When it comes to insurance, I’ve always believed in getting covered without paying too much. In other words, if there’s a way to get the same protection for less, then I prefer to go for the low-cost approach.

As insurance is one of the fundamental tenets of financial planning, it pays to ensure that you get the maximum coverage you need at a level that you can afford. At all times, insurance should not hinder your wealth-building journey.

To start planning, your life circumstances matter.

I prioritise my coverage needs based on my unique life circumstances, which may or may not apply to everyone. In our case, my husband and I single-handedly support 3 parents (including paying for their insurance policies) and our 2 young children. Given our higher financial responsibilities, going for low-cost insurance options is crucial.

On the other hand, if you’re a single, young working adult with siblings and your parents have their own (sizeable) retirement savings, you probably will just need to think about your own needs. Even if you’re able to afford to pay for more expensive policies, it doesn’t necessarily mean that you need to – you should only be paying for what you truly need.

But if you’re part of the sandwiched generation (and it gets even more stressful if you and/or your spouse is the only child), you might already be stretched to your (financial) limits and not all plans may be suitable for you. Whole life plans and education endowment plans, for instance, which are frequently sold to parents with young children, may thus be too much for you to service each month.

But how many agents do you know will tell you this?

Or did your agent try to sell you a whole life plan (and/or endowment plan) once your child was born?

When it comes to insurance, I’ve observed that most people generally fall into 3 camps:

- The Clueless: those who are totally clueless, and hence are the most likely to be sold policies that they will later on regret buying

- The Outsourcer: this group understands the importance of buying insurance (and will proactively initiate a discussion with their adviser), but prefer to outsource the planning entirely to a trusted professional

- The Savvy: those who are extremely savvy and already know what they want or need, who would consult advisers only to get a second opinion or confirmation and proceed to compare insurance premiums on platforms like MoneyOwl or CompareFIRST. These people prefer to ultimately DIY and manage their own insurance portfolio

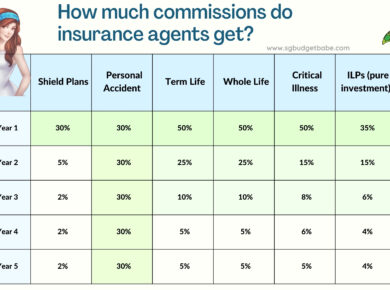

If you fall into the first or second group, you could have bought insurance policies recommended by some insurance agents that give them higher commission, which you now regret and you’re thinking of cancelling.

In this case, it is crucial that you either find a trusted adviser who will put your interests ahead of his/her own commissions OR work with non-commissioned advisers – even if this means recommending you an insurance policy that they do not sell (and thus do not earn from).

Now, as a fresh graduate or young working adult, you may not know where to seek unbiased financial advice. Worse still, if your agent happens to be one who’s “recommending” you products based on commissions instead of your financial needs, you might remain the clueless consumer who never realizes this conflict of interest because the commissions aren’t made transparent to the public in the first place.

If you’re clueless or simply unsure, you’d want to find advisers who have no incentive to sell you products (you don’t need) at prices you cannot afford.

Is conflict-free advice just a myth?

Well, have you checked out MoneyOwl?

As a social enterprise, MoneyOwl’s philosophy is that being wise about money is about making life decisions before financial decisions, and that one’s coverage needs can be protected with low-cost insurance.

Their advisers are salaried-based and are not remunerated by commissions, so there is no incentive to hard-sell or to promote products that reward themselves with higher commissions. Instead, they focus on helping you make wise money decisions in your best interests.

With fully commissioned agents out of the picture, you can definitely be reassured that the advice you’ll be getting from MoneyOwl is free from any conflict of interest.

They also cover a wide range of protection plans:

Which is why you can think of them as your go-to partner for all of your financial needs at every stage of your life. When new needs or plans emerge (such as CareShield Life private supplements last year), I’ve also seen their advisers proactively reach out to existing customers to educate and talk about it.

But of course, on the other hand, if you’re already savvy enough to decide on your own plans, then you’d want to be using their comparison tool to make informed decisions for yourself instead.

What if I want to DIY my own insurance?

If you can, you probably should! After all, no one else will know (or care) as much about your own personal finances as you.

Regardless of how savvy you are, you’re gonna be needing resources to help you determine if you’re on the right path. Check out MoneyOwl’s online insurance guided journey here to discover plans that you need to be protected for.

Or, if you already know which products you need, you could directly compare plans and premiums to decide which is better suited to your needs and budget. Check out MoneyOwl’s comparison tool, which spans across a variety of products including life insurance, hospitalisation and critical illness.

Can I get advice without buying a policy?

If you’re not sure about what you truly need, you can always seek out advice from MoneyOwl before deciding.

I have tried out one of their services myself (called Comprehensive Financial Planning, a service that looks holistically at all aspects of your finances, including identifying investment and insurance gaps, how to fund your children’s education and projecting your CPF Life payout). I can attest that I was never once made to feel like I had to buy anything from them. In fact, my assigned client adviser from MoneyOwl recommended that I consider taking up a disability income plan, but was understanding when I explained how it wasn’t my priority due to limited budget vs. other insurance needs. He did not hard-sell me into purchasing anything, and I walked away with a better understanding of a gap in my portfolio I hadn’t previously been aware of.

And since any discounts offered are usually direct from the insurer (e.g. Aviva’s current perpetual discount off CareShield Life upgrade plans), whether or not you decide to purchase from them or elsewhere will not affect how much you pay.

But if you were to decide to purchase through MoneyOwl? In this case, what’s different is that MoneyOwl helps to bring down the cost for you, by offering up to 50% commission rebates on eligible products (60% for NTUC members) on top of the discounts offered by insurers.

This means that you’ll still pay the same premiums either way, but a portion of the commissions that the insurer pays to MoneyOwl is back to your bank account!

Based on my own experience, I’d recommend that you speak with their team if you need some help examining your current insurance portfolio.

Disclosure: This article is sponsored by MoneyOwl to raise awareness of their platform. All opinions are that of my own.

Sponsored Message

Speak with MoneyOwl’s client advisers and get up to S$40 NTUC shopping vouchers when you sign up for any eligible term insurance plan. You should only commit to an insurance policy if it fits your needs and budget. Terms and conditions apply.

Find out more about MoneyOwl’s ongoing promotion here.

This advertisement has not been reviewed by the Monetary Authority of Singapore.