Worried that you might be the victim of a fraudulent car accident? Here’s what you need to do to protect yourself.

Ever been in a car accident that made you realise the dark nature of some drivers – especially those who try to twist the incident to their advantage and claim thousands of dollars from you?

Let’s face the truth of motor accidents in Singapore – some are staged by syndicates for a quick buck, while others simply involve opportunistic (or dishonest?) drivers who inflate claims to their benefit…all at your expense.

For experienced car drivers, these tales are a norm, or perhaps you’ve even encountered a few yourself. But if you’re a new car owner, it is only natural to feel anxious when your first motor accident occurs.

Just like the “buffet syndrome” that plagued the healthcare industry (where consumers do not have to pay out-of-pocket for their hospital bills thanks to insurance), the same is happening in the motor industry; except that the authorities have yet to intervene.

How is this possible?

Thanks to debatable car repairs and opportunistic car drivers, that’s how.

Common tactics used

Learn to spot the common tactics these rogue drivers typically use so that you’re less likely to become their next unfortunate victim.

Some car drivers take advantage of accidents (no matter how minor) to claim a huge sum of money from the other party. It is easy to recognise such opportunistic drivers: they usually ask you for a private settlement in cash (usually an exorbitant amount), and if you decline, they threaten to file it against your insurer and sue you for damages.

Aside from vehicle repair costs, one thing you should particularly watch out for is when the other party makes “false personal injury claims where personal injuries are grossly exaggerated”. This is also flagged out as an example of motor insurance fraud in Singapore by the General Insurance Association.

Common tactics that such drivers tend to use include

- threats at the scene of accident

- inflating car repair claims (usually at an unauthorised workshop – one unaffiliated with any insurer)

- ridiculous claims for “invisible” medical conditions that are difficult to prove (such as strains or whiplash)

- claims for “loss of income”

- sending a lawyer’s letter to threaten and subdue you into a settlement

My husband and I were recently involved in two accidents recently, and here’s how differently both played out.

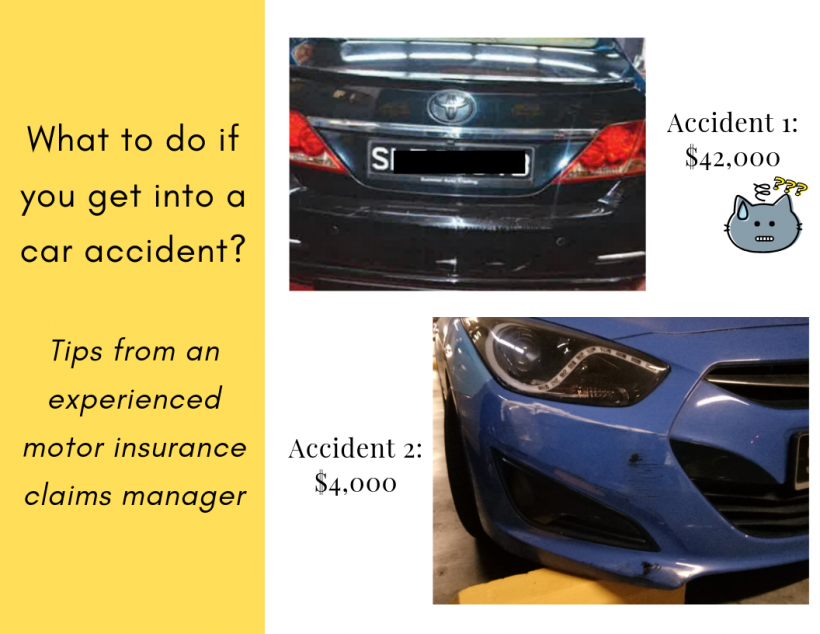

Our experience: Accident 1

My husband was unlucky enough to encounter one such accident recently, where the other party tried to claim S$42,000 for nothing more than a bumper kiss. It made us learn several lessons, and I hope our experience will help prevent others from landing into the same fate.

These were the photos of the car whose bumper he “kissed” lightly:

|

|

Driver

|

Passenger 1

|

Passenger 2

|

|

Neck strain

|

$3,000

|

$3,000

|

$3,000

|

|

Back strain

|

$3,000

|

$3,000

|

$3,000

|

|

Right thumb contusion

|

–

|

–

|

$2,500

|

|

Medical expenses

|

$80

|

$70

|

$80

|

|

Medical report fee

|

$320

|

$320

|

$320

|

|

Loss of income

|

To be assessed

|

To be assessed

|

To be assessed

|

|

Public Trustee fees

|

$225

|

$225

|

$225

|

|

Costs

|

$3,750

|

$3,750

|

$3,750

|

|

Total Claims

|

$10,600

|

$10,600

|

$13,000

|

|

|

Car Owner

|

|

Cost of repairs

|

$4,600

|

|

Rental car

|

$960

|

|

Total Claims

|

$6,700

|

You can be the judge of whether a $42,000 is warranted for such a minor accident.

How I started suspecting that the other driver had less-than-honest intentions was in how he behaved at the scene of the accident. He took photos of my husband’s NRIC, but refused to give my husband a copy of his own, and did not allow my husband to take photos of his passengers in the car due to “privacy” reasons.

It was only after we received his lawyer’s letter that we understood why he had acted so suspiciously at the scene of the accident – because, with photos and videos, his claims for $10k and $13k on his passengers would have been unlikely to go through.

In a 2017 research study on insurance fraud, it was found that one of the easiest injuries to fake for motor insurance submissions are sprain and strain claims. In our case, the other party tried to claim $18,000 on such a basis.

What was shocking was that separately, I had initially shortlisted the guy’s company in our list of potential interior design firms to work with, but this accident made me see such an ugly side to the person’s character that it made me question whether they applied the same operational ethics to their customers engaging them for renovation, and hence we have since blacklisted them permanently.

Side note: Another friend of ours was also previously involved in a motor insurance fraud case, where the other party tried to claim several thousands for “whiplash” (another medical condition that is difficult to prove) and “loss of income”. Can you see a similar pattern emerging?

Even if you have a dashcam view of the accident, how are you supposed to counter and prove that their so-called injuries do not really exist, or have been exaggerated beyond a reasonable doubt?

Moreover, in my husband’s case, a repair workshop that was barely more than 1 year in operation was used. This was a big mistake that we failed to prevent because once the other party goes to an unauthorised car workshop, it is too late.

Our experience: Accident 2

Another accident happened a few months later, where a taxi driver rammed into my husband’s car at a carpark. This wasn’t just a light “kiss”; there was a serious impact felt. In this case, the damages are clearly visible:

|

| A dent, scratches and blue paint. |

|

| A dent and areas where the paint came off |

When he got out of the car, the first words out of the taxi driver’s mouth was an apology, followed by whether we were going to claim a lot from his insurance. He looked scared, and shared that usually when such accidents happen, rogue drivers tend to make claims amounting to tens of thousands against him and his insurer.

“Are you injured? Please don’t do that to me”, he begged. It made me wonder how many times he had encountered such rogue drivers before to be so worried.

My husband reassured him that he would only claim for the damaged area to the car, and would not claim for anything more such as injury or a whole car makeover.

Our claim?

$4,000 for the left side of our car which was damaged and had the leftover blue paint that came off his taxi.

Accident 1 vs. Accident 2

$42,000 for a light kiss where you can barely even see any damages, versus $4,000 for an accident where the taxi that rammed into us had sent our car veering off track.

How can I protect myself?

Learning from my husband’s mistakes, we realised a few key points in order to prevent anything like Accident 1 from getting the better of us again in the future:

Your best bet is always the video footage from the dashboard camera, so make sure you have one set up and working.

If you do end up in an accident, always take as many photos of both vehicles and all passengers.

For more tips, you may refer to this link.

You may call me kiasu, but I would personally even do a video recording at the scene with the vehicles, the driver and all passengers involved. These are my other “unorthodox” tips:

- Do not agree to a private settlement (unless you’re trying to save your NCD and the loss of your NCD premiums is much higher than the sum being asked for) if the other party is asking for an exorbitant amount. In this case, leave it to the car repair workshops and your insurer to assess.

- Take note of any other parties who are not involved in the accident, especially if they’re giving out advice and name cards. They may just be touters out to make some quick cash by referring business to workshops for costly claims.

- Insist on sending the car(s) to an authorised car repair workshop ONLY. Make them agree (in writing or on voice recording) that if they choose otherwise, then they agree to a lower payout as well. It’s their choice!

- If you really want to avoid any dispute about their “loss of income” claims, try getting the details of the other party’s workplace as well (and that of their passengers) and pay them a visit to make sure they’re indeed at work. It’ll be ridiculous if you have proof of them at work but they’re claiming for loss of income later, isn’t it?

What are some authorised workshops?

Using Aviva as an example, you can check out their list of approved car repairers, which includes names like ComfortDelgro Engineering Pte Ltd, Tan Chong Motor Sales Pte Ltd and Kah Motor Co. Sdn. Bhd.

Once an unauthorised workshop enters the picture and helps the driver do extensive repairs (many not due to the accident), there’s very little you can do to reduce the claim from here.

How do the insurers deal with this issue?

I interviewed Aviva’s motor claims manager on how he deals with such claims, especially if he suspects them to be fraudulent given the prevalence of such tactics, and this was what he had to say:

One way we try to help our Aviva Prestige customers is that they can activate our on-site accident service by calling us immediately, and we will send our mobile accident response service officers down within 20 minutes to the accident site to help. With an independent party by an insurer, there will be less incidence of an inflated claim.

5 comments

Hello SGBB,

So what's the verdict of the S$ 42,000 claim and can you share the interior design company that he works for with your readers? Thanks.

Regards

Leo

Thanks for this informative blog. If we are clear with budget management, things get easier.

free personal financial statement template

legal document creator

nice article. still dont quite understand the part on "Insist on sending the car(s) to an authorised car repair workshop ONLY." do the two parties usually agree upon which car repair workshop they will go to at the accident scene? new driver over here.

Li Ting, depends on how you handle the situation at the point of the accident, as well as how honest the other party is. If they refuse to, that's usually one red flag that you should probably watch out for an inflated claim coming your way soon. So then quickly take as many photos and videos as you can to protect yourself.

it is still "pending" -.-

Comments are closed.