The recent research conducted among 1,200 Singapore residents as part of a longevity study has yielded quite surprising results. I was on the panel for the media launch earlier this week and these are the findings I thought were worth mentioning:

More Singaporeans aspire to take career breaks

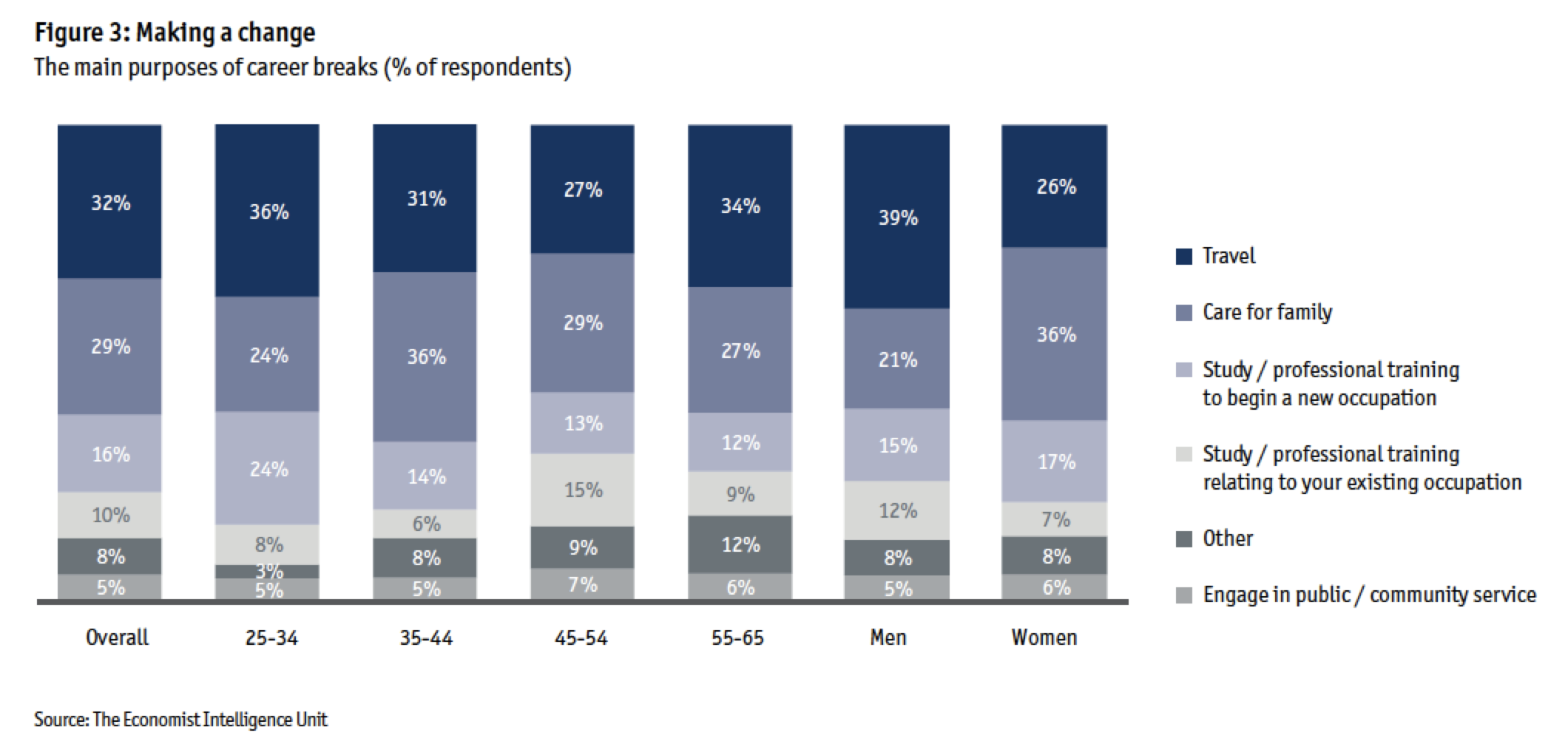

With rising lifespans, more Singaporeans aspire to take career breaks to travel, care for the family, or follow their passions. This is an interesting insight because while I’ve definitely seen several of my (female) friends leave the workforce to become a stay-home mother after giving birth, I didn’t realise the same longings for travel would drive a sizeable portion of people (almost 1/3 in the study) to take a break from work.

Multi-stage lives where each life stage (study, work, retire) is now increasingly becoming blended seems to be the new norm. Even my friend, who had announced his semi-retirement last year after building up a sizeable nest egg, was forced to return to the workforce due to (his father’s) unexpected health circumstances.

We are seeing a new generation of younger Singaporeans who are seeking to break away from the traditional three-stage life of study, work and retirement. They desire to live a multi-stage life where they could have three or more occupations with career breaks in between to meet their personal aspirations. – Dennis Tan, CEO of Prudential Singapore

Duty of Care and Healthcare are our Great Challenges

Millennials will be increasingly challenged by their responsibility to financially support their ageing parents and children, and the study shows they’re increasingly cognisant about this looming duty on the horizon.

Nearly 9 in 10 polled say they expect to have to take care of their ageing parents’ needs, but only 30% expect their children to provide for them when they retire. This is in line with our personal beliefs where we’re aiming to take care of our own retirement so that Nate will not have to bear this financial burden in the future. But it isn’t easy and requires saving and planning earlier, together with using various instruments to get there.

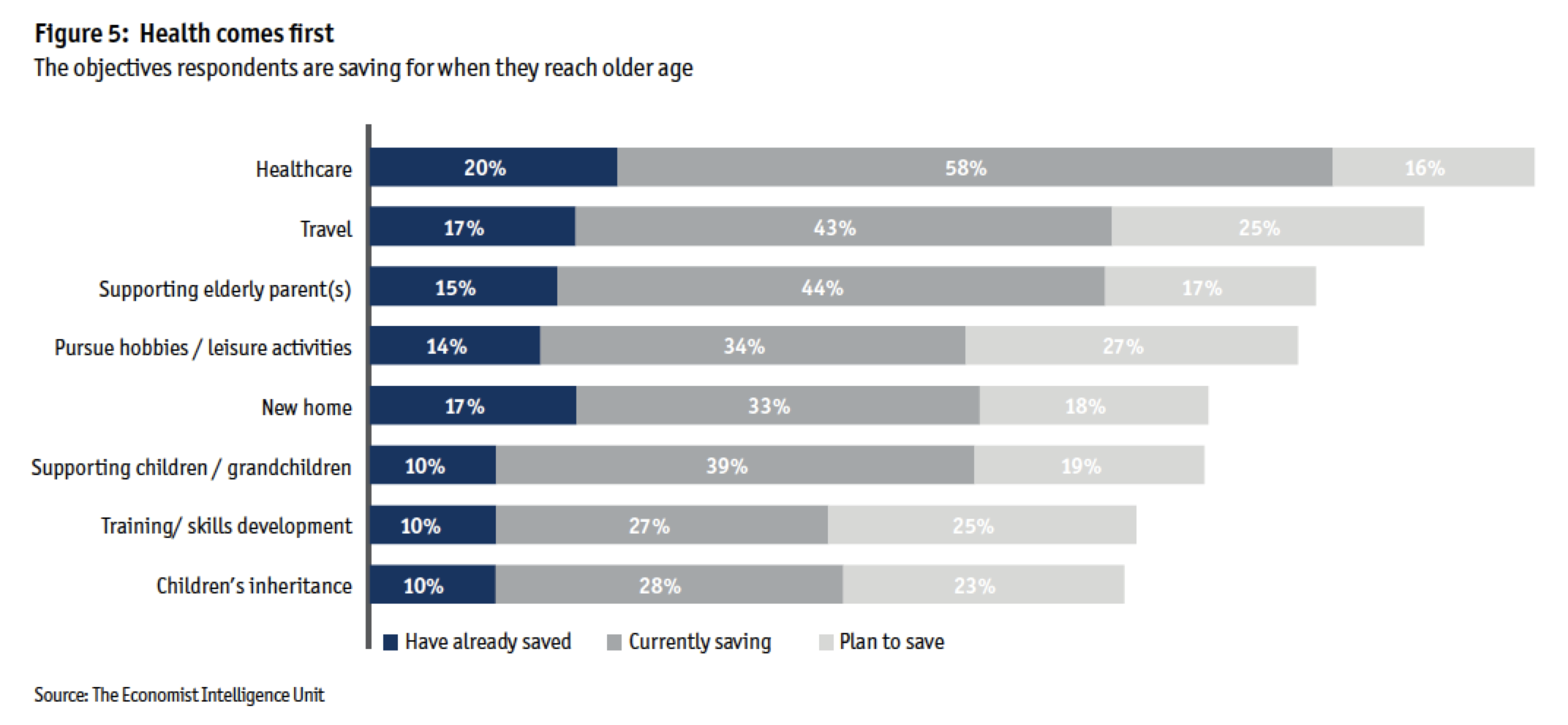

Rising healthcare is another key challenge, with 80% polled listing it as their top saving priority. Remember, if you don’t already have a private health insurance plan, it should be one of the first policies you consider getting. Read my Guide to Healthcare Insurance in Singapore here.

Of course, how to do this is equally important.

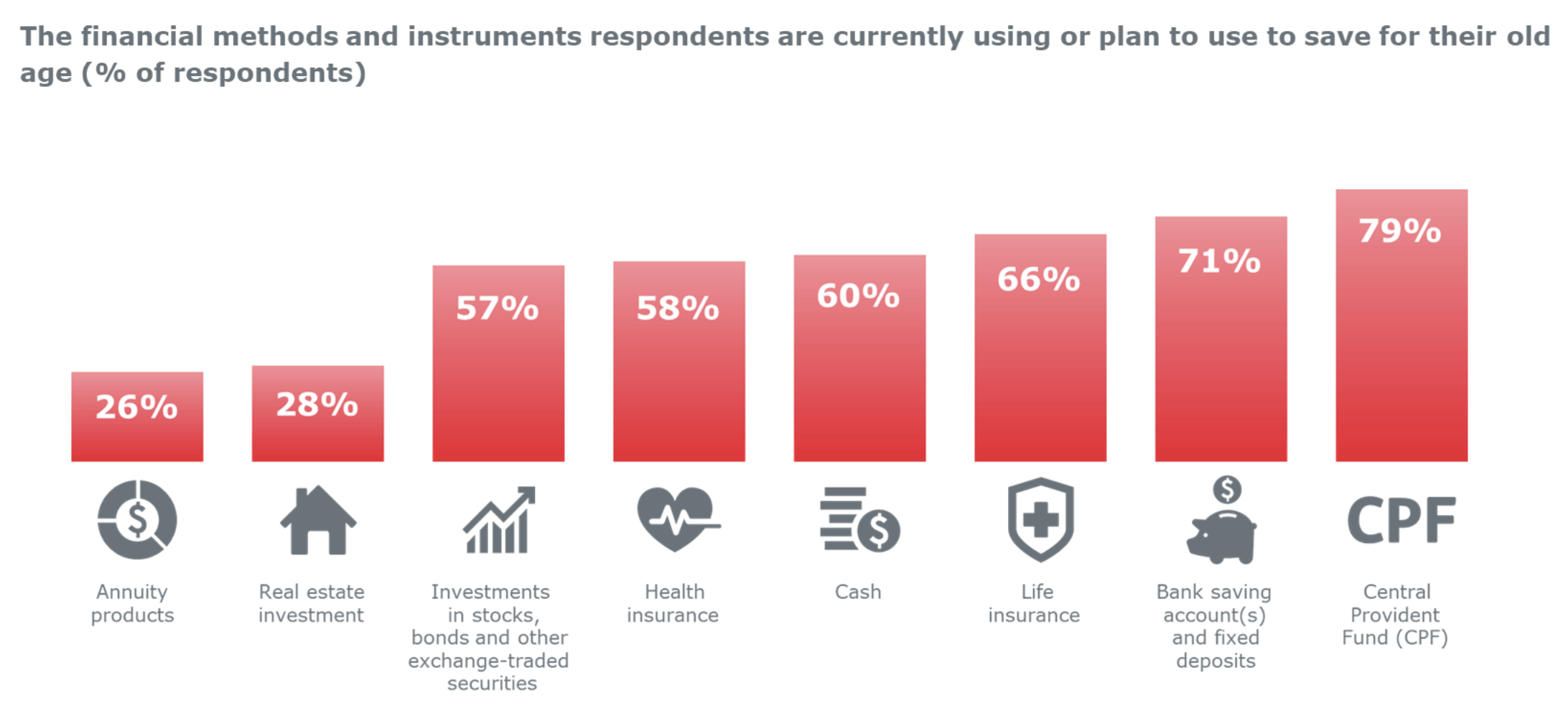

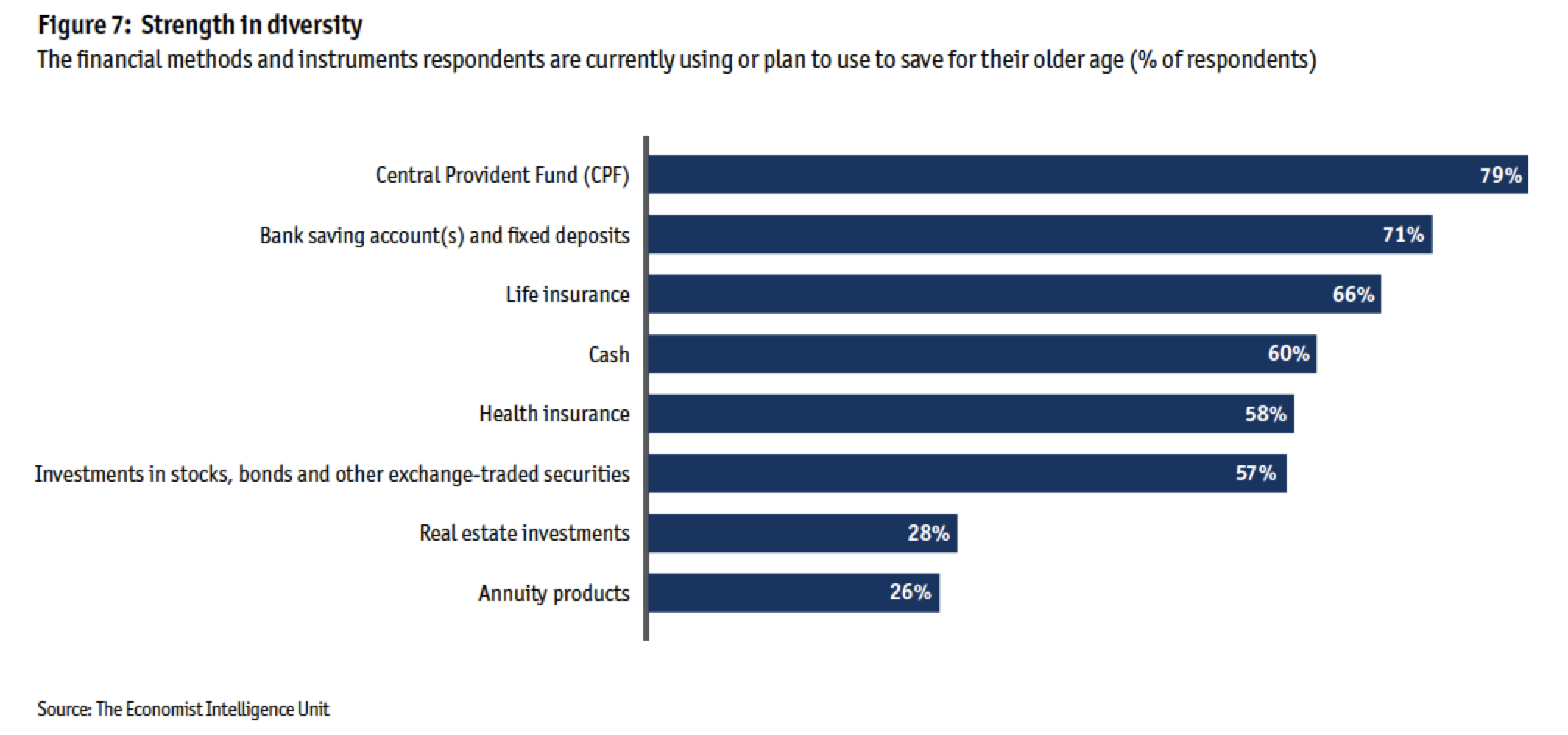

Financial instruments used by Singaporeans to save for older age

The study revealed that the majority of respondents rely on their CPF as a key instrument to saving for longevity. This forms an important foundation because of the compounding interest rate (2.5%, 4% and 6%) over time, as well as your employer contributions that help to grow this pot significantly. I’ve also previously written on this topic here at 3 Moves To Make Your CPF Work Harder For You.

For myself, I personally do a combination of

- voluntary top-ups to my own CPF

- moving my OA funds to SA for higher interest

- topping up my son’s MA

Aside from CPF, 71% of people are also relying on bank accounts and fixed deposits to fund their retirement savings. However, this is not a fail-proof strategy, given how the interest rates may not be enough to keep up with inflation + the recent cut in global interest rates across the board, which saw the majority of Singapore banks follow suit.

Even the Singapore Savings Bonds aren’t as attractive as they used to be.

There’s no way you’ll be able to save enough for healthcare especially if you’re hit by unexpected critical illnesses, so your best bet against that is to get health insurance (and critical illness protection if you have dependents to care for).

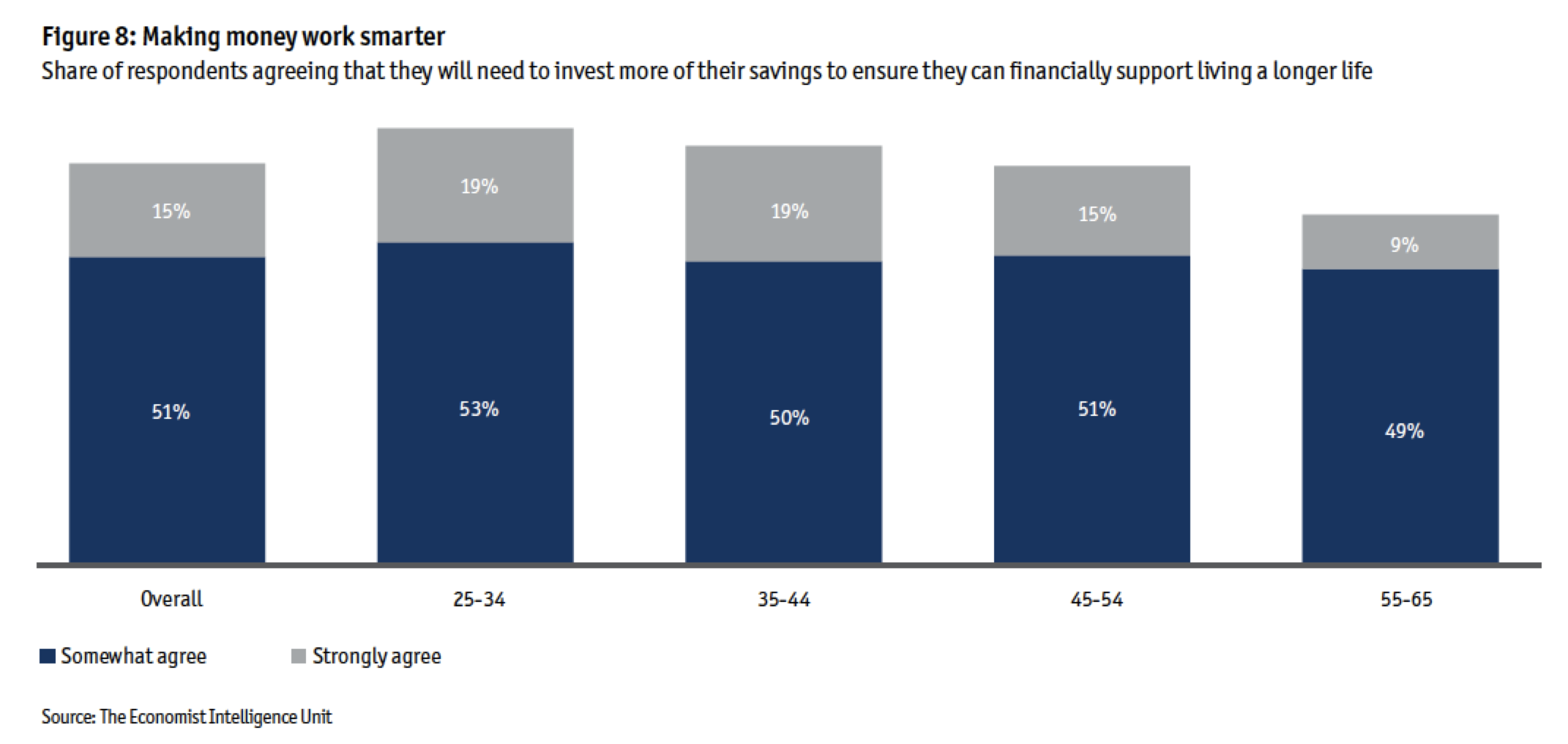

Investments will need to play an even bigger role, moving forward. Right now, even as interest rates on fixed deposit products have fallen this year, the stock market continues to reach new all-time highs. Several of my investments have reached double-digit returns, and some even triple-digits, as a result of the market movements.

Millennials need to seriously start thinking about investing if they want to get ahead financially and not have to worry about retirement.

Do you agree with the research findings too?

The Economist Intelligence Unit first reached out to me earlier this year in January for an interview regarding longevity in Singapore, and the full report (together with my insights) are now available via Prudential, who commissioned the study.

You can view and download the full report here.

With love,

Budget Babe

2 comments

On the part of the private insurance, it varies from different persons. If one does not mind subsided treatment at the public hospitals, the private insurance might not be a must. Medishield Life is sufficient as per my perspective.

At the end of the day, it is to each of individual's own.

WTK

Agree that it isn't a must, but I personally see it as a basic insurance plan in my coverage since MediShield Life is primarily designed to cover stays in Class B2/C wards in public hospitals, and does not cover pre and post-hospitalization costs which can add up to quite a bit for some.

Comments are closed.