Simulate your retirement finances with OCBC Financial OneView and OCBC Life Goals

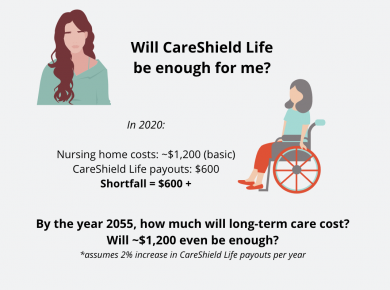

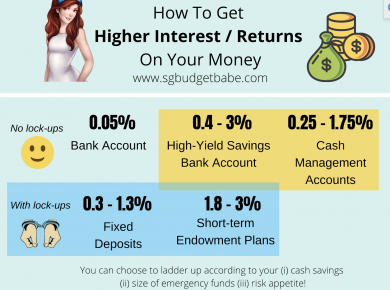

With 1 in 2 Singaporeans already having some form of passive income, you’ll be lagging behind your peers during retirement if you’ve yet to start. What’s more worrying is that…