When Chocolate Finance launched last year and offered 4.5% p.a. on your first $20,000, it created quite a bit of buzz among the personal finance community folks here. But while some Singaporeans were skeptical and some chose to stay out, some braver souls who understood its business decided to test it out and juice the returns for themselves.

If you couldn’t get in, you weren’t the only one as Chocolate Finance launched in beta mode last year, which meant it was on a by-invite only basis.

I was intrigued enough back then to do my due diligence (which you can see documented here), where I grilled the CEO to understand its execution and the mechanics behind those returns. My investigation outcome gave me enough reassurance to invest my own money into it and I promised to update in due time about how my money in Chocolate Finance fared, so let’s dive into how that has performed.

Were the 4+% rates too good to be true?

That was the sentiment among many consumers and retail investors back then. To be fair, you can’t blame them because the concept of a managed account is still relatively foreign to most people.

Chocolate Finance was founded to provide an alternative to traditional banking – following the success that its founder, Walter de Oude, had on building the Singlife account earlier on. When he left Singlife, he started Chocolate Finance and designed it to beat fixed deposit returns without any lock-ups so that customers had an option to earn more without tying their monies down.

To do that, the monies are invested in short-term fixed income bond funds that were chosen based on their ability to meet the target returns. What’s more, Chocolate Finance was so confident of its ability to achieve the returns back then that it also offered a Top-Up program guarantee i.e. in the event of any shortfall where the funds do not perform as expected, Chocolate Finance had shareholder reserves allocated to top up the difference for the first $20k by every customer.

A year on, it is safe to say that the skeptics and disbelievers missed out on a good 1 year worth of earning 4.5% p.a. while it lasted. Not only has Chocolate Finance proven itself to be legit and not to be a scam, they have also delivered on both the promised and target returns. Here’s a recap of what they promised back then:

- 4.5% p.a. on your first S$20,000 – guaranteed by Chocolate Finance.

- 3.5% target returns on anything above the first $20k

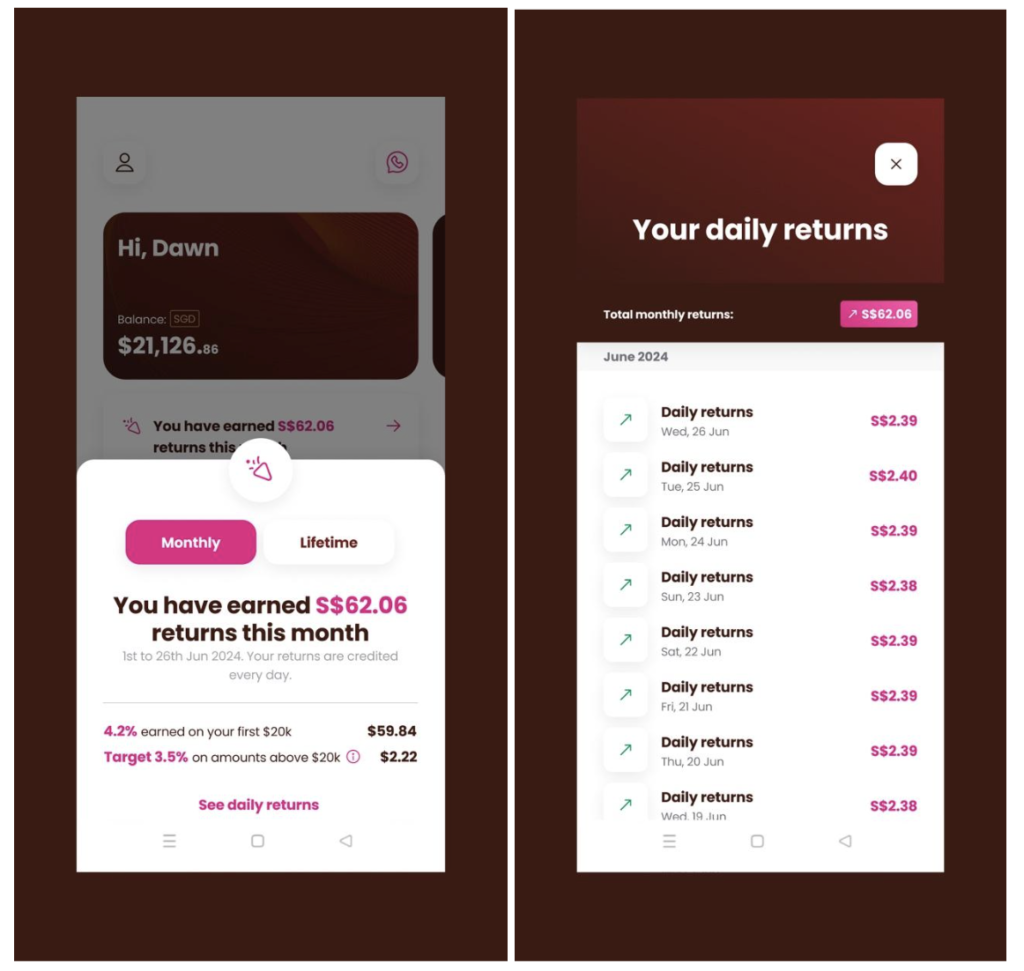

Of course, I’ve seen the daily returns come into my own account, but since I didn’t put in more than $20k, I reached out to the Chocolate Finance team to ask what happened to the customers who did.

Background disclosure: I’ve known Walter since his days at Singlife, back when his marketing team worked with me to promote Singlife as a digital insurer to Singaporeans. Just look at what Singlife has grown to today!

As a result of this connection, I have access to the Chocolate Finance team who knows about the quality of the work that I do, which is also why they're more open to me grilling them with questions than most other companies might be.

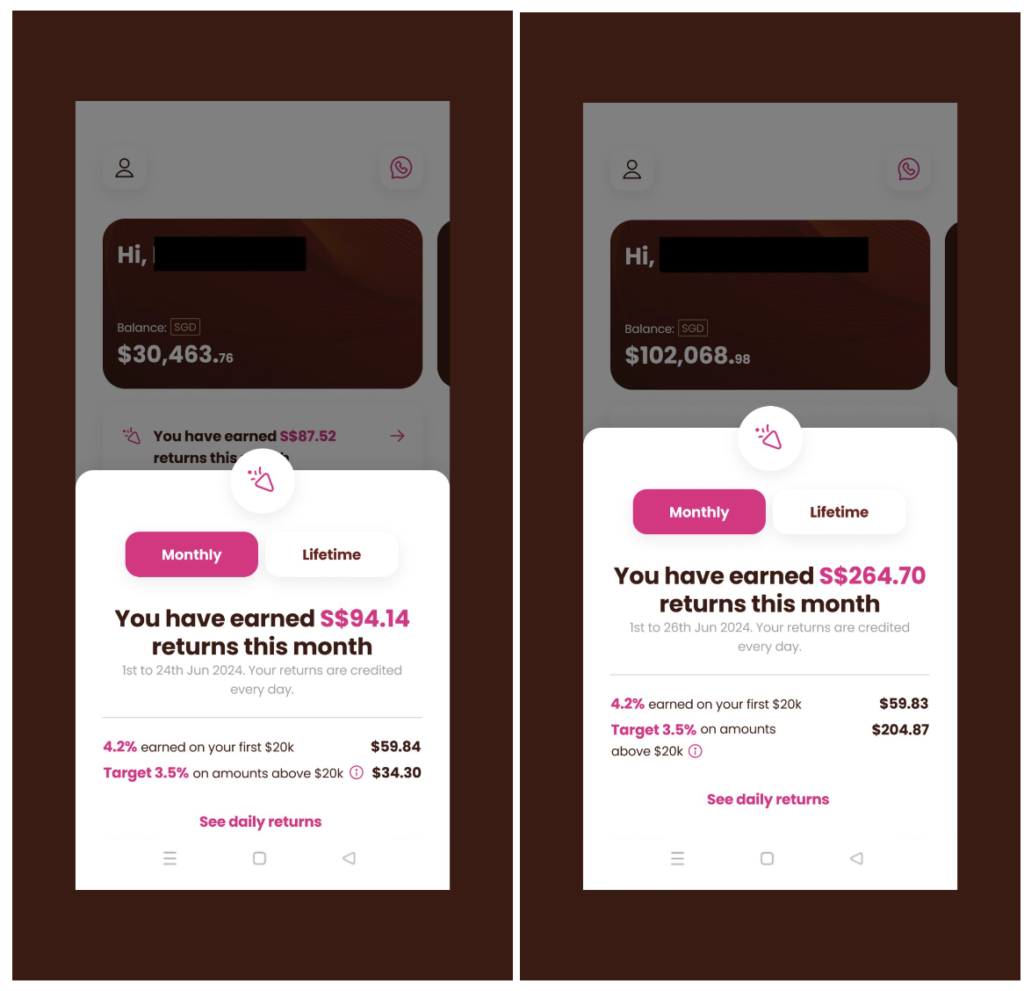

Here are screenshots they shared with me from customer accounts with $30k vs. $100k deposits:

If you too, deposited $30k or $100k into your managed account with Chocolate Finance, here’s a reminder that if your interest paid out differ from the above 2 customers’, that is because your exact returns depend on (i) when you deposited the money, (ii) whether it was at one go or in tranches, and (iii) whether you withdrew your daily interest paid, made withdrawal or top up transactions or left it to accumulate over the year.

Okay, so Chocolate Finance did indeed deliver on their 4.5% p.a. returns for the first $20,000 as promised. But what about the next 3.5% target return? Was that met?

Chocolate Finance confirmed that till date, the underlying portfolio has met its targets as planned. I grilled them pretty hard on this and after repeated questioning, I was finally able to get this confirmation from them: Chocolate Finance did not have to dip into their (already allocated) reserves for the Top-Up programme – in the event that the 4.5% was not achieved – as the overall fund performance was sufficient to pay the promised rates to customers.

A few more things have happened in the past 1 year as well:

- Chocolate Finance’s customers have left them 4 and 5-star reviews on Google Play and Apple App Store.

- The company has obtained its own full CMS license from the Monetary Authority of Singapore after the initial partnership with Havenport Investments for the “early access” beta phase, which shows that MAS is well aware about their business model and has allowed for them to operate.

- Note that their new license is under Chocfin Pte Ltd.

Now that Chocolate Finance has reopened allocations and is accepting new customer deposits again (currently via waitlist or referrals only), is it worth putting your money in?

To help you decide for yourself, you first need to understand how the business works, how they handle your funds, where your money will be invested in…and this differs from other options in the market today.

What is Chocolate Finance?

If this is the first time you’re hearing about Chocolate Finance, they are essentially a product designed to compete with banks as a high return cash account using a managed account construct. Chocolate Finance holds a CMS license by MAS. In other words, they are a licensed fund management company and a digital adviser serving retail investors focusing on giving you better returns on your cash.

Founded by Walter de Oude, who’s the founder of Singlife (and the man behind the ingenious Singlife account), Chocolate Finance first broke onto the scene last year in partnership with Havenport Investments. Chocolate Finance’s investors include Peak XV Partners (previously known as Sequoia), Prosus, Saison Capital and GFC.

After his success with the Singlife account, Walter started Chocolate Finance to see if he could generate even higher returns for consumers without lock-ins, that works kind of like a cash account, albeit in a different manner.

A year on, it seems Chocolate is now about to enter full growth mode having now obtained their own license, allowing for the original partnership with Havenport Investments to conclude with the novation of the managed accounts and assets to Chocolate Finance.

How does Chocolate Finance work?

Unlike the banks, which generate returns by investing customer deposits mainly in mortgages and credit, Chocolate Finance’s managed account primarily invests in short-duration fixed-income funds and money market funds, giving them greater flexibility to make your money work hard for you.

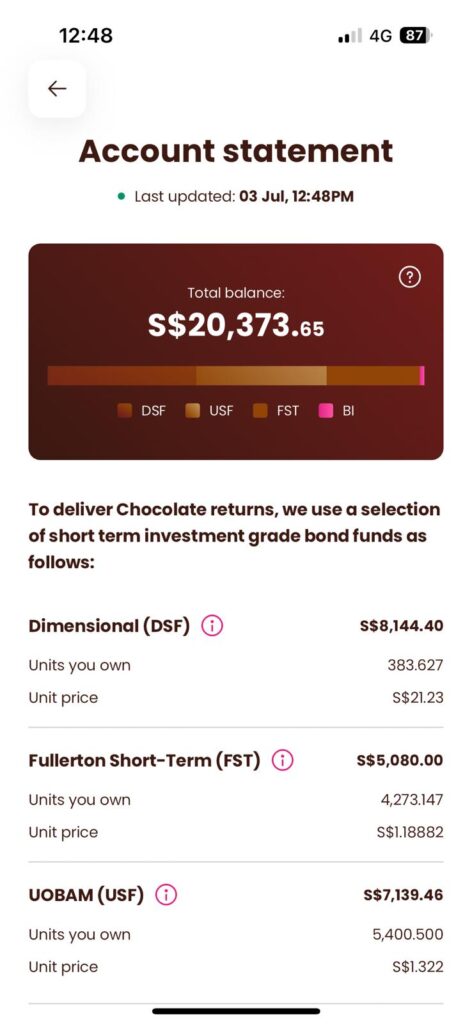

In summary, your funds get invested into a selected portfolio of short-term high-quality bonds determined by the portfolio managers at Chocolate Finance. At this moment, the portfolio is currently made up of:

- Dimensional Global Short-Term Investment Grade Fixed Income Fund (SGD)

- UOBAM United SGD Fund

- Fullerton SGD Cash Fund

If you’re unfamiliar with the above funds, essentially the money is being loaned to relatively big and reputable companies in short durations. Even then, fluctuations are to be expected when it comes to bond funds, because imagine this:

- You lent money to borrowers at 4% p.a. because today’s interest rates are still high.

- If interest rates get cut to 2% thanks to the Fed, the loan you own (at 4% p.a.) is now attractive to others, who may want to buy over that bond from you (and you earn a profit).

- But if interest rates get hiked to 7% p.a., your 4% p.a. loan no longer looks attractive and you may have to sell it at a lower price.

Funds that invest in a whole basket of bonds would naturally see their net asset value go up and down each day. If the volatility bothers you, you can simply focus on the first $20,000 of deposits which falls under Chocolate Finance’s Top-Up programme for the 4.2% p.a. headline rate. Regardless of the situation, as long as you hold your bond to maturity, you would have gotten back the capital and the original investment’s yield. But in the short term, you can expect the value to dip every now and then, which is where Chocolate Finance’s top ups come into play.

And for the eagle-eyed, you may be wondering, hey, I can find these funds on several brokerage or fund platforms like EndowUs, FundSupermart, POEMS, etc as well! So what’s stopping me from investing in them directly?

NOTHING 🙂

If you’re a savvy investor who prefers to manage your own fund investments, then why not?

But if you’re someone who is just looking for a place to park your spare cash for higher returns without having to bother or manage too much, then you can see why Chocolate Finance’s managed account was appealing.

Personally for me, it’s still a place for me to put my spare cash that forms part of my liquid, emergency funds and get returns higher than what the banks paid me, so that I could free up my time and energy to focus on work and the stock markets instead.

The team at Chocolate Finance generally targets to offer 0.5% or 50 basis points (bps) higher returns than the best 3-month fixed deposit rates available.

When interest rates were high last year, most banks and fixed income investments offered higher returns as well. Today, most of those rates have dropped across the board. We’ve seen UOB cut their interest on savings accounts, lower fixed deposit rates being offered, MAS T-bills yield declined, Singapore Savings Bonds returns dropping, etc.

Against such market conditions, it is not surprising that Chocolate Finance has also revised their latest offer to the current 4.2% on your first $20,000 invested.

In the event that the funds do not perform as planned, the Top Up programme* kicks in to top up the difference and disburse the interest due to you for 4.2% p.a. on your first $20,000 during the Qualifying Period. Amounts above $20k will get the actual underlying portfolio returns, which have met the 3.5% target thus far in the past year.

The Qualifying Period is from now until 31 December 2024, or until the assets under management for the Chocolate Managed Account reach S$500 million – whichever comes first.

Please also note the following risk disclosure from their app: This programme does not constitute a guarantee of capital or returns. Chocolate has the right to pause or stop the programme at any time due to market disruption, over-utilisation of the programme, excessive withdrawals, exchange restrictions, or other unexpected force majeure events.

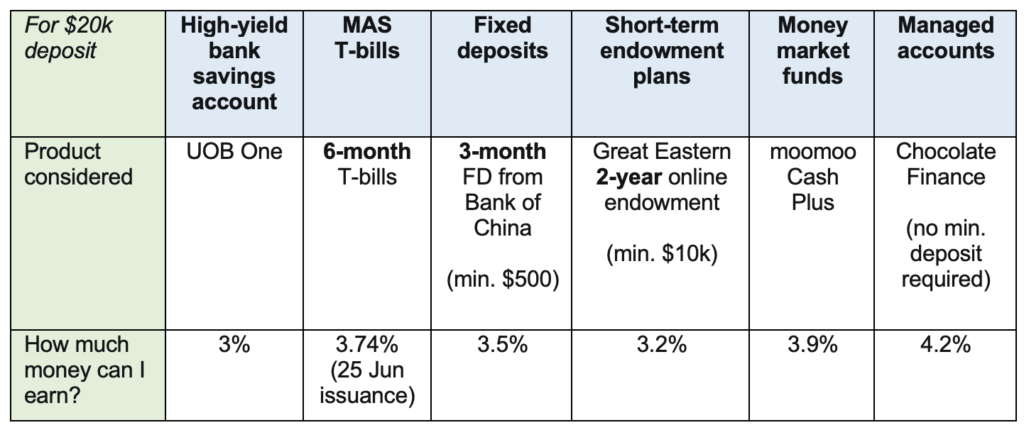

4.2% p.a. is still approximately 70 bps ahead of the best 3-month fixed deposit in town right now. As a consumer, I also have other options, so I’ve compared where I would normally consider putting my spare cash into:

Important Disclaimer: The above table merely documents my own thought process and is NOT meant to suggest that the products are similar or exactly the same. The above simply shows several options that I can put my own stash of $20,000 into today. You should note that these options are NOT apple-to-apple comparisons as they each have different attributes e.g. your money kept in banks and insurers here are insured for up to $100k per financial institution per depositor, while the MAS T-bills are capital-guaranteed by the Singapore government (MAS) themselves. Money Market Funds and Managed Accounts, on the other hand, belong to a class of investment products and thus are not SDIC-insured.

You can see that the (i) rates, (ii) minimum deposit requirements and (iii) lock-in periods differ among the various options, which is what you should factor in before making a choice.

While Chocolate Finance offers the highest rates at 4.2% p.a. right now, the important differences to take note of are:

- No lock-in, meaning you can withdraw almost instantly (or within 1 – 2 days if your amount is >$20k, as larger funds will require more time to liquidate)

- No minimum (or maximum) deposit amount

- There’s no sales charge, management or wrapper fees

- Since Chocolate Finance is not a bank, your funds are not SDIC-insured.

The lack of SDIC protection extends to all investments outside of a bank or insurer. However, the same rules apply to any funds you park in a brokerage’s cash management account or money market fund, hence those should be your basis of comparisons rather than against the larger financial institutions.

As for security, MAS regulations require Chocolate Finance to ringfence and segregate customer funds in a separate, third-party account for safety reasons. Hence, in the rare event that Chocolate Finance were to close down, your funds would still be safe.

Translated into simple English, that means that your deposits and $$$ are held separately from Chocolate Finance’s operating capital, so in the event Chocolate Finance goes bust, your assets with them are still safe. This is held in custody by HSBC and State Street under ChocFin.

TLDR Conclusion

At 4.2% p.a., customers can evaluate if Chocolate Finance’s offer is attractive enough for them to park their spare cash in without having to do anything extra.

Personally, a few of my friends and I already have up to $20,000 each invested in this since last year, when it was open on a by-invite only basis then. We made the choice because we still have spare cash that sits outside of our high-yield bank savings accounts’ interest rates…and we decided it doesn’t make sense for us to put more than $100k at less than 4% in each bank anyway especially if we’re trying to max out the SDIC-insured amounts.

However, if you’re someone who only wants to put your money in SDIC-insured accounts, then you should note that this is not covered. What’s more, risk-adverse folks who do not trust the underlying funds, or asset managers, or the team, may want to stay away.

For me, I’m ok to put a portion of my spare cash there and see how it goes. The past 1 year has been pretty good with Chocolate Finance – considering I earned more than 4% without having to do anything or worry about jumping through any hoops for extra rates (such as GIRO-ing my bills or salary, much less clocking a minimum spend on my credit cards, etc)…so I’m comfortable with this arrangement.

Want to get 4.2% p.a. for your cash on Chocolate Finance too? Click here to use my member code here to get early access.

Read the Terms & Conditions here before you do.

Important Disclaimer: This is a review and NOT a recommendation on whether to invest your funds in Chocolate Finance. I reached out to Chocolate Finance to partner with their team on this article prior to their second launch (under their own management and not Havenport) this month, but they had no editorial control or influence over my article, except to fact-check to ensure full accuracy.

All opinions are that of my own.

9 comments

While The interests are guaranteed at 4.2% till 31 Dec 2024, how about the $20k deposit? Is it possible that the $20k will drop in value? Just like equity, although the dividend may be consistent, but the share price may drop.

Hi I don’t see the the member code. Link just directed to App download.

When you click on it it will download the app with the member code already input for you at sign-up page.

No, this is not equities. The $20k will not drop in value. It’ll be the amounts above $20k that aren’t covered by the Top-Up program so that’s where it is debatable. So far through last year, no one has lost their capital amounts yet though – but everyone’s interest payments received differed based on the various factors I identified.

Are the interest deposited after midnight?

Hello, I click the link and don’t have the referral code.

Hello, I click the link and don’t have the referral code tho.

Hi Michelle! You can use this too: https://share.chocolate.app/nxW9/tl2v21z9

Hi Dawn, appreciate your articles and used your code!

Comments are closed.