How should I invest if I’m a complete newbie?

Received 2 emails from readers this week that really made my day. They’re both 23 year old, female, and fresh from university into their first job.

Both of them asked about starting to save and invest. It reminds me of when I started on this #adulting journey too a few years ago – clueless about where to put my money in. #bbinvestments

Insurance agents who read my viral blog post tried to convince me to sign up for ILPs or unit trusts. I politely declined – when someone makes commission from selling you something, you should always question if they’re recommending that to you for their own benefit or yours.

Did you read about the MDRT female insurance agent this Sunday? At 25, she already has a car, a condo, and paid for a luxurious family holiday last year. Where did that money come from?

Selling policies lor. Go check.

But anyway, I digress. Here’s what I replied these 2 lovely girls in summary:

Focus on building up your savings first.

Learn to live within your means. If you managed to get by (while living a perfectly fulfilling life in university) with $500 a month not too long ago, there’s no reason to suddenly splurge like a princess just because you’re earning more now that you’re employed. Learn to live a frugal lifestyle. Spend on experiences, not materialistic items. Pamper yourself where it matters. Learn to set budgets. Track your expenses. Aim to save 10% of your salary. Then increase to 20%. Or why not even more?

Pay off your debts.

Got a tuition fee loan? Channel all your excess funds to paying this off first – there’s no reason for you to let the bank earn your money in interest for each month that you let the amount roll over. Got a credit card? Feel free to swipe that plastic, but make sure you pay off the full sum every month, and on time! $60 late payment surcharge can easily buy you a lot of meals. 26% interest on CC debts is nothing to be laughed at.

Outsource your risks and get yourself protected. Or else your savings might be gone in a second if anything unfortunate happens to you.

I don’t favour all insurance agents, but I’ve repeatedly emphasised on my blog how important it is to get insurance for yourself! CPF has also gotten me to talk and write about this before when MediShield Life was launched last year, because too many people were under the misconception that it alone was enough.

For God’s sake, buy yourself insurance. Outsource your risks to the insurance companies and be smart about it. Buy the right policies. But don’t overpay for your insurance either.

And now finally, invest like a beginner!

People always say that the best time to start investing is today. My good friend likes to joke that it should be yesterday. 😅😂

If you know nuts about investing, it is simply about letting your money work for you and grow over time. The easiest way is to start with a good savings account that pays you interest for the money you put with them. I like OCBC 360, UOB One and BOC SmartSaver. (Search for those posts on my blog.)

The best way to learn how to invest and pick stocks? Read finance blogs.

I like to read stock analysis from other people, whether or not we agree or disagree that the stock is a good investment. The important thing is in learning how they think, how they approach the investment quadrant, and their art of valuation.

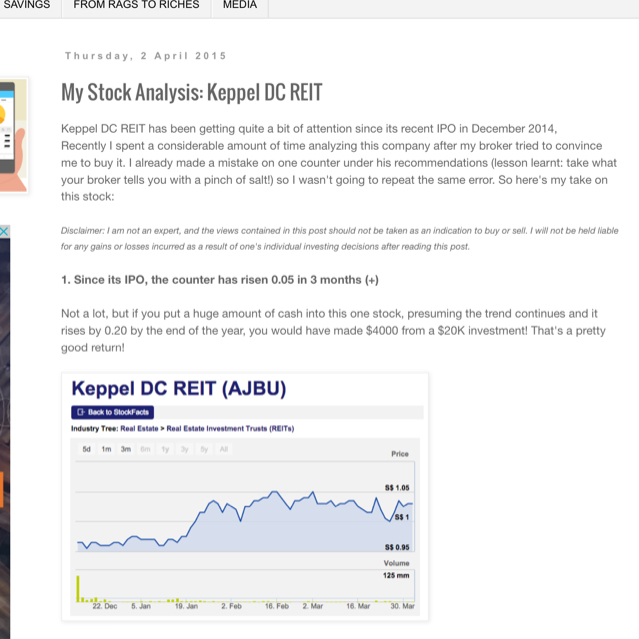

You can get a peek into my investment mind for this on my blog. Search “stock analysis” or look for Keppel DC REIT, Procurri, McDonald’s, Comfort Delgro, Rickmers Maritime (most recent post).

You can then see how I predicted that Procurri and Rickmers Maritime would drop in stock value. And it came true. Did I have a crystal ball to see into the future? No, but by my investment thesis, I felt a strong conviction that my prediction would be correct. And it wasn’t long before I was vindicated.

If you’re really clueless on where to start, look at investing in bonds.

I like the Singapore Saving Bonds by our government. It gives you a juicy yield and has no early penalty if you wish to withdraw your funds early. Between an endowment plan and SSB, I’ll always choose the latter.

What about corporate bonds? Hmm I’m not a fan. Search my blog for my breakdown of Aspial bonds to understand why. (Aspial sells jewellery. You might recognise their other brand, Lee Hwa jewellery.)

Buy stocks that you know and are comfortable with. I bought Apple stocks a while ago (have sold now). Why? Because I like the brand, I know customers are loyal to it such that they’re almost like a cult (just look at the iPhone 7 response man), and their management has a solid record of delivering results. That isn’t gonna disappear overnight.

With so many #dayrebrides and #dayrehomes getting their stuff from #taobao, which company can benefit from this growing e commerce market? Maybe SingPost? Or Alibaba?

Or if you’re really scared you’ll pick the wrong stocks, then just buy an ETF. I highly recommend checking out the POSB InvestSaver for a start! You get to buy into the top 30 companies in the Singapore stock market including DBS, Jardine, CapitaLand, etc within a single ETF purchase that way.

Another foolproof way is to adopt the Permanent Portfolio strategy. I explained this on my blog in detail too so feel free to pull it up.

There’s no shortage of investment options!

Disclaimer: I’m invested in SingPost myself.

One advantage we have as females when it comes to investing is our eye to spot trends. Men tend to be slower in this regard.

Or what about #PokemonGo? Which stocks can benefit from this craze? Hehe answer is up on my blog, I researched into this just last month!

See, investing isn’t really as hard as you may think it is.

#dayreinvest #dayrefinance #financialfreedom #dayreinsurance #dayresavings

Love using Dayre? Believe that this platform will only grow from here? Then you might want to look at the company that owns it – Nuffnang! Did you know you can buy Nuffnang stock too? 😏 @nuffnangsg

Should I start a series of stock analysis here on Dayre? Let me know if there’s any you girls want me to look at!

Pros and cons of Keppel DC Reit. All that data you have on Facebook, Google and more? It is stored on data servers – this is the business of Keppel DC.

5.25% is quite high! But is this a good corporate bond to invest in?

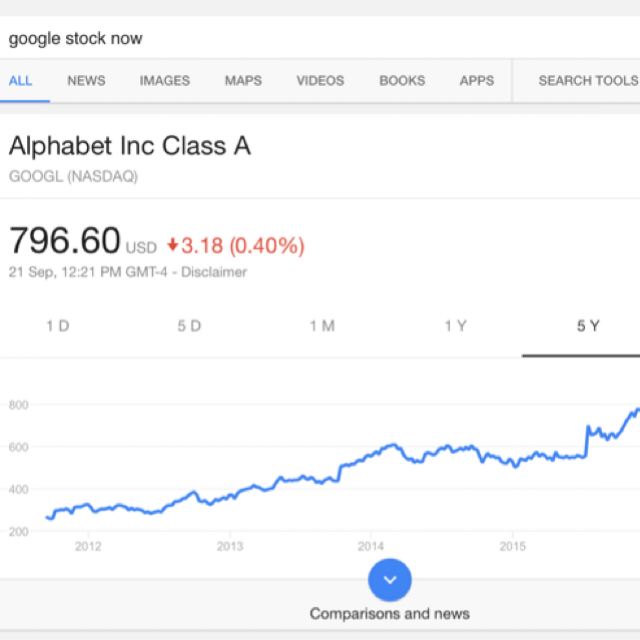

Look at Google’s insane stock price!

I have 2 e-books that I’ve given out to over 300 readers since January. If you want a copy, head over to the blog post for instructions on how to snag one for yourself! No hidden charges or ads I promise. Financial literacy should be free.