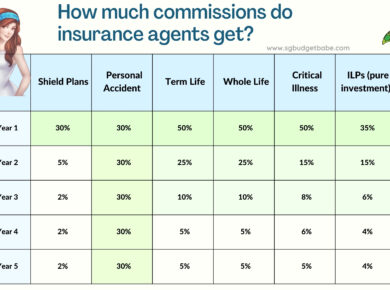

When I last wrote about getting life vs. term insurance, and firing my insurance agent now that MAS has made it possible for me to buy direct, it caused quite a stir as the articles were being shared furiously to spread the word that Budget Babe doesn’t trust most financial advisors. Not surprisingly, I got quite a few hate mail from insurance agents after, but that’s not going to stop me from writing on this topic because I think it’s important that all Singaporeans start to learn how to be smart (and not swayed) when it comes to buying their insurance.

If you’re keen to understand why, you may want to take a look at this piece I wrote for DrWealth on why the best financial advisor is ultimately…myself.

Now, don’t get me wrong. I’m not saying I don’t work with any financial agents (I do, by the way), nor are all financial agents bad. But if you want to make sure you’re getting the right kind of insurance products for yourself, you’ll need to become financially literate and understand how these work.

The biggest mistake people make when buying their insurance is trusting their agents blindly, without bothering to read the T&Cs, exclusion clauses, or asking the questions they should be asking.

Most insurance agents will just highlight certain parts of the policy to you, but few spend enough time running through every single important detail.

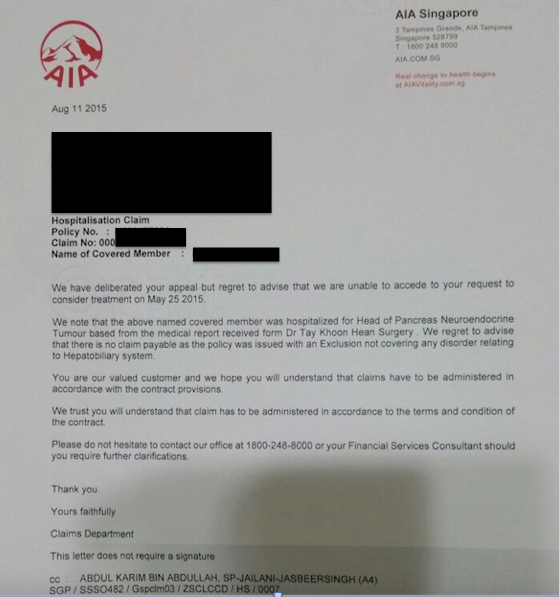

Take a look at what happened recently to a friend of my friend. His 60-year-old father was diagnosed with pancreatic cancer, and only proceeded with the operation procedures AFTER receiving a verbal confirmation from their insurance agent that everything would be claimable up to 600k a year.

Note that the agent was the same person servicing this family from the start till the end. Yet this happened.

Read the rest of the story below to find out more.

Names have been omitted to protect the family’s privacy.

Here’s AIA’s letter in full.

Lesson learnt?

Never simply trust what your agent tells you.

Make sure you know what you’re buying and what you’re entitled to. Don’t be afraid to ask the hard questions about claiming procedures, coverage in different situations, etc.

Remember, the best financial advisor is ultimately yourself.

2 comments

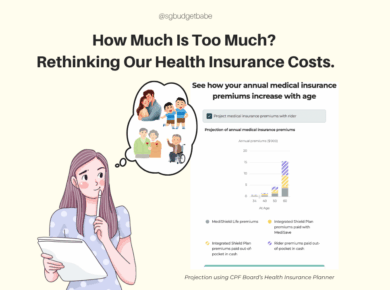

My suggestion is don't buy too much insurance. Just get the Medishield Plus and ignore the rest. The reason that insurance companies are making money is because the clients are losing money in the long term. If so, why still buy so much insurance? It's like gambling, most people lose in the long run. Don't listen blindly to all the good stories about how insurance benefits are worth more than the premiums. If this is true, the insurance companies would be bankrupt long ago. How can people claim they are good investors but yet so irrational in insurance? Puzzled~

Medical bills have been one of the biggest pains in my life. I have always been in and out of the hospital for various reasons because I seem to always accidentally hurt myself doing something dangerous and then I end up with a huge bill for it when seeking medical attention. They all add up very quickly and its hard to pay it back once it accumulates.

Jason Hayes @ DECORM

Comments are closed.