Finding your investment approach!

Are you someone who likes to buy things when they're on sale? Or get things at really good value for money?

Then you might just be naturally more inclined to value investing.

Or are you someone who's a little afraid of the stock market and all its risks? Perhaps you want to invest, but are scared to lose your capital? If you're satisfied to stick with tried-and-tested companies who are too big to fail, then perhaps you might be more of a blue-chip investor.

Or are you looking to get passive income at a decent yield? Perhaps you might prefer dividends or income investing then.

Maybe you're easily excited. You like to keep up with the latest trends and spot the next big thing. You get excited when Apple releases a new gadget. Who knows, maybe there could be a growth investor lurking inside of you.

This post is all about the different styles of investing when it comes to selecting and buying stocks on the open stock market. While there are many different approaches, I'll focus only on the more common methodologies and what they tend to look like. #bbinvestments #dayrefinance #dayreinvest

Knowing your investment strategy is important as it sets the foundation of your entire investing journey. It provides a set of rules, behaviors or procedures, designed to guide an investor's selection of an investment portfolio and what stocks to narrow their choices down to. Individuals have different profit objectives, and their individual skills make different tactics and strategies appropriate. Some people fail badly at value investing while others excel at spotting growth counters.

Which one are you?

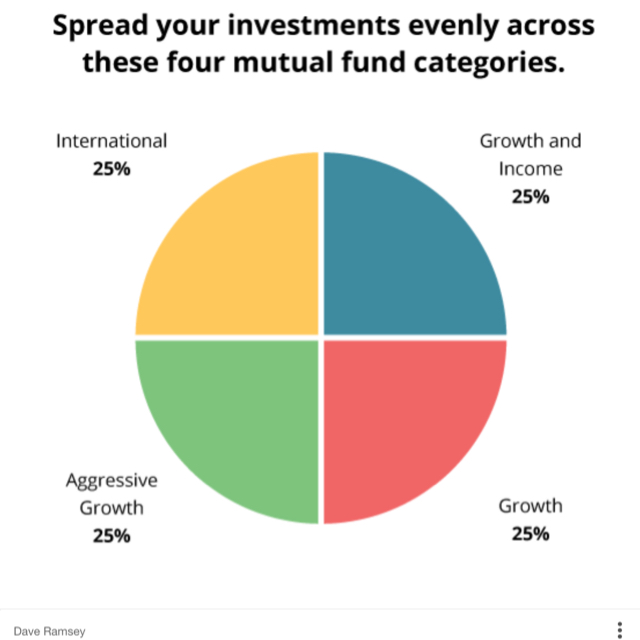

Can't choose? You don't necessarily have to. Maybe building a diversified portfolio across different types would be your cup of tea?

Value investing

You'll try to go for the market leaders so that you can sleep soundly at night knowing that there's a very low chance of the company folding. While many oil and gas companies have landed in hot soup and some closed down due to being unable to repay their debts, the bigger conglomerates like Keppel and Sembcorp are still surviving.

Value investors look at getting a valued stock at below cost price. That's like someone paying $10 for a bag that actually retails for $20.

Value investors like companies whose assets trade for less than their intrinsic value. This occasionally happens when the market has yet to uncover a gem, or when bad news causes price to drop unreasonably, or when other valuations are causing the market to price the stock at lower than what the company is really worth.

Key financial ratios that the value investor looks out for are the Price to Book (PB) ratio or Net Asset Value (NAV).

The most important financial statement to a value investor is the Balance Sheet. This is where they determine whether a company is undervalued.

Warren Buffett and Benjamin Graham are famous value investors whom the world looks up to because of their track record in identifying undervalued companies whose stock prices later rose once the market realised the price wasn't an accurate reflection of the company's worth.

Sometimes this includes investing in unloved companies.

Since value is a subjective term, you'll have to decide yourself whether you think a stock is undervalued or not.

Income / dividend investing

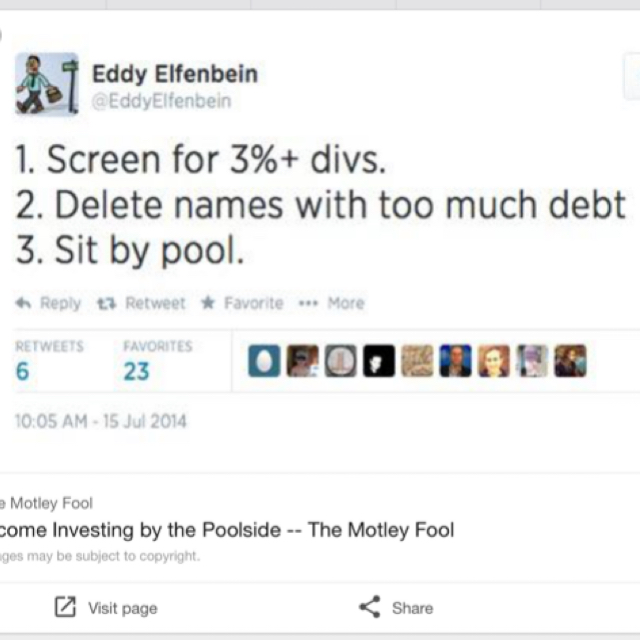

An income investor's approach. Of course, investing is never that easy, but this tries to simplify it.

Income investors invest in the stock market looking for yield. For instance, if I put in $1000, I hope to get back 5% returns every year.

These investors look for companies that produce growing and sustainable dividends. They'll look at the dividend payout ratio to assess if the company keeps all of its profits, or shares them with its shareholders.

Since you can only afford to give dividends when you're in profit, these investors therefore tend to zoom into the Cash Flow Statement to see how much free cash flow the company generates. If there are excess profits, these are often channeled back to shareholders, and that's where yields get juicy.

Some call dividend investing a fairytale. I shall not comment here, but you can google it on my blog using the search function.

Income investors feel shiok when they receive money every quarter / year. Since we don't usually get high interest rates from the banks for our savings, income investing can be a good way to help us keep up with inflation and get passive income without doing much

StarHub is a widely recognised dividend counter.

Up and up and up!

Growth investing.

Growth investors look for companies which have the potential to grow bigger. Technology and biotech companies tend to fit this bill, because when their research do accumulate into a breakthrough, their profits usually start rolling in after and stock price then rises.

One good example of a growth company would be Google and Salesforce, which has grown over 1000x already.

However, growth companies do not usually pay out much dividends as they retain the cash for expansion.

Thus, your returns will be more on capital gains rather than on yield alone.

Key financial ratios would be Price to Earnings (PE) ratio and Return on Equity (ROE) or Return on Assets (ROA). The Income Statement of the company will be your best friend for you to see if they're indeed growing their earnings every year.

Blue chip investing.

Technically this is not a common investment approach in the financial world but I'm including this because it is very typical Singaporean behaviour.

Kiasu, kiasi (scared to die or lose).

Some investors like sticking with big and known companies who are too big to fail. They therefore are happy to look for blue-chip counters who pay 2% yield or upwards, and get it at a fair price. Buy and hold is sometimes their investment strategy.

In SG, some blue chip counters include Keppel & CapitaLand.