As the COVID-19 situation worsens, many Singaporeans have started to add on more insurance coverage in a bid to protect themselves and their loved ones further, with the highest in-demand options being policies with shorter terms and lower premiums.

If you’ve yet to do the same, take this chance to review your insurance portfolio and ensure that you have enough. Your needs will likely differ based on your profile, but when it comes to life protection, it helps to think about the loved ones or dependents that you’ll be leaving behind, and what could be the worst-case financial scenario for them if you are no longer around.

If you’re part of the sandwiched generation like I am – with both young children and elderly parents/in-laws to think about – here are some factors that I generally take into account in deciding how much coverage we need:

- (for my spouse) expenses needed to hire a caregiver so he can continue working to provide for the family

- (for parents) their remaining lifespan

- (for children) years remaining until they graduate from university

- loans (thankfully, we only have our mortgage for now, which we’ve gotten mortgage insurance to protect against)

- future household expenses (groceries, bills, insurance premiums, school fees)

Which is why long-term regular readers would have noticed that we’ve been adding on to our insurance coverage in recent years, given that 4 significant life events happened within just the past 4 years alone:

(i) my dad retired, and got diagnosed with 2 terminal illnesses

(ii) we welcomed the birth of our first child

(iii) we bought our first home

(iv) we’re now expecting our second kid

To be exact, we’ve added on further coverage to our life insurance and critical illness (together with early CI) as a result.

If you’re also thinking of increasing your life coverage for the sake of your loved ones, check out online term life insurance plans like ePROTECT term life plan here, as it includes other benefits such as financial assistance in the event of COVID-19 and any side effects arising from a COVID-19 vaccination.

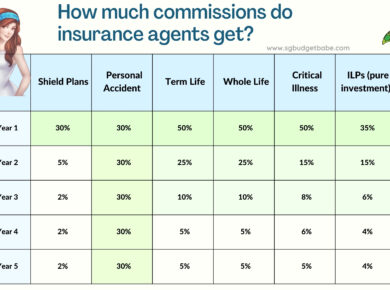

Term life plans like these offered online are also among the most competitive in the market, since there are no agent commissions or distribution fees to be paid out. With the ability for you to generate your own quotes here (instead of having to ask, or wait for an agent), it has also made the whole buying process a lot cheaper, easier and more convenient for consumers.

For instance, premiums for a 30-year-old (non-smoking) male to get covered for a minimal $100,000 will cost you less than your Starbucks coffee, at just:

The coverage amount is totally flexible, so you can choose anywhere between $50,000 to $2 million.

And if you’re currently unsure as to how long you can commit to the plan, you can opt for a shorter term period of 5-years renewable. Otherwise, a medium term option (20-years) or up to age 65 is also available.

How much coverage should you get? 3.9 times of your annual salary is recommended, based on the Life Insurance Association of Singapore (LIA) Protection Gap Study of 2017. However, I personally advocate that as a general guideline instead as your exact needs may or may not be higher, and balancing between that and the amount of premiums you can comfortably afford to pay.

If it helps, my husband and I feel we’ll need at least $250,000 per young child and $100,000 per elderly parent.

Of course, $100,000 may hardly be enough when you have multiple loved ones to consider. As such, if you need a coverage of at least $401,000 or above, you can take advantage of the current promotion of up to 18%* perpetual premium discount (i.e. throughout your policy term).

At this coverage level, the discounted premiums for a 30-year-old (non-smoker) female will be just $9.35 / month for a renewable, 5-year term:

Tip: Opt to pay annually (instead of monthly) if you want to save more.

If you’re a male, the premiums are $12.37 / month instead:

If you have chosen a policy term of 5 years (renewable), it means the policy will be renewed automatically from the renewal date for another 5 years at the same sum insured, without you having to give any proof of good health.

The renewal premium will be calculated based on the prevailing premium rates at the attained age of the life insured and will stay level throughout the renewed term. Thus, if u want flexibility (or affordability for now), go for 5 years. If you’d rather have certainty, go for 20 years.

The perpetual discount will apply as follows:

| Plan Type | Premium Discount | Sum Assured (S$) |

| 5-year renewable term plan | 14% | $401,000 & above |

| 20-year fixed term plan | 18% | $401,000 – $999,000 |

| 20-year fixed term plan | Up to $100 Cashback (with min. annual premium of $500) | $1,000,000 & above |

If you’re sharp-eyed enough, you may have noticed that the perpetual discount does not apply for plans covering until 65 years old. However, you can still get to enjoy a $100 cashback if you were to purchase during Etiqa’s current promotional period.

Summarizing the benefits of the ePROTECT term life plan, here’s what I like about it:

1. Affordable life insurance – whether you need it to cover you and your loved ones for this period (or for a much longer term), to cover you against death, terminal illness or total and permanent disability.

2. Up to 18%* perpetual premium discount.

3. Includes financial assistance benefits for COVID-19 and side effects from the vaccination.

4. Flexible coverage amount and term period to fit your every budget or need.

Get a quote for yourself here before you decide.

P.S. I own direct-purchase term life insurance plans myself, which I first used to obtain coverage when I was a broke graduate, and later on to increase my coverage at different life milestones. If you find this strategy similarly useful for your own circumstances, feel free to check out the current promotion for ePROTECT term life plan here.

Disclosure: This is a post written in collaboration with Tiq by Etiqa Insurance.

With ePROTECT term life, you can enjoy up to 18% premium discount* throughout your policy term. Refer your friends and get rewarded too!

Sponsored Message

Read more about the terms and conditions governing the policy here.

*Terms apply.

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

This content is for reference only and is not a contract of insurance. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

Protected up to specified limits by SDIC.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is accurate as at 12 June 2021.