Good news for Singapore: SGFinDex now officially includes insurance data, which means that you and I are finally able to manage our bank accounts, CPF, HDB, IRAS, CDP investments and insurance policies all within one place. To do so, you’ll need an application, and the one I personally use the most is OCBC Financial OneView. Here’s how you can make the most out of it, like I do.

It is no secret that I’m a huge fan of SGFinDex. After all, it is thanks to this that I was finally able to ditch the Excel sheets and see all my bank accounts in one place last year. And although I’ve known this was coming for some time, I’m glad I can now talk publicly about the latest addition of insurance data to SGFinDex – a huge breakthrough that was announced by the Monetary Authority of Singapore (MAS) late last year.

If you haven’t been following, SGFinDex is the world’s first public digital infrastructure that enables individuals like you and I to securely access – via Singpass – our financial information held across different government agencies and financial institutions.

Thanks to SGFinDex, you can now skip the manual work and let technology do it for you. However, you’ll need an application in order to benefit from SGFinDex. While the different banks and financial institutions are fighting to build the best app to win market share, my favourite for now is still OCBC Financial OneView.

OCBC Financial OneView – a financial planning tool found in your OCBC Digital app – is one of the enhanced mobile applications that you can use to sync with the enhanced SGFinDex right now, to get a sense of your overall financial data across all the different government agencies and financial institutions. It also happens to be my personal favourite because I’m a sucker for the pretty UI design, which makes for great screenshots on my blog and social media.

With OCBC Financial OneView, you can leverage the power of SGFinDex to take back ownership and control of your finances, as you can now consolidate, plan ahead, track goals and even get personalised insights.

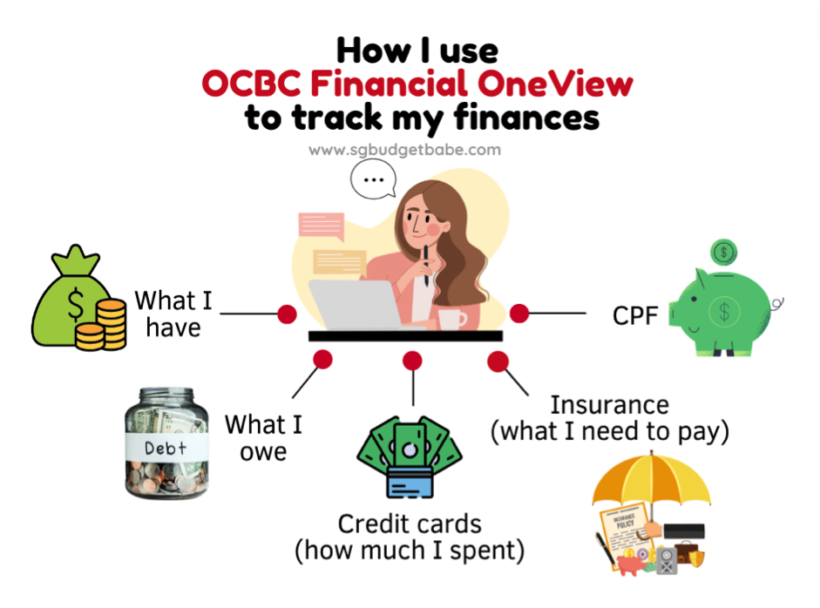

In my case, I use the app each month to check on the following:

- Are my assets growing over time?

- Are my debts or mortgages reducing / manageable?

- Did I overspend on my credit cards in my last bill statement(s)?

- Are there any upcoming insurance premiums that I need to pay?

- How much am I spending on insurance this year?

- Is there an upcoming insurance policy payment due that I may have overlooked?

- How has my SGX portfolio allocation changed due to volatile stock price movements in recent months?

- Am I on track to hitting my 1M65 CPF target?

- Am I optimising my SRS funds?

These are pertinent questions that you can adopt for yourself to monitor your financial health just like how I do.

In this article, I’ll show you how I use the app to make sure I’m always on track, financially.

Manage everything in one place with OCBC Financial OneView and SGFinDex

The fruits of SGFinDex would be useless without a powerful application to make sense of all that data, and my choice here is OCBC Financial OneView.

The best part is, the tool is free to use for all OCBC customers.

Which should pretty much describe almost every Singaporean, or at least, every Budget Babe reader because the OCBC 360 account was one of the first few I recommended most of you to open since I started this blog in 2014 (the account made its debut just a year before this blog was born).

If you’ve already used it before, all you need to do is to sync to update your latest month balances. But if this is your first time using, you will first need to connect your latest data with SGFinDex (see how here).

I’ll cover the below steps for those of you who have yet to sync your insurance data, since that’s the new development.

Step 1: Connect your insurance data

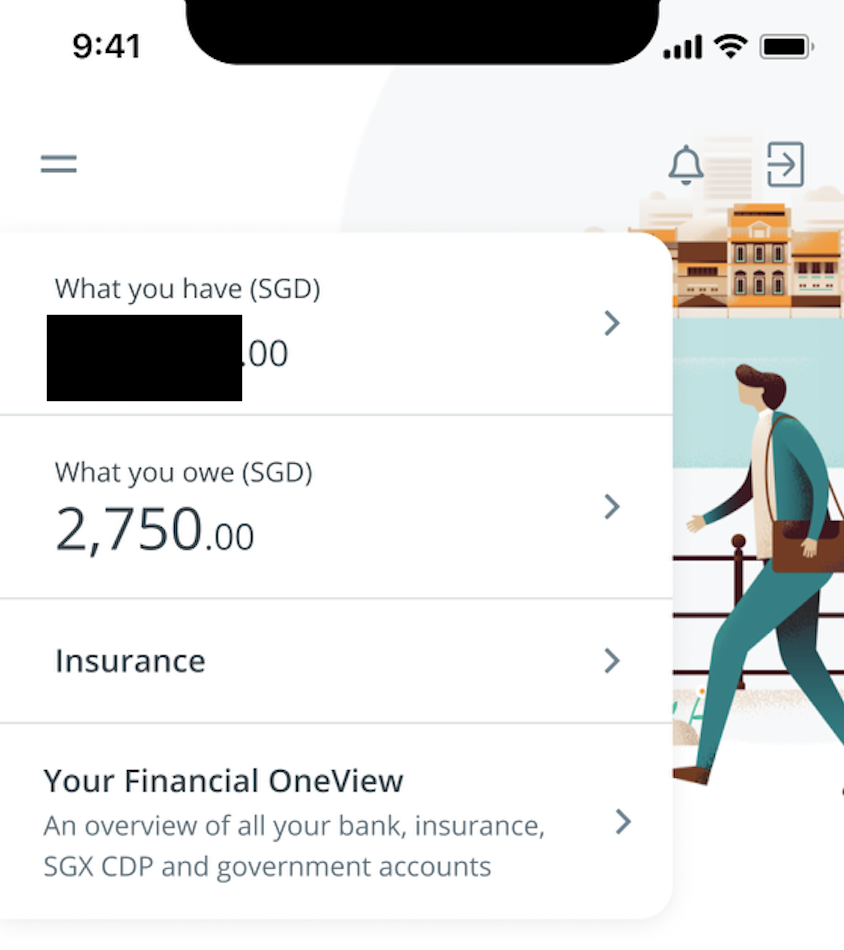

Start by tapping on “Your Financial OneView”.

Select “Manage” (at the top right corner).

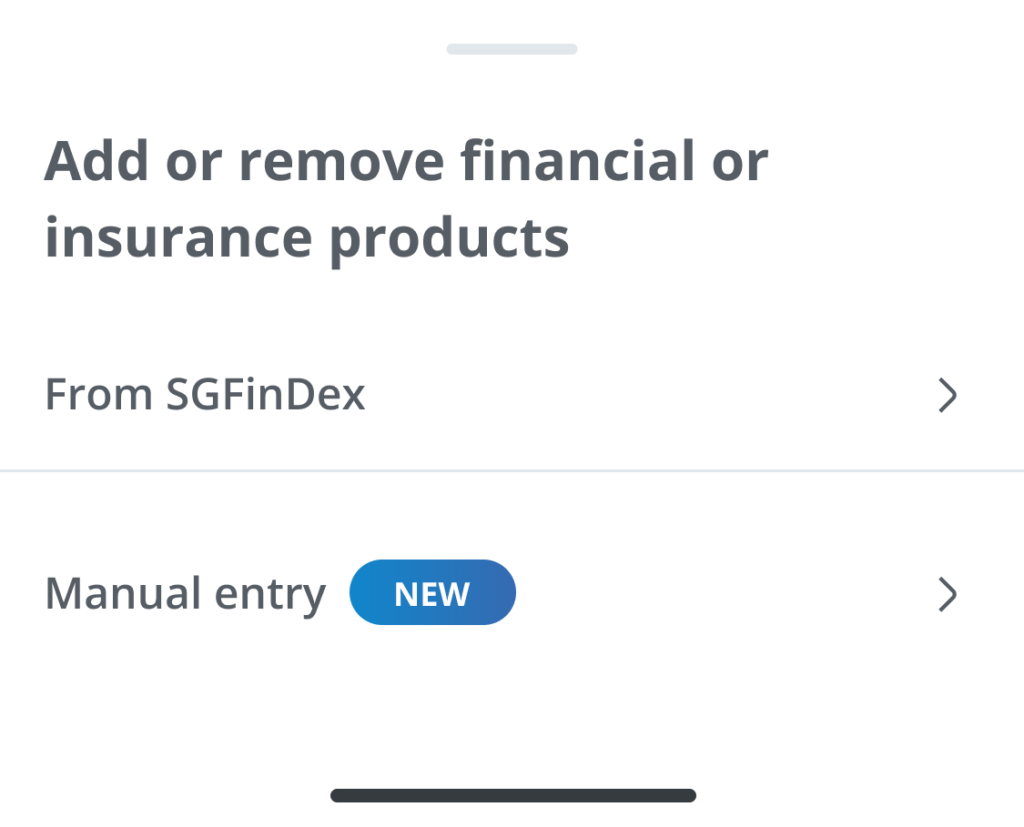

Alternatively, scroll to the bottom of your summary page and choose “Add or remove” portion to add your insurers.

Select “From SGFinDex” to add the insurers that you have policies with.

Note: You will need to manually login to each of their portals in order to connect and sync the data over, so this may take a while depending on how many different accounts you have.

Step 2: Update your financial data with SGFinDex

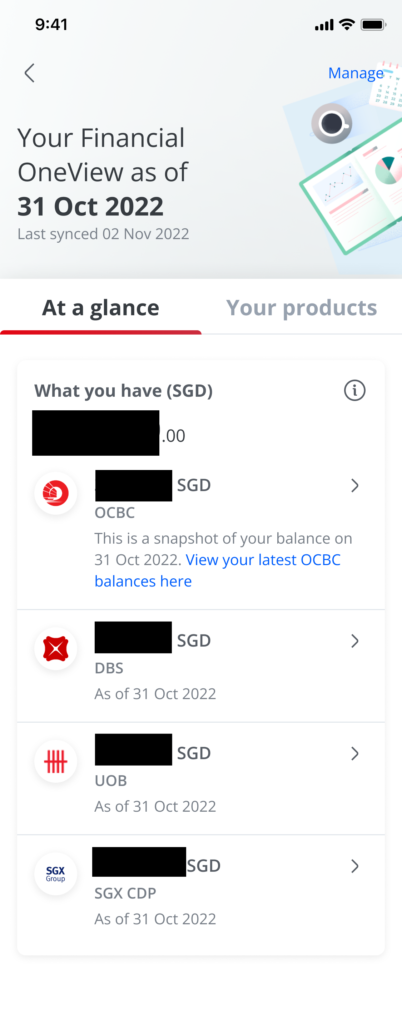

Next, sync to update your latest month balances across the different insurers, banks, CPF, IRAS, HDB and SGX CDP.

(Note: You will need to refresh your connection with SGFinDex every month in order to retrieve your latest data, since our finances are in a constant state of change.)

If this is your first time, check out my previous article here on how to connect with SGFinDex.

Now that you have a view of your latest data, congratulations, you’re ready to manage it.

Let me show you how I do it each month.

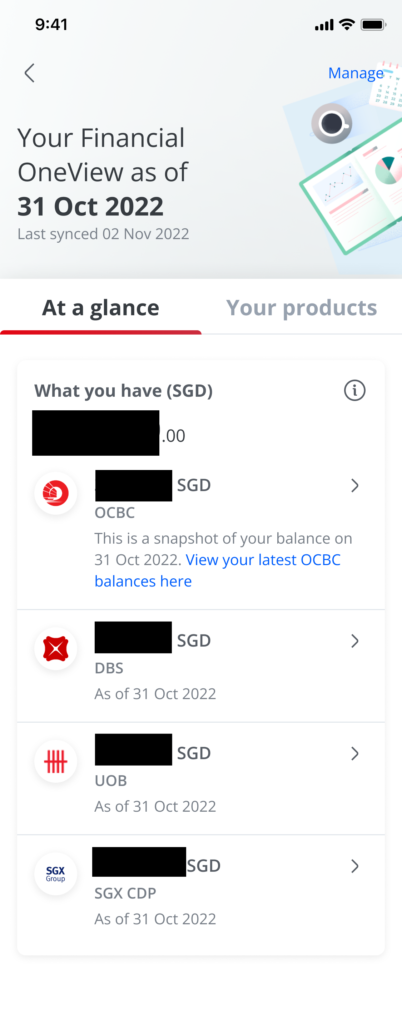

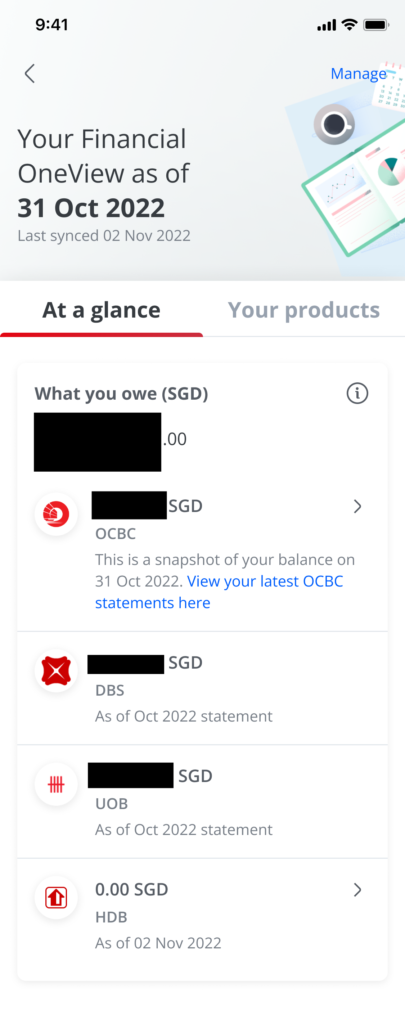

1. Check on your assets vs. loans

Every month, I’ll sync my data so I can check on my assets and what I owe.

What I’m looking out for here includes:

- Are my assets growing?

- What my short-term debts (credit cards) did I incur this month, and have they already been paid?

- Are my long-term debt (a mortgage) repayments still manageable in this era of rising interest rates?

Of course, there are still some limitations that I still cannot use SGFinDex to track for now. Right now my list includes:

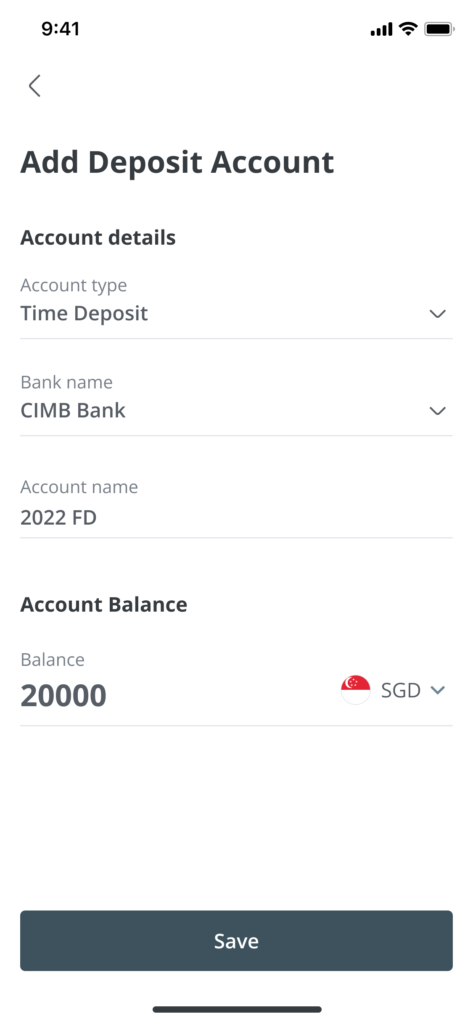

- My cash and fixed deposits held in other banks (e.g. CIMB)

- My equities / securities custodized with other brokerages, which do not sit in my CDP (especially for US and HK stocks)

- My investments in robo-advisors

I’m hoping these will eventually get added into SGFinDex, But till then, the good news is OCBC Financial OneView tool allows you to manually add your cash holdings (in other banks) for greater clarity and fuller picture of your finances.

Simply go back to Step 1 and select “Manual entry” to add what you have in the other banks (or even your piggy bank savings).

2. Check your credit cards expenses

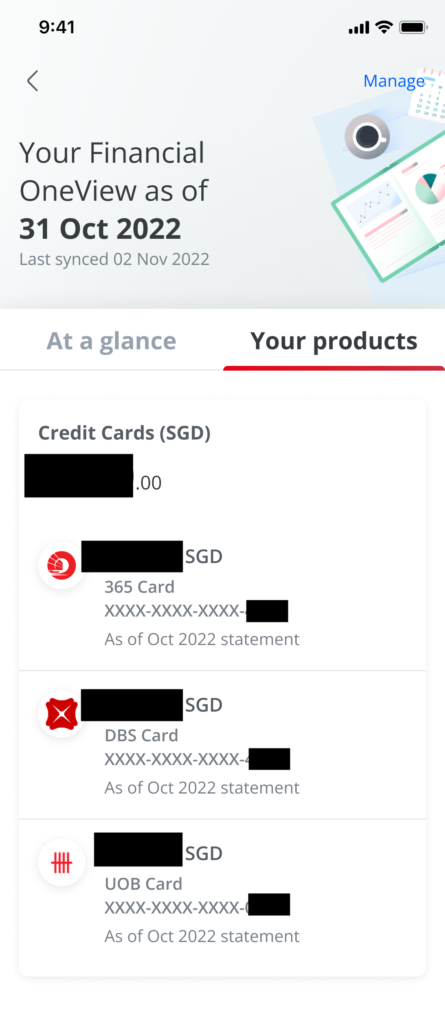

In the previous step, I already saw how much I’ve spent across all my credit cards.

To track how much I’ve spent on each card last month, I’ll then click on the “Products” overview on my app. This helps me to track my overall spending patterns, as well as serve as a reminder to check whether I’ve paid off my credit card bill.

By tracking this monthly, I’m able to spot if there are some months where I’ve spent more than I normally do, and align back to the root cause (usually because insurance premiums were due in that month, or we went on a family holiday).

Note that if you have credit cards from an issuer that isn’t part of the SGFinDex partner network, then that will be a gap that you’ll have to handle separately on your own…for now. In my case, my CIMB credit card warrants separate attention, since it doesn’t show up here.

Now that I’ve reviewed my credit spending and am satisfied with the health of my credit cards for the month, I go on to check on the status of our insurance.

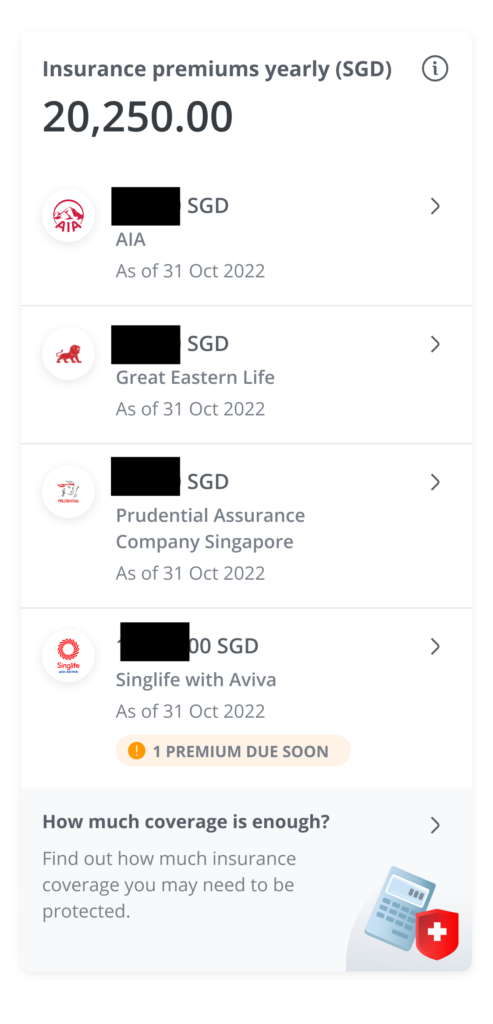

3. Track your insurance premiums

One of my biggest fears involves policies lapsing because we forgot to pay the premiums. Thankfully, the latest from SGFinDex now allows me to finally (!) see most of my insurance policies on OCBC Financial OneView.

All of our kids’ insurance policies are under my name, so with this, I’m able to track how much I’m paying every year and get reminders when any upcoming premiums are due.

You can now track your insurance premiums, both individually for each policy and the gross total of what all your policies cost you.

Need more details on a particular policy? Simply tap on it to view – this saves you the hassle of having to log into the insurer’s website or app separately when you just want to see a quick overview of what you have!

If you have policies with other insurers who are not in the SGFinDex network, you’ll have to continue monitoring them separately. Unfortunately, this means I’ll still have to track my FWD policies with my Excel spreadsheet for now.

Psst, while getting the OCBC team to review this article for factual accuracy, they told me that they’re working on building the ability for users to manually add any other insurance that they have, so that might go live soon!

P.S. If it helps, I’m currently using this for consolidating and sharing our family’s insurance policies with my husband.

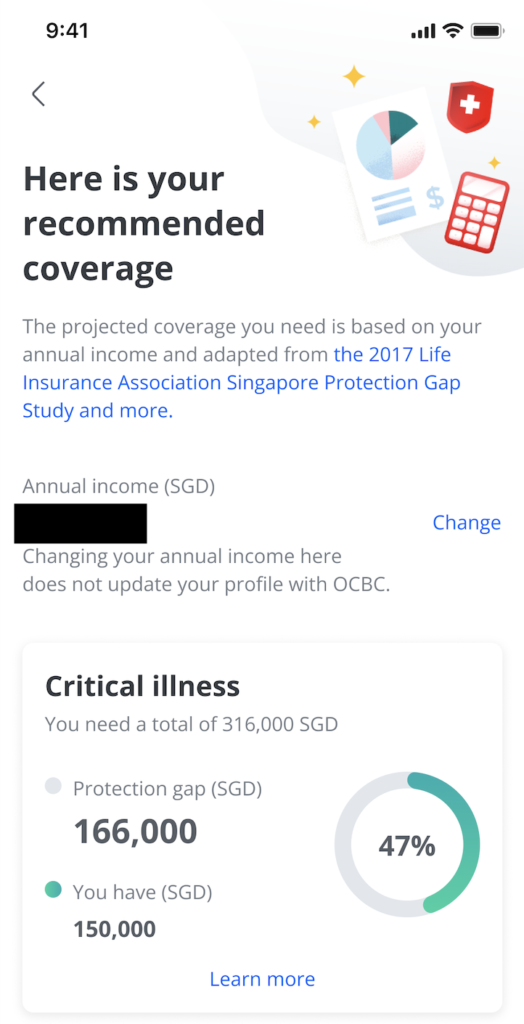

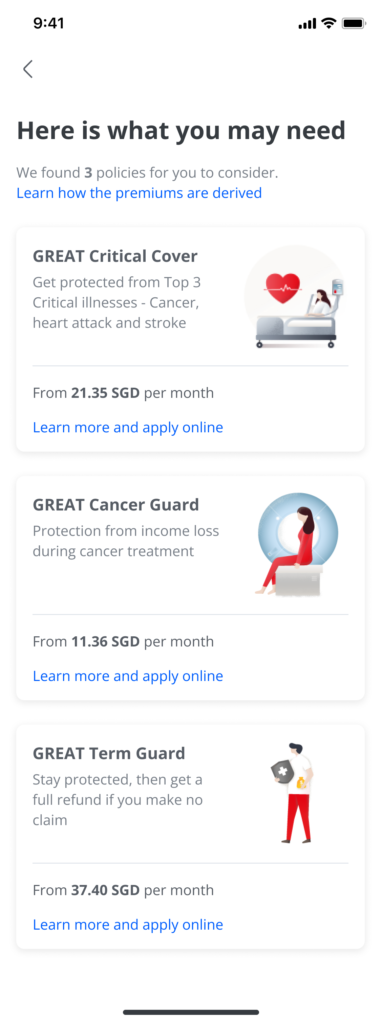

Review your coverage gaps

Of course, if you’re not sure whether you’re adequately insured, you can use OCBC Financial OneView to help spot any coverage gaps and see what they recommend for you, based on your annual income.

For instance, before I synced all my insurance data over, it identified that I might have a gap for Critical Illness:

and thus recommended me these plans:

This also makes for easier regular reviews with your spouse and/or financial advisor, and equips you with more information when listening to your FA’s recommendations on what to buy.

In light of the inflationary environment we’re in, please make sure you’re well protected against your biggest financial risks!

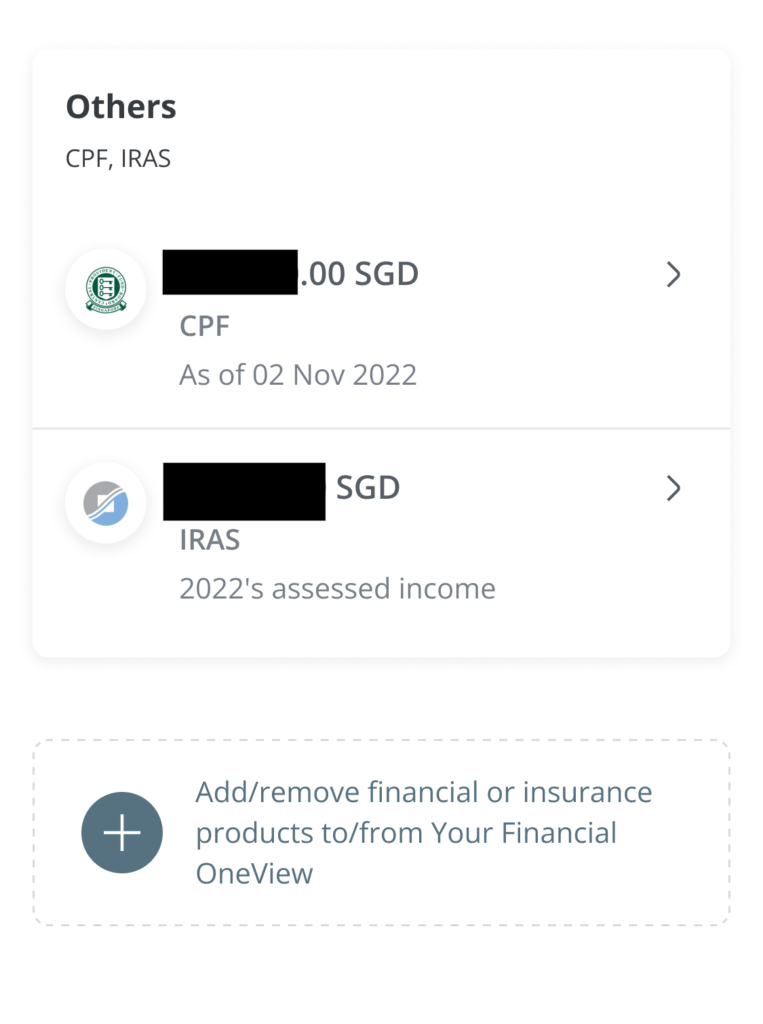

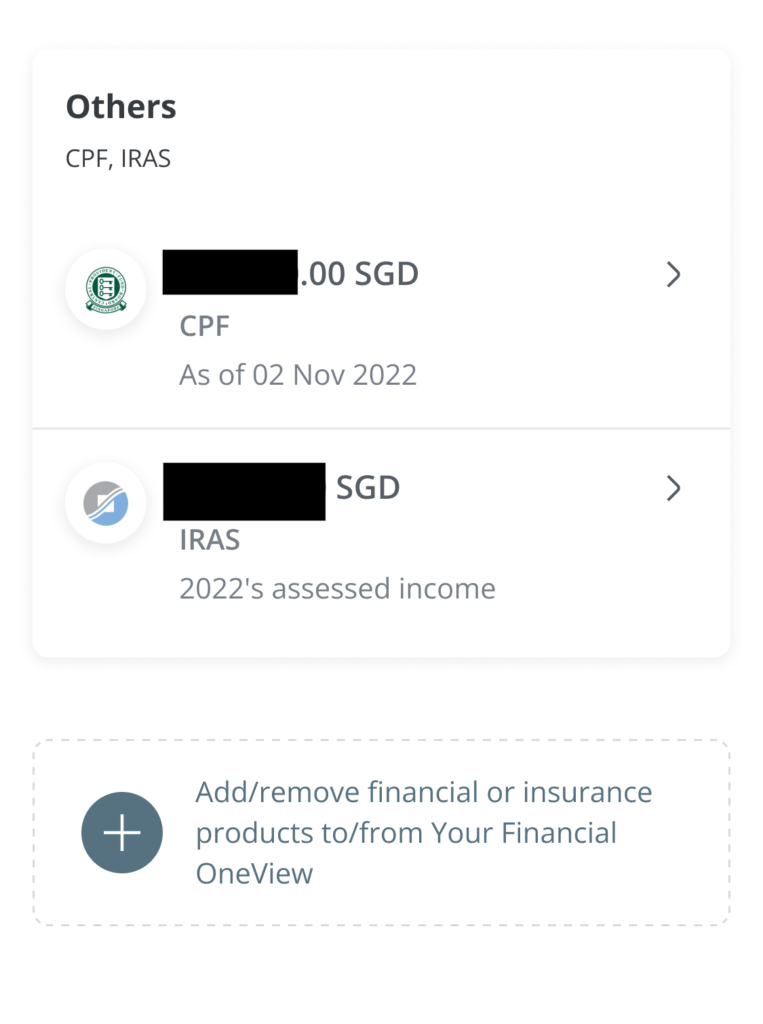

4. Check your CPF balances

My CPF is my safety nest for retirement, so I started making voluntary top-ups in my mid-20s and continued that practice until now. Since hitting the Basic Retirement Sum 2 years ago, I’ve gone on to hit the Full Retirement Sum earlier this year.

I like to check on my CPF balances to make sure I’m on track to achieving 1 million by 65 (read about the 1M65 strategy here).

Top up your CPF directly from OCBC

A few months ago, OCBC became the first bank to enable Singaporeans to make CPF top-ups directly using their OCBC app. As someone who has been doing this manually for the last few years, I can tell you, this has made my life so much easier.

P.S. If you haven’t already done your CPF top-ups for this year, make sure you do it before the year ends if you want to qualify for tax relief!

And that’s it!

Once I’ve synced with SGFinDex, doing the above review of my financial health takes me just a few minutes on OCBC Financial OneView each month.

Get your financial life under control

I’ve been using OCBC Financial OneView with SGFinDex since it was launched, and do a lot of my financial monitoring with the app. This is important to make sure that I’m on track to hitting my life goals, including retirement and for my kids.

If you’ve not already been using it, then you’re really missing out!

Start by planning for your life goals using OCBC Financial OneView, then ensure you have a plan to get there. Along the way, you can receive and make use of the financial planning tips personalised for you by the app, so that you can make better-informed decisions when it comes to your finances.

We all know the importance of financial planning, but starting your plan and regularly reviewing it used to be a tedious chore. Not anymore.

Thanks to SGFinDex and OCBC, planning and monitoring your progress each month is now so much easier.

I hope that having walked you through how I personally do it, you can now replicate the same and gain that confidence to enjoy the present…without having to worry about this “must-do but not done yet” responsibility that lingers at the back of your mind. It’ll now just take you a couple of minutes!

TLDR: use OCBC Financial OneView like I do to:

- Plan for your financial goals

- Monitor your assets vs. debts

- Make sure you don’t exceed your credit card expenses

- Keep track of your insurance and get payment reminders for upcoming premiums

- Review your coverage and plug any protection gaps in time

- Ensure that you’re on track to hitting 1M65 in your CPF

OCBC Financial OneView was recently acknowledged at the latest 2022 Global Retail Banking Innovation Awards (GRB Awards), winning Best Mobile Banking Initiative for OCBC Bank.

The best part is that the app is free, so what else are you waiting for?

Disclaimer: This is a sponsored post written in collaboration with OCBC. I’ve been using OCBC Financial OneView ever since SGFinDex enabled me to connect all my data across the different financial institutions, and personally experienced the progressive changes to the tool made since then, which has helped me get even more clarity and control on my own finances. All opinions in this article are that of my own.