If you need another reason to cancel your investment-linked policy (ILP) which you may have bought a few years ago, consider this: a lot of financially-savvy folks are cancelling have already cancelled theirs.

I bought my first insurance policy, an ILP, at the advice of my then-financial agent. 2 years later, I cancelled it once I realized how I had been misled to think favourably of a policy that clearly wasn’t that beneficial to me. The biggest flaw I didn’t spot then was the distribution fees, which entitled the fund managers and my insurance agent to be paid rather handsomely for managing my investments.

At that point, I was thinking, if I’m already spending so much time swopping my funds, why should I be paying the fund managers? If I’m paying someone to manage my investments for me, then they better do a job good enough where I don’t even need to interfere. Furthermore, I can manage my own investments, so why continue with this useless ILP which I have to pay for over 20 years before I can even breakeven?

I’ve not regretted my decision ever since.

A friend of mine whom I consider to be rather financially-savvy also recently terminated his ILP, and publicly shared his cancellation experience on Facebook. I reproduce the conversation here:

On another note, I’ve been quite busy in the last 2 weeks, but yes, I did get the emails from some of you who wrote in asking about insurance. I’m currently in the midst of drafting up a proper guided post on that and putting all my answers together, so stay tuned.

Till then, stay clear of ILPs (or at least reconsider whether you realllllly need one).

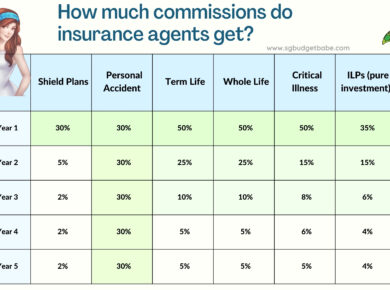

P.S. Whose pockets are ILPs reallllly lining?

With love,

Budget Babe

6 comments

Hmm. Wouldn't it be wiser to just go on a premium holiday especially when the fund values would have taken a beating in recent months.

Good point. This was meant to be a timeless article though and advising to sell the ILP if it isn't working for policyholders, and not referring to selling exactly NOW since we're in the down market. Thanks for highlighting this! 🙂

I agree. So I thought that it was strange that your financially savvy friend would have terminate his policy at this time.

I too have made the mistake of getting ILPs.

In fact I had 2. One from prudential, the other one was from AIA. But I didn't terminate. I choose the holiday instead. Reason is that the insurance charges are really low at my age and I will waiting for the market to recover.

I must say that for AIA, I was already breaking even from a very early stage because their ILP is different from many others, ie their distribution charges are back end loaded. Thus the premiums are invested right from the beginning. However the premiums must be paid for a determined timing, in my case was 8 years.

I've reach my 8 years few months back, the cash value is still higher than the premiums paid. I can just imagine that I will have quite a few years of free insurance since my fund values are rather inexpensive at this time of writing.

However if you ask me, will I start with ILP again? I most probably won't. But well since the mistake was made, just got to make sure that I don't over correct the mistake.

All the while there have been a conflict of interest between insurance agent & client. As long as the products commission is tied to the agent's well being ,clients will not have the best insurance plans /coverage for themselves.

i think you did the right choice. i didn't terminate my ILP when i realised i had been conned (i was a noob back then who just hit the 100k saving milestone and thought that it was time to buy a life insurance) but caveat emptor. i thought very hard how to "break-even" and eventually did a re-allocation of insurance components to keep it as a life insurance, reduce the insurance to 1%, to maximise the investment component to 99%. i dunno whether i had done the right thing, but i believe it is better than cancelling and suffering an immediate loss.

you can read more about it here: http://littletoybrush.blogspot.com/2015/12/saving-my-ilp-part-5.html

Thank you for sharing such great information. It is informative, can you help me in finding out more detail on online life insurance policy, i am interested and would like to know more about this field and wanted to understand the basics of online life insurance policy

Comments are closed.