It is no secret that critical illness coverage – while essential – doesn’t come cheap. Which is why when I saw FWD’s latest Big 3 Critical Illness insurance, with premiums from as low as 1/3 the price of regular CI plans*, my husband and I immediately applied for it. So if you’ve been wanting to increase your CI coverage like us, but found the premiums too expensive, you might also find this plan helpful.

A few weeks ago, my dad was recently diagnosed with yet another critical illness. The cost of long-term care isn’t cheap, which meant that our financial responsibilities had just gotten even heavier, and that led to our decision to increase our CI protection levels in case anything happens to either of us.

But adding to our CI riders on our life policy didn’t seem like a viable option for our budget, given how much the premiums cost us.

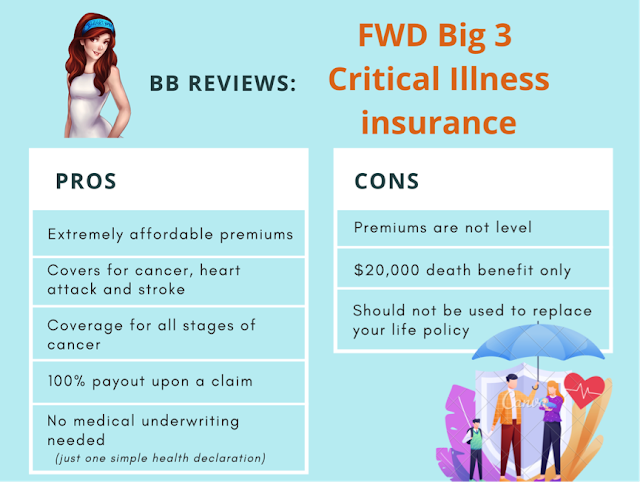

So we decided to layer our coverage by adding FWD Big 3 Critical Illness insurance instead, which protects us against the 3 most common critical illnesses affecting Singaporeans – cancer, heart attack and stroke. As the plan provides coverage for all stages of cancer and even early conditions for heart attack and stroke, it can serve as both ECI and CI.

At just one-third of the price of a regular CI plan, it was a no-brainer for us.

Review of FWD Big 3 Critical Illness Insurance

Cancer, stroke and heart attacks comprise 90% of critical illness claims in Singapore (based on data collected across the 9 major insurance players here).

Given how advanced medical science has made it possible for many diseases to be diagnosed earlier, there is now a stronger reason to get early CI insurance so that you may qualify for a payout and use the money for treatment.

Within my own circle of friends, I have already seen a few of them get diagnosed with cancer (stage 1 or 2) even though they were only in their 20s and 30s. Most of them were healthy and exercised regularly, so it was a shock when it happened. A few of them even had to stop working in order to focus on their recovery.

It is scary to imagine what it would have been like if they didn’t have early CI insurance to help pay for the treatment cost and living expenses then.

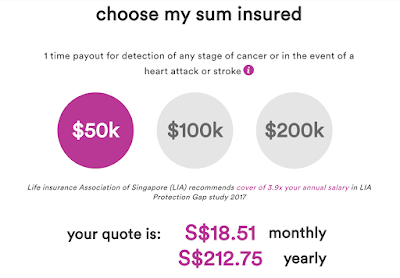

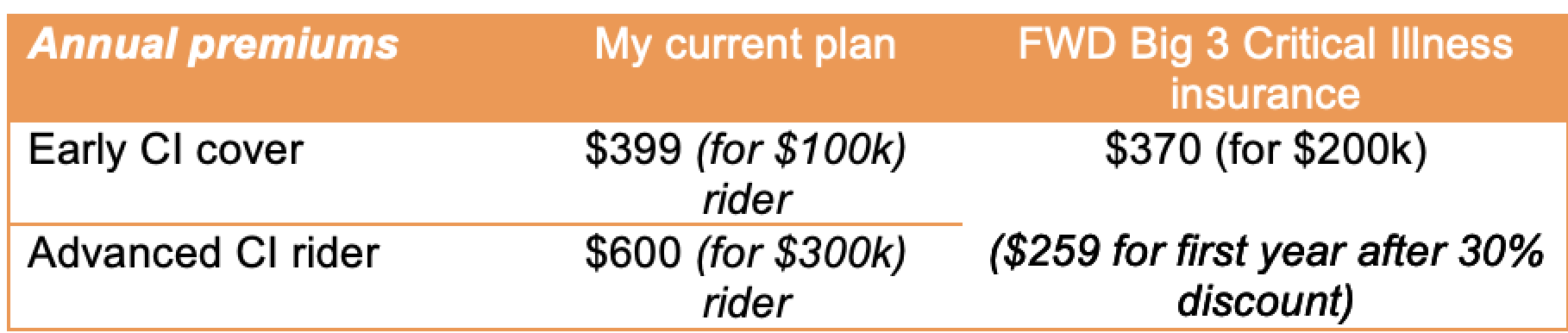

But as we all know, early CI protection plans don’t come cheap. To give you an idea of how the costs look like:

From as little as $18.51 per month for $50,000 coverage, this plan allows me to top up my coverage without having to pay too much.

Here’s how the annual premiums for $100,000 coverage (non-smoker) looks like:

|

Age 30

|

Age 40

|

Age 50

|

|

|

Male

|

$253

|

$322

|

$771

|

|

Female

|

$314

|

$453

|

$910

|

The premiums are indeed the most affordable on the market right now for this much coverage.

Premiums are not level

Unlike CI coverage that is bought on a level term or whole life plan, the premiums for this term contract are not flat throughout.

As long as you continue to renew your policy before the deadline each year, FWD will not ask for any health declarations again in subsequent years, and any chances in your health status for renewals will not affect the policy’s coverage.

What’s not covered

The exclusions for this policy are pretty straightforward. No benefits will be paid in the event that:

- you are diagnosed within the waiting period (90 days from policy issue date)

- it is caused by a pre-existing condition

- fraudulent or inaccurate data was submitted during your policy application

Unfortunately, those who already have an existing FWD Cancer insurance policy are not eligible to purchase FWD 3 Critical Illness insurance.

A standalone or a complementary plan?

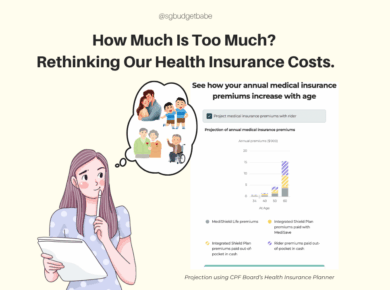

Critical illnesses can strike at any point of our lives, although it is often the most painful when it happens at a stage where our financial liabilities are the highest. That said, you should consider getting comprehensive critical illness coverage for as long as possible.

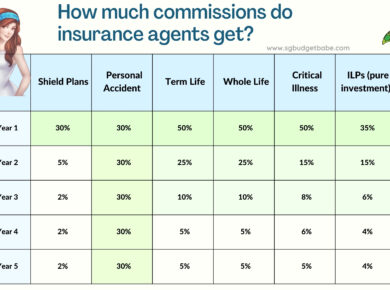

This means that this plan should not be used as a substitute for your life policy, but as a complement to it. Your foundation should still be built on a broader critical illness and life policy which can cover you for multiple critical illnesses instead of just cancer, heart attacks or strokes.

For those of you with greater financial responsibilities and/or dependents, the maximum coverage of $200,000 and $20,000 death benefit from this FWD plan may not be sufficient on its own.

Thus, it will be helpful for you to combine this with other plans, which is what I did.

Your payment preferences can also affect your decision. If you want premiums to be level throughout your policy term, then this may not be suitable for you, as premiums may be higher than a similar regular CI plan at older ages.

Once you’ve settled your base policies and you wish to top up your coverage at each point where your financial responsibilities increase, standalone plans like FWD Big 3 Critical Illness insurance can be a powerful tool to add to your arsenal of insurance weapons.

With such affordable premiums, I see this as the most cost-efficient way to top up our existing CI coverage for common conditions without having to pay excessive premiums that would otherwise bust our budget.

Who the plan could be good for

Most of you should find this useful, either as a standalone policy or to complement your existing ones.

If you too, think it could be a good addition to your insurance portfolio, head over to FWD’s website here to find out more. You can also read the policy contract terms here first, like I did.

Disclosure: This post is written in collaboration with FWD. All opinions are that of my own. The information is meant purely for informational purposes and should not be relied upon as financial advice. As my life circumstances differ from yours, you should seek advice from a licensed representative for customised advice on your financial needs.

This FWD plan is protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is accurate as at 8 November 2020.

* FWD Big 3 Critical Illness insurance provides critical illness coverage from as low as 1/3 the price of a regular critical illness plan. This base plan comparison is for All stage Cancer, late stage Stroke and late stage Heart attack against similar plans (not identical) in the market and is accurate as of 25 June 2020.