2018 was the year my life changed forever, as I got pregnant and gave birth to my firstborn within this year.

|

| Hello baby Nate! |

Once you have a life you’re now responsible for, and one who’s so vulnerable and completely dependent on you for their survival…your whole world undergoes a massive change. Gone were my days of quiet, personal time and being able to work / write without stopping; now, I’ve to drop everything once my baby cries and go to tend to him.

But of course, a baby comes with huge costs as well, and we knew this would significantly affect our finances from here on. I will no longer be able to skimp and save as much as I did before, now that my income will need to account for another human being as well.

With the year coming to an end, it is time to look back again on how I fared this year and set some new resolutions to usher in 2019. But before that, here’s a quick recap of previous years:

- 2014: Saved $20,000

- 2015: Saved $30,000 and grew income

- 2016: Saved $40,000 and grew income, hit $100k in net worth at age 26 including CPF

- 2017: Saved $45,000 and doubled my net worth in a year

Did I manage to double my net worth again this year? No, as a substantial amount was spent from my pregnancy to delivery to confinement period, but the silver lining was that I did manage to increase my savings because I worked harder than I ever did at my job, and this in turn boosted my income.

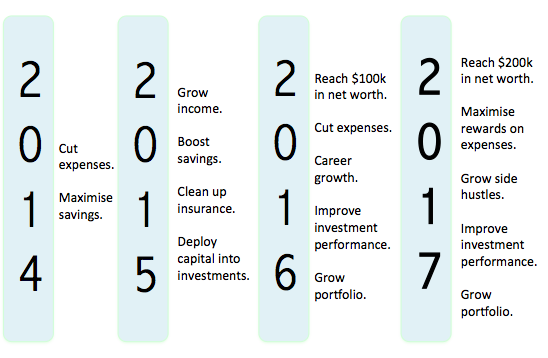

These were my goals in previous years:

These were my goals in previous years:

I didn’t really set any goals for 2018 as my aims remained largely the same as the year before – boost income, maximise rewards on expenses, grow my side hustles, improve my investment performance, and grow my investment portfolio. Some were achieved while some weren’t.

1. Increase income – Achieved!

Knowing that this would be my last chance to work my ass off before the baby arrives, I spent most of this year focusing on work and boosting my side income through weekend tuition and the blog. Readers would probably have noticed that I’ve also taken on some affiliate partnerships (3) and done a couple of sponsored posts this year.

I’ve always been selective about the clients I choose to work with, and you can read my policy here – to qualify for a post on this blog, the product or service needs to be something I’ll personally use and be willing to pay for even if I weren’t sponsored. An interesting trend to note was that a lot of (unknown to me) cryptocurrency and investment companies started approaching me for a sponsored post, but I rejected them all as I didn’t believe enough in their offering to talk about it. Money is good, but trust once broken is harder to win back, and I value my credibility far more than short-term monetary payments.

On weekends, I also took up more tuition assignments for the last few months and that helped to boost my income. However, I don’t foresee next year to be the same – in fact, I’ve made a conscious decision to cut down on my weekend tuition and hence there will be significant income loss in 2019 for this area. While I’ll still be teaching a handful of GP students for the A Levels, I don’t intend to continue taking in any more English O Level students anymore. Although the drop in income is saddening, I prefer to spend quality time with my baby while I still can. After all, they grow up way too fast. Money can be earned back, but time cannot.

2. Grow savings – Achieved!

There was a slight surprise here as I had expected my savings to go down, but as it turned out, my workaholic days paid off handsomely in the form of increased earned income. Thus, my cash savings this year came in at $50,000 – mostly due to increased income, a decent work bonus, dividend payouts, and a portion from cashback and interest on my high-yield bank saving accounts. But the growth rate in my savings has dropped. This is in line with what I said previously about your 20s being the best time of your life to save before your financial commitments of a housing mortgage and kids arrive, so this is hardly surprising at all.

Nonetheless, I’m hoping to hit a quarter of a million before I turn 30, so let’s see if that materializes.

Our biggest expense this year was for the pregnancy and delivery of our baby boy. On the travel front, we spent on 2 holidays this year – Cambodia and London, of which cost us $600 and $2,800 per person respectively, similar to how much we’ve spent in previous years as we keep to our aim of touring one long-haul and one short-haul travel destination every year. This was only possible through much planning and being savvy about our activities and payments, enabling us to make more memories together as just a couple before our baby arrived.

From here henceforth, I don’t think I’ll be able to save so much anymore as our expenses will be going up and my income will be going down since I’ve scaled back on my weekend work. The craziness is over. My baby boy needs me now.

3. Increase net worth – Achieved!

In November 2016, I managed to reach $100k in net worth (cash + investments + CPF), and doubled it to $200k last year. However, this year, due to a downturn in the market, my investments didn’t fare as well and it was by a stroke of pure luck that I outperformed the market simply by holding on to cash…because I was too busy with my pregnancy to do anything else.

This year’s contribution towards my net worth increase largely came from:

- Increased work income

- Investing in a government-grade AAA bond (a.k.a. topping up my CPF and smiling as I look at all the compounded interest over the years)

- Bank interest on my high-yield savings accounts

- Increased cashback from my credit cards and other tools

- Dividend payouts from stocks

4. Fill protection gaps – Achieved

This year was the year I revamped our entire insurance portfolio and made sure our protection needs were well taken care of, now that we have an additional dependent. Aside from the policies for my husband and I, we’ve also gotten insurance for our baby and spent some time making sure our downsides are covered.

The last remaining task for me would be to write our will, which I hope to finish within the next few months.

5. Improve investment performance – Not achieved 🙁

For one simple reason : I didn’t have much time this year. Aside from a few bonds and IPOs that captured my attention, I mostly spent the rest of my investment moves on adding to positions that I already owned / had waitlisted for a long time.

I had completely underestimated the effect pregnancy would take on my body, and the afterbirth recovery. Reading annual reports were now considered a luxury…if I could even find the time to do so. As a result, I mostly held onto cash for this year, which eventually turned out to be the right move (by a stroke of luck and timing) as global stock markets went into a downturn, and SGX wasn’t spared either.

Hence, even though my returns “outperformed” the market, I think the truer statement would be to admit that I did not improve my investment performance, as I was not as active as I would have wanted to be, and only made a small number of buy and sells this year. That is nothing to be proud of since it is by a stroke of pure luck and timing, and hence I would consider my investment performance to have remained stagnant..

Cryptocurrencies also took a skydive, but as I had limited myself to only investing a sum that I could afford to lose, I’m still holding on to my cryptocurrency portfolio as I’m still bullish on them in the long run. There has been a lot of speculation on prices within this sphere, and I took a step back from February onwards once I became pregnant. Till date, I have no intention to sell them.

Goals for 2019

Since my income will drop next year, and as expenses go up, my savings rate will probably go downward from here. In addition, we’re looking to get a place of our own in 2019, so that will be another big financial expense.

All I can say is that I’m glad I saved crazily while I had the chance in my younger years, as it is getting harder now.

|

| I promise to be there for your milestones, baby Nate. |

As we move into 2019, I realise that my goals have changed. Instead of focusing on the financial goals alone, I also intend to spend more time with my baby and learn to become a good parent. Of course, that will include teaching him how to be financially savvy and not falling for scams. I have also started a savings account for him and will use the money to implement my child’s investment portfolio in 2019, which we intend to hand over to him when he turns 21.

A key lesson I learnt this year? That there’s more to life than money. Yes, we still need to manage our finances and make sure we plan for retirement, but someone wise told me this:

Money can always be earned back, but your time with your child cannot. They grow up too quickly.

I’ll leave compound interest to work its magic on my cash and investment portfolio, while still keeping an eye out for opportunities in the stock market. More than anyone else, I’m secretly hoping for a market crash because only then do the big opportunities appear. I’ve been watching on the sidelines these past few weeks, and if the stock market remains down or dips even further, I’ll be looking for a chance to enter.

See you in 2019!

Till then,

Budget Babe

5 comments

Hello! Can i ask how will you calculate your net worth now, especially with a child now and soon, a house? I feel like I've been saving since starting work 3 years ago and feel like my savings is constantly being depleted, but I guess I also get smth in return (e.g. downpayment for a house). but i find it difficult to track then! Any advice? (:

Personally I won't be factoring in my house that I'm staying in as part of my net worth. My formula for net worth can be found in my 2017 breakdown 🙂 consists of cash, CPF and investments only.

Hi! Was wondering how would you set savings goals for yourself now with a baby and next time a house? I feel like I've been saving like crazy since starting to work but recently it got depleted due to our house downpayment and upcoming reno… how would you calculate your net worth next time?

My net worth formula is always cash + CPF + investments only. It excludes house and car because these things depreciate, and I'm too lazy to input a depreciation value year after year.

I don't have any saving goals for 2019 so far because I need to monitor how a baby will affect our expenses first this year before I can set more accurate saving goals for 2020 and beyond 🙂

Just discovered your blog, and I've back read your posts from '14. You're an inspiration!

Comments are closed.