Personal accident plans are usually inexpensive, but can go a long way providing you with a financial peace of mind in the event that you suffer any injury. For instance, my husband has been claiming from his own PA plan every year for outpatient treatments due to accidental sports injuries. If you ask him, he’ll definitely tell you that a PA plan is a must-have.

If you don’t already have a personal accident insurance, you may want to consider getting one, especially given the recent spate of accidents that we’ve been seeing in Singapore, such as a 25% increase in road traffic accidents involving cyclists and fire accidents in HDB flats that affected multiple neighbouring households as well.

Unique PA plans – such as Singtel Active Protect – go one step further as it not only reimburses you for outpatient medical treatments for accidents, but also covers loss of your electronic devices and accidental death.

This unique 3-in-1 benefit is underwritten by AIA, and there also currently exists no direct competitor with a similar offering, so any comparisons would be moot.

What’s covered under Singtel Active Protect?

Aside from a $10,000 payout in the event of accidental death, I would say the real value of this plan in fact lies in the reimbursement of 3 outpatient medical visits you get each year, on top of covering loss of your electronic device.

Even food poisoning cases and any injuries caused by an insect (or animal) bite, sting or attack – including dengue fever and zika – are covered under this plan. Considering how it is pretty common for most of us to visit a General Practitioner at least once a year due to an accidental injury, being able to claim up to $50 for each visit can already make the premiums on this plan more than worth what you paid.

You can view the rest of the policy’s benefits detailed here.

What’s more, if you’ve ever worried about losing your AirPods while exercising (or even just moving around), you may have considered getting an accident plan that covers your electronic devices. However, these plans seldom come cheap – premiums are often about $10 per month, which is why they’re hardly popular among the masses.

Then why are premiums only $9.90 / year?

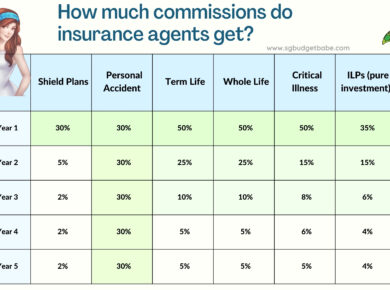

At less than a dollar each month, if you’re wondering how (and why) the premiums can be so affordable, the answer is because this is a group personal accident policy rather than one where you’re the insured policyholder. Group insurance plans have always been one of the most cost-effective ways to get insurance coverage instead, but of course, the usual caveat of being eligible for it applies.

And in this case, it is priced so competitively because of Singtel’s partnership with AIA to offer its customers some exclusive perks…provided you qualify for them in the first place.

Which is why the plan is limited to only Singtel postpaid mobile line customers, and excludes any lines registered under a corporate business registered number or GOMO. You’ll also have to be between 18 years old to 65 years old.

The good news is, even foreigners can apply!

As long as you’re a Singapore resident with a valid NRIC/FIN (includes a work pass or immigration permit), you’ll be able to qualify for this group insurance plan. See the full definition of a “Singapore resident” here.

For greater convenience, your annual premium will be paid through your Singtel bill (instead of you having to arrange a separate payment directly to AIA).

When do applications close?

This unique Group Personal Accident plan is only available for eligible Singtel customers from now until 16 May 2022.

If you’re signing up, don’t forget to opt in for a monthly giveaway to win prizes such as iPhones, Bromptons, SecretLab and more (from now until 31 July 2022). Plus, receive a $5 Grab transport voucher between this period (30 July – 31 August 2021) when you opt in for the giveaway!

Is it worth signing up for?

If you don’t already have your own personal accident plan, this group insurance policy could be a good supplement (or starter plan if you don’t have any coverage for PA) to consider adding to your protection portfolio – especially when the premiums are this low.

In my personal view, as the premiums are so affordably priced (you’ll be hard-pressed to find any other plan out there in the market that you can purchase for under $1 a month with such benefits), this is a really good deal as long as you’re an eligible Singtel customer.

And considering how outpatient medical treatments are also included for up to 3 visits a year, I would think that the odds of you claiming for at least 1 visit is highly probable. In that sense, this alone would already offset the cost you paid for the policy throughout the entire year.

Click here to learn more about Singtel Active Protect.

Disclosure: This post is written in collaboration with Singtel and AIA.

Disclaimers:

This is only product information provided and should not be taken as financial advice in any way. It is not meant to replace any of your existing policies unless you have received licensed advice for such a recommendation. SG Budget Babe is not an introducer, nor an agent, of the companies mentioned in this article i.e. Singtel and AIA.

You are encouraged to review your own insurance portfolio and decide if such a product is suitable. For full details and terms and conditions, you should read the provided links here, here and here.

Singtel Active Protect is a Group Insurance product underwritten by AIA Singapore, and Singtel Mobile Singapore Pte Ltd is the Master Policyholder. Protected up to specified limits by SDIC.

This advertisement has not been reviewed by MAS.All information accurate as of 5 August 2021.