as much when I buy from a convenience store vs. a supermarket. To stretch your dollar further and make sure that you’re getting the most bang for your buck, cultivate a habit of comparing before you buy. You might just find the same thing for less elsewhere!

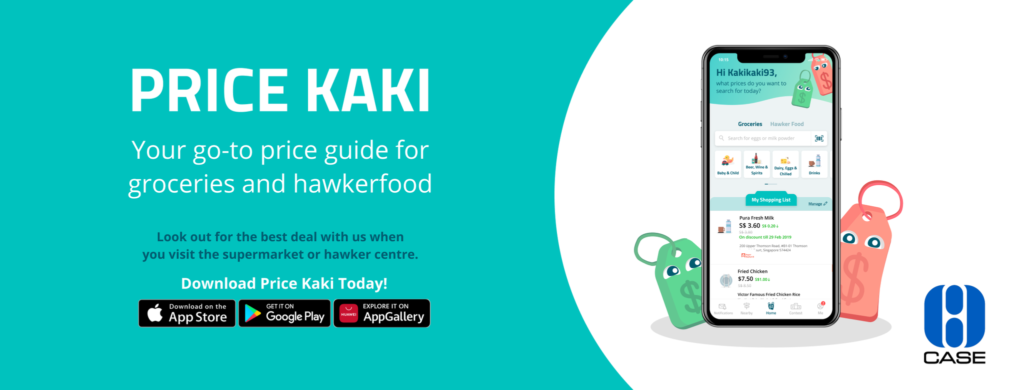

So take your time to compare prices across different shops or even different platforms. You don’t always have to compare manually by yourself either, as one easy way is to download and use Price Kaki – a mobile app launched by CASE in 2019 – where you can compare prices of supermarket items and hawker foods, including time-sensitive promotions flagged out by fellow app users.

Add the things you regularly buy to your “shopping list” on the app and turn on notifications so you can even receive alerts about price fluctuations, so you won’t miss out when the items on your list become cheaper.

Don’t scoff at saving 20 to 50 cents on a product, because when you buy a whole basket of groceries, the savings can really add up.

Compare between house brands and branded items as well. In recent years, house brands have increased their range and quality of products. Check out my experiment here where I shaved 30% off my grocery bill by replacing my cart with house brands instead!

During the pandemic when rice prices were soaring, I compared and found a local supermarket house brand version of my favourite Thai rice to be much cheaper. After buying once to try, I’ve been hooked on the taste and texture ever since and we’ve not gone back to the previous brands anymore.

On another instance, I compared and found the Paw Patrol toy set my son wanted was being sold at 3 different retail prices, at the event pop-up stall vs. the departmental store vs. a toy shop in a heartland shopping mall. Then, when I searched online, I even found the same playset being sold for a fraction of its retail prices – some new, some preloved. In the end, I bought a preloved set on Carousell from a father whose son had outgrown the series, and spent only 30% of what a brand new set would have otherwise cost me!

Tip: Once you’ve confirmed (in step 2) that the item is something you do need and will put to good use, shop around for discounts and compare prices before you decide on which shop (or platform) you’ll be buying it from. If you’re open to second-hand items as well, many people are happy to sell it off for reduced prices online, or even give it away free on apps like Olio.

Over the year, I’ve also cut back on convenience costs whenever I can. Some of these include:

- Making my own coffee every morning, for instance, saves me the $7 that I used to spend on take-out coffee to fuel my work day

I keep a foldable eco-bag in my handbag so that I don’t have to pay an extra $0.10 for plastic bags

I try to take the public transport whenever possible, rather than paying for taxi rides every time

Sometimes, you might find in the midst of your comparisons that the better deal lies in a prepaid package or bundle, such as for a gym membership or a manicure package. However, you should be wary of large prepayments, and think twice because there is the very real chance that the merchant may not be able to service you until the end of your package.

In the first half of 2023 alone, consumers reportedly lost $302,205 in prepayments…many of which were attributed to businesses who wound up or disappeared halfway!

Psst, did you know? In Singapore, we are protected for your prepayments made to accredited renovation, spas and wellness businesses under CaseTrust Schemes. Upon making prepayment to such CaseTrust accredited businesses, you will be given a proof of protection containing your personal details and the protected sum. In the event of business closure, you can then claim back the unused portion of the prepayment made. Find out more about the prepayment protection schemes here, and see the list of CaseTrust accredited businesses here.

Step 4: Buy

Finally, after you’ve (i) checked to make sure you don’t already have the same item at home, (ii) confirmed its utility value and (iii) compared for the best price, you can now cart out and pay.

But before you pay, don’t forget to make use of vouchers, discount codes, affiliate codes, or even credit card discounts that can help you shave more dollars off your purchase!

Conclusion: Inflation is real, but we’re not helpless.

Inflation may have led to rising costs of living, but that doesn’t mean that we cannot adapt and become smarter at how we spend our money. More importantly, we can become savvy consumers and learn how to stretch our dollars in such inflationary times.

What’s more, over time, our wages will catch up to inflation, especially if we continue to invest in ourselves and our career to boost our earning power.

By being smart about how to stretch your dollars, you too, can be a savvy shopper and beat inflation.

Disclosure: This article is brought to you in collaboration with the Consumers Association of Singapore (CASE) to help Singaporeans stretch their dollars and overcome inflation.

Liked the cost-saving tips here? Check out CASE’s Facebook for more!