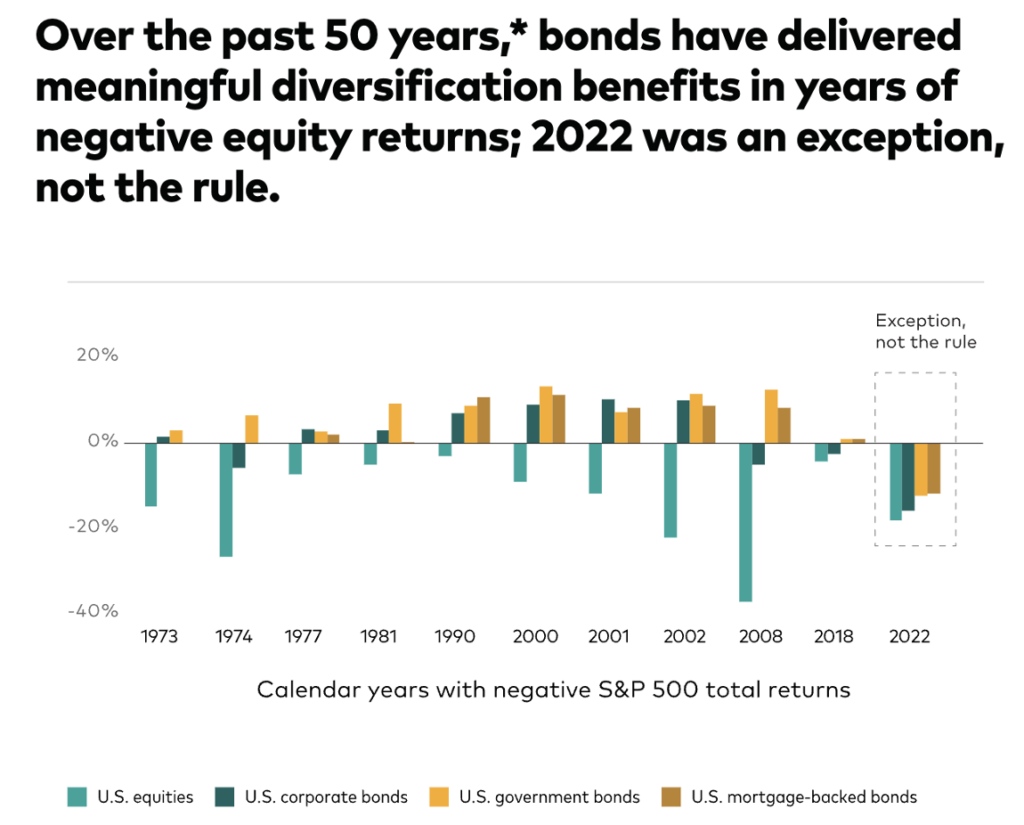

The past few years have been challenging for bond investors as central banks rapidly raised interest rates, which created uncertainty and volatility for both equities and particularly for long-term bonds.

After decades of very low yields, the Federal Reserve embarked on a very rapid rate hiking program in March 2022, moving the Fed Funds rate from nearly zero to over 4% in just nine months. This had an impact on the bond market, and the losses have been worse for holders of long-term bonds, including:

- 50% declines in some 30-year US Treasuries

- 75% declines in a 100-year Austrian bond

As losses grow, it would seem easy to give up on bonds.

But if you’ve been paying attention, you may have noticed that bonds are coming back into the spotlight now that the Fed is expected to either halt or cut interest rates soon.

After all, bonds perform better when interest rates start to decline, which is a stark contrast from 2022 where rising rates led to significant losses for both bonds and equities.

Many finfluencers have been advocating the S&P 500 instead of bonds – especially given its recent historical returns – but if you think putting 100% of your portfolio into the S&P 500 is “safe”, I suggest you think it through again.

Instead, I believe that the current bond market sell-off provides an attractive risk-reward trade-off with real yields now at multi-decade highs…provided you know where and how to look for it.

Why would investors put money in bonds?

Traditionally, bonds have always been a mainstay of defensive portfolios, given how it provides reliable income, help to cushion the volatility of stocks and ease the pain of a bear market (where stocks typically fall and bonds perform better relative to stocks).

What’s more, bonds generally come issued with fixed maturity dates, which also allows you as an investor to know when you can expect to receive your principal back.

Bonds tend to be redeemed at maturity and this gives you:

- The certainty of fixed income

- The certainty of knowing when you’ll get your principal back

Bonds therefore not only provide you with fixed income payouts, but also allow you to match your capital redemption with any future planned expenses (e.g. buying a new house or welcoming a new baby).

Personally, I primarily invest in bonds to balance the risk from holding only equities in my portfolio. What’s more, I’m cognisant that there’s always the risk of a recession, where one could get laid off and see their equity investments go down at the same time.

Owning bonds for their fixed income and stability helps me to diversify against asset class risks that way. Some of you might even recall a few of my public blog posts from several years ago, where I mentioned finding a bond that would pay me a fixed interest rate of 4.35% p.a. every 6 months. As that bond has recently matured, I can confirm now that I not only got paid my passive (coupon) income for the last 5 years, but also received my principal back in full at the end of it.

Is this a good time to look at the bond markets again?

Even though younger investors may only remember reading the bad news about bonds in recent years, but what you may not realize is that given the inverse relationship between bonds and interest rates, bonds prices will rise when the Fed lowers interest rates.

You may already see this starting to play out in the markets.

And because of the recent sell-offs, there may be some great investments to be made in bonds – if you know where and how to look for it.

Individual bonds vs. Bond ETFs

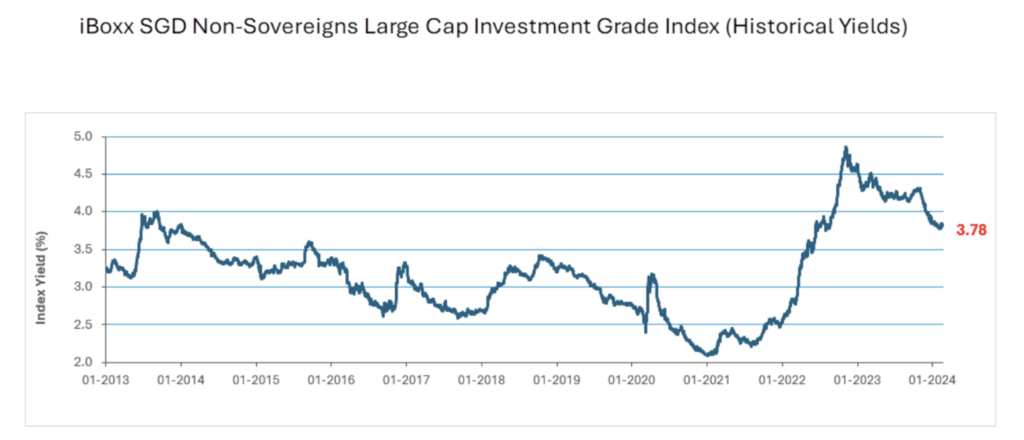

Generally, interest rates have significantly adjusted from their low levels and are relatively attractive from a historical perspective. Bond investors now have a chance to lock in these high historical yields for themselves if they wish, where these higher current yields also support a much-improved outlook for bond returns going forward and may help provide a stronger base for future returns if the Fed begins cutting rates.

Individual bonds

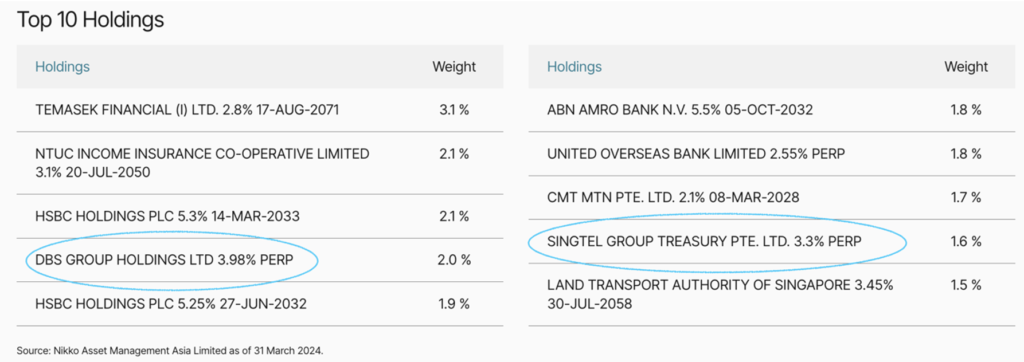

Take a look at DBSSP 3.980% Perpetual Corp (SGD) – an idea I got off from NikkoAM SGD Investment Grade Corporate Bond ETF’s Top 10 Holdings – as an example, which is still currently trading below par value (as of today) and pays out fixed income twice in a year until its maturity due date in 2025.

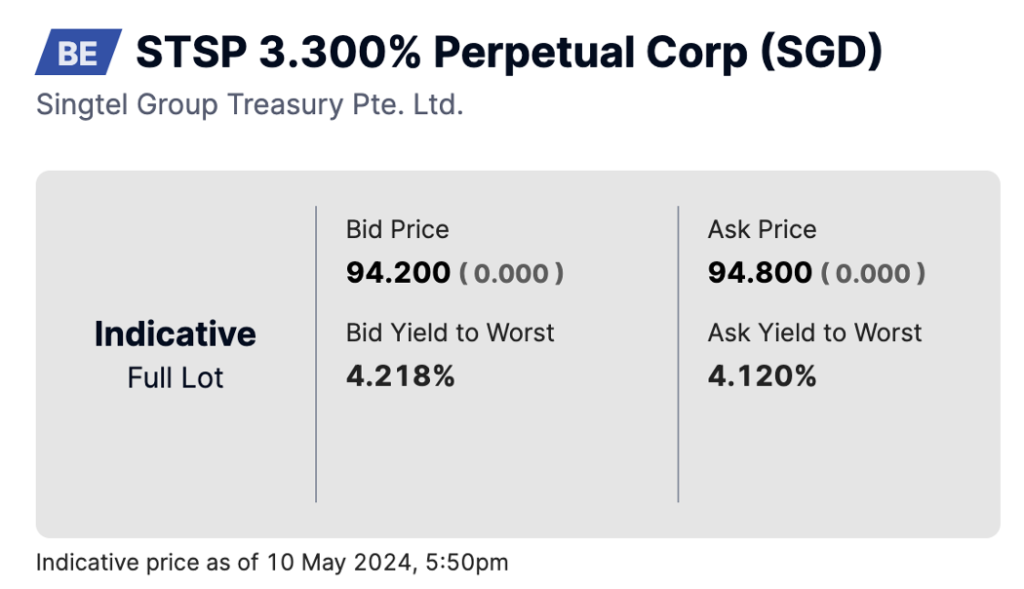

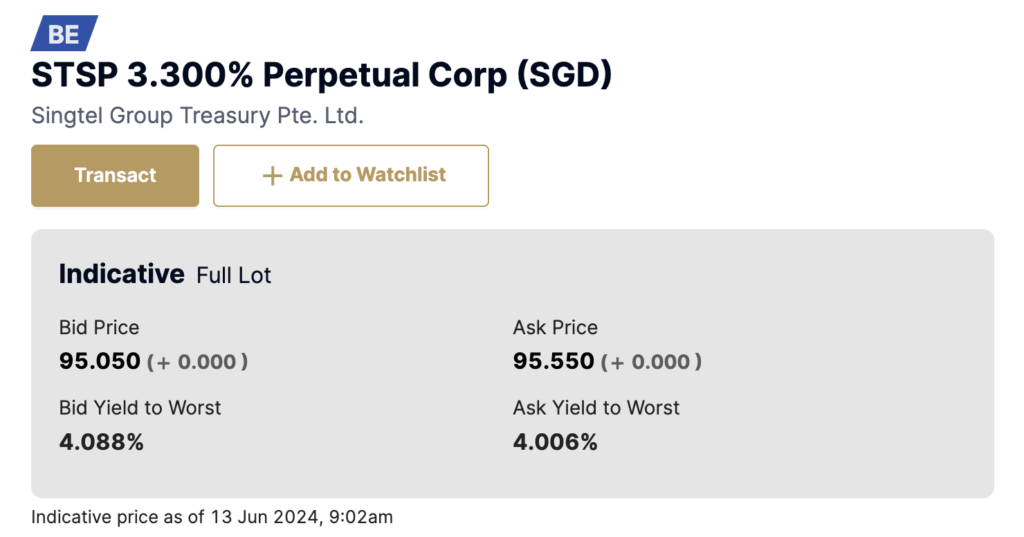

That isn’t the only bond trading below par either – here’s another example of a bond I spotted as trading below its par value: the Singtel Group Treasury 3.3 Perpetual Corp (SGD).

Bond ETFs

But putting your money in individual bonds could still be seen risky for some, especially if the underlying bond issuer does not redeem the bond after the stated period. An easier way is to invest in a bond ETF, where you don’t get paid directly by the bond or get your principal back at the end of a fixed period. Instead, the ETF manager is responsible for making your fixed income payments and managing a diversified bond portfolio.

Of course, you could continue to screen for undervalued bonds and analyse them individually, but if you prefer not to put your money in just 1 bond, the NikkoAM SGD Investment Grade Corporate Bond ETF allows you to diversify across these and several other investment-grade bonds at once.

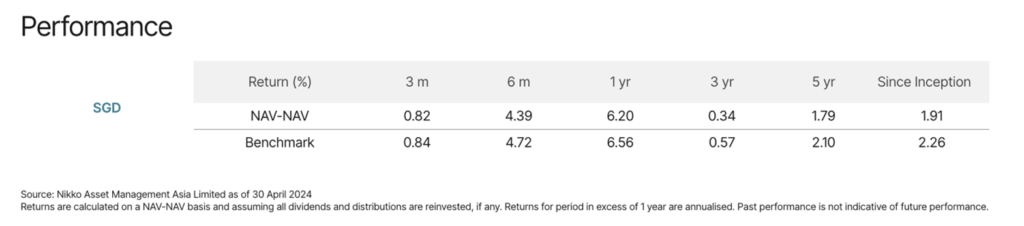

This ETF tracks the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index, which is made up of investment grade bonds issued by a majority of Singaporean companies and Singaporean statutory boards. And in case you haven’t noticed, this fund is already up 6.20%* in the past year (as last reported on 30 April 2024)

*Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance.

In fact, the higher yields and lower bond prices in the market today means that this can be an opportunistic time to look at bonds, especially investment-grade ones.

Government bonds ETFs vs. T-bills

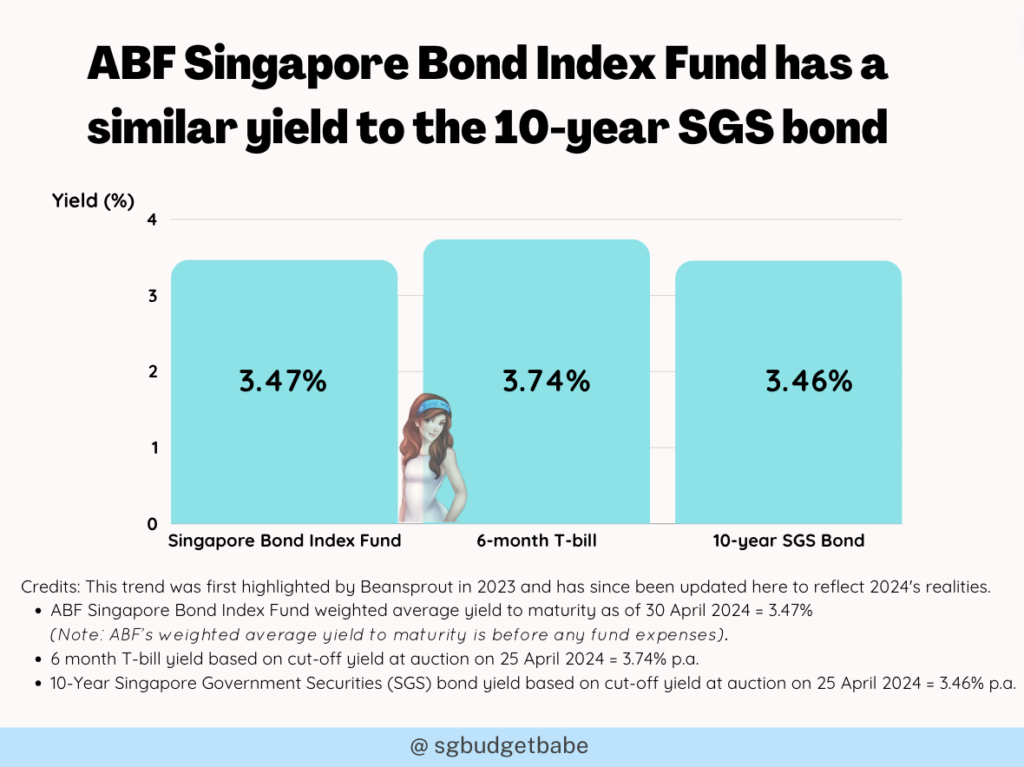

Or, if you prefer a safer choice with SGD government bonds, another ETF you may want to look at would be the ABF Singapore Bond Index Fund.

The ABF Singapore Bond Index Fund is one example of a bond fund that may be interesting for investors who wish to earn passive income through a portfolio of Singapore government bonds (one of the highest rated in the world), and are also looking for some potential medium to long-term capital appreciation should – or when – interest rates start to fall.

Of course, the flip side is also true i.e. investors may suffer capital losses especially if interest rates continue to rise.

If you’re mainly looking for one that will help diversify your portfolio beyond equities, then you’d appreciate how historically, the index of this ETF has mostly performed well during periods of difficult market conditions.

As T-bills have captured plenty of investor attention lately, you’d probably be wondering how the ABF Singapore Bond Index Fund compares against it.

| T-bill | ABF Singapore Bond Fund | |

| Net Yield | Higher yield currently, but may not always be the case. * | Lower yield |

| Minimum investment | S$1,000 | As low as about S$1 |

| Maximum individual holding | No limit | No limit |

| Term | 6 or 12 months for T-bill | Current weighted average maturity of about 10 years, but will be reinvested by fund manager |

| Capital guaranteed | Receive principal amount at maturity. Potential interest rate risk if sold before maturity. | Not capital guaranteed |

| Capital appreciation potential | Receive principal amount at maturity. Potential for capital appreciation if interest rates fall and sold before maturity. | Potential for capital appreciation if interest rates fall |

| Flexibility | No early redemption but can be sold in secondary market | Trades on the SGX |

| Diversification | Have to build bond ladder to diversify holdings | Diversified holdings that will be reinvested by fund manager |

Even though T-bills are displaying higher yields currently, please be mindful that this is not always the case – yields on T-bills are only higher at this time because of the inverted yield curve.

(An inverted yield curve means the interest rate on long-term bonds is lower than the interest rate on short-term bonds. This is often seen as a bad sign for the economy.). Under normal market conditions shorter end maturity bonds & bills would have lower yields.

The key thing you should note is that investing in T-bills require you to take on work of managing it by yourself, i.e. building your own bond ladder of T-bills or SGS bonds to build your passive income. You’ll need to actively monitor your own bond portfolio and rotate your money on a frequent basis (every 6 months for T-bills) as you keep reinvesting the funds.

So if you find that too much of a hassle, then what you’d get by buying the ABF Singapore Bond Index Fund is the same diversification through a portfolio of Singapore government bonds.

Conclusion: Don’t strike bonds off

With most of the online chatter currently focused on advocating for the S&P 500, I’ve seen many people – especially younger investors – go all-in with a 100% equities portfolio.

But remember, most investors will want to buy low and sell high. With the steep sell-off in the bond markets right now, this is when it might be worth taking another look at bonds again.

I hope this article serves as a good reminder for you to recalibrate your investment strategy and review your portfolio.

After all, investing in bonds can offer a balanced blend of income, safety, diversification, and risk management, which makes bonds a valuable asset class for a variety of investment strategies for investors.

Sponsor’s Message:

To find out more about the bond ETFs mentioned in this article, check out their fund pages here:

– NikkoAM ABF Singapore Bond Index Fund

– NikkoAM SGD Investment Grade Corporate Bond ETF

– Other ETFs by NikkoAM

Disclosure: This post is brought to you in collaboration with Nikko Asset Management Asia Limited. All research and opinions are that of my own. I highly recommend that you use this as a starting point to understand more about the various ETFs offered by NikkoAM (which you can also use for SRS and CPF investing) and my insights shared above to help you decide whether any of them fits into your investment objectives.

Important Information by Nikko Asset Management Asia Limited:

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

Neither Markit, its Affiliates or any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herewith nor as to the results to be obtained by recipients of the data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the data for any inaccuracies, errors or omissions in the Markit data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Markit has no obligation to update, modify or amend the data or to otherwise notify a recipient thereof in the event that any matter stated herein changes or subsequently becomes inaccurate. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the content, information or materials contained herein. Copyright © 2023, Markit Indices Limited.

The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index are marks of Markit Indices Lmited and have been licensed for use by Nikko Asset Management Asia Limited. The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index referenced herein is the property of Markit Indices Limited and is used under license. The Nikko AM SGD Investment Grade Corporate Bond ETF is not sponsored, endorsed, or promoted by Markit Indices Limited.

Nikko Asset Management Asia Limited. Registration Number 198202562H.

3 comments

Bear in mind also when you buy an ETF you’re paying fees (e.g. 0.17% for the SG Corp bond fund example above, or 0.195% for the ABF government bond fund) which eat into your yield slightly.

Dear SG Budget Babe,

Thank you for your sharing and explaination

Is the interest earned daily compunded ?

If I withdraw interest after 1 month or 6 month later ,will that make any difference ?

After the Top-Up program guarantee end in 31/12/24 , does that mean will no longer get 4.2% for first 20K?

Please reply to my email. Thanks

Daily compounded if you don’t withdraw.

If you withdraw interest after 1 month, you have less $ inside vs if you hadn’t withdrawn, so yes that will make a difference in the compounded amount you receive.

After the Top-Up program guarantee ends in December, we will have to see what Chocolate Finance announces on the yield paid out thereafter. No one can predict at this point what they’ll do then. If interest rates hike, they’ll have to offer a higher rate to stay competitive. If interest rates drop, I won’t be surprised if the new rate changes to a lower one too. Just look at last year’s 4.5% p.a. vs. this year’s 4.2% and you’ll know.

Comments are closed.