Unlike in the past, where financial lessons revolved around physical cash, kids today need to understand both traditional money management and digital financial tools. Don’t expect schools to teach your children about these; the responsibility belongs to us, my dear parents.

As our society shift towards cashless payments, traditional methods like using coins and cash are fast becoming irrelevant. These days, I can leave home without my wallet and still be able to get by – my mobile phone’s NFC feature allows me to pay for public transport, while I can pay for almost everywhere else via scanning PayNow QR codes. Outside of school, our children are already being exposed to these digital transactions, so it is up to us to teach them about it.

Unfortunately, many of the methods that my parents used to teach me about money in the past will hardly work today. In the past, my parents used to give me cash for my daily allowance, where I could literally see my money get taken away as I spent it. As I got older, my parents switched to giving me a weekly allowance, so I had to learn how to budget my day-to-day in order to avoid running out of money before the week was over. I learned how to save my loose change in a piggy bank, and felt a sense of accomplishment as I saw the coins accumulate until I had enough to buy what I wanted (mostly CDs and Harry Potter books). By the time I entered university, I was receiving money at the end of each month (from hustling as a private tutor) which I kept in my bank account, withdrawing only enough cash from ATMs for my regular expenses.

Most of us Millennials grew up in this way, learning how to budget and manage our money through handling physical cash. So, when digital banking tools came along – think online transfers, mobile wallets and cashless payments – we were able to make the transition relatively smoothly. Our foundational understanding of money made it easier to navigate this shift, as we had already learned the basics of budgeting and saving from a young age.

What’s more, the rise in scams has shown that while our generation and my parents’ may know how to handle money, being able to manage digital banking tools is a different skill altogether. Unfortunately, the consequences of mismanagement are a costly one, as scams and fraudsters take away the lifelong savings of their unlucky victims.

Teach kids how to manage money and navigate digital banking tools

To truly prepare our kids for financial success, we need to start teaching them the basics of money management now—budgeting, saving, and how to handle digital transactions. By making these concepts a part of their daily lives early on, we can ensure they grow up equipped to handle their finances responsibly in a cashless, digital world.

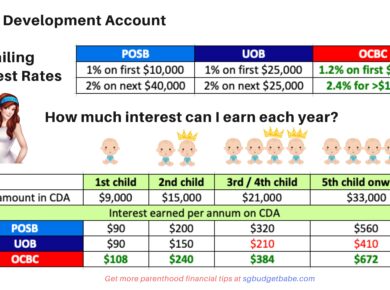

Unfortunately, there’s a gap in the current tools available to help us parents do this. For instance, children in Singapore cannot open their own bank account until they are 16, meaning younger kids’ savings are often stashed away in a joint account, and they cannot access it unless their parents login for them.

This lack of direct access denies them a hands-on experience to learn how modern banking apps work.

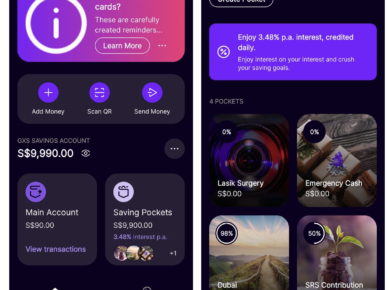

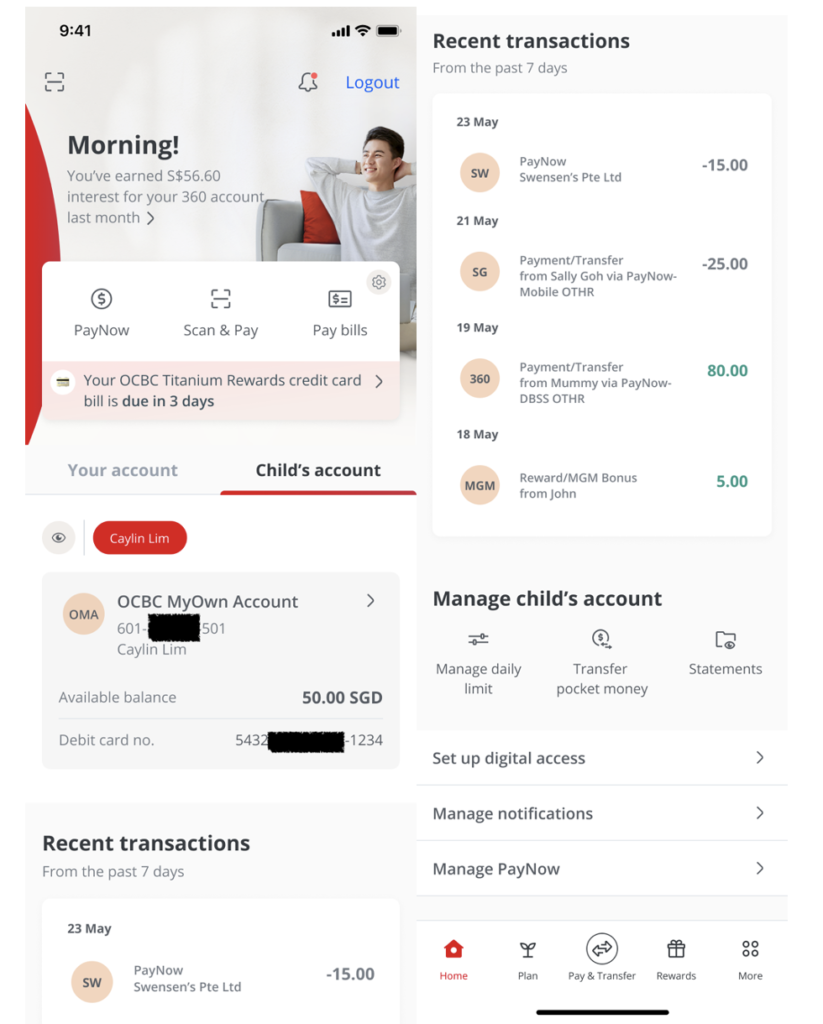

Thankfully, that will soon change, as OCBC is now the first bank in Singapore to enable Gen Alpha to bank digitally via their own bank accounts. From 20 October 2024, parents will be able to open a OCBC MyOwn Account for their children between 7 and 15 years old. This account will be registered solely under your child’s name, and your child will now be able to operate their own bank accounts digitally via the OCBC app – albeit within the boundaries and parental controls set by you.

OCBC said that they created this account based on feedback from parents, who indicated that they want to give their children an early start to learning digital banking basics and financial independence, all while being able to supervise their child’s financial behaviours during these formative years.

If you’re here to learn how you can teach your children about money and make use of the OCBC MyOwn Account to help them become financially savvy, read on!

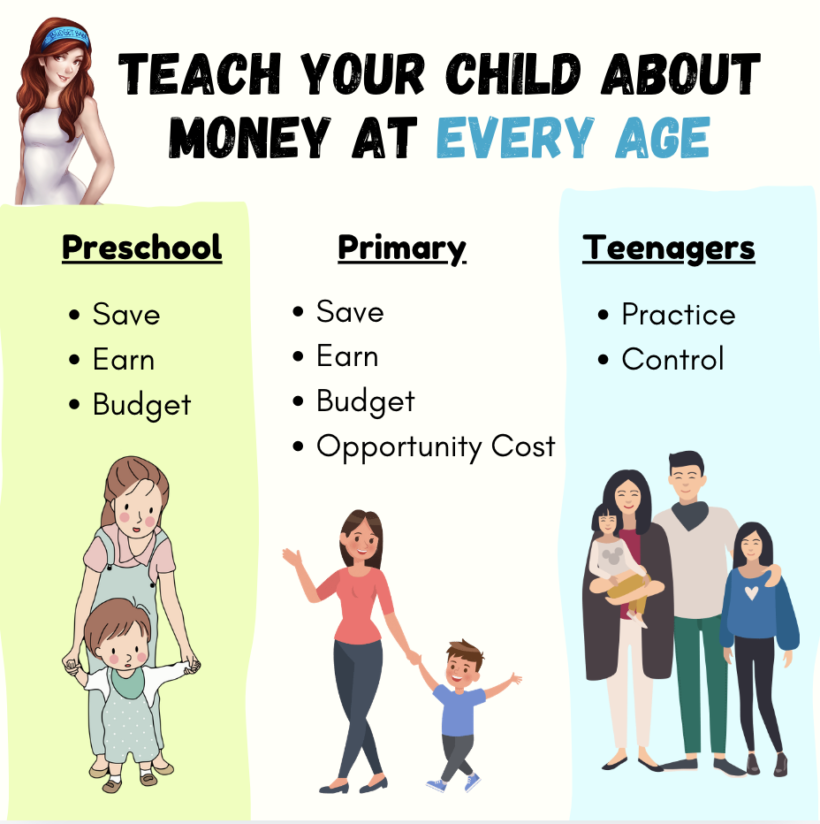

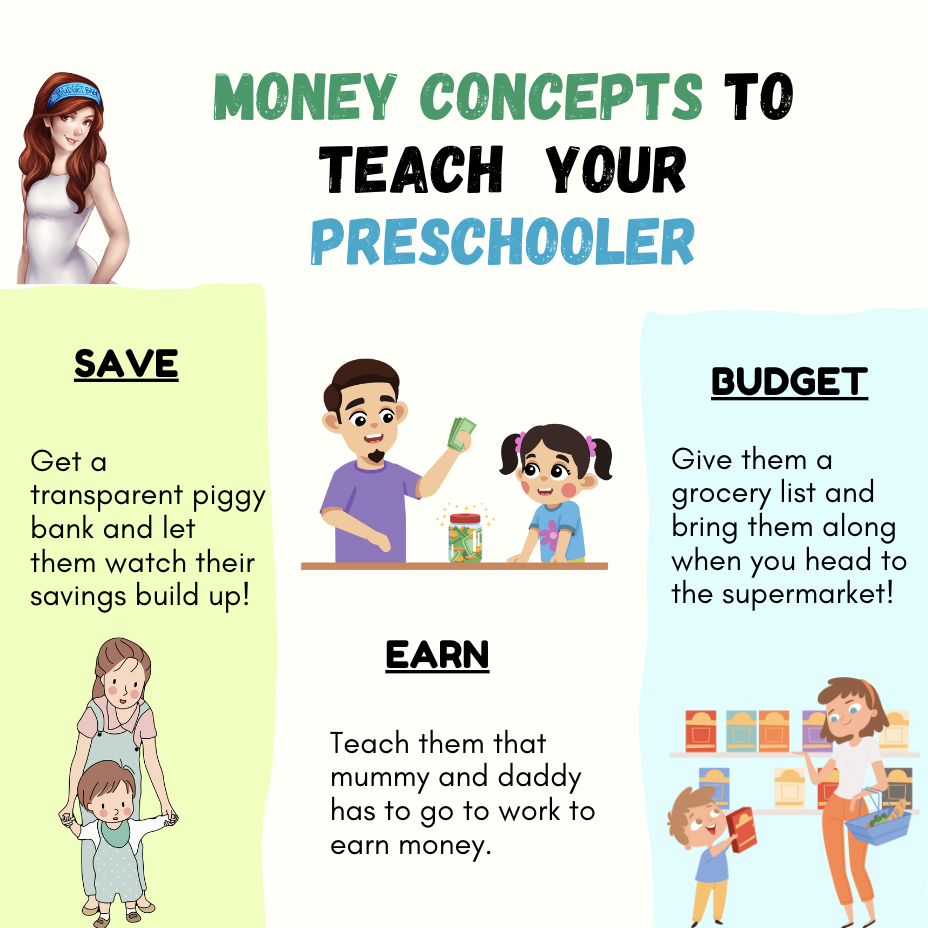

Teaching preschoolers about money

Teaching your child to become financially savvy starts from a young age. A study by the University of Cambridge showed that by the time your child turns 7, they would have already developed basic financial behaviours.

During their preschool years, you can let your child practice paying for things with cash and look for opportunities to involve them in your errands – such as going to the supermarket together or helping to choose a birthday present for their classmate within a budget.

As soon as my son Nate could read and count, here are a few things we started doing with him:

- Bring him along on our supermarket runs – we started bringing him on trips to the supermarket, armed with a grocery list of items to buy. At the milk powder aisle, I would point out the price difference between Similac and Nature One Dairy (which we chose for our kids – see why here). I would also get him to compare between the house brands and branded versions, and let him choose which one to get instead.

- Pass him cash to pay for our drinks, and let him keep the change in his transparent piggy bank where he can watch it accumulate.

- When our bills arrive in the mail, we’ll show them to him and let him watch us login to the apps to pay. (I’ve also let him see me do this at the AXS machine, from time to time.) We take this chance to remind him that the electricity and clean water he enjoys at home aren’t free, and that daddy and mummy have to work to earn money so we can pay for them.

Young children learn best by seeing and doing, so these are just some of the activities you can try for your child as well.

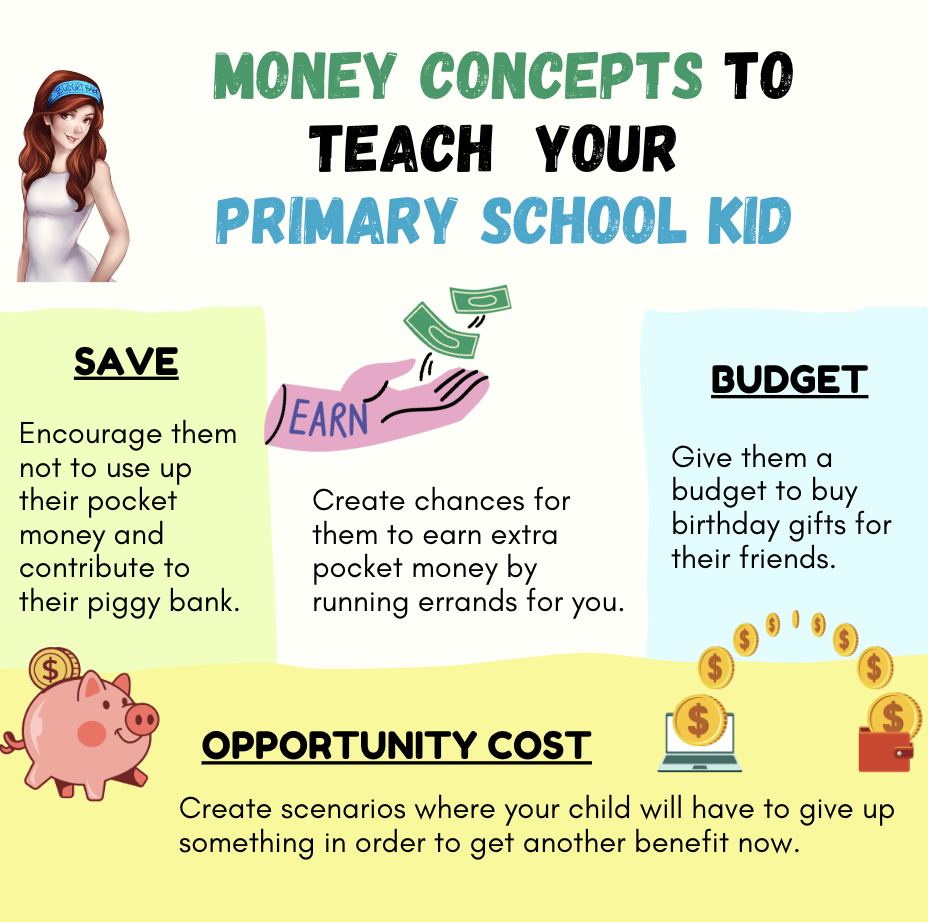

Teaching primary school kids about money

To prepare Nate for Primary 1 next year, we first started by teaching him to recognise the various dollar notes and coins, followed by keeping his allowance safe in his wallet and spending within his means.

During their primary school years, you can focus on teaching them the basics of how to save, earn some extra cash and keep within a budget. One of the hardest lessons for our kids to learn at this age is that of opportunity cost i.e. that something must be given up to make a purchase. Money can only be spent once.

Try bringing your child to the store and letting them pick 3 of their favourite items, and then give them a bill that is less than the total cost, so that they will have to choose which one to give up. In doing so, this becomes a teachable moment where we can explain to our child how we need to make financial decisions based on the money we have.

Learning how to save is one of the most valuable habits we can teach our kids. For cash, give them a clear jar that they can use to save up towards a goal. Once your child has grasped this concept, make the transition to digital savings.

You can make use of the OCBC MyOwn Account dashboard on the OCBC app to let your child see how deposits made via ATMs or digital fund transfers can help grow their account balance online. Reviewing this at the end of every week can provide some valuable teaching moments, but if you’re too busy, then at least set aside time once a month to go through this together.

You can login to view their account transactions either on your own OCBC app, or using your child’s login credentials on a separate smartphone.

Create opportunities at home for your child to help out and earn some extra cash. For instance, I sometimes let my kids help me when I pack e-commerce parcels for my customers, and reward them with $1 if they help to carry it to the nearest drop-off point. Those ang pow monies that they receive every year? Accompany your child to the ATM to deposit them using their own debit card. Remind your child that the money is in their own name, so they feel a sense of ownership and pride as their savings grow.

You can keep your child’s debit card for them and hand it over only when necessary.

You can monitor your child’s account activities on your own OCBC app, without the hassle of having to install a separate app. You retain oversight of your child’s financial activities via the parent-and-child dashboard, receive transaction notifications, and set spending limits.

Once you feel your child is ready, you can then download the app on your child’s smartphone and hand over their login credentials, as you teach them how to navigate the app for themselves.

For teenagers: practice and giving control

As your child goes on to secondary school, you can give them more freedom to manage their own bank account, debit card and make online transactions. This will enable your teenager to make digital payments more easily while they’re out with friends, without having to rely on you or using your credit card.

Your child will now be able to pay for their own food and services outside, especially as more merchants go cashless. In the event that they need to take a cab ride back (such as when it rains) or borrow a bike from Anywheel, they can now scan a QR code and make their own payment without having to call you for help.

With the OCBC MyOwn Account, your child can check their app and see how their spending affects their account balance, while you will be notified on all their financial transactions and can continue to have supervisory oversight on their financial transactions.

In the event that you find your child has problems exercising self-control, you can tighten their daily transaction limit, while teaching them a lesson about what happens when we run out of money.

Note: What happens to the OCBC MyOwn Account after my child turns 16?

Once your child comes of age, you can opt to fully release control of the account to your child.

Do all these well while your children are still young, so that even if they were to go and open their own bank account later on at 16, you can trust that they’ve now been equipped with the financial skills they learnt from you.

Tip: if you’re concerned about the additional burden of having to monitor your child’s digital banking activities (on top of everything else you already need to supervise for), remember that it all boils down to what you want to teach and achieve for your child when it comes to managing digital banking tools in this new era. I see this as a necessary parenting task!

OCBC MyOwn Account: Safety Features

If you’re concerned that your child might not be able to exercise self-control and end up secretly splurging all their money on games or online purchases, you can always withhold their debit card details from them until they are ready, or set transaction limits to ensure they cannot spend beyond a certain cap.

My friend Deanna previously shared how her 5-year-old daughter shocked her by managing to buy a toy on Shopee for herself, which was paid for using her stored credit card details in the app. Our children learn by imitation, so don’t underestimate your child – they may already know how to buy things online by now even without telling you!

Or, if you worry about your child becoming the next target for scammers like I do, then my best advice would be to educate your child about how to spot a scam, how scams work and what to do in the event that they fall for one.

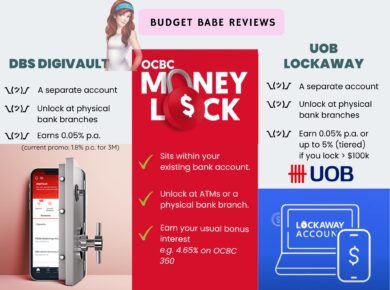

OCBC has also extended their Money Lock feature to the OCBC MyOwn Account, where you can digitally lock up portion of funds to prevent it from unauthorised access. In the event of emergencies, you can also activate a “kill switch” to freeze the account. Using the OCBC app, you will be able to lock (or unlock) the debit card to prevent debit card and ATM access if your card is lost.

These functions can be done by either the parent or via the child’s login.

Learn the basics of financial literacy with OCBC

Aside from pioneering Singapore’s first digital banking access for children aged 7 – 15, OCBC will also be creating a special financial literacy programme specifically for Gen Alpha.

This will be rolled out with the launch of OCBC MyOwn Account, and the programme will provide an overview of budgeting, tracking of expenses, money management, debit card usage, online safety and how to protect themselves from scams.

The financial literacy content will be available on your child’s OCBC app, so that they can be equipped with the necessary knowledge and skills to navigate their finances and the digital financial world responsibly. As a parent myself, I look forward to using this to complement my teaching efforts for Nate.

Sponsored Message from OCBC:

You can also teach your child financial literacy content using the comics, activity sheets and resources for young savers that are available digitally on your OCBC app, OCBC website, and in print at the OCBC Wisma Atria branch! These comics feature beloved Disney characters Ralph and Vanellope from Disney’s Wreck-It Ralph. Check out the resources by OCBC here.

Register here for the OCBC MyOwn Account now! http://go.ocbc.com/myown

Disclosure: This series to help parents teach their children about money is brought to you in partnership with OCBC, as part of their efforts to help Gen Alpha become more digitally and financially savvy.

All opinions are that of my own.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.