For those of you who know me, it is no secret that I am a big advocate of insurance. In fact, I see it as a non-negotiable purchase in our lives, and would rather spend on this than any branded goods anytime.

I believe so strongly in insurance that I’ve written quite extensively on this topic, including:

- important questions to ask your insurance agent (aka how to sieve out the bad eggs)

- your guide to hospitalisation insurance (aka Integrated Shield Plans) in Singapore

- should you buy hospitalisation insurance when you’re already covered by MediShield Life and your employer? (answer = yes!)

- why so many consumers find their medical claims rejected (and what you can do to ensure it doesn’t happen to you)

- why you don’t have to buy whole life insurance (if you have no dependents)

- are retirement saving plans offered by insurance companies a good deal?

- the 7-year historical fund performance of insurance companies (2015)

- why I’m not the biggest fan of Investment-Linked Plans (and why I cancelled mine)

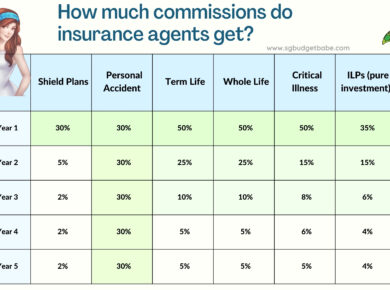

- how much in commissions do insurance agents earn?

- should you buy term or whole life insurance?

- whether you should get maternity insurance when you’re pregnant (including a realllly comprehensive comparison I spent hours doing up across 7 insurers here in Singapore)

- the best car insurance for (safe drivers) only

- the importance of getting home insurance and what’s covered

- how to buy your insurance directly

- should you buy direct insurance or through your agent?

As a new parent-to-be, one of the biggest concerns I’ve been deliberating over includes the type of insurance plans I ought to and want to get for my child.

But as much as I advocate buying insurance, I’m also always reiterating the fact that you should NOT be overpaying for your insurance plans. Some are necessities, some are good-to-haves, others are only-if-you-can-afford-it-comfortably.

|

| Image Credits |

And for my child (or yours!), here are the top few insurance plans I think are essential (in order of priority):

1. Hospitalisation / Integrated Shield Plan

I would also recommend going for the highest level of coverage (i.e. private hospitals) if you can afford it. That’s because you can always downgrade the policy anytime, but upgrading from a public hospital coverage to a private one may not always work. Plus, should anything happen to your child, I’ll bet most parents will want to just go for private consultations and treatment (I’m saying this based on what my parent friends are doing and have recommended me to do the same).

Do note that the earliest you can buy insurance plans for your child is after 14 days (but not if they have jaundice, in which case you’ve to wait until the jaundice has been completely cleared), so if you want any hospitalisation coverage for your newborn during the first 0 – 14 days of birth, only a maternity insurance plan will offer you that (but there are apparently no insurers who cover for jaundice, based on the info I’ve been given by a few agents).

Hospitalisation coverage plans may seem a little pricey at almost $1000+ for your child every year, but we believe it’ll be worth it. Even as a child, I was hospitalised for close to 3 weeks and it was thanks to my mother’s foresight of having bought insurance that we were able to focus on the treatment and not worry about not being able to pay the bills.

|

| Image Credits |

2. Personal Accident Plan

Children are known to run into injuries and accidents, so this is another good basic plan to have. Other stuff like the spread of infectious diseases or Hand Foot Mouth Disease (HFMD) can also be quite common among toddlers, as well as doctor visits due to insect bites, falls, knocks and cuts, development of allergies, etc…and all these can usually be covered under a PA plan. Your plan might also help offset the financial burden of your childcare or school fees in the event of any accident, medical leave or even home quarantine (due to infectious diseases).

Although I don’t personally have a PA plan (my husband does, but has never claimed from it either, so I really don’t see the point as most accidents are quite minor and we don’t even see a doctor or TCM sometimes on the rare occasions that it happens and it isn’t serious enough for hospitalisation), I see this as essential for children given how prone they are to accidents, so don’t skimp on this!

Do note though, that if you’re lucky enough to be working in a company which has great employee benefits, check if your company insurance plan is extended to your spouse and/or children as well (mine isn’t, but some of my friends do have this!). If so, you may not need to purchase an additional PA plan.

Good news for those who do? It doesn’t cost too much!

3. Whole Life Plan with Critical Illness

I used to think getting a whole life plan on a child’s life was hypocritical, since the payout will go to the parent if anything happens to their child.

But when it comes to whole life plans with CI coverage, that’s where I’ll make an exception, and this was also one of the key reasons why I was interested in getting maternity insurance while I was pregnant – so that my child can get access to a life plan with CI and without medical underwriting. Otherwise, waiting till something happens might then be too late to buy, due to exclusion clauses on pre-existing illnesses that will last a lifetime.

The cost of this plan is not cheap though, so ultimately it depends on your budget and affordability. If you have the spare cash for this, then this might be a good plan to consider adding on. Speak to an agent about this, who will generally recommend that you get a life insurance plan for your newborn so that in the unfortunate event (touch wood!) that an illness or condition develops later on, your baby will be able to still have full coverage. If you choose not to get one at this point, you run the risk of being rejected for insurance if something else happens later on.

(My friend developed a blood condition when she was younger, and therefore her insurance policies now exclude blood-related illnesses, because she got them only after she started working and her parents did not buy a life policy for her prior to that.

However, affordability is key for whole life insurance policies, and that’s one reason why I personally advocate term life insurance instead whenever cash flow is key.)

|

| Image Credits |

4. Endowment Plan

If you need a plan to basically force you to save for your child’s future (eg. university fees), then perhaps getting an endowment plan might just give you that discipline that you lack.

However, I’m not the biggest fan of this personally, as (i) the returns are generally too low for me (ii) I don’t like having the money locked up (iii) I don’t need anyone to enforce discipline on me when it comes to saving money, haha (iv) I don’t like having to wait for X number of years before I get to withdraw without any penalty and (v) I see more value in DIY-ing my own “endowment plan” for my child – by saving and investing money.

5. Investment Linked Plan (ILPs)

Almost everyone who knows me will know my stance towards ILPs – basically I’m strongly against them, and a huge advocate of “buy term invest the rest” instead. However, I will concede that ILPs might just be good for those who do NOT have the discipline to save and invest, because at least this is a forced safety net that keeps you covered then.

You can combine #3 with this, and go for an ILP which takes part of your premiums paid to invest in market funds and hopefully get more returns than a traditional endowment savings plan. However, this also comes with the risk that the funds may not perform as well (not up to the 4% or 8% projected returns you see in your policy document), so this really depends on you.

—

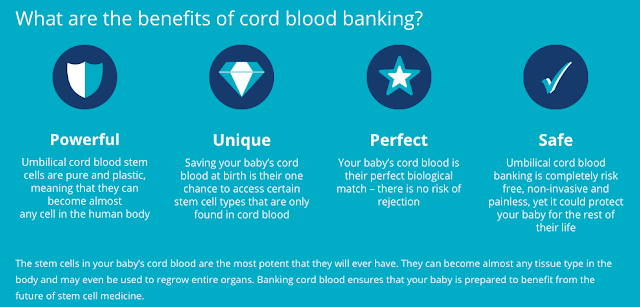

Another form of insurance (non-financial) that I’m now looking into is biological insurance i.e. cord blood banking. Will update more after I’m done with my research and also speaking to SCBB and our 3 local private cord blood banks to find out more!

|

| Image Credits: Cells4life |

Do I really need to get all?!

Obviously not! Ultimately, I would prioritise the above insurance plans in their respective order of #1 to #5, and if you have the budget for it, then going for 1 to 4 (or 5, in replacement of 4) might be a good move.

However, if you’re already stretched enough from having to care for and raise a child, then perhaps 1 and 2 might be good enough for a start.

As always, weighing affordability factors against the risks you want to take is key to making your own decision when it comes to insurance.

If you’re curious, my husband and I decided to get a (private) hospitalisation plan, personal accident plan and life with critical illness coverage for our child. As for #4 and #5, we do our own investments and will also be creating an investment portfolio for our child to cover that.

As always, speak with a trusted financial advisor to work out the plans for you and your family! Check out my article here on questions to ask your FA to check whether they’re working for their own benefit or yours. If you don’t know of any trusted agent, you can always drop me an email and I’ll be glad to point you to the insurance agent I work with and entrust my family’s policies to. However, do try to ask around in your circle of family and friends first!

With love,

Budget Babe

4 comments

agree with how you have ranked them in terms of importance. With our cost of living and medical bill, insurance is quite important. Personally, I have only gotten the no 1 and no 2 for my children.

that's good to hear! I'm also on the fence about #3 and will probably NOT get it as a standalone WL policy, but we're possibly getting it via a maternity insurance plan if we can afford the premiums 🙂

hi BB,

how about the lady 360 (ntuc). what would that be ranked at?

That would be under #3. I'm still on the fence as to whether it is worth buying a gender-specific plan in contrast to a general CI plan though, because of the price to pay for those additional benefits

Comments are closed.