Many of you may recall that I previously invested in Astrea’s first Private Equity (PE) bonds for retail investors, as documented here. Azalea Asset Management redeemed these bonds last year so I got my capital back, together with the 4.35% p.a. coupon that was paid to me throughout the past 5 years where I held the bonds for.

Now that they’ve launched their latest Astrea 8 PE bonds which are currently open for public application until 17 July 2024, I’ve received quite a few DMs about it so here’s my take.

1. Key Details

– The bond is launched by Azalea Investment Management Pte. Ltd., which is an indirect subsidiary of Temasek Holdings

– There are 2 interest rates being offered: 4.35% (SGD) and 6.35% (USD) per annum, payable in July and January each year

– IPO applications close at 12 noon on 17 July 2024.

– You can apply through ATM or online banking via DBS, POSB, OCBC or UOB. There is a non-refundable administrative fee of S$2 paid by the applicant for each application.

– Minimum subscription amount: $2,000

– If you’re applying for Class A-2, the rate will be fixed at an exchange rate of US$1.00:S$1.35.

– You CANNOT use your CPF or SRS funds to apply for this bond.

– Bond starts trading on SGX-ST on 22 July 2024

2. Is it a safe investment?

First things first, I had a few readers DM me saying they deemed this as a safe investment because it’s being backed by Temasek. That is NOT true – please note that this is NOT a Temasek bond. Rather, it is a bond issued by one of their subsidiaries.

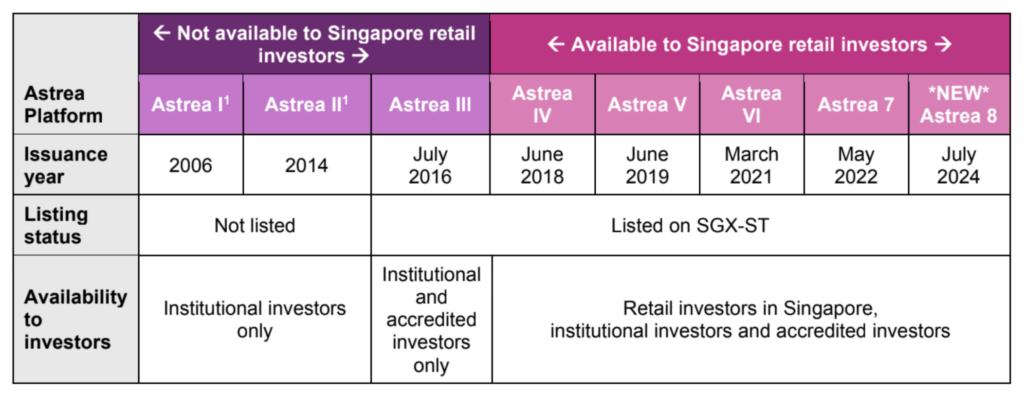

The Astrea 8 PE Bonds are part of the Astrea Platform. The Astrea Platform was started in 2006 and is a series of investment products by Azalea that is based on diversified portfolios of PE Funds. Unlike most bonds which are either government-backed or corporate-backed, these are a more unique class of private equity bonds. PE Funds are typically close-ended and managed by professional PE Fund managers, who generate returns by proactively making improvements in an investee and utilising various strategies, such as helping the investee improve its operations and its capital structure to either grow or be bought out later.

For Astrea 8 PE bonds, the total portfolio net asset value (NAV) for these funds is US$1.47 billion, with a fund strategy of 76% buy-out and 24% growth equity:

When the first retail tranche of Astrea PE bonds were launched in 2018, the market was rightfully skeptical about it back then. However, it has been 6 years and Astrea has since gone on to launch several more bond tranches, with the Astrea 8 PE Bonds being the fifth listed retail PE Bonds that will provide retail investors in Singapore exposure to the PE asset class:

| Bond | Launched in | Coupon Rate (SGD) |

| Astrea IV | 2018 | 4.35% |

| Astrea V | 2019 | 3.85% |

| Astrea VI | 2021 | 3.00% |

| Astrea 7 | 2022 | 4.125% |

| Astrea 8 | 2024 | 4.35% |

Since then, the Astrea series of PE bonds have built a strong track record of credit rating upgrades and steady distributions to bondholders. Even through the COVID-19 pandemic, for example, the Astrea IV and V portfolios generated sufficient cash flows to fulfil all bond obligations and Azalea confirmed that their credit facilities were not utilised. All bond obligations for all Astreas right through Astrea 7 have also been duly fulfilled to date, and the Astrea PE bonds have also enjoyed multiple credit rating upgrades since issuance.

What’s more, Azalea fully redeemed its previous bonds i.e. Astrea III (in January 2022), Astrea IV (in December 2023), and most recently the Astrea V Class A Bonds on their Scheduled Call Date (20 June 2024), 5 years after issuance.

If you didn’t already know this, your bond investments are not capital-guaranteed nor protected by SDIC insurance (since Azalea is neither a bank nor an insurer).

3. Risks vs. Rewards

While the Astrea 8 PE Bonds provide retail investors a chance to gain exposure to private equity at a fixed return of 4.35% p.a., they are not without risks. The private equity market’s performance can be significantly affected by economic conditions, market sentiment, and geopolitical events.

| Key Risks | Rewards |

| Volatility in private equity markets | Fixed 4.35% p.a. coupon rate + 1% p.a. step-up if not redeemed on scheduled call dates |

| Not capital guaranteed | Potential for capital gains (e.g. if interest rates falls and you then sell before maturity) |

After all, the potential for higher returns comes with higher volatility and risk of loss.

4. What are you buying into?

Astrea 8 PE bonds are backed by cash flows from a portfolio of 38 PE funds managed by 27 reputable general partners. As of 31 December 2023, these funds invest in 1,028 companies across various regions and sectors.

The funds are mostly based in the US (63%), followed by Europe (20%) and Asia (17%). The weighted average fund age is 6.1 years, which is “highly cash flow generative” according to Azalea’s chief investment officer. That’s because more mature PE funds are more likely to generate cash flows from its underlying holdings, which are then used to fund coupon payments to bond holders.

5. Astrea 8 vs. Astrea 7 Bonds: What’s the Difference?

Of course, instead of applying for Astrea 8 PE bonds, you could also buy Astrea 7 bonds from the secondary market today. Which would be a better choice?

If you want a bond that will be redeemed earlier, then Astrea 7’s scheduled call date of 27 May 2027 (in 3 years time) would be more appealing. The market price of past Astrea bonds take into account the interest rate differentials and includes accrued interest, where market dynamics and current interest rates (at time of your search and purchase) will also influence the actual price and yield of Astrea 7 bonds that you’ll actually be getting.

On the other hand, Astrea 8 bonds are being sold at par value.

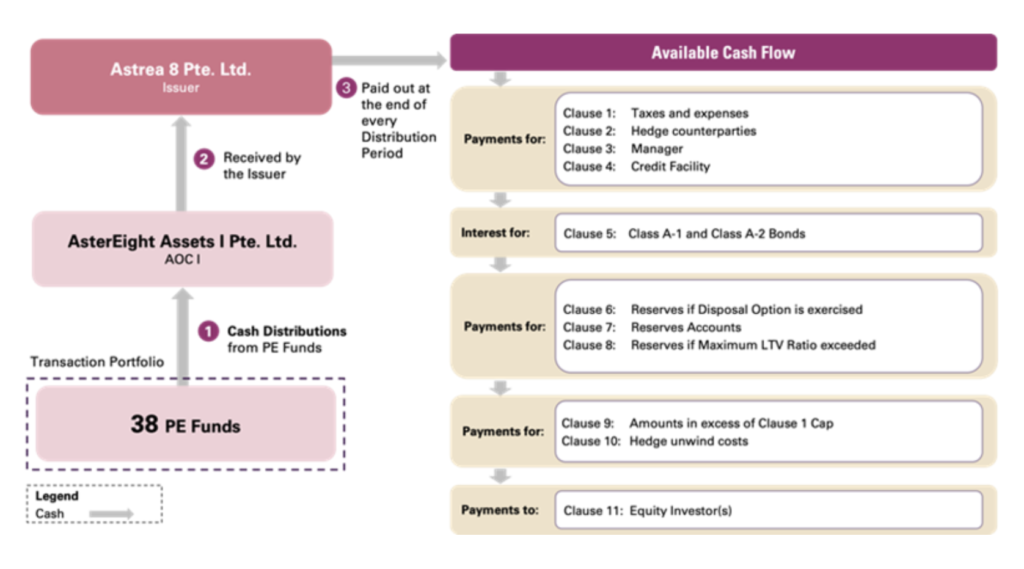

6. Structural safeguards in the Astrea PE Bonds

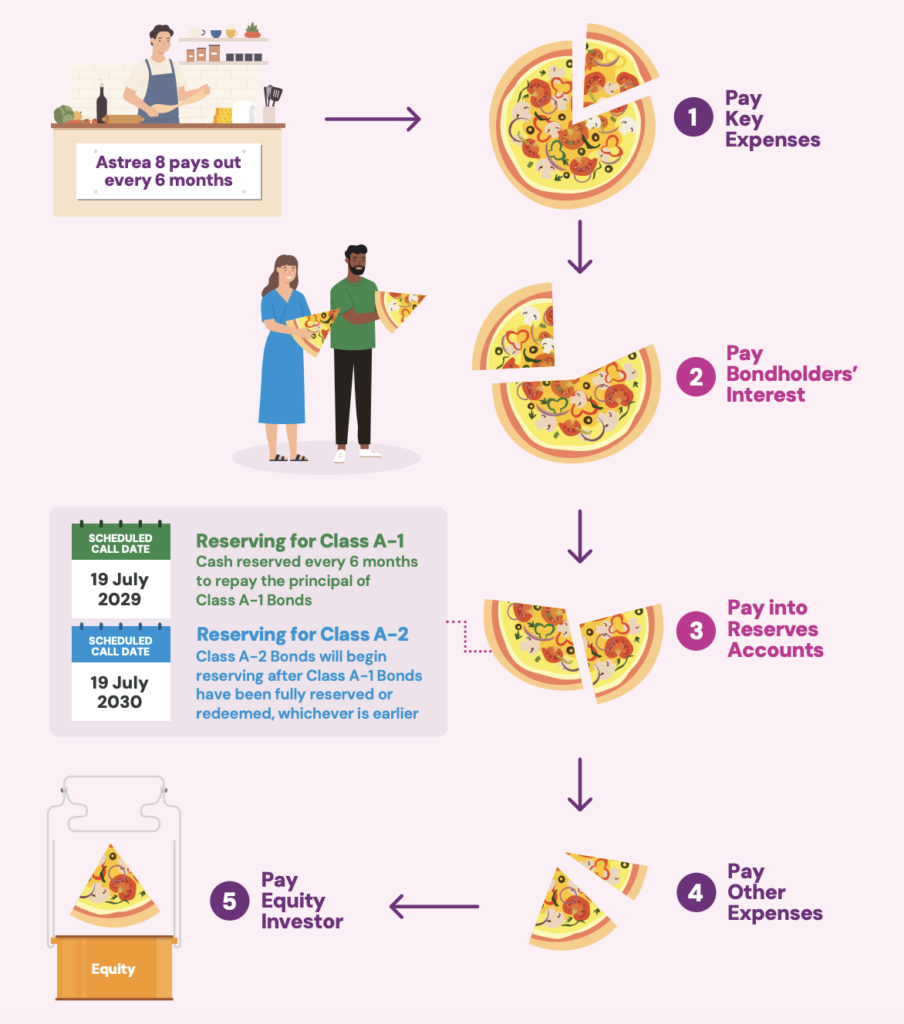

Traditionally, PE bonds were not accessible to retail investors, so when Azalea first launched theirs in 2018, there were structural features put in place to cater to protecting retail investors. These include a prescribed sequence of priority payments so that cash is reserved to pay retail bond holders first before equity investors:

What’s more, the sponsor Azalea holds 100% of the portfolio’s equity, which means the portfolio will need to lose 60.2% of value before bond holders are affected. There is also a reserve account to ensure a cash build-up to repay principal amounts, and the loan-to-value ratio is to be maintained at under 40%.

7. Can the bond issuer decide not to redeem Astrea 8?

No. By design, it is mandatory for Astrea 8 to redeem the Class A-1 and/or Class A-2 Bonds on their respective Scheduled Call Dates, if the following conditions are met:

- For Class A-1 (SGD) Bonds: The cash set aside in the Reserves Accounts and the Reserves Custody Accounts are sufficient to redeem the bonds, and there is no outstanding Credit Facility loan.

- For Class A-2 (USD) Bonds: There is no outstanding Class A-1 Bonds to be redeemed, the cash set aside in the Reserves Accounts and the Reserves Custody Accounts are sufficient to redeem the bonds, and there is no outstanding Credit Facility loan.

Should the bonds not be redeemed on their respective Scheduled Call Dates, then there will be a one-time 1.0% per annum step-up in the respective rates, which means Class A-1 bond holders can expect to be paid 5.35% in the 6th year onwards, while Class A-2 bond holders will receive 7.35% p.a. until the bonds have been fully redeemed.

8. If it’s such a good deal, why is Azalea issuing these bonds?

To obtain funding for its operations, companies typically can borrow from the banks or raise funds by issuing bonds or equity.

Issuing bonds often costs less than equity, since it does not entail giving up any control of the company and allows the issuer to cap its payments – in this case, at 4.35% p.a. for the SGD class. Equity ownership, on the other hand, entitles equity investors to a share of the profits, which could be more than 4.35% if the fund manager does well.

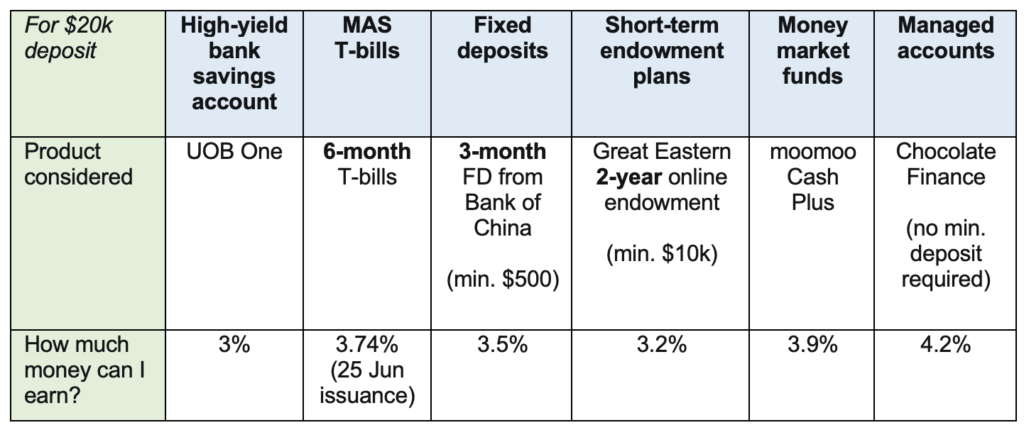

As for whether 4.35% p.a. is a good deal for you, this is where you’ll have to factor what alternatives you have access to. Just last month, I did a comparison of options for my cash when Chocolate Finance opened up their 4.2% p.a. offer for up to $20,000:

Hence, with the launch of Astrea 8 PE bonds, this would put it in the same class as Chocolate Finance for me as they’re both open for applications at somewhat the same time:

| Astrea 8 PE Bonds | Chocolate Finance | |

| Rate of return | 4.35% p.a. | 4.20% p.a. |

| Lock up duration / Liquidation options | 5 years (hold until maturity) or liquidate within a few days (sell on the open bond market) | None, withdraw tomorrow |

| Min. investment | S$2,000 | S$1 |

| Max. investment | Depends on your allocation | S$20,000 for 4.2% p.a. |

| Offered by | Azalea Investment Management Pte. Ltd., owned by Azalea, a subsidiary of Temasek | ChocFin Pte Ltd |

| Years of operation | 7 years | 2 years |

| Invests in | Private equity funds | Short-term, high-quality bonds |

TLDR: Are the Astrea 8 PE bonds worth applying for?

These bonds are being launched at a good time, as current market expectations are for the Fed looks to cut interest rates in the near term.

For investors who are worried about the potential fall in fixed income options when that happens, the Astrea 8 PE bonds offers a chance for you to lock in 5 years of 4.35% p.a. coupon payments (SGD) or even 6.35% p.a. (USD).

However, whether 4.35% p.a. (SGD) or 6.35% p.a. (USD) is attractive enough for you will ultimately depend on what alternatives you currently have access to.

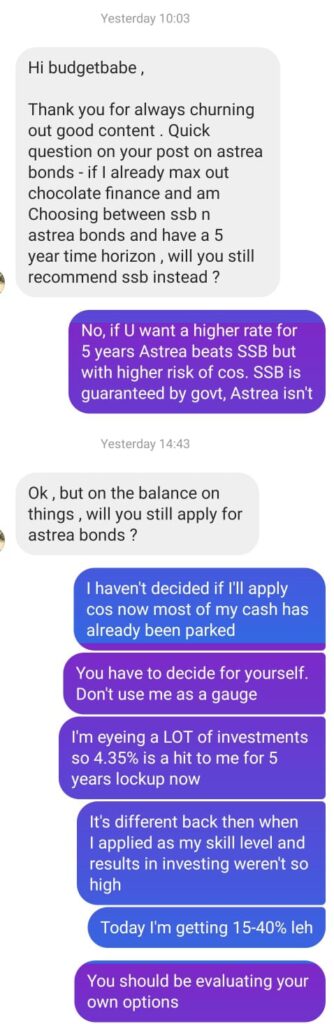

I will personally not be subscribing as most of you know I’ve already parked my excess cash in Chocolate Finance at 4.2% p.a. recently, and I’m currently eyeing several investments which I expect to give me anywhere between 20% – 50% in the next 6 months to 2 years. Given that my options are between double-digit investments vs. settling for a 4.35% or 6.35% p.a. fixed income bond, I’m obviously choosing the former.

Of course, these are much higher risks than the Astrea 8 PE bonds, but again, that’s why I said you guys need to start making your own investment decisions without simply asking, “So will Budget Babe be investing?”

If you’re more risk-adverse or do not have access to investments offering you a better rate, then I can see how the 4.35% p.a. (SGD) or 6.35% p.a. (USD) coupon payments on Astrea 8 PE bonds can be attractive to you.

So once again, here’s a quick summary of the Astrea 8 PE Bonds – especially if you didn’t read through my analysis above:

Pros & Cons:

- Astrea 8 PE bonds have been designed with structural safeguards in place for retail investors, including priority of payments and 100% equity ownership by the Sponsor.

- Azalea has built a long track record since 2018 of fulfilling its retail bond obligations, and it is notable that it did not have to dip into its cash reserves even during the pandemic when the value of many growth investments suffered.

- At 4.35% p.a. (SGD) and 6.35% p.a. (USD), this bond offers investors an option to lock up and be paid these rates for the next 5 – 6 years respectively in the event that interest rates fall.

- Your investment is diversified across more than 1,000 investee companies and multiple industries. And at 39.8% LTV, the entire portfolio value is more than twice the US$585 million of Astrea 8 PE Bonds being issued.

- Cons

- The bonds are not capital-guaranteed, and are neither backed by any government or listed blue-chip corporation.

- The private equity markets are prone to volatility, thus carrying higher risk than if your money was invested in other more stable investments instead.

- You’re not buying a Temasek-backed bond, even though the fund manager is a subsidiary of Temasek Holdings.

Important: This is NOT a sponsored review. I was neither paid nor received any in-kind benefits - from Astrea, Azalea, Temasek or even anyone else - for writing this article.

While I personally will not be subscribing, it is important to note that I DID subscribe to the last 4.35% p.a. Astrea IV bonds, which were the first retail bonds launched by the fund manager back then. My bonds have also been successfully redeemed last year. My choices are simply different this time, hence I'll be skipping this tranche this round.

That does not mean I feel the Astrea 8 PE bonds are bad; on the contrary, if I didn't have any better investment options and cared only about locking up a decent rate for the next 5 years, then I would definitely put my own money in.

If you are interested to apply for the Astrea 8 PE Bonds, you can apply via ATM or online banking before Wednesday, 17 July 2024, 12pm. There will be a non-refundable administrative fee of S$2 for each application. You may submit only one valid application for each class of the bonds, i.e. you can apply once each for Class A-1 Bonds (SGD) and Class A-2 Bonds (USD) if you wish.

The minimum amount in the respective currencies (SGD/USD) is $2,000, and applications must be in multiples of $1,000. If you’re applying for the USD bond, note that USD funding will NOT be accepted and your SGD will be converted at the fixed exchange rate of US$1.00 to S$1.35 instead.

The bonds will be issued on 19 July 2024, and will start trading on SGX-ST from 22 July 2024.

Please make sure you’ve read the prospectus or bond page here and you’re fully aware of what you’re subscribing for.

With love,

Dawn

1 comment

Thanks for the very comprehensive explanation! Really useful!

Comments are closed.