What if you could change your child’s financial future and give them a head start by starting an investment portfolio for them now?

|

| Image Credits: Vector Stock |

Salary increments are no longer enough to keep up with the rising costs of living. If it is already difficult for us now, just imagine how much harder it will be for our kids 20, 30 years down the road.

Well, what if you could change their future and start an investment portfolio for them?

With the wide variety of investment tools available to us today, there’s hardly an excuse not to start if budget is not an issue.

If you’re already spending several hundreds a month on your child’s enrichment activities (or even tuition), consider putting aside as little as $100 towards their investment portfolio instead. That $100 monthly investment can eventually grow – thanks to the power of compound interest over time – into a sizeable sum that can be used later.

Here are 3 ways you can help them to invest:

Invest in an Index Fund

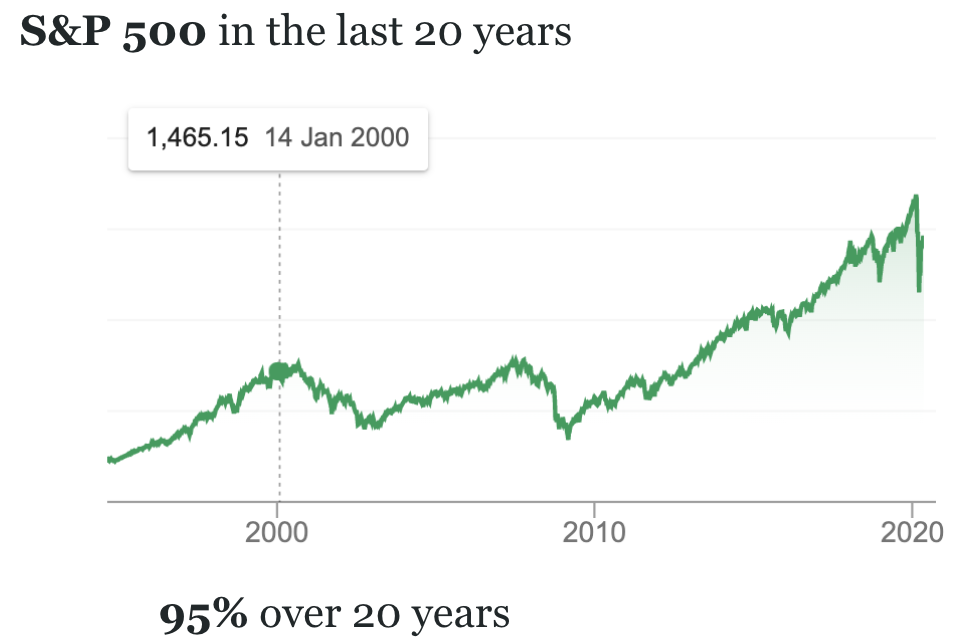

Advocates of passive investing frequently share that the easiest and least stressful method to invest would be to invest in an index. They’re not wrong, and this method will definitely be better than simply leaving your money in the bank…or in an endowment fund, where costs erodes your returns.

By investing a fixed amount regularly regardless of whether the market is up or down, you end up buying more when the market is doing badly, and less when the market is bullish. This dollar-cost averaging strategy helps you to thus lower your average overall cost, which then improves the rate of returns of your investment.

If you had invested in the S&P 500 in the last 20 years, here’s what your returns could have looked like:

Or compare this over the next 21 years,

- Saving $100 a month = $25,200

- Investing the same into an index with 4% returns instead = $38,000

- Difference = $13,000 (the equivalent of you saving up for another 13 years!)

Invest for Passive Income

Imagine if you could invest your child’s angpao money into companies that would pay you dividends…which you can then use to pay for their enrichment activities, or even bring them on a short holiday getaway.

It can also be such a valuable teaching opportunity for your child as you explain to them the power of investing, and how it can give you passive income after your initial set-up has been done.

- Saving $1k a year = $21,000

- A 7% yield on a $21,000 portfolio = $1,470 annually

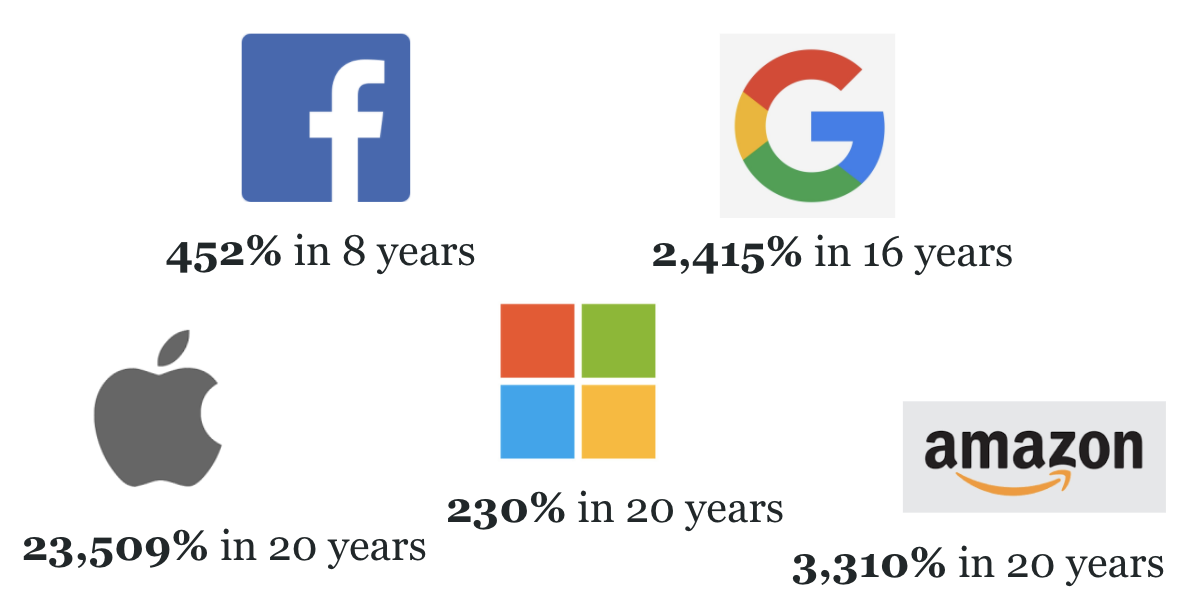

Invest for Growth

When it comes to investing for your child’s future, you have the power of time on your side. If you learn how to pick out and invest into fast-growing companies that will become a core part of our (and your child’s) future, it can give you incredibly amazing returns. Just take a look at the 5 companies below and how they’ve rewarded their shareholders over the past few years:

|

| Shareholder returns as of May 2020 |

For someone who has been exposed to 3 out of 5 of the above companies since I was a kid, I can only imagine if my parents had invested in them then. Just imagine if your parents were financially savvy investors and had picked these stocks out for you when you were a kid! I know I would certainly go ballistic.

I almost didn’t make it to university – much less an overseas exchange program – because of money issues. My parents did an amazing job in bringing us up and putting food on the table, but they didn’t save, much less invest, for our future (and their own retirement). And because of that, we’re now the sandwiched generation. It is something I hope my own child will not have to go through.

And if you’re a parent like me, you can definitely take steps to make sure you give your child that head start by starting an investment portfolio for them now.

With the recent market crash, there’s no better time than now to start.

We’ll be sharing more about the different approaches in detail tomorrow on a webinar with EndowUs, so register for that here if you haven’t already.

Learn how to invest here today.

P.S. If you’re keen to learn how to invest, get 60% off applicable courses at the academy with promo code “iattendedyourwebinar!”

*Valid only for Strategic Investing Masterclass and Investing for Parents.

With love,

Budget Babe