[Updated for 2019]

Back when I was still in my first job, my annual income tax was only about $200. This was based on a yearly income of $30,000, of which I saved $20,000 – read about how I did it here. (Nope, no bonuses either.)

I don’t mind paying taxes as I understand and appreciate the fact that the money is channeled for the government to help the lower-income groups, as well as pay for other public goods such as our roads, education, etc.

But ever since I got headhunted to my second, and now third, job where I received a pay raise each time, my income taxes have jumped significantly and it has come to a point where I’ve been looking into (legal) ways to reduce paying so much. For context, my income tax jumped by over 10x, but my salary hasn’t jumped 10x at all!

I’ve talked about how achieving financial freedom involves cutting down your expenses while looking for ways to increase your income at the same time. Income tax is definitely one area where you’d want to reduce, because Singapore’s tiered income tax system is such that the more you earn, the higher percentage of taxes you’ll have to pay.

For someone earning $30k a year, they only need to pay 2% of income tax, or $200.

If you earn $3,500 a month and get a 13-month bonus, you’ll be looking at an annual tax of $935. If you’re luckier and get more (eg. 3 months bonus), you can expect to pay $1,425.

But if you earn $80k annually (about $6k monthly with bonus), you’ll be paying $3350.

If you earn $100k a year, you’ll be paying over $5k…which could otherwise pay for a holiday to Europe!

While evading taxes is a crime, there are perfectly legal ways for you to reduce your income taxes. Here’s some:

1. Top up your CPF account (and/or that of your parents).

I used to give my parents their monthly allowance in pure cash. However, ever since I found out about this hack, I’ve changed this to put the money as voluntary contributions to their CPF accounts instead. Given that my dad is already retired and my mum will soon be eligible to withdraw her funds, this approach makes a lot of sense to me as my parents still get their money, and I get to concurrently enjoy tax rebate for the same.

Since the maximum tax relief we can claim is $7000, you can also make voluntary top-ups to your CPF Special Account (SA) where it can earn attractive interest rates, and up your tax relief amount further to a maximum of $14,000.

Do it before the end of the year so you’ll get the tax relief! I’ve blogged about this previously here as well.

2. Supplementary Retirement Scheme (SRS) relief.

If you’ve already maxed out your CPF tax reliefs, you can also make use of the SRS relief scheme to enjoy up to $15,300 of tax relief if you and/or your employer make contributions to your SRS account!

3. Donate to charity.

It (literally) pays to be kind!

I’ve always believed in contributing to charity to help those who are less well-off than us. After all, I come from a family whose parents couldn’t even afford to send me to university, and I benefited from the university scholarship (generously funded by alumni) which allowed me to pursue my studies, so I’m extremely familiar with the struggles of not having enough money.

Because of my background, I have a soft spot towards donating to bursaries and other funds for needy students.

Aside from helping those who need it, the additional good news is, you can claim 250% in tax deductions based on the amount you donated!

4. Claim tax relief for supporting dependent or handicapped grandparents / parents / siblings / spouse.

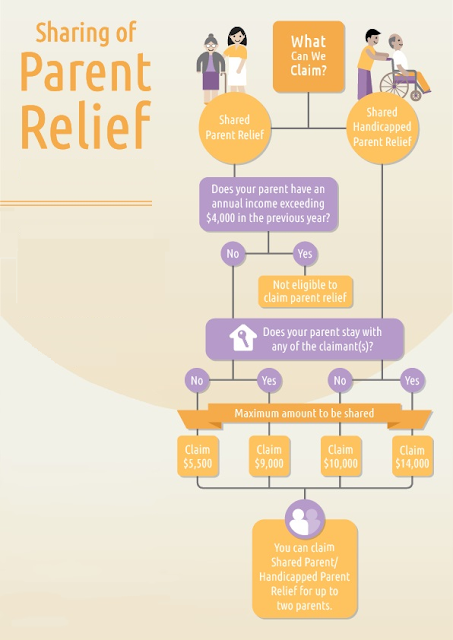

If you have or parents, living with you who are older than 55 and earn no more than $4,000 annually, you can also claim up to $9,000 tax relief for supporting them (or up to $14,000 if they’re handicapped, in which case the income requirement doesn’t quite apply). But if you have siblings who are claiming for the same, you’ll need to split that evenly with them. There are also tax reliefs if your grandparents stay with you.

Unfortunately this scheme doesn’t apply to me since my mom is still working and my dad only just retired recently, so his annual income still exceeds $4000 for this year, but I’ll be able to claim this soon next time!

If you’re supporting a handicapped spouse or sibling, you can also claim up to $5,500 of tax relief.

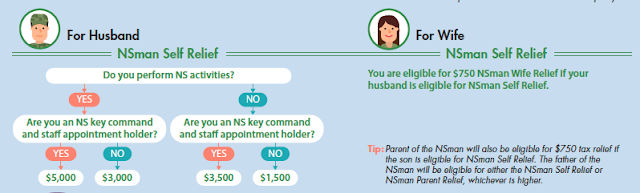

5. For married spouses, claim NSman Self Relief.

Husbands can claim up to $5,000 if they’re a key appointment holder (or up to $3,000 if they’re not but served reservist), while their wives can claim $750 tax relief.

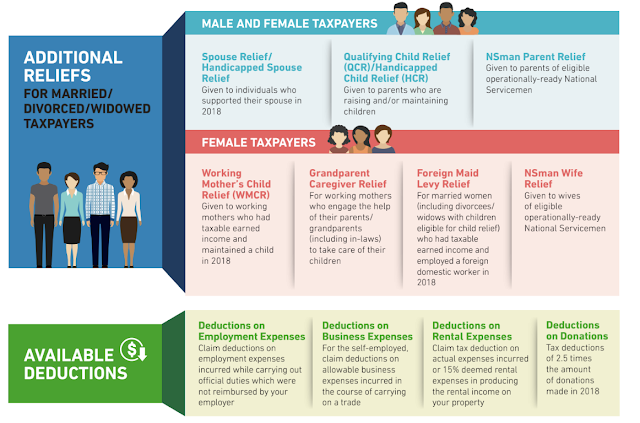

6. For parents, claim Parenthood Tax Rebate / Qualifying Child Relief / Working Mother’s Child Relief / Foreign Maid Levy Relief

It seems like the government is really encouraging us to have kids, as they’re giving out a lot of tax subsidies for those who do!

On your first child, you can claim $5,000 of Parenthood Tax Rebate. If you have 2 kids, add on another $10,000 for your second child. Or, if you’re like my cousin with 3 children (or more), you can add on $20,000 more for each subsequent child! This works out to a significant total of $35,000 of tax rebates if you have 3 children and make the maximum claims for them!

[New in 2019]

I gave birth last year and received my IRAS letter informing me that our child relief of $4,000 will be automatically pre-filled for us and divided equally between my husband and I. For those of you who would like to change your allocation basis, remember to indicate when you file your taxes online.

Under the Qualifying Child Relief, you can also claim up to $4,000 per child if your offspring is younger than 16 years of age or studying full-time.

Tip: the spouse with the higher income should be the one claiming for this, as it could probably reduce his/her taxes by a larger margin!

For mothers who are working and handling dual roles (mad respect to you women), you can claim 15% of your earned income in tax reliefs for your first child, 20% for your second, and 25% for each child if you have 3 kids or more! Do note that the total cap for QCR and WMCR is $50,000 per child, but that’s already a lot of tax deductions (and making me think twice about whether we should aim to have 2, or 3 kids!)

If you’re hiring a domestic helper at home, you can also claim twice the amount of foreign maid levy paid for a maximum of one foreign maid last year against your earned income.

7. Claim reliefs for any courses attended.

If you went for any approved courses, seminars or conferences last year that is relevant to your profession as a part of skills upgrading, remember to claim reliefs on those too! There is a maximum relief of $5,500 on those, including but not limited to examination fees, enrolment fees, tuition fees, etc.

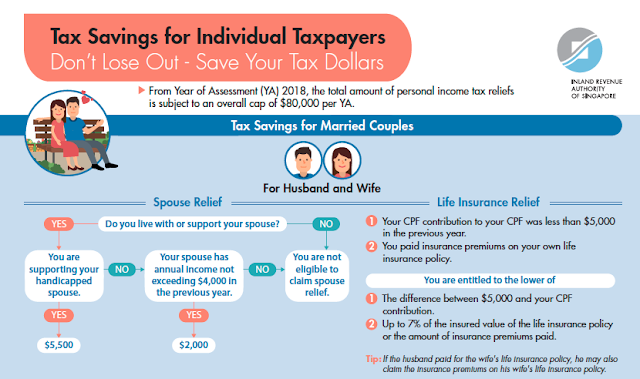

8. For the self-employed / unemployed, claim life insurance relief.

Did you know? If your CPF contributions last year was less than $5,000, then you can apply for reliefs on the premiums you paid for your / your spouse’s life insurance policy. You can claim the difference between $5,000 and your CPF contribution, up to 7% of your policy’s value, or even the amount of insurance premiums paid (whichever is lower).

9. Business owners, remember to claim deductions on your business expenses.

Every business incurs an operating cost, whether you’re a small business startup running your online shop on Instagram, or a bigger company hiring full-time staff, or even part of one. As long as you’ve incurred business expenses by which you were not reimbursed for, you can claim deductions on them, but do make sure that you keep supporting documents as IRAS might check routinely to confirm whether your deductions are valid. Don’t cheat! It’s not worth it if you get caught.

10. For landlords, claim tax deductions on rental expenses.

Saving up to 15% of your gross rent or actual rental expenses incurred can be quite significantly, while protecting your (somewhat) passive rental income earned!

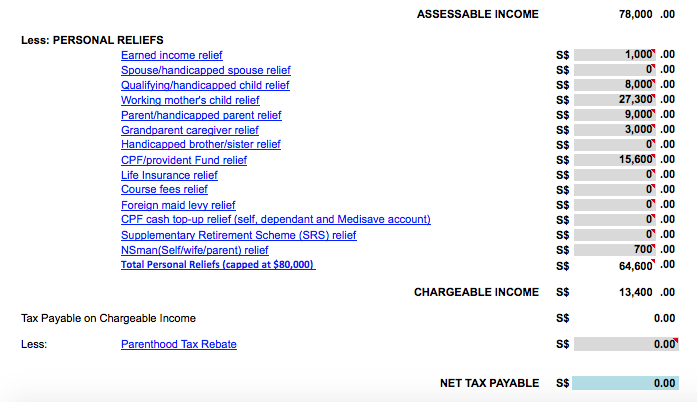

Worked Example

Thus, by using the (applicable) methods above, a working mom (under 55 years old) who earns $6k a month with a 13-month bonus, yet has 2 children and lives with her retired parent who’s helping to care for her kids, can get away with paying NO income tax, instead of the original $3,210!

*Assumes the following parameters:

That’s a whopping $3,210 saved in taxes (which you can then use to fund a holiday abroad, or other expenses) as long as you make full use of the reliefs available!

(I haven’t even factored in Parenthood Tax Rebate – which should be $25k in this worked example – and already this mom doesn’t need to pay a single cent of taxes lol!)

And that, my dear, is how you can legally get away with paying ZERO taxes in Singapore.

As your income rises (the moment you get any pay raise, commissions or bonuses), you’ll soon realise that your income taxes rise disproportionately and you could be paying a huge chunk if you aren’t savvy about the various relief schemes available for you to tap on. Considering how much you’ll have to pay otherwise, this is where saving on your taxes become increasingly important!

However, do also bear in mind that there is a cap of $80k on the amount of tax reliefs you can claim. You can also calculate your income taxes and reliefs here on the IRAS income tax calculator.

Looking at the schemes available, wouldn’t it make sense for the husbands to be stay-at-home dads while the mothers go out to work? 😛 (since there isn’t a working fathers child relief scheme). If you want to reduce your income taxes, having kids will definitely help!

At any rate, just don’t try to avoid paying taxes as the Singapore government now considers that as a predicate to anti-money laundering! That involves personal and even criminal liability, so just be a good citizen and pay your income taxes. But be a smart citizen so you can get away with paying less, or even none at all 😉

Public Service Announcement (PSA): Remember to file your income taxes by April 18, 2019 🙂 and don’t forget to make use of these tax reliefs and deductions that I’ve just shared!

With love,

Dawn

Note: This post was written in conjunction with IRAS, and all infographics shared here are rightfully credited to them!

1 comment

You probably saw how Bitcoin increased over 900% over the course of last year.

It was wild but not totally unprecedented if you’d been watching cryptocurrency over the last several years.

And here’s the crazy thing:

There are many other coins that still have tons of room to grow.

You may have heard of Ethereum, Litecoin, Ripple, and others but there are more coins and many more opportunities –

Follow the link below to get the full story.

https://cryptocrusher.net?46df4gsd4f

Comments are closed.