Like most Asian children, I’ve been giving my parents $200 each every month. This is usually done through monthly bank transfers, but recently I made a change by giving my parents their allowance through CPF cash top-ups instead.

But money in the CPF is untouchable!

It took me a while to convince my parents about the merits of this move. But there are multiple benefits that eventually got me off my lazy butt to make this change.

Why contribute to their CPF?

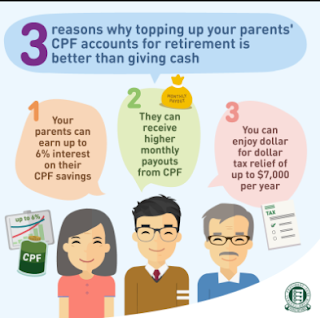

While some reasons are already listed in the graphic above, the main reasons that drove me to make this change were:

1. Tax reliefs

For each $10k rise in annual income, you also have to pay twice of your usual taxes.

When I was on my pathetic $2,500 salary in my first job, I only had to pay $200 in yearly income tax.

However, once your annual earnings hit $40k, that rises to $550 in taxes. Earning $50k means you’ll have to pay more than double of that i.e. $1,250. An additional $10k income raise also increases your tax by another 56% ($1,950). And for those who are lucky enough to earn $100k a year, prepare to pay $5,650 back to the government.

A legal way of hacking the tax system is to do voluntary cash contributions to your CPF account, or that of your parents / siblings / spouse / in-laws / grandparents. If you’re giving your parents anything less than $600, this hack makes a lot of sense because you’ll get exact tax relief i.e. dollar-to-dollar matching up to a maximum of $7,000 of taxable income. That’s like an added reward for being fillial!

2. You’re helping your parents to grow and protect their money

If your parents haven’t yet met the full retirement sum, every dollar you put in their Retirement Account earns up to 5% per annum in interest. This is far better than if you put the money in their bank accounts, which typically pay less than 1% per annum.

With scams (especially those targeted at the elderly) on the rise, I’ve been worried that my parents will become the next victim, and lose their hard-earned money to these scammers.

By putting the money in their CPF, it ensures that their funds are locked up and they cannot withdraw it to fall prey to a bogus investment scheme or some other scam. Their principal sum are protected while concurrently drawing a higher interest rates.

Furthermore, with CPF LIFE, your parents will receive fixed monthly payouts for the rest of their lives. This will ensure that they continue to receive “pocket money” to pay for their regular living expenses in retirement. I don’t have to worry that they will run out of cash one day.

3. CPF top-ups are infinitely more convenient than bank transfers or cash

Instead of having to remember to deposit money into my parents’ respective bank accounts each month, I can now simply transfer an entire year’s worth of “pocket money” for them in one go and let CPF dispense that to them via monthly payouts.

Doing it once instead of 12 times a year saves so much time and effort!

How to give your parents money through CPF:

The steps to do this are fairly simple:

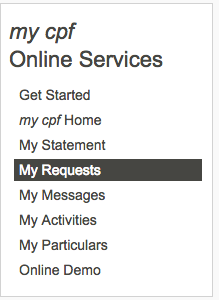

Step 1: Log into your CPF using your SingPass and click on “My Requests”.

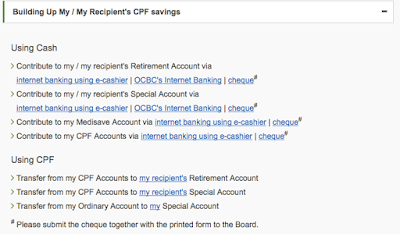

Step 2: Choose the below option and expand the field. Choose either e-cashier payment or OCBC Internet banking.

(Cheque is far more troublesome because you have to fill up a form)

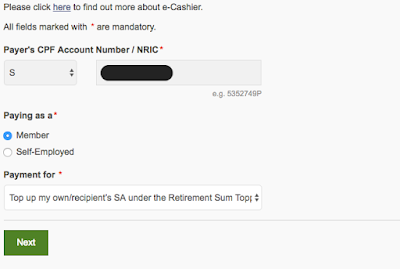

Step 3: Choose whether you’re topping up RA, SA, etc.

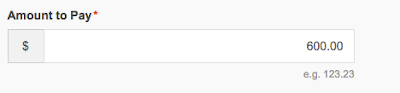

Step 4: Key in your parents’ NRIC number and relationship to you. Key in the amount you wish to transfer.

Step 5: Pay via e-cashier OR OCBC internet banking.

In case you’re confused by which transaction number to quote in your bill payment, please select the FIRST ONE i.e. the Bill Reference Number (not the one in the table!) I got confused by this when I first did the transfer initially, and had to test this to make sure I got it right.

If the $7000 tax rebate from this hack isn’t enough to bring your income tax down to the corresponding lower bracket, you can also consider donating to charity for further tax deductions. Donating $1,200 will result in an additional $3000 tax-deductible income for the year (2.5 times).

Remember that although your taxes won’t be due until April, you’ll have to finish these actions by 31 December to qualify for the following year rebate.

You can download the IRAS tax calculator here and estimate how much you’ll need to pay next year, and then see how much you’ll need to bring the final tax figure down to a sum that you’re comfortable with paying. Good luck!

With love,

Budget Babe

17 comments

Thanks for this article BB! I don't know why this hasn't occurred to me over the last few years to do this!

I might rally my siblings together to do this for my mother!

Wah hello rare pokemon! Haven't seen you commenting in the longest time haha.

I like the idea of the govt "paying" me for fillial piety, especially when it is something I have to do anyway.

I didn't search if the 7k cap applies to siblings as well, did you find any info?

hey BB,

yea, this is like a why-i-didnt-think-of-this-moment.

btw, if one's parent is already pass the withdrawal age. does the tax relief still count?

and they can withdraw it immediately?

Hello BB! We are on the same page! I actually just started doing the same for my parents, maxing out the 7k contribution that qualifies for tax relief. I wrote an article to try and project how much mum can potentially get if i continue with this for a few years. Its like giving your parents allowance perpetually! To me, one other consideration is that if i should pass away earlier than them (never say never!), the money i contributed will still see them through their lives. Thats an added motivation.

My own experience is narrated here: http://fighting4financialfreedom.blogspot.sg/2016/06/753-instant-capital-gain-538-yield-on.html?m=1

This comment has been removed by the author.

If I am not mistaken, the 7k cap applies to each individual only, meaning that your siblings can contribute and get the tax relief as well. To prevent abuse, if you parent already has the FRS, your contribution will not qualify for any relief.

No i dont think so. All monies received under the RSTU (retirement sum topping-up scheme), including all interest earned, cannot be withdrawn. It will be used to join CPF LIFE or Retirement Sum Schemme when the beneficiary turns 65.

Can refer to the FAQs here: https://www.cpf.gov.sg/Members/FAQ/schemes/retirement/retirement-sum-scheme

Hmm, what if parents need the money for daily living, how is the cpf going to help them if they are still years away from the age that cpf life is activated? So I guess this only works if they do not need your monthly pocket money for living expenses?

Thanks for clarifying F4FF! I didn't search on this because my sister doesn't give my dad any money so it is a little redundant for me, haha. At any rate, going by that regard, rallying siblings together would also mean that each sibling get to enjoy the tax rebates for a shorter duration, as the parent's FRS would be reached sooner rather than later with everyone contributing in this manner. Maybe then I'll need to research another hack instead…hahah

Hmm it seems like if it is past their retirement age and the money wasn't deposited straight into their RA, they would be able to withdraw some of the monies, although I might be wrong on this. I'll send in an email to CPF Board to ask! 🙂

Yeah it'll only work for parents who have some money in their savings to sustain on, or for parents who are still working. Many of us have parents who are still working 🙂

Thanks for running the numbers! I didn't go so much into the earnings my parents could earn as they're already fairly old, so there isn't enough time for the interest to compound significantly, but agreed that they'll be getting more money from me via this method than if I give them cash. That's what I told them when I embarked on this (and it took quite a bit of convincing, tbh I'm not entirely sure if they're convinced yet) – "Daddy, Mommy, I get to pay less in tax and your money from me will grow into a bigger sum, so why not?"

This comment has been removed by a blog administrator.

Hey foolish chameleon,

I've just gotten the answers straight from the horse's mouth:

Yes, one can enjoy the tax relief when making a cash top-up even if his/her parents have passed their withdrawal age. However, if the parents’ CPF balances have reached their FRS, then the child may not be able to claim for the tax relief. Hence, it is advisable for the child to check on his/her parents’ current CPF balances before making the top-up to enjoy the tax relief.

Q: If one's parent is already past the withdrawal age and exceeded the FRS, can they withdraw the monies anytime?

Members aged 55 and above, who have the Full Retirement Sum (FRS) or Basic Retirement Sum (BRS) with sufficient property charge/pledge in their Retirement Account, may apply to withdraw the balances in their Special and Ordinary Accounts. The withdrawal of the Special and Ordinary Account savings is optional. If a member does not withdraw at 55, he/she may continue keeping his/her savings in CPF to earn attractive interest and withdraw at any time later.

For members who have previously withdrawn their CPF savings upon reaching 55, they may submit a withdrawal application at any time if they have CPF monies that may be withdrawn.

Savings in the Retirement Account (including RSTU topping-up monies) may be withdrawn in monthly payouts once the member attains the payout eligibility age of 65. Similarly, the withdrawal of monthly payouts from members’ Retirement Accounts is optional.

For more information, please refer to these links: https://www.cpf.gov.sg/Members/FAQ/schemes/retirement/withdrawals-of-cpf-savings-from-55 and https://www.cpf.gov.sg/Members/FAQ/schemes/retirement/retirement-sum-scheme.

hey BB,

thanks for the followup!

looks like its quite a no-brainer to give cpf, assuming parents havent reach FRS. and of coz, dont need it for daily expenses.

Hi Budget Babe,

Thanks for the article. Its something that i might try.

Just a question. If presuming my dad is above 65 and has not hit FRS. Lets say i topup 7k into his RA this year. The 7k is split evenly into 12 months and paid to my dad's bank account?

Also, in the case above, how does the interest earned on the 7k top up work?

Thanks again for your article. I enjoy reading your writings. Keep it up!

No, it's paid in a few days after you top up. The interest will be on that 7k top-up as per CPF usual interest schemes.

Comments are closed.