The same warning signs that led the state of our healthcare insurance to what it is today has also just appeared in the motor insurance industry. What’s going to happen next?

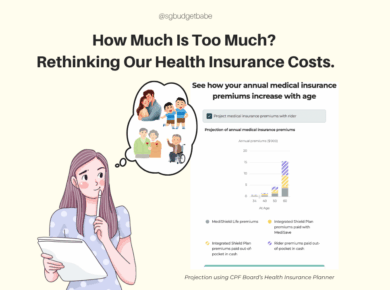

If you recall, earlier this month, it was announced that patients with new Integrated Shield Plan (ISP) riders will no longer be able to enjoy zero co-payment of their hospitalisation bills. A 5% co-payment will now be imposed (capped at $3,000 annually) to address the issue of over-consumption of medical services.

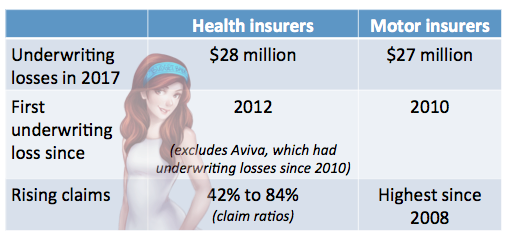

Between 2005 – 2016, the industry’s claims ratios surged from 42% to 84%. These rising claims have prompted hikes in ISP and rider premiums, but that didn’t help the insurers from still making underwriting losses.

Q: How did this come about?

A: Rising claims + underwriting losses.

For many years, riders on top of their healthcare insurance policy (which would allow one to not fork out a single cent for hospitalization) were highly popular among Singaporeans, with 1 in 3 Singaporeans opting to take up a rider.

But in the last 2 years, ISP premiums had risen by up to 80%, with older policyholders and those on private hospitalisation plans experiencing higher increase. Yours truly was one of them. One of the causes identified by Health Minister Chee Hong Tat was that the zero co-payment feature of these full riders had resulted in a “buffet syndrome”, which led to over-consumption and over-charging of healthcare services.

He pointed out that the average medical bill size for full-rider policyholders was about 60% higher than for those without riders, even though the former group are generally younger and in better health.

Were there warning signs that this was coming?

Yes. Frankly, I wasn’t surprised by the news. That’s because after having seen how all the healthcare insurers suffered from underwriting losses in 2016, and coupled with the rise in healthcare costs, I knew this move was only a matter of time.

|

| Source |

The industry chalked up underwriting losses ranging from S$7.3 million to almost $30 million, with AIA and NTUC Income suffering the biggest hits. Even AXA, which only started selling ISPs and riders in the second half of 2016, suffered a considerable loss.

Now, there’s no point in crying over split milk, which is why I haven’t really bothered writing a commentary about the state of the healthcare insurance industry (mainly because I expected it) until today…because I just spotted a glaring similarity in another insurance segment:

Is the motor insurance industry headed down the same slippery slope?

We already know by now that the healthcare insurers got to this state because of rising claims and underwriting losses. But why aren’t we talking about how the same warning signs have now appeared in the motor insurance industry?

I quote:

Motor insurers in Singapore are expected to review the commercial viability of their business after booking a combined underwriting loss of S$27.2 million in 2017 compared to the previous year – the segment’s first underwriting deficit since 2010.

The general insurance industry’s 2017 full year results were announced by the General Insurance Association of Singapore (GIA) yesterday, revealed a 3.3% drop in gross motor premiums to S$1.1 billion while claims rose by 12%, representing an increase of S$60 million.

Loss ratios in motor jumped to 64.9%, the highest recorded by the industry in the last 5 years.

With love,

Budget Babe

1 comment

This comment has been removed by a blog administrator.

Comments are closed.