The Singapore REITs market has generally been profitable for its investors, but with the new measures amid this economic crisis, are they still safe to invest in?

In Singapore, real estate investment trusts (REITs) are leveraged property instruments which are mandated to distribute 90% of their income back to investors in the form of dividends. Because of this, they are generally viewed as attractive and stable income instruments, appealing very much so to the income investor who relies on these dividends as a form of passive income. And for the savvy investor who is able to pick the best of REITs, they stand to be rewarded in the form of both capital gains (in share price) and dividends.

However, in April 2020, the regulations governing REITs have been amended to help support them through the challenging business environment in the near term. These changes include:

- Gearing limit has been raised to 50%

- Enhanced Share Issue Limit: REITs can now issue pro-rata shares and convertible securities of up to 100% of its share capital (previously 50%)

- Distribution timeline has been extended (to qualify for tax transparency)

- Implementation of requirements for a new minimum interest coverage ratio has been pushed back to 2022

So are S-REITS still safe to invest in?

They’re no longer as safe as before, but real estate in Singapore should generally hold up well even during and after this crisis. And as share prices come down, this might present good opportunities to add REIT stocks for cheap.

Tenancy rates and potential of defaults is definitely an area to watch, and so REITs that derive the majority of their income from the hospitality and retail industry will be the worst hit. Office REITs may also be affected if the work-from-home arrangements continue.

The more resilient REITs during this period will likely be the industrial REITs and healthcare REITs. (However, First REIT has its own troubles which I’d rather stay away from.)

What should S-REITs investors expect from here?

Investors should expect a higher probability of new rights issued, and keep aside cash to subscribe for those rights or risk having their shares diluted.

Dividends are also expected to be cut further, so anyone relying on these dividends to fund your monthly expenses should start thinking of diversifying into another income source now.

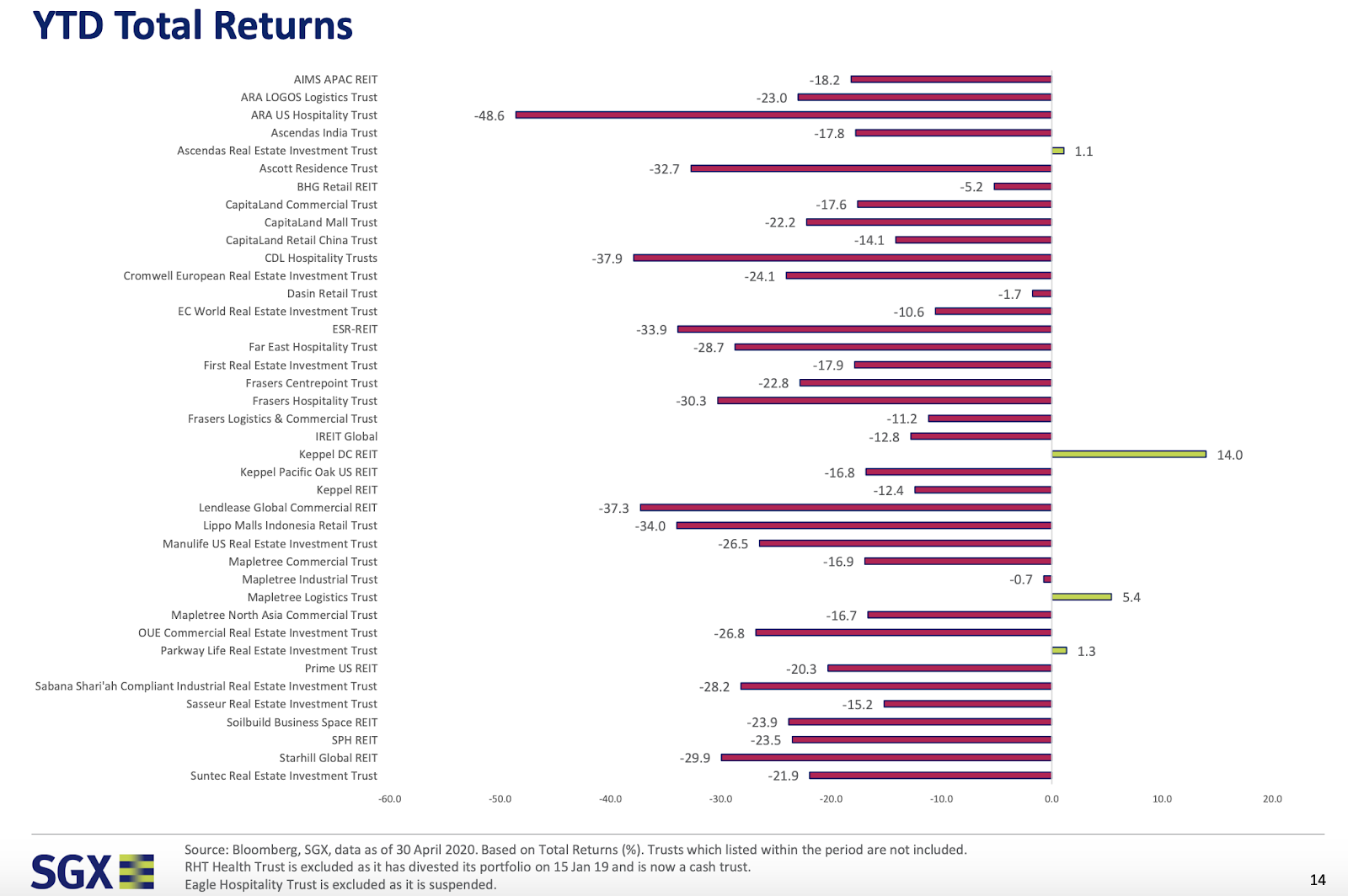

If you’re holding for the short-term, the returns certainly look like crap right now:

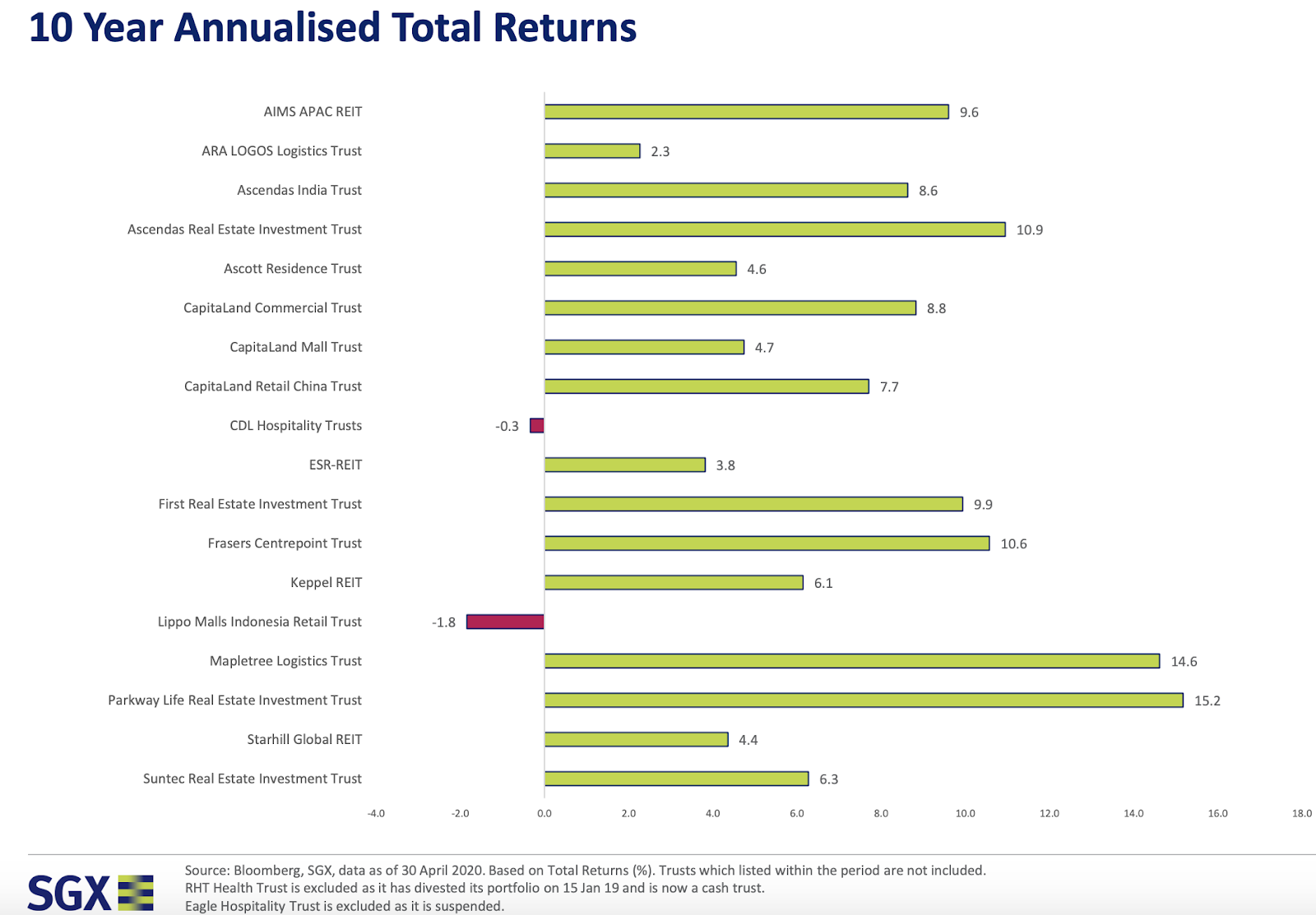

But if you’re holding them for the long term, the picture looks very different:

So for long-term investors, this crisis could be an opportunity instead, and there’s no reason to run away from REITs.

Just make sure you have enough cash on hand to prepare to participate in potential equity fund-raising by the REITs you’ve invested in.

With love,

Budget Babe

3 comments

Have been formula your blog regularly but this is the first time I leave comment. Indeed it is good time to accumulate SREITs with good price since March this year. Another good thing I am happy about is, some SREITs started to follow a standardized interest cover ratio formula as per MAS Code on Collective Investment Schemes which revised on 16 April 2020. When all follow this we can have an apple to apple comparison.

Yes!

This comment has been removed by a blog administrator.

Comments are closed.